Narrated Solutions, Ch7&14

SOLUTIONS, CH. 7 & 14

ASSIGNMENTS

ACCT7310, Spring 2016

7-26, 27, 28, 29, 34, & 39; 14-23

Problem 7-26 Straightforward DM, DL

• Al

Formulas:

MPV = (AP-SP)*AQpurchased = ($5.10-5.00)*3700 = $370 U

MEV = (AQused-SQallowed) *SP = (3700-4000)*$5 = $1500 F

Also called Usage or Quantity variance!

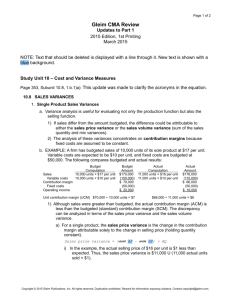

Direct Labor variances--Similar

Direct Manufacturing Labor

Actual Costs

Incurred

(Actual Input

Quantity

× Actual Price)

(900 hrs. × $9.80)

$8,820

Actual Input Quantity

× Budgeted Price

(900 hrs. × $10.00)

$9,000

$180 F

Price variance

$1,000 F

Efficiency variance

$1,180 F

Flexible-budget variance

Flexible Budget

(Budgeted Input

Quantity Allowed for

Actual Output

× Budgeted Price)

(2000 × 0.5 × $10.00)

(1,000 hrs. × $10.00)

$10,000

Or Rate variance

Here the term Efficiency is a good fit, because efficiency is commonly associated with labor.

Identifying DM variance at time of purchase

Ex. 7-27, Journal entries

Ex. 7-27, Journal entries cont’d

Ex. 7-27, Journal entries concluded

Ex. 7-27,assuming 6000 yds. purchased

(vs. 3700 used)

Ex. 7-28 —Reconciling to static budget

Ex. 7-29: Mkt Share, Mkt Size

Ex. 7-29: Mkt Share, Mkt Size

Ex. 7-29: Mkt Share, Mkt Size, Reasons

The market share variance is favorable; the company increased its percentage of the market.

Since the total market decreased , this could be due to providing a higher quality product or more after-sale services than competitors, a decrease in sales price, or negative actions by competitors.

Problem 7-34

Flexible budget for quantity purchased .

Flexible budget for quantity used .

Q2: Causal effects?

“Actual input” may be awkward terminology here.

3. Switching vendors good idea?

• Can we say whether it was a good decision?

• Outcome:

• The $25,200 savings in the cost of titanium was outweighed by the

$33,000 extra material usage.

• Also, the $33,000 does not reflect the total cost of inefficiency; 500 lbs remain to be used used. At current usage rate (7900/800), could produce about 50 more units. At standard, 50 more units should take 50 × 8 = 400 lbs., not 500 lbs.

Additional questions

4. Performance issues

•

•

Should PA (M. Scott) be evaluated solely on price variances?

The prod’n manager solely on efficiency variances?

• Important for owner to understand causes before evaluating performance.

• Variances raise questions . Managers must interpret--construct a story.

• 5. Other than performance evaluation, what reasons for calculating variances?

• 6. What future problems from decision to buy lowerquality of titanium?

Pr. 7-39: Comprehensive Review

Static Budget calculations

Static Budgeted Amounts

Units sold

Selling price per unit

Revenues (1,500,000 × $6.00)

Direct materials purchased and used:

Direct materials per unit

Total direct materials costs (1,500,000 × $1.50)

Direct manufacturing labor:

Direct manufacturing rate per hour

Labor productivity per hour in units

Manufacturing labor-hours of input (1,500,000 ÷ 300)

Total direct manufacturing labor cost (5,000 × $12.00)

Direct marketing costs:

Direct marketing cost per unit

Total direct marketing cost (1,500,000 × $0.30)

Fixed overhead costs

1,500,000

$ 6.00

$9,000,000

$ 1.50

$2,250,000

$ 12.00

300

5,000

$ 60,000

$ 0.30

$ 450,000

$ 800,000

Pr. 7-39: Comprehensive Review

.95*1,500,000 1,500,000 units

=1,425,000

Total static-budget variance

$ 263,290 U

Flexible Budget with Variances

Units (diskettes) sold

Revenues

Variable costs

Direct materials

Direct manuf. labor

Direct marketing costs

Total variable costs

Contribution margin

Fixed costs

Operating income

Actual

Results

Flexible-Budget

Variances

Flexible

Budget

Sales-

Volume

Variances

Static

Budget

1,425,000 0

$8,692,500

2,280,000

69,540

356,250

$142,500 F

142,500 U

12,540 U

71,250 F

@$6

@

$1.50

.04

1,425,000 75,000 1,500,000

$8,550,000 $450,000 U $9,000,000

2,137,500

57,000

.30

427,500

112,500 F

3,000 F

22,500 F

2,250,000

60,000

450,000

2,705,790 83,790 U

5,986,710 58,710 F

810,000 10,000 U

2,622,000

5,928,000

800,000

138,000 F

312,000 U

0

2,760,000

6,240,000

800,000

$5,176,710 $ 48,710 F $5,128,000 $312,000 U $5,440,000

$263,290 U

Total static-budget variance

$48,710 F

4

Total flexible-budget

variance

5

$312,000 U

Total sales-volume

variance

Analyzing the Sales Volume Variance

Market size & share var’s (contr. mgn)

If we had maintained our share, we would have sold this many units.

6

Only one product, so no question of “mix.”

Price, efficiency var’s for DL

7

Or, thinking in terms of formulas:

LRV = (AP-SP)*AQ = ($12.20-12.00)*5700 = $1140 U

LEV = (AQused-SQallowed) *SP = (5700-4750)*$12 = $11,400 U

8

Pr. 14-23, Detroit Penguins

Note that this is the difference between the Static and the Flexible budgets:

Static: 4000*$20+6000*5 = $110,000

Flex: 3300*$20 + 7700*$5 = 104,500

$104,500- $110,000 = $5500 U

24

Sales-Quantity Variance [from last week]

Effect on CM purely from quantity sold

=

(Actual units of all products sold

– Budgeted units of all products sold)

×

×

Budgeted sales-mix percentage

Budgeted contribution margin per unit

Rationale:

•If overall sales increased…

•and the sales mix had been as expected (budgeted)…

• then contribution margin would have increased at the budget rate per unit.

The sales-quantity variances are:

Lower-tier tickets = (11,000 – 10,000) × 0.40 × $20 = $ 8,000 F

Upper-tier tickets = (11,000 – 10,000) × 0.60 × $ 5 = 3,000 F

All tickets $11,000 F

Sales-Mix Variance

Actual units of all products sold

=

×

Change in mix:

(Actual sales % – Budgeted %)

×

Budgeted contribution margin per unit

Computed for each product and total.

25

Conclusions

• The Detroit Penguins increased average attendance by

10% per game. However, there was a sizable shift from lower-tier seats (budgeted contribution margin of $20 per seat) to the upper-tier seats (budgeted contribution margin of $5 per seat). The net result: the actual contribution margin was $5,500 below the budgeted contribution margin.