financing of working capital in select cement companies

advertisement

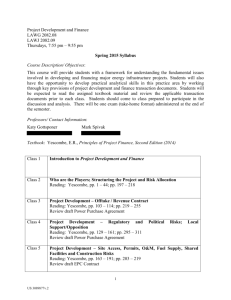

FINANCING OF WORKING CAPITAL IN SELECT CEMENT COMPANIES- A POLICY PERSPECTIVE Dr. K. Bhagyalakshmi1, Dr. P. Krishnama Chary2 1 Lecturer, Dept. of Commerce and Business Management, University College for Women, Kakatiya University, Warangal, Telangana. (India) 2 Professor, University College of Commerce and Business Management and Director IQAC, Kakatiya University, Warangal, Telangana, (India) ABSTRACT Working Capital is very important for any manufacturing organisation such as cement, textiles etc. The way in which the working capital is financed to a company influences its profitability and the firm’s ability of using fixed assets possessed by it. The cost of capital used to finance the current assets also very highly impacting the profitability and the future course of actions of the companies. Cement is vital to the construction sector and all infrastructural projects. The construction sector alone constitutes 7 per cent of the country's gross domestic product (GDP). Since the cement sector notably plays a critical role in the economic growth of the country, the present paper focuses on the analysis of various policies followed by the six selected cement companies viz., Ultra Tech, The India, J.K, ACC, Ambuja and Madras Cements Ltd. in financing working capital by using the Statistical techniques like Percentages, Ratios, Averages, Standard Deviation (S.D),coefficient of variation (C.V) etc. The paper concludes that, the trade payables formed a predominant source of short-term funds in Ultra tech and The India; other current liabilities played a major role in J.K. and Madras and the short term provisions occupied a major proportion of short sources in the case of the remaining two companies viz., ACC and Ambuja in financing working capital. Keywords: Aggressive, Conservative, Hedging, Working Capital Approach I. INTRODUCTION Working Capital is very important for any manufacturing organisation. The way in which the working capital is financed to a company influences its profitability and the firm’s ability of using fixed assets possessed by it. The cost of capital used to finance the current assets also very highly impacting the profitability and the future course of actions of the companies. According to walker “ the type of capital used to finance working capital directly affects the amount of risk that a firm assumes as well as the opportunity for gain or loss and cost of capital”. II. POLICIES FOR FINANCING CURRENT ASSETS A firm can adopt different financing policies to invest on current assets. Three types of financing may be distinguished as: 133 | P a g e 2.1. Long term financing: The sources of long-term financing include ordinary share capital, preference share capital, debentures, long-term borrowings from financial institutions and reserves and surplus (retained earnings). 2.2. Short-term financing: The short-term financing is obtained for a period less than one year. Short-term finances include working capital funds from banks, public deposits, commercial paper, factoring or receivables etc. 2.3. Spontaneous financing: Spontaneous financing refers to the automatic sources of short-term funds arising in the normal course of a business. Trade (supplier’s) credit and outstanding expenses are examples of spontaneous financing. The company has to decide, the mix of short and long –term sources in financing current assets. Depending on the mix of short and long-term financing, the approach followed by a company may be of 3 categories. 2.4. Matching Approach (Hedging Approach): The firm can adopt a financial plan which matches the expected life of assets with the expected life of the source of funds raised to finance assets. The justification for the exact matching is that, since the purpose of financing is to pay for assets. The source of financing and the asset should be relinquished simultaneously. When the firm follows a matching approach, long-term financing will be used to finance fixed assets and permanent current assets and short-term financing to finance temporary or variable current assets. Under a matching plan, no short-term financing will be used if the firm has a fixed current assets need only. 2.5. Conservative Approach: A firm in practice may adopt a conservative approach in financing its current and fixed assets. The financing policy of the firm is said to be conservative when it depends more on long-term funds for financing needs. Under a conservative plan, the firm finances its permanent assets and also a part of temporary current assets with long-term financing. The conservative plan relies heavily on long-term financing and, therefore, the firm has less risk of facing the problem of shortage of funds. 2.6. Aggressive Approach: A firm may be aggressive in financing its assets. An aggressive policy is said to be followed by the firm when it uses more short-term financing than warranted by the matching plan. Under an aggressive policy, the firm finances a part of its permanent current assets with short-term financing. Some extremely aggressive firms may even finance a part of their fixed assets with short-term financing. The relatively large use of short-term financing makes the firm more risky. III. RISK-RETURN TRADE-OFF Thus, there is a conflict between long-term and short-term financing. Short-term financing is less expensive than long-term financing, but, at the same time, short-term financing involves greater risk than long-term financing. The choice between long-term and short-term financing involves a trade-off between risk and return. If the firms follow a policy of financing current assets through short term sources, funds are borrowed only when needed. As a result, profitability will be higher but the risk of non-availability of funds may also be greater. Alternatively, if the firms follow a policy of financing current assets through long-term sources, the risk of non-availability of funds is significantly reduced but it may reduce the profitability of the firms on account of idle funds in times of seasonal droughts. Therefore, in order to maximise the overall rate of return on investment and minimise risk, firms have to employ and optimal mix of financing policies. 134 | P a g e IV. NEED FOR THE STUDY The cement sector notably plays a critical role in the economic growth of the country and its journey towards conclusive growth. Cement is vital to the construction sector and all infrastructural projects. The construction sector alone constitutes 7 per cent of the country's gross domestic product (GDP). The industry occupies an important place in the Indian economy because of its strong linkages to other sectors such as construction, transportation, coal and power. India is the second largest producer of quality cement in the world. The cement industry in India comprises 183 large cement plants and over 365 mini cement plants. Currently there are 40 players in the industry across the country. Since the type of capital used to finance working capital directly affects the amount of risk that a firm assumes as well as the opportunity for gain or loss and cost of capital, the need is felt to undertake a study on the financing policies of working capital of the select cement companies. V. OBJECTIVES The following are the objectives of the study. 1) To present the conceptual framework of different policies in financing the working capital. 2) To examine the proportion of long-term sources and short-term sources in financing the working capital of select cement companies. 3) To analyse the proportion of each component of short-term sources with a view to identify their approaches towards financing the working capital. VI. SOURCES OF DATA AND METHODOLOGY 6.1. Sources of Data: The present study is based on secondary data. The sources of secondary data consists of Annual Reports, circulars, research periodicals, Text Books, news papers like Economic Times, websites and other published sources. The data collected from the above sources for the period of 5 years from 2008-09 to 2012-13. 6.2. Methodology: The following methodology is adopted for conducting the study. Aggregate financial variables relating to financing of working capital of selected cement companies are processed, tabulated, analyzed and interpreted for a period of 5 years i.e. from 2008-09 to 2012-13 with the help of statistical techniques like Percentages, Ratios, Averages, Standard Deviation (S.D), and Coefficient of Variation (C.V). Finally conclusions have been drawn based on the facts revealed by the study. VII. SELECTION OF SAMPLE For the purpose of the present study, six cement companies have been selected as sample namely, 1.Ultra-tech Cement Ltd., 2. The India Cements Ltd., 3.J.K Cement Ltd., 4. ACC Ltd., 5. Ambuja Cements Ltd. and 6. Madras Cements ltd. The collected data of selected companies have been analysed as under. 135 | P a g e VIII. CURRENT LIABILITIES AS A PERCENTAGE OF TOTAL CURRENT ASSETS TABLE 1 shows the proportion of current liabilities in the total current assets of the selected cement companies. The data reveals that all the selected samples used the current liabilities as a source of financing the working capital above the 50% of the current assets except in J.K during 2008-09, during the period from 2008-09 to Table-1 Current Liabilities as a Percentage of Total Current Assets Year/Company 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V 91.27 88.23 91.89 67.26 79.81 83.69 10.37 12.39 53.80 44.29 187.01 178.87 153.21 123.44 69.13 56.00 J.K. Cement Ltd. 34.56 52.23 71.00 68.01 87.27 62.62 20.01 31.96 ACC Ltd. 135.71 136.07 101.28 71.86 73.91 103.77 31.54 30.40 87.96 76.36 63.18 54.97 51.35 66.76 15.26 22.85 39.72 48.10 53.69 145.28 128.80 83.12 49.82 59.93 Ultra-tech Cement Ltd. The India Cements Ltd Ambuja Cements Ltd. Madras Cements Ltd. (Source: Annual Reports) 2012-13. The proportion is highest with 187.01% in 2010-11 in The India Cements and lowest in J.K cements with 34.56% in 2008-09 among the selected cement companies. The two companies, The India and ACC have the proportion i.e. more than 100% in three years of the study period. This indicates that the companies had used the remaining short-term sources for financing the fixed assets. The other four companies have their proportions below the 100% of working capital namely Ultra-tech, J.K, Ambuja and Madras Cements Ltd. The highest average proportion is registered as 123.44% and the S.D is 69.13 with the C.V as 56.00% in The India Cements Ltd. The least average is stood as 62.62% in J.K. and the S.D is 20.01 with the C.V as 31.96%. After having analysed the current liabilities as a percentage of current assets, it is now proposed to examine that, the proportion of each source of short-term finance, prominent source which has given highest proportion of short-term finance and the approach which has been followed by the selected cement companies in financing their working capital needs during the period of 5 years i.e. from 2008-09 to 2012-13. There are four important components of current liabilities are identified such as Trade Payables , Short term Borrowings, Other Current Liabilities and Short Term Provisions in the selected cement companies in financing working capital and anlysed as under. IX. ULTRA-TECH CEMENT LIMITED It is observed from the TABLE 2 that, the trade payables including sundry creditors and bills payable formed a predominant source of short term funds in financing the current assets. The percentage of trade payables is 136 | P a g e Table-2 Financing of Working Capital in Ultra tech Cement Limited (Each Source as a Percentage to Total Current Liabilities) Component 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V Trade Payables 54.30 46.29 45.19 29.97 28.06 40.76 10.11 24.80 21.56 20.64 8.52 2.38 7.28 12.07 7.65 63.38 6.46 10.37 71.54 24.61 32.51 29.10 23.22 79.80 9.71 10.94 12.27 10.29 11.96 11.03 0.97 8.80 91.27 88.23 91.89 67.26 79.81 83.69 9.28 11.08 Sources 8.73 11.77 8.11 32.74 20.19 16.31 9.28 56.89 Total 100.00 100.00 100.00 100.00 100.00 100.00 Short-term Borrowings Other Current Liabilities Short-term Provisions Short Term Sources Long Term (Source: Annual Reports) varied between 28% and 54% during the period. The highest proportion of short-term finance is contributed by trade payables with 54.30% in 2008-09 and the lowest percentage belongs to short-term borrowings with 2.38% in 2011-12. The average proportion is also highest in trade payables with 40.76% and the S.D is 10.11 with the C.V as 24.80%. The average proportion of total short-term sources is 83.69% and the proportion of long-term sources is 16.31% in financing working capital. It is thus clear that around 90% of the current assets has been financed by the short-term sources and remaining proportion by the long-term sources. This indicates that the Ultra Tech has been following the “Hedging Approach” in financing current assets. X. THE INDIA CEMENTS LIMITED It is noted from the data given in TABLE 3 that, the major source of short term financing of current assets include trade payables and short term borrowings. The proportion of trade payables is varied between 25.36% and 52.63% and the proportion of short term borrowings are varied between 12.20% and 55.38% during the period. The highest contribution towards short term sources is observed with the average of 42.82% in trade payables and the 137 | P a g e Table-3 Financing of Working Capital in The India Cements Limited (Each Source as a Percentage to Total Current Liabilities) Component 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V Trade Payables 34.73 25.36 48.93 52.44 52.63 42.82 12.21 28.51 12.20 12.23 52.47 64.52 55.38 39.36 25.18 63.97 2.89 2.88 78.79 55.93 40.08 36.11 33.31 92.23 3.98 3.82 6.83 5.98 5.11 5.15 1.29 25.03 53.80 44.29 187.02 178.87 153.21 123.44 69.13 56.00 46.20 55.71 -87.02 -78.87 -53.21 -23.44 69.13 294.93 100.00 100.00 100.00 100.00 100.00 100.00 Short-term Borrowings Other Current Liabilities Short-term Provisions Short Term Sources Long Term Sources Total (Source: Annual Reports) S.D is 12.21 with the C.V as 28.51%. The company has been mobilising the finance through the short term sources which is more than enough to finance the working capital by the end of the period. The proportion of short-term sources used to finance long-term assets is 23.44%, which is a significant proportion. Obviously it can be said that The India Cements has been following an “Aggressive Approach” in financing working capital by the year 2012-13. XI. J.K. CEMENT LIMITED The data of TABLE 4 clearly reveal that other current liabilities have constituted a significant source of short term financing during the period from 2008-09 to 2012-13. The percentage of other current liabilities to total current assets has been moving around 16% and 44%. It has been showing a consistent increasing trend by the year 2012-13. The highest average proportion also lies in other current liabilities with 33.16% and the S.D is 12.10 with 138 | P a g e Table-4 Financing of Working Capital in J.K. Cement Limited (Each Source as a Percentage to Total Current Liabilities) Component 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V Trade Payables 16.54 20.95 18.75 16.28 19.03 18.31 1.93 10.56 0.18 0.53 6.41 7.64 18.27 6.60 7.34 111.11 16.29 24.50 42.08 39.32 43.60 33.16 12.10 36.51 4.91 4.29 3.67 4.78 6.29 4.79 0.97 20.32 37.91 50.27 70.91 68.01 87.20 62.86 19.14 30.44 62.06 47.73 28.99 31.99 12.73 36.70 18.85 51.35 100.00 100.00 100.00 100.00 100.00 100.00 Short-term Borrowings Other Current Liabilities Short-term Provisions Short Term Sources Long Term Sources Total (Source: Annual Reports) C.V as 36.51%, it is followed by trade payables with 18.31% for the 5 years study period. Since the proportion of long term sources in financing working capital is found with 36.70% for the period, which gives an understanding that, the J.K. Cement has been following “Hedging Approach” in financing working capital. XII. ACC LIMITED The information in TABLE 5 exhibits that, the percentage of short-term provisions has been playing a major source of short term financing followed by trade payables during the period. ACC ltd. mobilised the finance through the short term sources, which is more than the investment in current assets during 2008-09 and 2010-11 and later the policy has been changed and using long term sources in financing working capital. The highest average proportion of short term sources is also observed in short term provisions with 38.08%.The S.D is 15.98 and the C.V as 41.97%. The average proportion of total short term sources is more than 100% of financing the working capital, which denotes that the ACC Ltd has been following the “Aggressive Approach” in financing the working capital for the study period. 139 | P a g e Table-5 Financing of Working Capital in ACC Limited (Each Source as a Percentage to Total Current Liabilities) Component Trade Payables Short-term Borrowings 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V 61.47 53.08 19.63 13.69 14.47 32.47 22.95 70.70 - - - - - - - - 24.13 22.97 41.93 31.41 34.99 31.08 7.86 25.29 50.12 60.02 29.02 26.76 24.46 38.08 15.98 41.97 135.71 136.07 101.28 71.86 73.91 103.77 31.54 30.40 -35.71 -36.07 -1.28 28.14 26.09 -3.77 31.54 837.46 100.00 100.00 100.00 100.00 100.00 100.00 Other Current Liabilities Short-term Provisions Short Term Sources Long Term Sources Total (Source: Annual Reports) XIII. AMBUJA CEMENTS LIMITED The data presented in TABLE 6 shows that the proportion of trade payables and short term provisions have been showing declining trend and other current liabilities has shown an increase by the year 2012-13. The highest source of short term financing is registered with 46.60% in trade payables in 2008-09, while the lowest proportion of short term source is found as other current liabilities with 6.10% in 2009-10. There are no funds mobilised through short term borrowing during the period. The average proportion of short term provisions found to be highest among the sources of short term finance with 28.16% and the S.D is 6.50 and the C.V as 23.07%. The average proportion of long term sources used for financing working capital is 27.90% in Ambuja cements ltd. for the period, which leads to understanding that, the Ambuja cements ltd. has been following “Hedging Approach” in financing working capital by the end of the study period. 140 | P a g e Table-6 Financing of Working Capital in Ambuja Cements Limited (Each Source as a Percentage to Total Current Liabilities) Component 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V Trade Payables 46.60 35.28 22.31 17.72 17.60 27.90 12.70 45.52 - - - - - - - - 7.31 6.10 14.11 12.43 14.31 10.85 3.88 35.73 34.05 34.97 27.52 24.81 19.44 28.16 6.50 23.07 87.96 76.36 63.93 54.97 51.35 66.91 15.22 22.74 46.60 35.28 22.31 17.72 17.60 27.90 12.70 45.52 100.00 100.00 100.00 100.00 100.00 100.00 Short-term Borrowings Other Current Liabilities Short-term Provisions Short Term Sources Long Term Sources Total (Source: Annual Reports) XIV. MADRAS CEMENTS LIMITED The analysis of TABLE 7 reveals that the major portion among the short term sources is observed in other current liabilities with 76.40% in 2010-11 and lowest is found as 1.61% in 2009-10. The average proportion of other current liabilities is also highest with 40.67% among the sources of short term finance. The S.D is 36.13 and the C.V as 88.84% for the period of 5 years. The company has mobilised 83.12% of current assets through the short term sources and remaining proportion through the long term sources. Hence it can be understood that, the Madras Cements Ltd. has been following ”Hedging Approach” in financing working capital by the end of year 2013. A close look at the average composition of current liabilities discloses that, the trade payables formed a predominant source of short-term funds in financing working capital requirements in respect of Ultra Tech and The India Cements from 2008-09 to 2012-13. While the other current liabilities played a major role in J.K. and Madras Cements. Other current liabilities include Unpaid Dividends, Liability for Capital Goods, Advances from Customers, etc. The short term provisions occupied a major proportion of short term source in the remaining two companies viz., ACC and Ambuja. 141 | P a g e Table-7 Financing of Working Capital in Madras Cements Limited (Each Source as a Percentage to Total Current Liabilities) Component 2008-09 2009-10 2010-11 2011-12 2012-13 Avg. S.D C.V Trade Payables 14.85 14.51 12.70 9.07 11.43 12.51 2.37 18.98 12.96 21.43 30.79 59.18 46.98 34.27 18.80 54.85 1.81 1.61 76.40 64.85 58.66 40.67 36.13 88.84 10.11 10.55 11.03 12.18 11.73 11.12 0.85 7.62 39.72 48.10 53.70 145.28 128.80 83.12 49.81 59.93 60.28 51.90 46.30 -45.28 -28.80 16.88 49.81 295.13 100.00 100.00 100.00 100.00 100.00 100.00 Short-term Borrowings Other Current Liabilities Short-term Provisions Short Term Sources Long Term Sources Total (Source: Annual Reports) XV. CONCLUSIONS 1) All the selected companies used the short-term liabilities as a source of financing the working capital and varied between 34.56% and 187.01% during the period. 2) The proportion of current liabilities to current assets is comparatively higher in The India and ACC ltd. among the selected samples. The highest average proportion of current liabilities to current assets is registered as 123.44% in The India Cements. 3) The trade payables including sundry creditors and bills payable formed a predominant source of short term funds in financing the current assets in Ultra Tech. The percentage of trade payables is varied between 28% and 54%. 4) Since around 90% of the current assets has been financed by the short-term sources and remaining proportion by the long-term sources in Ultra Tech, it can be said that the Ultra tech Cement Ltd. has been following the “Hedging Approach” in financing current assets. 5) In the case of The India Cements Ltd., the major source of short term financing of current assets include trade payables (varied between 25.36% and 52.63%) and short term borrowings (12.20% and 55.38%) during the period. 6) The India Cements Ltd. has been mobilising the finance through the short term sources which is more than enough to finance the working capital with the average proportion of 123.44%. Obviously it can be said that the company has been following an “Aggressive Approach” in financing working capital by the end 201213. 7) Other current liabilities have constituted a significant source of short term financing in J.K., which is moving around 16% and 44% of short term sources during the period. 142 | P a g e 8) Since the proportion of long term sources in financing working capital is found with 36.70% in J.K for the period, which gives an understanding that, the company has been following “Hedging Approach” in financing working capital. 9) The percentage of short-term provisions has been playing a major source with 38.08% in ACC ltd. followed by trade payables during the 5 years period from 2008-09 to 2012-13. 10) The average proportion of total short term sources is more than 100% of financing the current assets in ACC ltd., which denotes that the ACC Ltd has been following an “Aggressive Approach” in financing the working capital for the study period. 11) In respect of Ambuja Cements Ltd., the highest source of short term financing is registered with 46.60% in trade payables during 2008-09. 12) Since 66.91% of current assets are financed by short term sources and the remaining portion of working capital i.e. 27.90% is financed by long term sources in Ambuja Cements, which leads to understanding that, the Ambuja has been following the “Hedging Approach” in financing the working capital by the end of the study period. 13) In the case of Madras Cements Ltd., the major portion among the short term sources is observed in other current liabilities with 76.40% of total short term funds. 14) The Madras Cements Ltd. has mobilised 83.12% of working capital through the short term sources and the remaining proportion through the long term sources. Hence it can be understood that, the Madras Cements Ltd. has been following the ”Hedging Approach” in financing working capital by the end of year 2013. REFERENCES [1]. Ernest W. Walker, “Towards A Theory of Working Capital”, The Engineering Economist, winter 1967, pp. 21-35. [2]. Rajeshwari, N. (2000):“Liquidity Management of Tamil Nadu Cement Corporation Ltd.-A Case Study”, The Management Accountant, Vol.35, No.5, pp-377-378. [3]. Hennessy, C., & Whited, T. (2005). Debt dynamics. Journal of Finance, 60, 1129–1165. [4]. Padachi Kesseven, “Trends in working capital management and its impact on firms‟ performance: An analysis of Mauritius small manufacturing firms.” International Review of business research papers. Vol. 2 No. 2 October 2006 pp 45-58. [5]. Krishnamachary, Prof. P. (1990) “Investment management in Public Enterprises (with special reference to selected undertakings)”, Readings in Public Enterprises, Hyderabad, Vikas Publications, Volume IV. [6]. Shin, H. H., & Soenen, L. (1998). Efficiency of working capital management and corporate profitability. Financial Practice and Education, 8(2), 37-45. [7]. James C. Van Horne, John Martin Wachowicz , “Fundamentals of Financial Management”, Prentice Hall of India (PHI), 2005. [8]. Prasanna Chandra, “Financial Management”, Tata McGraw-Hill Education, 2008 . [9]. I.M. Pandey, “Financial Management”, Vikas Publishing House Pvt. Ltd, 01-Nov-2009 143 | P a g e [10]. Websites: www.indiacements.co.in, www.ultratechcement.com, www.jkcement.com, www.acclimited.com, www.worldcement.com, www.eindiabooks.com, www.ambujacement.com, 144 | P a g e