Anderson School of Management BBA FINANCIAL MANAGEMENT

advertisement

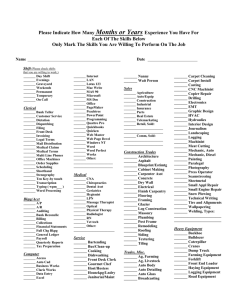

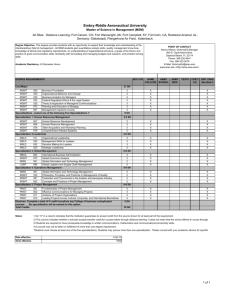

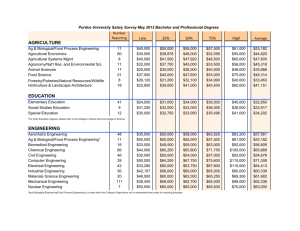

Anderson School of Management BBA FINANCIAL MANAGEMENT CONCENTRATION All Concentration Information Effective For Students Admitted Fall 2011 or Thereafter. Revised March 2014. Profession Overview: Managers need finance to find funding sources for their firms, to identify and manage risk, and to decide whether to make capital expenditures or produce new products. Individuals use the principles of finance to set long term financial goals and to make personal investment decisions. Areas of study in the field of finance include financial management, banking, planning, investments, insurance, money flow, real estate and financial services. Admission Process: Students must be admitted to Anderson in order to take upper division MGMT courses. Admission applications are submitted online at www.mgt.unm.edu. Junior Year: 1st Semester Cr. Hr. MGMT 300: Operations Management MGMT 303: Managerial Accounting MGMT 306: Org Behavior & Diversity MGMT 326: Financial Management MGMT 398: Career Management Skills Free Electives Total Credit Hours 3 3 3 3 1 3 16 Junior Year: 2nd Semester Internships: Internships are highly recommended. An internship will help you become a viable, experienced job applicant and significantly impact your chances of landing a professional career at graduation. Complete your internship during the fall, spring, or summer semester and earn 3 credits toward free electives or concentration electives. Learn more at http://brandyou.mgt.unm.edu. Concentration Overview: The Financial Management Concentration requires completion of 128 credit hours including the following course work: Pre-Admission Course Work Anderson Core **Financial Management course work ***Upper Division Humanities Additional Free Electives Total 55 credit hours 31 credit hours 15 credit hours 3 credit hours ~24 credit hours 128 credit hours ***Upper Division Humanities: One 3 credit hour course, 300-level or above from American Studies, Classics, Comparative Literature, English, History, Philosophy or Religious Studies Fall: July 1 Suggested Schedule: GRADUATION APPLICATION DUE: Spring: November 1 Summer: April 1 MGMT 310: Legal Issues for Managers MGMT 322: Marketing Management *MGMT 426: Advanced Prob. in Fin Mgmt. *MGMT 471: Investment Analysis & Mgmt. Free Electives Total Credit Hours 3 3 3 3 6 18 Summer/Fall/Spring: Optional Internship See Career Services for possible credit options Senior Year: 1st Semester MGMT 308: Ethical, Political & Soc Environment MGMT 328: International Management MGMT 450: Computer Based Info Sys **Financial Management Electives Free Electives Total Credit Hours 3 3 3 6 3 18 Senior Year: 2nd Semester MGMT 498: Strategic Management **Financial Management Elective ***Upper Division Humanities Free Electives Total Credit Hours 3 3 3 9 18 Faculty Concentration Advisor and Department: *Financial Hsuan-Chi Chen Associate Professor Phone: 505-277-4702 chenh@unm.edu **Financial Management required electives. Choose 3 courses from the following list: Gautam Vora Professor Phone: 505-277-0669 vora@unm.edu http://bba.mgt.unm.edu/concentrations/finance.asp Management required course MGMT 470: Financial Markets and Institutions MGMT 472: Securities Analysis MGMT 473: Commercial Banking MGMT 474: International Financial Mgmt. MGMT 476: Derivatives (Futures and Options) MGMT 479: Applied Investment Management MGMT 496: Seminar in Entrepreneurial Financing MGMT 490: Fixed Income Securities w w w . m g t. u nm . e du What Can I Do With A Degree In Finance? fe i n e ie Managers need finance to find funding sources for their firms, to identify and manage risk, and to decide whether to make capital expenditures or produce new products. Individuals use the principles of finance to set long-term financial goals and to make personal investment decisions. Areas of study in the field of finance include financial management, banking, planning, investments, insurance, money flow, real estate and financial services. p e Please ask your Career Advisor for help in identifying additional occupations for your major or resources for each of the occupations. Note that some of these options may require an advanced pa i n • Account Analyst • Bank Examiner • Bank Trust Officer • Bond Broker • Budget Consultant • Budget Officer • Comptroller • Credit Analyst • Credit Manager • Estimator • Financial Consultant • Financial Manager Investment Analyst • Loan Officer • Loan Underwriter • Operations Manager • Purchasing Agent • Special Agent • Median Annual Salary (Bachelor Degree Candidates): Functional Area Auditing (Private) Commercial Banking (Lending) Consulting Financial/Treasury Analysis Investment Banking (Corporate Finance) Investment Banking (Sales and Training) Portfolio Management/Brokerage Sales Informational Websites: Average Salary Offer 2009 $ 48,385 43,340 54,698 51,715 51,029 57,063 46,121 40,002 http://www.bls.gov/ http://online.onetcenter.org/ http://www.naceweb.org/default.asp American Finance Association http://www.afajof.org Association of Finance Professionals http://www.afponline.org Commercial Finance Association http://www.cfa.com Have questions about Anderson Career Services? Contact Kate Williams kwill07@unm.edu Get the competitive edge! Anderson School of Management Office of Career Services