Prep Provider Guidelines Program Manual-2016

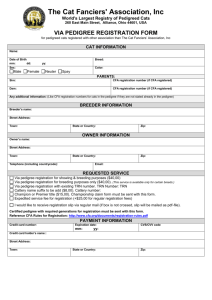

advertisement