Working capital management: Theory and evidence from New

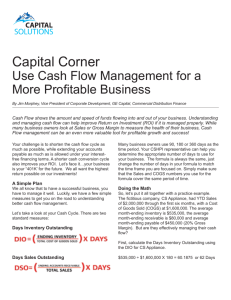

advertisement