“HSL--meets fast world changes with unchanging eternal philosophies”

Suddenly the Big Picture looks

Big

Picture

like a Big Gulp, & a gasp or two.

Stock markets are freezing up. No price traction. Volume

shrunken. Volatility at historic lows. Political polarity in the

US (& worldwide vs the US) more emotional than anyone

alive can remember. Currencies, normally safe for medium-term moves, suddenly whip around like soybean futures. Interest rates are causing grey hair to those who will

suffer if they move as high as money supply hints they

could. Eight Central banks are printing money on a larger

nominal, real & % scale than since the 1920’s. US Fed has

broken the sound barrier with credit creation. Govts are

proving the stupidity of the public by repeating the mantra

that inflation is not a worry, when the data & charts prove

otherwise. Taxi drivers, housewives & retirees know govts

are lying. Reminds us that Hitler said: “What good fortune

for govts that the people do not think.”

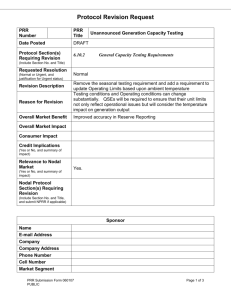

Time is now a critical factor in all the above. Normally,

which US political party wins does not affect stk mkts very

much; data proves that. This time will be very different, if

only because of the multi-billions being spent on wars—

which will by admission escalate under Bush & diminish

under Kerry. The

cost of Iraq is

still being kept

secret by US

Deputy Secretary

of

Defense

Wolfowitz.

He

dare not lie so

he

says

he

“doesn’t know”

the cost. But after the Nov 2

election, those

costs will need

to be revealed. I hear they will be shocking. ••The political

climate will also change if Kerry is elected, partly because it

would represent a public rejection of Bush policies. If Bush

is re-elected, the polarization will not soon disappear, IMO.

In short, a political sea-change seems possible in the US,

whichever way the vote goes. The polarization outside the

US won’t go away either if Bush wins; feelings run too high.

Another time factor: Many US military chiefs want a return of the draft as US forces are stretched thin around the

world & dangerously so in Afghan & Iraq. The Pentagon want

to increase the navy by 1/3rd! Both ships & men. What men?

Who will pay? Taxpayers? Yes & no. Maybe not mainly via

direct taxes but partly via inflation (the renown hidden tax).

Two bills are now before Congress to bring back the draft

(S.89 & HR 163) for men & women. They are poised for a

vote, right after the election, I’m told. If Bush wins, many

will wave goodbye to sons, daughters & grand-kids age 1624 as they’re called up. If Kerry wins? Draft less likely, I’m

told. ••Note: much also hinges on whether Congress stays

in GOP hands or reverts to Dems.

“Merlin”, at the US Fed

isn’t likely to wave his wand

to raise interest rates very

“ HSL-HSL-—the Newsletter much pre Nov 2, per his secret pact with GWB, which

with a Global

could risk some bubbleConscience.”

popping. Yet, the pressure

from bond mkts makes that

HSL 642 - 08 AUG 04

The Original

International Newsletter

HSL

THE UNITED

STATES OF HSLM

AMBASSADORS

Harry Schultz Life Strategies

• Financial • Health • Geopolitical • Philosophical • Life Tactics

AKA: HSL, &/or The International Harry Schultz Letter

~ For THINKING humanoids ~ (in 80 nations)

Single copy price : US$50, SwFr63, £27, €41, A$70, C$66, 0.13 oz Gold

HSL 642 August 8, 2004 - DJIA 9,815

© Copyright F.E.R.C.

a dangerous game---keeping the

IN THIS ISSUE :

lid on a heating pot. Makes for a

bigger pop later. But moss- 1984 …………………………. 3

covered Merlin isn’t reluctant to 40 years (forecasting) ……. 2

increase the broad money supply, M3, at $50bil a week, which Closed positions ………... 10

will, if continued, add over $2.5 Futures (back to) ………... 11

trillion in a year. My friend, ex Gold …………………………. 5

CEO Raleigh Shaklee, believes Health (light therapy) …….. 6

“this almost unbelievable inflation of ‘money’ is likely to end or HSL investment box ……... 9

let up after Nov, regardless of HSL masthead …………….. 3

election result. Reversal of the HSL model pf …………….. 10

monetary pendulum will signal HSL services box …………. 6

massive corrections in markets HSL web box ………………. 4

worldwide.” He concludes: “It

would be only the beginning of HSLP (market predictor) ...10

truly hard times. And if they do New Country ………………. 4

not stop the printing presses, it Nutshell …………………… 11

will be the beginning stage of hy- Off the cuff …………………. 7

per-inflation.” I might have

phrased it differently, but it’s hard Open positions ……………. 9

to fault Raleigh’s directional logic. Potpourri ………………….. 12

The time window is narrow- Recommendations (new) ..10

ing. In the few wks til Nov 2, all Tech stress (wrong way) ... 3

this may come more clearly into Trek …………………………. 5

focus & the listless mkts of today Uncles notes ……………... 12

will probably begin forming chart

patterns that reveal which way US Mkts …………………….. 7

the economy, stocks, bonds, War & pieces ………………. 6

metals, commodities & curren- World mkts analysis ………8

cies will push. Will they form coil Your voices ………………... 4

springs to rise or toppy patterns?

In Oct HSL, I hope to be able to see & correctly analyze

which way each separate mkt will jump. Between now &

then U should watch prices, volumes & trends to draw preliminary conclusions. Our FMU & GCRU website updates

will serve as backups for U also. Meantime, stay with all

energy stocks (coal, gas, oil, pipelines, energy svcs), hold

gold bullion & coins U already own, sell semi conductors &

most financial svc stks, & get set to trade (not hold) gold

stocks in their next stage (see inside). Tech stocks? Lighten

up. Why? See US

"Few of us can easily surrender our

Mkt section.

Copper

stocks belief that society must somehow

should rise after cur- make sense. The thought that the

rent correction, says State has lost its mind & is

Ed Yardini. And I punishing so many innocent people

agree. If U hold de- is intolerable. And so the evidence

fense stks (eg, Boe- has to be internally denied."

--Arthur Miller

ing, Raytheon, Gen-

... The Letter for Millionaires — current & prospective (& former) ...

1

HSL

BY PRIVATE SUBSCRIPTION ONLY

eral Dynamics, Northrop Grumman, Lockheed) watch ’em

carefully. IMO, they’ll be buys or rebuys if Bush wins, sells if

Kerry wins. Their charts may tip us ahead of Nov 2. If polls

lean more strongly toward GB, U can begin buying & increase after 11/2. If polls lean toward JK, begin selling &

more after 11/2. ••Much US military spending accounting

has been pushed to post-election. 2005 will see the truth &

almost certainly a deficit skystreak. If so, it will push US$

to lower levels. Result: push inflation higher, along with

gold & commodities. Property is a bubble, but its sell-by

date will probably be delayed till the bigger inflation ahead

is tamed. Property doesn’t usually fall in inflations, but

high int.rates can restrain it. Depends size. Use bond rally

to exit bonds longer than 3yrs. Be out by USTB 104-105.

Rally sucks in fundamentalists.

NYTimes reports: “Rarely has a presidential campaign

been this intense, this polarized, this partisan, this early.

It’s only July, but the battle is already joined.” And rarely

has the ROW (rest of world) been so interested in a US

election. If they could vote they would, according to an

Economist mag poll, elect Kerry (“anybody but Bush” is the

usual answer) by an astonishing 94% margin. “The ROW

wants a regime change in Washington” says Boston Globe.

European Studies Centre, Oxford, says “If Bush loses, ROW

will say this was a difficult period but an aberration from

the norm. If Bush wins there’ll be a long-term effect on

European {& ROW, IMO} policy & development of a permanent rift between US & EU.”

Bush’s unilateral approach to everything (from land

mines & Iraq to Kyoto & world court) is the main ROW complaint. ESC says “Bush’s willingness to flout int’l law will

cause Europe to define ourselves against America. U will

become ‘the other’ for Europeans.” Says Kerry will disconnect Iraq from the war on terror. “With Kerry there will be

dialogue, not dogma.” Center for European Reform, London

think-tank, says “This is a foreign policy election for the US

& a defining election for the world.” Americans seem almost unmoved by world opinion, but are deeply divided.

The US is currently called 1 country, 2 nations. ••By the

way, absentee ballots of expat Americans & soldiers will be

extremely critical if the count is close. With so many military abroad, the number is large & if ballots arrive late, as

is usual, the winner may not be known on Nov 2. Meantime,

watch the polls, which may cast a shadow & help U make

profitable investment decisions, hopefully before Nov 2.

Newsbites that bite: US deficit rising its fastest since

1993. •••Pimco chief Bill Gross, world’s biggest bond

fund mgr says “US economy less stable than in past 2030yrs; US$ supported by kindness of Japan/China, should

be 20% lower, & they will change that support—we just

don’t know when.” Says banks are playing the carry trade,

borrowing short, lending long, things not done before. Lots

of risk in economy. •••The Great Mall of China is a wild

card in forecasting here. Are there 2 go-slows? China

growth & US consumer buying. Or only 1 or none? It’s unknown at moment. IsTGMofC thus a major cause of the

mkts freezing up? Probably. (See stopress in Uncle’s Notes)

•Europe inflation rate up to 2.5% (admitted) from

2.0. •••U can make a case for anything, with selective

data. So very much is judgmental. U must fight not to pick

out factors U like.

like •••The struggle for perspective is what

drives Big Picture. Eg, an S&P chart in euro currency terms,

not US$’s, shows the May-June S&P rally was been between modest & tiny. Shows how much it matters to be

tuned-in to currencies. •••US Treasury chief Snow says

2

HARRY SCHULTZ LIFE STRATEGIES

the US govt is not a guarantor of FannieMae & FreddieMac’s $3 trillion in mortgages. When we get into deep

stagflation in say 2yrs, this will be the loose cannon on the

economic ship of state. Meantime, the stocks are a

sell. •••3 cheers to private enterprize for launching a private space ship! I guess I’ll have to organize an HSL space

ship for Hslms who want to take a day trip into space. Or

push off to another planet due to the pollution, politics &

fraud on Earth. Book early! ☺

markets is hardly an easy occuForecasting

pation! Yet, through major bull &

bear mkts, HSL has persevered for 40 years,

years an event we

celebrate today. But HSL didn’t just survive for 4 decades.

HSL led the parade in many areas. Scores followed & multiplied. I feel like a Godfather to a myriad of ideas & life & mkt

strategies that have been adopted around the world. Newer

readers will be surprised, even shocked,

shocked to learn that HSL

boldly went where no one went before. Longtime readers will

smile in remembrance. Here’s a list, as best I can recall,

which I predict U’ll find truly amazing:

•HSL has been written on every continent, & in many

cases printed there too, during short residencies (eg,

HongKong, Switzerland, Denmark, US, SoAfrica, Belgium, UK).

•HSL was first to recommend international investing to a

then-insular public, & even wrote a book (Harpers&Row) in

early 70’s on Terms &Tactics for the Int’l Investor. •HSL was

first NL (newsletter) to cultivate “friends in high places,” top

intellectuals like Nobel prize winner von Hayek, & finance

ministers & tiptop politicians—from Japan to Germany to

SoAfr to the UK & US. •HSL was first to establish contacts

around the world to tap for readers, before most news organizations even had global contacts on the ground. CNN & CNBC

were not even dreamed of. •HSL was first to have experts &

top central bank & govt officials speak at seminars and take

time to talk to ordinary investors one-on-one. •HSL was first

to recommend foreign currencies to Americans, which some

thought unpatriotic! (can U imagine?)

It’s hard to remember what a different world it was 3040yrs ago! •HSL was first to recommend foreign bank accounts to readers. •HSL was one of first to recommend gold

stks, long before it was legal for some citizens (eg, US/UK) to

own physical gold. •HSL was part of the original hard-money

movement that arguably was the main reason gold became

legal for US citizens to own. Jim Blanchard (who called us his

mentor) spearheaded that cause, flying a banner over Nixon’s

inauguration saying: Legalize Gold! •HSL was easily the most

international NL from the start, often preferring to gogo-see

what was happening rather than be anchored at home. •We

wrote the first ever book on bear mkts (PrenticeHall). •We

invented the investment seminar for average investors, bringing brains to our doorstep.

We mentored the Githlers, Blanchard, Vern Myers, & a few

others, then retired from seminars. Many achieved fame after

appearing at a Schultz seminar, which were held in several

nations. •HSL was first NL to savvy & explain the connection

between politics, govt action, & mkts. Hence, first to discuss

major geopolitical issues & their mkt effect. Others just talked

about stocks & DJIA. •We pioneered charting when it was

deemed by most an untried theory & way-out. •Schultz

Schultz Clubs

sprang up around the world in the 70’s, headquartered in Holland where HSL was based for a year. •We were the first NL

to attend IMF meetings. •HSL was first to recommend So Afr

gold shares, thought an outrageous idea at first but proved

the biggest money-spinner of any group in the world.

... “Decriminalize & tax drugs to reduce street crime & reduce govt violation of individual privacy & rights.” H.D.Schultz …

HSL 642 - 08 AUG 04

HSL

BY PRIVATE SUBSCRIPTION ONLY

•HSL was first & still is the main NL that points to the

folly of making money if individual (not national) freedom is

limited. We labour in the vineyards of liberty. •We exchanged

words for action in founding an HSL hospital for orphaned or

injured Afghan children on the Pakistan-Afghan border &

treated 200,000 kids. •We created the PT concept, then a

daring idea, which has now grown into an industry! •HSL &

HS received more awards than any NL & probably more than

all other NL’s combined, worldwide. (eg, 2 Man of the Year

awards; 2 Freedom Fighter awards; Most Outstanding Newsletter award; A Newsletter Excellence award; Liberty Award

by Congress of Freedom, Original Thinker Award, & aprox 20

others. Personally, we were made a Knight of Malta, later

Knight Commander of St.Agata & 3 other such honours.

•We created our own abbreviated spelling (as G.B.Shaw

also tried), which UK politician/friend Enoch Powell called

Schultzese, which was ahead of its time, & we had to drop it.

But now it’s often seen (like R U for are you) & is widely used

in email by the entire world. Being ahead of your time is

tricky. As Napoleon said: don’t get too far ahead of your

troops. •We also created several words (eg, stagflation),

now commonplace.

•Uniquely, we also tried (for 18yrs) to start a new country, encouraged by Hslms. We came close 3 times, but the

Tri Laterals stepped in. •HSL also formed a newsletter association (IILA) with Vern Myers aid. •We helped with the Euro

arm of Pres. Reagan’s StarWars program. •We were given a

listing in the Guinness Book of World Records in 1981

(which has been ongoing). •HSL was first & largely still alone

to annually publish a list of political & charitable organizations who merit support. •Our HSL family was often knitted

together with HSL ties, scarves, towels, playing cards, cuff

links, pens, parties & reunions.

•HSL has, I believe, more lifetime subscribers than any

NL. While those who pay annually are just as valued, lifers

tend to join to give a longterm vote of confidence & support

to our causes, principles, & beliefs. •Our independentlyminded readers don’t pretend to agree with all we say, but

they accept that even a husband/wife don’t always agree, &

urge us on with renewals despite areas where we differ. •The

list above isn’t complete, but it’s a good sample, eh? Also a

kind of autobiography •I won’t live for another 40 yrs but I’ll

keep producing as long as U want me. It’s your call.

I’m late to report this Boston Globe story but such

1984

good news keeps well: Annoyed by the prospect

of a massive new federal surveillance system, two research-

ers at the Mass. Institute of Technology inaugurated (in

2003) a new Internet service that will let citizens create dossiers on govt officials. The system started by offering standard background info on politicians, but then goes a bold

step further, by asking Internet users to submit their own intelligence reports on govt officials--reports that will be published with no effort to verify their accuracy. "It's sort of a citizen's intelligence agency," said Chris Csikszentmihalyi, assistant professor at MIT Media Lab.

He & graduate student Ryan McKinley created the Govt

Information Awareness (GIA) project in response to US govt's

Total Information Awareness program (TIA). Revealed in

2002, TIA seeks to track possible terrorist activity by analyzing

vast amounts of info stored in govt & private databases, such

as credit card data. The system would use this info to analyze

actions of millions of people, in an effort to spot patterns that

could indicate a terrorist threat. News of the plan outraged civil

libertarians & prompted Congress to set limits on the scope of

HSL 642 - 08 AUG 04

HARRY SCHULTZ LIFE STRATEGIES

such activity. Defense Dept then renamed the program Terrorist Info Awareness, to ease [deflect] public concern.

But the controversy gave McKinley the idea for the GIA

project. "If total information exists," he said, "really the same

effort should be spent to make the same information at the

leadership level at least as transparent--in my opinion, more

transparent." McKinley worked with Csikszentmihalyi to design the GIA system. It's partly based on technology used to

create Internet indexes such as Google. Software crawls

around Internet sites that store large amounts of info about

politicians. These include independent political sites like

opensecrets.org, as well as sites run by govt agencies.

McKinley created software that ferrets out useful data from

these sites, & loads it into the GIA database. The result is a 1stop research site for basic info on key officials. (Part II nextime) (courtesyThe New York Times Company)

Like so many things

Wrong

way

round!

in society today,

priorities & direction have been reversed, not for the better.

Among many such is the computer/email/Net world. For 137

yrs or so we communicated very nicely with typewriters as

the only equip U needed. Then came the fax, which was a

faster way to send the things U wrote on typewriters. No big

skill needed to use either. Neither required upgrading. Neither did pencils/pens. But then came computers, the Net,

SUBSCRIBERS IN 80 COUNTRIES

HSL

The ideas that

matter most Founding Member— Financial

Newsletter International

-Blue-ribbon newsletters

Financial & Liberty-Loving Strategists

Harry Schultz Life Strategies / HSL / International Harry Schultz Letter

Published as needed-approx monthly. For info: fax, phone

or E-mail our fulfillment office in Costa Rica: Free phone for

US: (1) 866.725.3724. Cad: (1) 877.659.9004. Fax: (506)

272.6261 (if U can’t reach Costa Rica, fax Switzerland (41)

21.652.0525. E-mail: info@hsletter.com. Or write:

HSL, PO Box 622, CH-1001 Lausanne, Switzerland.

-All Rights Reserved•HSL website: www.hsletter.com

Due to virus risks, we will not open unannounced e-mail with attachments.

Please advise in a separate message who U are (name & postal address) &

purpose/content of attachment, then wait for our reply before uploading the

message cum attachment. Sorry for the inconvenience but viruses are deadly.

• Subscriptions: 1 year US$327, SwFr409, £178, €265, A$460, C$431, 0.82 oz Gold,

2 years: US$562, 4 years: US$1012, Lifetime: $2442. Make cheques payable to HSL.

Allow 3-4 weeks for subscription & address change processing.

Back issues available: US$12 to subscribers, US$25 non-subscribers.

Subscriptions are neither assignable, nor refundable.

• Editor Emereri: Chevalier Harry D. Schultz, KHC, KM, KCPR, KCSA, KCSS.

• Mkt analyst: John McMillan. Spinner royalty recipient: Paul Griffiths.

• FMU geopolitical editor: Gordon Frisch.

• Quoting HSL permitted if HSL name, address & subscription price given. • Repeated

photocopying of HSL is illegal. Violators will be prosecuted. $2,000 reward for

evidence of consistent violation. • Recommendations to buy or sell any security,

options on securities, futures or options on futures, are opinions of HSL & do not in

any way guarantee or assure that the investor will either make money or avoid losses.

We may/may not buy/sell stocks, bonds, options, commodities recommended in HSL.

• HSL does not advocate the violent over-throw of any govt. • As you are aware,

inserts/flyers are paid for by fee or commission. This is done to defray rising costs.

Without them, subscription rates would need to rise.

• Products/services advised in HSL & flyers are presumed to be of good quality, but

HSL expressly & explicitly disclaims responsibility for them.

• H.S. Consultation fee: US$2,400 per hour. Minimum service (by fax or letter): 30

mins at $1,200. Weekends $3400 per hour. Payment in advance.

• Harry Schultz is also: Founder, Int’l Investment Letter Assoc - 25 year-mbr, Nat’l

Press Club, Washington DC - Advisory Board, Nat’l Taxpayers Union, WashDC Charter mbr, Nat’l Assoc of Investment Advisory Publishers - mbr, Economic

Research Council, London - Advisory Board, Nat’l Comm Monetary Reform - mbr Free

Market Foundation, Joburg , S.A. - mbr Adam Smith Club, London -Life Patron,

Freedom Assoc, London - Listed in Guinness Book of Records as world's highest paid

investment consultant 1981-2003

... “All governments, of course, are against liberty.” H.L.Mencken ...

3

HSL

BY PRIVATE SUBSCRIPTION ONLY

email. They promised to save us time & give us more leisure.

They did the opposite & grow worse by the hour.

In addition to learning & upgrading your profession/job U

are now forced to spend as much time coping with computer

problems as U do your job! Like crashes, incompatable upgrades, net failures, viruses, spam, server failures, disappearing files, erasures of what U just typed, data connection problems, glitches, etc. Email often saves us a lot of time, but then

something goes wrong (with the Net, server, line or computer)

& the time saved is now entirely lost (& more) while simultaneously giving U intense stress. As we are now computer dependent, as breakdowns occur, we are inescapably involved & frustrated. It’s also depressing there is an immoral army out there

sending emails to U daily aimed solely at entrapment, to trick/

entice U to download their email & get an instant virus! U must

ever be on your toes; if U slip just once, the virus will cripple U

big time. It’s a permanent Russian roulette game with bullets

in several chambers. And, of course, govts can track U far

more easily by email than by phone or fax. They have backdoor

keys, required by law. Encryption is good but is hard/extra

work, inefficient & requires key coupling with other parties.

The Net also opens the door to excessive input, from

friends & biz. They can push a button & overload 10 or 100

people at once. They steal your time without apology. Computers aren’t really guaranteed, but frustration is guaranteed,

indeed it is built-in. Technicians are often needed to sort out

problems (if U can find one when U need him, & not all can

afford their rocketing fees). Big firms employ teams of technicians to resolve hourly glitches. Stress is a proven killer. So

what have we gained, net, net? Frustration takes the fun out

of life. Something should be done to reverse this dependency. I don’t know the long-term answer, but shorterm it’s

clearly: faxing. If we boycott the Net for most communication, we gain peace of mind, time, privacy, control. My oldest

friend has done this for 75% of his big biz & personal traffic

& loves the result! Stress down 75% also. ☺ Computers

when used as typewriters/word processors perform well. Tie

them to the Net & U risk a black hole where your time & data

disappears. I invite your ideas because we are taking 3 steps

forward & 5 steps back as we are.

Your Voices

“How few realize there are indeed

WMD's that exist & are being

used across the US & many other countries. In this case,

WMD's = Weapons of Mass Disinformation designed to blind

& confuse everyone, & they seem to appear from nowhere at

just the right time(ing) for politicians. I need not name ‘em. U

know. I enjoyed last HSL re your pasta-powered Formula One

car. Stay in the journalistic pole position! For your health column: rub an ice cube on a burn as soon as pos. Same result

as lavender oil. Re your WWII copy: how true. Eisenhower saw

the waste/horror of war & became almost a pacifist. He calculated how much each bomber/fighter cost in lost schools.

Anyone doing that today? Congrats on Big Picture. Keep us in

focus. Ed Lee.” That’s my job.

Since it’s HSL’s 40th birthday, I’m entitled to print a couple

of cozy letters: “I’m glad to contact U again, after some cause

de force majeurs kept me away from my unique HSL ‘Bible’—

as such do I consider the wisdom, shrewd insights & art of

living that our dear Uncle Harry pours into each of his masterful writings! Kindly renew my subscriptions to HSL & GCRU on

a yearly basis. May Uncle Harry & his extremely valuable

team keep on enlightening Humankind for centuries to

come. Isadore Somerville A., Mexico.” That’s a tall order,

Señor, & muchas gracias para las lindas words. •••Not to

4

HARRY SCHULTZ LIFE STRATEGIES

be outdone with encouraging words is Lyle Knudson, Washington, who writes: “I should have gone for an HSL life subscription 10-20 yrs ago, but wasn’t sure U could outlive me,

knowing I’ll only go another 52 years, to 140, & be shot by a

jealous husband. ☺ U’re possibly 10yrs younger than me (88)

& I’m still not sure U can keep going until 2056. Here’s a

joke: Olga: ‘Lena, I hear your husband just died. What were

his last words?’ Lena: ‘Lena, put down the gun!’ Sincerely,

LK.” LK: your humor isn’t dimmed at 88. Make U a deal: I’ll

keep going if U’ll keep going. Ok? ☺

Also in a good mood was Hedy Kauffmann of Australia

who wrote: “Dear Harry, I made a great mistake in not taking a

life subscription as I subscribed only for 1 year each year for

about 30 years! I’ll be 94 on July 17 & still enjoy HSL but lost a

lot of money by not subscribing for a lifetime. Greetings!

Hedy.” I’ll try to visit U at Hunters Hill nextime I’m in Oz. Meantime, may the force be with U! •••From VA: “Your latest Big

Picture is excellent. U did it again. U truly captured the mood in

the US, though written ‘out there’. Objectivity! People here are

nervous, while feeling burned out with corrupt politicos. They

really would rather it all go away, yet they know their future is

at stake. HSL & U get better with age.” All this talk of aging

makes me feel like mellowing Scottish malt whiskey. Cheers!

••From Las Vegas: “Re last HSL: Yes, sports are vicious

these days. They aren’t sports, & players not sportsmen.

Fight match here is like a Roman Coliseum; anything goes

but no lions. Capacity crowd, 10K people, mostly 20-35. Barbaric. 45% women, all with tattoos. Re your class-act contest: how about Mel Gibson as producer/director? Re your

1984: freedom is doomed, due to ‘security’ paranoia. It will

pass but we may not see it. HSL is great. Best, Marvin.”

Agree re Mel Gibson. ••“Dear Harry, re Vermont State motto

as ‘yep.’ You're close, but no cigar. Here in the (gorgeous,

independent-minded!!) Green Mountain State, it's pronounced AYUP. Along with the pronunciation of cows as

CYOWZ, & the modification of a profanity to JEEZUM CROW.

Regards, Bill Morton” Ho,ho,ho. •••I’ve got a lot more mellowing letter for nextime. Thanks to U all. My HSL readers/

family are a collective class act!

READ OUR UPDATES BETWEEN HSL’s...

on our website: www.HSLetter.com (Subscribers Only section).

Updates (at least one FMU between each HSL) are available on

publication Monday’s by 9AM US NY time (often Sunday PM). Date

given in Potpourri. ••In transit & missed an Update? Check Archives

for Updates since last published HSL. Instructions for accessing our

website: 1) In browser, type in: www.hsletter.com; 2) Click on Subscribers Only button on lefthand side of the Home page; 3) In the

User Name box, type in: hslm; 4) In the password box, type in the

current password (see below); 5) Click on either Geopolitical Update

or Free Mkt Update button; or Full Mkt Update button if U are a subscriber to FULL Update service; 6) If reading one & U want to read

the other, click on the BACK button in your browser. Then select

the other Update; 7) If this is not clear—call the Red Cross! ☺

User Name: hslm (not your name!) Password: cheerful

Note: FreeUpdate password changes Sept 5 to: astute

I was in good company when

New

Country

trying to start a new country,

as I did for about 18yrs without success. I just discovered that

US Vice President Aaron Burr tried to start his own country

west of the Mississippi, long after the founding of the US. He

didn’t like the way things were going, even then. ☺ The Republic was being watered down into a democracy. His new

nation plan led contemporaries & a few historians to label

him a traitor. But a jury acquitted Burr, presumably because

...“Silence (when freedom is threatened) is not golden; it is yellow.” Tom Anderson...

HSL 642 - 08 AUG 04

HSL

BY PRIVATE SUBSCRIPTION ONLY

the Constitution provides for both dissent & for any state to

break away from the Union—something Abe Lincoln ignored

in attacking the South for exercising its right to break away.

Presidents are good at ignoring the Constitution. It restricts

them, which was, of course, its purpose. Like ignoring the requirement that gold&silver are the primary means of exchange or backed thereby.

The Aaron Burr legacy, by coincidence or fate, extends to

one of our HSL team members & from there to our book on

Re-Making the World on breaking up large nations into new

(smaller) nations for better governance. Some say coincidences are not random but occur rationally.

(That Re-Making the World book is still available. It was

written in 1991 & events moved on, but principles don’t

change. Senator Steve Symms said of this book: “A watershed

in political thinking.” Richard Russell said: “A bombshell.” Congressman Phil Crane: “This book coaxes our mind into new

channels.” Howard Phillips: “HS consistently is ahead of his

time, floating new ideas which seem outlandish but which often become mainstream thinking.” Ray Vicker (WSJ) “This

book merits much consideration.” Tom Anderson, writer, once

candidate for US presidency: “Hallelujah! Harry has done it.

Harry is an original thinker.” Leon Richardson (HK columnist &

CEO): “This book surpasses my standards for a worthwhile

book.”) To order this book contact our Swiss or Costa Rica offices. US$20 check or $20 bill preferred. Limited supply)

had an exciting day last Friday, 8/6, after 3 wks

Gold

of sliding—then sideways action. The excitement

was caused by the terrible US jobs report. Gold flashed up $7

to $401.50. It closed at 399.0. But if U step back, U see gold

has been in a shallow sideways movement of $27 (385 to

412) for 2months. And if U step back 1 more step, a broader

sideways move has been going on for over a year, between

370 & 430, a $60pt trading range (T/R). ••I said in last HSL:

don’t expect price rockets til volume increases, & for sure

382 must hold—which it has done (tho it had a scary testdrop to 387). I said if 382 breaks, we’ll see a test of the 373

low. On the upside, I said we need gold to break up & hold

over 400-405. It did so. But I said the target after that was

only 415, but maybe 428. We got to 412 & died there. Why

not higher? I asked on your behalf. Because, IMLO (in my

lonely opinion) we’re in a TR we forecast here a year ago.

Last HSL I showed U a 17-18yr chart illustrating this scenario, which so far has been accurate. It predicts gold will

reach a minimal $580 target when it eventually (prob not in

2004) breaks its reverse/H&S neckline--at 428, which I’ve

mentioned before as the top of the action zone. I’ve been a

lonely gold advocate in NOT forecasting “$500 gold any day

now” for the past 2yrs or so, & that’s been validated! Fortunately, U don’t need $500 gold to make money; in fact vertical mkts are higher risk, as corrections come out of the blue

& sharply. It’s far safer & easier to make money in trading

ranges in any stk, metal, fund, or commodity & as U “know”

the top part of the TR is where U sell & the bottom area is

where U buy. I said in Gold Charts R Us (GCRU) the other day:

when U are happy with the gold mkt, sell. (☺) When U are annoyed with it, buy. (). ••Of course, buy/sell only via the bullion price is not the way to win the game. Except for futures

traders, most buy shares not bullion.

And each gold stk has its own indiv pattern. U should keep

charts of each gold stk U own or may trade. Alternatively, get

my GCRU service where I supply specific prices. But keeping

your own charts (or checking them free via BigCharts on Net)

HSL 642 - 08 AUG 04

HARRY SCHULTZ LIFE STRATEGIES

is good in any case to develop a chart feel. •••Meantime,

I’ve cut my recommended % of your portfolio in gold from 2535% to 20-25%. Gold isn’t running away & U can make all

the money U can carry by trading the Trading Range. Later,

when gold breaks, or threatens to break out of this T/R, I’ll

increase the %. I’m also increasing my recom for bear stock

funds by 5% as stk mkts look lower. ••The flipside of gold is,

of course, the US$, which has seemingly built a reverse H&S

pattern, predicted in last Wed’s Gold Charts R Us, before the

right shoulder was more than a blip. Implication: resumption

of the $ rally (in the face of big $ fall on 8/6) & renewed correction in gold. At presstime we’re poised at the make/break

point of this pattern. See Currencies & Futures sections for

guidelines. A tough call just now! ••Planning/tactics pay off

in every investment, & in gold more than most.

We trekked to Switzerland & Paris by train this

time & what a delight are trains. No long drive to

Trek

an airport (train stations are usually mid-city). No departure

delays! No seat belts. No customs. No security check. No Xray of your body & bags. Little or no passport control. No

stress! No ear-pressure, no engine noise. No queue to get on

board. Less struggle to find seat & place bags. No lifethreatening takeoff & landing (the most dangerous part of

flying). Instead, subdued rail spinning, wide windows, views of

sea-side, mountains, or farms, access to snack bar, room to

walk & stretch. No hour drive from airport back to city. No

mid-air collision risk. No skyjack risk. No turbulence. Our

trains were not full. (1st class pays). Porters avail. Why would

anyone fly if given a train option? Is also zero effort vs driving,

though driving beats flying too.

Switzerland is always a breath of fresh air, literally (less

cement & more trees per capita) & psychologically. Enjoyed

visits with friends. Did some R&D. ••To Paris, which was,

well, Paris. It can be whatever U want it to be. Paris still setting trends in architecture, fashion, style. Bot stuff. Our usual

first stop: English book stores. This time to Galignani, 224

rue de Rivoli, the first English bookshop on the Euro continent. Was amazed at the blaze of books on the US election.

Titles: Bushes, Bush vs the Beltway, American Dynasty,

Worse than Watergate, The Bush Haters Handbook, Madame

Hillary, The Price of Loyalty, Tyranny in America, Power

Plays, Where’s My Country? Bush Quotes-raves, rants,

Thieves in High Places, John Kerry, How to take America

Back from the Far Right. etc!

Enjoyed a boat trip on the Seine which is worth doing

every 1-2yrs; U see things U never saw before. Notre Dame &

the 1/3-size Statue of Liberty always attracts the most photo

taking. ••Tons of Japanese tourists in Europe this year,

again. American tourists have returned to France. Maybe

Bush paved the way, via D-Day celebrations & EU meetings.

☺. ••Saw a few films. Saw Fahrenheit 9/11. Audience applauded, but that’s the case everywhere, I hear. U already

knew it was biased, but scintillating anyway. Panning is always popular. •Saw Lady-killers with Tom Hanks. Was also a

viewer killer. It was so bad, we left halfway through. Can’t

...“The right most valued by all civilized men is the right to be left alone.” US Supreme Court Justice Louis Brandeis...

5

BY PRIVATE SUBSCRIPTION ONLY

imagine why TH took the role. Don’t bother to see.

HSL

Visited Planet Hollywood (on the Champs Elysee) underground caverns, a bit like a boozy Carlsbad Caverns, NM.

••Finally visited the Pompidou Centre, vast multi-level, art

gallery, museum, galleries, library, trendy Costes café on top.

Worth doing; allow time. ••Stopped to refresh parched

tongue at famed Harry’s

Harry’s Bar, est. 1911. There are HB’s now

in Munich, NY, LA, Rome, London, Venice, HK, Sgpr,

SanDiego, Denver, Bonn, & Montreux (which has a celebration Nov 2--US election nite). What McDonalds did for fast

food, Harry did for bars (no relation ☺). ••Along with all the

above, I still average 8 hrs a day at deskwork while traveling.

I get 50 charts faxed to me daily of all principal mkts/stks

plus hourly price lists. So trekking is never just trekking. I

wouldn’t have it any other way.

Here are US&UK headlines

& quotes that say a lot

Wars

&

Pieces

about where we are & why. ••7/17 NYT: “For the first time,

a US majority, 51%, said US should have stayed out of Iraq.

62% said the war was not worth the loss of US lives & other

costs.” ••Boston Globe columnist HDS Greenway: “The US

cannot & never could, go it alone & have any chance of prevailing against terrorism. It’s a pity Bush admin. could not

have come to that conclusion earlier, before so much damage was done.” ••IHT pg 1 headline: “US losing high ground

on moral leadership. US seen hurt by Iraq war, detentions, &

‘incredible harm’ of prison abuse.” ••NYT columnist Nicholas Kristof: “Arab world must break out of its self-pitying

eddy. Bush admin must escape its echo chamber [where it

hears only its own voices] & understand the Arabs. Bush

might even pledge he won’t invade a country before learning

how to pronounce its name.”

••NATO’s chief warns “Afghan & Iraq are doomed to be

failed states if the US & int’l community don’t find a way to

work together to save them.” He criticized the US for deserting

Afghan, having troops there only to hunt bin Laden, not help

NATO bring stability to the country. ••P.J.O’Rourke, in his

book Peace Kills, says: “US is not a wily, sneaky nation. We

don’t think that way. On the contrary, US govt policies reflect a

resistance to thinking much at all.” FT headline: Karzai says

he is not cutting deals with Afghan warlords. (Which means he

is) ••NYT headline: War coffins still off limits. Bush Republicans vote 54-39 against allowing photos of flag-draped soldier coffins. (3-monkeys? See, speak, hear no evil) •Press

also reports nothing of the 24,000 US soldiers evacuated

wounded. Is this virtual reality? Or reality censorship?

New book Imperial Hubris–Why the West is Losing the

War on Terror by Anonymous. Says “US forces & policies are

completing the radicalization of the Islamic world, which

Osama bin Laden has been trying to do with substantial but

incomplete success since early 1990’s. As a result, I think it

fair to conclude the USA remains bin Laden’s only indispensable ally.” ••FT headline: Al-Qaeda link with Iraq on 9/11 attacks ruled out. ••LATimes & FT headline: Bush’s team is

dysfunctional, not duplicitous. (your choice) So says Max Boot,

senior fellow at the Council on Foreign Relations. ••Same

message on cover of The Economist mag, picturing Bush &

Blair. Heading: Sincere deceivers. ••“I don’t need to explain

what I say.” G.W.Bush.

Headline: US Supreme court orders a step back from lawlessness. “Torture clearly has enjoyed acquiescence or endorsement by high officials in Bush’s govt.”- columnist William Pfaff, Tribune Media Svc. ••Ex US Sec of State George

Shultz says: “If we put this in terms of World War II, we are

6

HARRY SCHULTZ LIFE STRATEGIES

now sometime around 1937.” (WSJ 3/29/04) IOW, the middle East wars have just begun.

begun ••Army Chief of Staff General Peter Schoomaker told Congress the war will “never go

away in our lifetime.” (USA Today 6/15/04). Someone let the

war genie out of the bottle. This points to large scale inflation

ahead, US$ weakness, hard asset strength, high interest, tax

rises, & much higher oil. Richard Maybury forecasts $150 oil

by end of decade. Don’t rule it out. Not to mention gas, coal,

pipelines, oil services. US$50 this year.

3 HSL Services

HSL is available (12 pgs) by airmail, e-mail or fax. Airmail OR email: US$327/yr—ie, $0.89/day. If you want both e-mail plus green

pages airmail copy: $402. HSL via fax, to your desk automatically

on deadline Sunday: $437/yr (*$417/yr). If you wish HSL by fax

plus green pages airmail copy: $512 (*$492). Lifetimers can get

HSL by fax for +$110/year (*+$90/year) or +$185 (*+$165) for both

airmail & fax delivery; or e-mail plus airmail for +$75/year. ••HSL

offers market updates via Internet between HSL’s: A Free Mkt Update (see “Read Our Updates Between HSL’s”, pg 4) & a Full Mkt

Update (with stock picks), at only $125/yr. ••HSL now offers a

weekly ‘Gold Charts R Us’ service (GCRU), by Net, fax & mail. Via

Internet at rate of: 3-mos $300, 6-mos $585, 9-mos $855 & 12-mos

$1,110. By fax add $120 per 3-months. By mail only $250 per 3mos. U can subscribe on-line at www.hsletter.com (click on ‘Gold

charts R Us’), or subscribe via fax or mail (see page 3 masthead

for contact details). Note: Special GCRU ‘2-Week Taster’ offer

avail-able at $45 via: www.hsletter.com/GCRUpromo_Special.html

•New Subscribers only (limited time offer). ••(“Newsletters don’t

cost—they pay”). *Reduced fax rate for No.American readers only.

Nothing new under the sun.

Light

Therapy

But much is unexploited or

blocked from public view. Here is what seems to me a health

alert that’s worthy of your interest. It’s from our frequent

health info contributor, Dan Reed. He offers a free copy of an

enlightening report on “Colored Light Therapy: Your Link to

Life. How to get well & stay well.”

According to Dan, here's the Big Health Picture:

“A healing miracle that was almost lost to humanity: Since

ancient times, it has been known that specific colors have

amazing healing effects. Hippocrates used colored gemstones to heal disease. The pyramids revealed a highly advanced color healing system among the ancient Egyptians.

Every culture in history, except for our present day medical

system of drugs & surgery, has practiced color healing.

“Now, so can U. In your own home--while U sleep. During

the 1920's-30's, Colored Light Therapy (CLT)--which is but the

shining of selected colors of light upon the body (Electro Magnetic Frequency—which is the basis of colour healing) was

used to treat every disease from colds to the most serious

afflictions. Patients that were abandoned by orthodox medicine often recovered under CLT. Dr. Kate Baldwin, a prominent practitioner of CLT, proclaimed it as ‘the most simple &

effective therapeutic measure ever to be developed.’ Did CLT

become a serious threat to the medical profession? Both antiquity & modern science have supported color therapy as a

literal healing panacea.

“But the healing benefits of CLT are not lost. My report

tells how U can treat yourself even while U sleep. If U hurt, U

need CLT. It has no side effects, & colored light doesn't cost

anything. In the 1930's heyday of CLT, many doctors remedied the majority of ailments that otherwise plague and take

our lives. My Report tells how easily you can duplicate their

methods and obtain the same result. It truly is ‘Your Link to

Life.’ I suggest U Fax or email me for my report. It's free but

“The spirit of resistance to govt is so valuable on occasions that I wish it to be always kept alive.” Tom Jefferson

HSL 642 - 08 AUG 04

HSL

BY PRIVATE SUBSCRIPTION ONLY

its value is inestimable. Now, U can know the secrets of how

to heal yourself when perhaps others can’t.

Fax: (916) 485-7014; email: www.remedy@gvn.net ”

PS from Uncle Harry: In my large health library I found

many references to light & color therapy. Eg, in BodyTime by

Gay Gaer Luce (Pitman Press, UK) it says: “Dr Richard Wurtman predicted light would some day be considered as potent

as any drug,” I’m sold & am using coloured light now.

Sometimes one is frustrated by the

Currencies

fickle finger of fate. We go to press

when the currency world is on a knife edge, after the dra-

matic US$ fall on Fri, 8/7. In 1-2 days we’ll know if that was a

1-day spike (as I tend to believe) or the end of the $ rally. If U

look at the US$ chart U can discern a large reverse H&S pattern, with the right shoulder achieving its precise target

(assuming it’s a valid

pattern) at 88.50,

level with its left

shoulder. If the pattern is valid the $ will

rally over the next few

days & test its neckline at 90.50, If it

breaks up through

that, the rally will extend to 92-93, where

I will expect it to terminate & we resume the $ bear mkt. This road map is clear.

But it will destruct if 88.50 doesn’t hold. That would mean no

$ rally for some time (A 120 min chart is the best place to

view this pattern, which U see on this page).

••Currencies are going to be differently affected by the

oil rise. Eg, the £, NorKr, Mex peso & ruble are benefiting. If

oil continues up, the disparities between currencies will become more pronounced. Factor that into your portfolio. I like

the £ chart. The Swiss have no oil wells in the Alps, so SFr

suffers, but $50 oil will ring safe-haven crisis bells for CH,

says RBC Capital. The US$ is hurt by high oil. The yen may

falter despite oil stockpiles if oil stays up. ••Rising yield will

help the US$, but it must rise a lot to make much difference.

NZ$ yields 6%. US: 1.5%. £: 4.75%. ••As Steve Roach keeps

reminding us: US$ is a faith-based currency. That’s true of

every currency. But the faith is only under fire for the US

these days, due to deficits, politics, war, & all the rest.

Please see our Back to the Futures section for further currency guidelines. U should always read it, whether U trade

futures or not, to give U price perspective on where we are &

may go. Especially if U can have curr. charts at hand as U

read our guides. U can get free charts via BigCharts.com.

China wants to slow its red hot

Off

the

Cuff

growth rate, a bit. But only a bit.

China scared itself with world’s reaction to its announcement

of a slowing. Foot is probably off the brake now & hoping

world believes it. US is slowing a bit. Europe is standing still.

US deficits will be addressed in 2005, by whoever wins the

election. That will slow things. Interest rate rise is another, if

modest at this stage, slowing factor. Put them all together &

a global slowdown is the outlook for 2005. India & China will,

however, still lead the growth parade, even if with smaller

numbers. Japan may be #3, looking good.

There’s been a lot in the EU press about a new EU tax

plan being virtually agreed. It’s been more vision than virtual

HSL 642 - 08 AUG 04

HARRY SCHULTZ LIFE STRATEGIES

for 3years. The Euro Union would have U believe the several

low-tax countries, like Switz, Andorra, Luxembourg, have

joined in. I don’t want to spell out the realities of the compromise. Much is unwritten. U can find that out from your Swiss

(or etc) banker. Better spoken than written. But bottom line:

worry not re your EU bank acnts. ••••General Sir Michael

Rose, ex commanding officer of British SAS, who led UN

forces in Bosnia, says we can’t go around the world changing

regimes everyplace. We must instead devote ourselves to

changing attitudes. For a military man, that’s impressive.

And he’s right, of course. He says it is perceptions, not reality, that matters in these sort of conflicts, eg, Israel & Iraq.

Says a clear exit strategy for Iraq & resolution of the Palestinian conflict is essential, quickly. If not, expect more

9/11’s. We must listen up.

A letter to the editor of the Int’l Herald Tribune by Eileen

Shire probably speaks for most people outside the US. She

divides her time between the US & EU, hears views both

sides. Says “It’s troubling that 50% of Americans plus a handful of undecided voters will determine the direction of world

politics. Wouldn’t it be wonderful if every country were allowed a vote?” She is right. Since US govt imposes its laws on

most of the world (eg, banking, security, trade, travel, surveillance) & the 7 seas between, the outside world ought to have

a voice in how they are ruled. The far-distant provinces (like

Britain) of the Roman Empire had the same complaint of

Rome; they wanted a voice. Will read up to see if they got it.

US TV networks are giving only 3 hours during 4 days coverage of the political conventions this year. Admittedly there

is no contest for candidates (a pity), but even so the networks

show a lack of social conscience, in educating the public on

politics of the day. Good old Larry King gave more coverage

than any network. •••It is US House Speaker Rep. Dennis

Hastert who is proposing a sales tax to replace the income

tax (see Uncle’s Notes). He rightly says it could double GDP &

bring back jobs to the US & make the US competitive. 3

cheers for Dennis! See his new book: Speaker: Lessons from

40 yrs in coaching & politics. Ending the income tax would

bring a lot of lost individual freedom back to the US.

Happy that Chirac will let the public vote on the EU Constitution. And shame on Schroeder for refusing to hold a referendum. Public can’t be trusted? I thought Germany grew out

of that? ••The more I travel & read/see, the clearer it becomes that what matters most is mental upgrading of the

planet. People call it education, but that word has lost its bite

& doesn’t imply direction or quality. It’s more than just knowledge input. Every negative we see in the world is born of insuf

sufficient understanding. Maybe a catch phrase that would

sell the idea is: ETW: Empowerment Through Wisdom. We are

in a war on ignorance/prejudice. Not terrorism per se. We’ve

been attacking the results instead of the roots.

THE NEWS: "Of course, it is possible for any citizen with

time to spare, & a canny eye, to work out what is actually going

on, but for the many there is not time, & the network news is

the only [most available] news even though it may not be news

at all but only a series of flashing fictions..." Gore Vidal

US MARKETS (& its spin-off effects)

In most presidential years, stocks rise, especially in the 2nd

half. The 2nd half of ‘04 is not starting off brilliantly for stocks

(or for the US economy). I’ve never been a fan of such data.

Because U bowled 190 yesterday there is little chance to ex-

... “We have not abolished slavery; we have nationalized it.” Herbert Spencer ...

7

HSL

BY PRIVATE SUBSCRIPTION ONLY

pect 190 today. Same with your golf score or tennis game.

This US election is like no other. And this war isn’t like the others. On top of that is the rise in energy prices—gas, oil, coal,

energy services, transportation. These things are acutely affecting the stock mkt. Mostly negatively. The airline industry is

a catastrophe. At least 5 airlines won’t be here this time next

year, maybe many more. ••I draw my conclusions mainly on

technical analysis, giving priority over fundamentals. But these

fundi’s are too important not to factor in, on top. ••Most

world stk mkts (not all) are looking toppy. Some seem to have

already peaked. It’s not decisive yet, but by the time it gets

decisive it may be too late to rearrange your deck chairs.

For the first time since April 2003, the US stock-to-bond

total return ratio has broken under its 40-wk moving average.

Also the bond-to-gold total return ratio is breaking above its

40-wk moving average. Both these financial mkt indictors are

flashing growth worries. Also, the Conference Board’s leading

economic indicator fell in June for the first time since Mar

2003. ••The lower-price stock index, which I’ve monitored

off&on for 45yrs, has broken down from a H&S top--a sign

the speculative element has left the mkt. •••I don’t care

philosophically which stock groups I buy; I just want to follow

strength. There aren’t many choices. They include: health

care stks (selectively), energy stks, & gold (but timed &

traded). Also in those commodities where supply is inelastic.

A couple of defence stks may be in order & UPS for their

China biz. Steel (alloys/producers, esp in EU) strong. Add a

China & an India fund.

The trouble with most tech stocks is: most don’t know for

sure what they will be producing in 2-3yrs. If U mine coal or

gold or pump oil & gas, then that’s what U’ll still be selling in

10yrs. But in tech, products often become obsolete in a year

&/or they switch to a hotter innovative item. U don’t know

what U are buying. Even big tech co’s switch direction. The

competition for innovation is intense. Lots of brain power! But

not much consistency. And near nil certainty of new products.

U’ve seen the mighty fall before in tech.

Don’t forget this is still a secular bear mkt. That’s the Big

Picture within which we have counter trends. A big minus is

rising interest rates. The main plus factor is lots of cash sitting on sidelines. But it doesn’t know where to put itself or

when, & fear is winning over greed just now. U don’t hear

people talking about their killings in the mkt. They aren’t

even playing. •In this climate, avoid most financial stks &

interest sensitive stks, airlines, stk brokers, long-term bonds,

semi conductors, ••It’s a sign of the times that Investors

Intelligence & Mkt Vane, etc, show the public is still wildly

bullish, even though they aren’t buying. I think they are voting their wish/hope, not their pocket book, so such surveys

are losing their significance. Low VIX mkt volatility & net

fund redemptions in Wall St prove my point. Follow the

money? It has cobwebs. Brokers tell me their clients are frozen in the headlights. ••In conclusion: the DJ World Index

fell 260 pts from yr 2000 to 2002, rallied 75pts in 03-04.

That’s about par for a bear picnic recovery. It seems to be

saying: enough already. •But U have to put your money

somewhere! So pick the plus areas I mention above, exit the

vulnerable areas above, & diversify cash, along with stocks.

He who plans, wins. Bonne chance!

••Market

MarketMarket-Track:

Track DJIA: at 9815.33, is 418.24 pts below

its key 200-day moving average (MA) at (10233.57).

S&P500: at 1063.97 is 44.14 pts below its 200-day MA

(1108.11). Nasdaq Comp: at 1315.30 is 130.75 pts below its

200-day MA (1446.05). Thus, DJIA, S&P500 & Nasdaq Comp

are bearish basis the 200-day MA.

8

HARRY SCHULTZ LIFE STRATEGIES

WORLD MARKETS ANALYSIS

Note 1: Apply our trailing stop strategy to lock in shorterm profits on all positions. Exit at mkt if trends turn sharply against you. Don’t wait for stop levels

to be hit. 1, 2-day close entry levels should be changed to mkt orders if intraday run-away action develops. Note 2: Where short selling (S/S) is not

possible, use our guidelines to aid U in determining price levels for simply

selling, & our S/S stops as buying levels. TPS= Trailing Profit Stop.

Canada:

Canada Mini H&S top. Sell short bit at mkt (if down on

day) &/or sell a bounce that fails below 8500; stop: 1-dc

over 8500. Sell again (more aggressively) below 8050 for

7700 profit target. Buy small size on 2-dc over 8600: stop 1dc below 8280. Buy again on rise above 8900. Take ½ profits at 9200.

SoAmerica:

Brazil Pullback to resistance. Sell short a

SoAmerica •Brazil:

rally failure below 23,000; stop 2-dc over 23,000. Take

½ profits at 18,000. Buy 3-dc over 24,000; stop: 1-dc below

22,500. Take ½ profits at 26,950.

Belgium:

Europe:

Belgium Ascending triangle. Buy 2-dc over

Europe •Belgium

2525; stop: 1-dc below 2400. Take ½ profits at 2650.

Sell or sell short 1-dc below 2400; stop 1-dc over 2525. Sell

again on 1-dc below 2300 for 2100 profit target. •France:

France

3518-3811 T/R. Per HSL641, traders sold short at 3593. If

out, sell short a bounce that fails below 3650; stop 2-dc over

3650. And/or sell short 1-dc below 3495; stop: 2-dc over

3600. Take partial profits at 3300. Next major buy cue: 2-dc

over 3811; stop: 1-dc below 3712. Take ½ profits at 4050.

Scalpers buy mini size on 2-dc over 3650 for run towards

3811 (& maybe higher); stop: 1-dc below 3575. Use TPS to

follow strength. •Germany:

Germany 3278-4151 T/R. Long traders

whipsawed for mini loss . Traders short from 3894 exited

½ of position on 4040 stoploss . Exit 2nd ½ on 1-dc over

3910. If out, sell short 1-dc below 3700; stop: 2-dc over

3850. And/or sell short a bounce that fails below 3910; stop:

2-dc over 3910. Take ½ profits at 3475, ½ at 3315. Nimble

traders buy bit on 1-dc over 3910 for shorterm run towards

4151 resistance. Keep stops tight. Others buy 2-dc over

4150; stop: 1-dc below 4000. Take ½ profits at 4480. •Italy:

Italy

breakdown from diamond top/ascending triangle. Sell short

bit at mkt (if down on day) &/or sell short a bounce that fails

below 21,000; stop: 2-dc over 21,000. Sell again on break

below 19,650. Take ½ profits at 19,800 &/or 19,000. Next

noteworthy bull cue: 2-dc over 21,400; stop: 1-dc below

21,000. Take ½ profits at 22,150. •London:

London Breakdown

from diamond top. Traders are

short at 4395 (or better). If out, sell

or sell short a rally that fails below

4500; stop: 2-dc over 4500. And/

or sell short 1-dc below 4270; stop:

2-dc over 4380. Take ½ profits

4300 &/or 4110. Gamblers buy

mini size on 2-dc over 4525; stop:

2-dc below 4450. Buy again on rise above 4580. Take ½

profits at 4740. •Netherlands:

Netherlands Multiple H&S top. Traders are

short at 345. If out, sell short bit at mkt (if down on day) &/or

sell a bounce that fails below 340; stop: 2-dc over 340. Take

½ profits at 280. Gamblers buy foothold longs on 2-dc over

350; stop: 1-dc below 335. Buy again on rise above 365 for

run towards 400. •Switzerland:

Switzerland Breakdown from symmetrical triangle. Traders are short at 5641 (or better). If out, sell

short mini size at mkt (if down on day) &/or sell short a rally

that fails below 5700; stop 2-dc over 5700. Take ½ profits at

5430 &/or 5200. Next major buy cue: 2-dc over 5900 for run

towards 6200; stop 1-dc below 5700.

SoAfrica:

SoAfrica Pullback to resistance. Traders are short

betwn 10,535 & 10,400. If out, sell short weakness

... “It is dangerous to be right when the government is wrong.” Voltaire ...

HSL 642 - 08 AUG 04

HSL

BY PRIVATE SUBSCRIPTION ONLY

below 10,500; stop: 2-dc over 10,500. Sell again on 1-dc below 9500. Take ½ profits at 9000. Gamblers buy bit on 2-dc

over 10,600; stop: 1-dc below 10,100. Buy again on rise

above 11,200. Take ½ profits at 11,400.

Asia/Pac Rim:

Rim: •Australia:

Australia Traders long at 3465 took ½

profits at 3540 ☺. Take remaining profits at mkt ☺. If

out, buy mini size on strength after dip that holds on/above

3450; stop: 2-dc below 3450. Use TPS to follow upside. Gamblers sell short 2-dc below 3450; stop: 1-dc over 3515. Sell

again below 3335. Take ½ profits at 3360 &/or 3250. •Hong

Kong:

Kong Tentative rise above 11,846-12,423 trading range. Buy

bit on 2-dc over 12,550; stop: 1-dc below 12,035. Buy again

over 13,150 for run towards 13,885 profit/sell target. Gamblers short at 11,997 exit on 2-dc over 12,550. Sell short 1-dc

below 11,846; stop: 2-dc over 12,225. Take ½ profits at

11,000. •Japan:

Japan symmetrical triangle breakdown? Longs & shorts

whipsawed in volatile trading .

Sell short 1-dc below 10,920; stop:

1-dc over 11,440. Sell again below

10,400 for 9710 profit target. Gamblers buy mini size on 1-dc over

11,440; stop: 1-dc below 10,075.

Buy again on rise above 11,950. Take ½ profits at 12,495.

•New

New Zealand (NZSX 50): Long traders take full profits at mkt

☺. Re-buy strength after dip that holds on/above 2700; stop:

1-dc below 2660. Take ½ profits at 2850. Sell short bit on 1dc below 2660; stop: 2-dc over 2720. Sell again below 2550.

Take ½ profits at 2560, ½ at 2425. •Singapore:

Singapore New high.

Short traders exited via 1880 stoploss . Buy bit on strength

after dip that holds on/above 1860; stop 1-dc below 1805.

Take ½ profits at 1975. Sell short on 2-dc below 1775; stop:

1-dc over 1840. Sell again below 1680 for 1560 profit target.

OPEN POSITIONS

S/S = shortsale. M/stop = mental stop. Take P/P = take partial profits at mkt.

S/C/O = stop close only. Non-US stops are 1-day close above/below indicated stop

levels. Price paid is listed after company name, last closing price in brackets.

••AUSTRALIA

AUSTRALIA:

AUSTRALIA Northern Gold @ 0.24 (0.30); stop: 0.24

S/C/O. ••CANADA

CANADA:

CANADA Candian Nat’l Res. @ 27.00 (49.95);

stop: 35.95; Canico Res. @ 12.15 (12.40); sell at the open;

Imperial Oil @ 57.90 (62.60) take P/P; stop: 58.95; Hudsons

Bay @ 14.10 (14.00); stop: 13.15; Ketch Resources @ 11.60

(12.34) take P/P at 13.00; stop: 10.45; Kirkland Lake Gold @

4.20 (3.72); stop: 3.44 S/C/O; Leeward Bull&Bear Fund @

1000 (1555); B/B fund investors take ½ profits on rally to

1750; Tan Range @ 0.91 & 1.90 (1.14); stop: your option;

True Energy @ 1.88 (1.90); stop: 1.69; Vaquero Energy @ 3.20

(3.73) take P/P; stop: 3.02 S/C/O. ••FRANCE

FRANCE:

FRANCE Generale de

Sante @ 11.87 (12.00) take P/P at 13.30; stop: 11.10;

Groupe Bourbon @ 87.00 (101.30) take P/P; stop: 90.00;

Neopost @ 47.00 (47.74) take P/P at 51.80; stop: 45.00;

Orpea @ 19.50 (20.50); sell at the open; Technip @ 113.20

(115.60); stop: 105; Total @ 143.60 (156.90); stop: 153.

••GERMANY

GERMANY:

GERMANY Celesio Ag @ 48.25 (50.90) take P/P at 53.00;

stop: 49.00; OMV Ag @ 156 (177.60) take P/P; stop: 156;

Reckitt & Benkiser @ 23.50 (22.35); stop: 22.00; Schoeller

Bleckman @ 12.50 (14.75); stop: 13.30. ••NETHERLANDS

NETHERLANDS:

NETHERLANDS

Cate Ten @ 44.20 (44.00) take P/P at 48.60; stop: 42.00.

••SWITZERLAND

SWITZERLAND:

SWITZERLAND Ascom @ 12.00 (13.75); stop: 13.00; BP

@ 11.15 (11.60) take P/P at 12.45; stop: 10.70; Concophillips @ 96.00 (94.10) take P/P at 107; stop: 93.00; Flughafen

Zuerich @ 105 (94.10) sell at the open. ••UK

UK:

UK Bisichi Mng @

106 (125) take P/P; stop: 106; Dragon Oil @ 42.00 (40.50)

take P/P at 47.00; stop: 37.80; Palladin Resources @ 128

(128.75) take P/P at 143; stop: 115; Petrel Resources @

HSL 642 - 08 AUG 04

HARRY SCHULTZ LIFE STRATEGIES

39.60 (42.00) take P/P at 45.00; stop: 34.55. ••USA

USA:

USA

Amerigroup @ 47.00 (44.76) sell at the open; Armor Hldgs @

28.90 (34.60) sell at the open; Delta Petro. @ 11.80 (11.65);

sell at the open; Enpro Inds @ 20.82 (19.20); stop: 18.75;

Exxon Mobil @ 43.55 (45.20) take P/P at 48.75; stop: 41.60;

Federal Natl Mtg (S/S) @ 67.75 (70.20) take P/P at 61.00;

stop: 79.00; Flamel Tech (S/S) @ 19.40 (16.86) take P/P at

17.00; stop: 21.72; iShares GS Tech (S/S) @ 42.80 (39.34)

take P/P at 37.60; stop: 47.10; Massey Energy @ 27.20

(25.24); stop: 24.20; Nicor Inc (S/S) @ 33.38 (32.68) take

P/P at 29.00; stop: 36.60; Northern Sts Fin’l (S/S) @ 27.86

(27.22) take P/P at 24.50; stop: 30.70; Oracle (S/S) @ 10.75

(10.19) take P/P at 9.40; stop: 12.04; Semiconductors

HOLDERS (S/S) @ 36.40 (30.65) take P/P; stop: 39.40; Silver

Standard Res. @ 10.70 (12.97); stop: 9.75 S/C/O; Spdr Tr

Energy Sector @ 30.60 (30.93) take P/P at 34.00; stop:

28.55; Spx Corp (S/S) @ 43.55 (36.65) take P/P; stop: 47.55

S/C/O; Total @ 98.17 (95.45); stop: 89.00; Western Gas @

28.50 (28.58) sell at the open.

••MUTUAL

MUTUAL FUNDS

FUNDS:: ••USA

USA:

USA Prudent Bear Fd @ 6.17

(5.91); mental stop: 5.50; Rydex Ursa Fd @ 9.44 (9.65) take

P/P at 10.38; mental stop: 8.50; UltraBear Profund Fd @

23.89 (24.77) take P/P at 26.30; mental stop: 21.50.

HSL INVESTMENT BOX

Managing your assets is a job you can’t totally delegate. Know-how is your

best protection; learn to do-it-yourself. (Abbrev: ST, MT, LT: short-, medium- & long-term). Changes are underlined.

COUNTRY/REGION WEIGHTING: US: 20%; Europe: 25%; Cda: 5%; UK:

15%; Oz/NZ: 15%; Asia: 18%; Latin Amer: 2%.

--------------------------------------------------------------------------------------------------•5% T-BONDS/NOTES/BILLS: 1-year maturities recommended in NZ, Oz

or UK treasuries (govt or govt-backed only).

•10% STOCKS (non-gold’s). Put half in energy stks. Raise stocks to 1015% if S&P500 makes sustained break above 1160.

•5-7% COMMODITIES: via futures & commodity stocks. Conservative

investors can buy (Jim) ‘Rogers Int’l Raw Materials Fund, LP’. Contact

George Rohrs: Tel (US) 312-264-4360. Offshore (clone) fund available for

non-U.S investors (min invest. $100K) via Dundee Leeds Management

Services Ltd. E-mail: cayotte@dundeeleeds.bm Or Fax: (441) 292 2239.

•10-15% TREASURY BILLS: 90-day or equivalent in first world nations.

Maximum 25% in US$ T-Bills, 50% in GBP/NZ$/Oz$/CAD$/Euro/Swiss

Franc or equivalent T-Bills, 25% in own/other country (if first world).

•20-25% GOLD STOCKS & BULLION: To increase profits in gold shares,

we recommend trading them with stops, not just holding. Our weekly ‘Gold

Charts R Us’ service (GCRU) is available via Net, fax or mail. GCRU offers

gold mine charts with specific buy&sell & stops levels for each pick. Via Internet at rate of: 3-mos $300, 6-mos $585, 9-mos $855 & 12-mos $1,110. U

can sign up online at: www.hsletter.com (click on ‘Gold Charts R Us’), or

subscribe via fax or mail (see page 3 masthead for contact details). Note:

Special GCRU ‘2-Week Taster’ offer available at $45 via: http://www.hsletter.

com/GCRUpromo_Special.html •New Subscribers only (limited time offer).

•20-35% CURRENCIES: Time Deposits &/or actual cash &/or futures.

Recommended longterm currency weightings for your portfolio’s: US$:

15%; AUD$/NZ$/CAD$/Sterling/ SwKr/Dkr/NorKr: 65%; Euro: 20%.

Note: raise US$ exposure to 20-25% if Sept dollar index holds 2-dc over 93.00.

•5-10% BEAR STOCK FUNDS: Prudent Bear Fund (BEARX): buy bit on

2-dc over 6.00; again over 6.25. Rydex Ursa Fund (RYURX): buy big on 2dc over 9.50; again over 10.20. UltraBear Profund Fund (URPSX): buy big

on 2-dc over 24.00; again over 28.00.

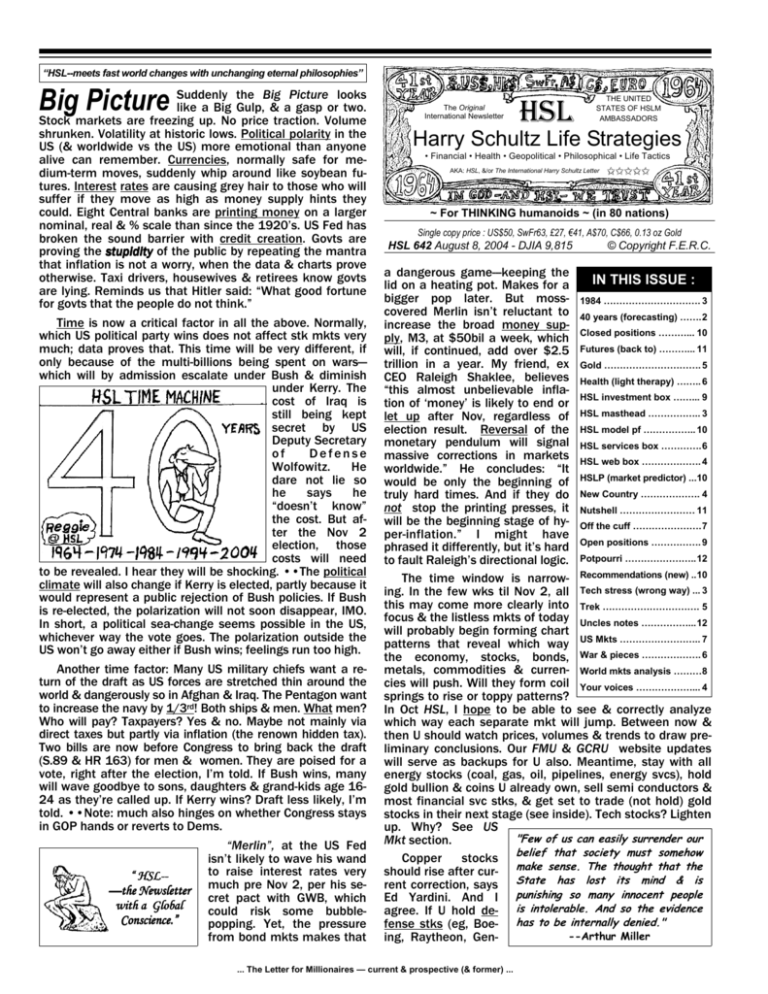

Treasury bills 10-15 %

Gold Stocks

& Bullion 20-25 %

Commodities 5-7 %

Stocks 10 %

T-Bonds/Notes/Bills 5 %

Currencies 20-35 %

Bear Stock Funds 5-10 %

... “National freedom is an illusion without legally-protected individual freedom, private property & personal privacy.” --H.D. Schultz ...

9

BY PRIVATE SUBSCRIPTION ONLY

NEW RECOMMENDATIONS

HSL

Non-US stk stops are 1-day close above/below price for all recommendations. Mkt = market. S/C/O = stop close only.

••AMSTERDAM

AMSTERDAM:

AMSTERDAM IHC Caland Nv (AEX: IHC) sell or sell

short at 38.00; stop: 40.25. Gamblers sell mini size at mkt.

Randstad Hldgs (AEX: RAND) buy strength after dip to

23.50; stop: 20.70. ••CANADA

CANADA:

CANADA Fairfax Hldgs (TSX: FFH)

sell or sell short at 210; stop: 235. Gamblers sell bit at mkt.

Gerdau Ameristeel (TSX: GNA) buy strength after dip to

5.25; stop: 4.75. Niko Res (TSX: NKO) buy at 40.50-stop;

stop: 36.45. Gamblers buy at 36.00; stop: 35.00. Trican

Well Svc (TSX: TCW) buy bit at mkt; stop: 39.25. ••FRANCE

FRANCE:

FRANCE

Bollore Inv (CAC: 003929) buy at 56.50-stop; stop: 50.85.

Gamblers buy at 52.00; stop: 50.00. Eramet (CAC: 013175)

buy strength after dip to 47.50; stop: 42.80. Gamblers buy

at mkt; stop: 47.00. Norbert Dentressan (CAC: 005287) buy

at 44.50-stop; stop: 40.05. Seche Envir. (CAC: 003910) buy

at 55.00-stop; stop: 49.00. Gamblers buy at mkt; stop:

46.00. ••GERMANY

GERMANY:

GERMANY Fortum Oyj (DAX: 916660) buy if dips

to 10.80; stop: 9.72. Group Technologies (DAX: 126201)

buy at 7.50-stop; stop: 6.75. Occidental Petroleum (DAX:

OPC) buy at 42.00-stop; stop: 38.00. Gamblers buy at

38.00; stop: 35.00. Solarworld Ag (DAX: SWV) buy strength

after dip to 27.50; stop: 26.00. Voestalpine Ag (DAX: VAS)

buy at 41.10-stop; stop: 37.00. ••SWI

••SWITZERLAND

SWITZERLAND:

TZERLAND Kuehne

& Nagel Int (SMI: 001254181) buy strength after dip to

182; stop: 170. Xstrata (SMI: XTAN) buy big at 18.50-stop;

stop: 16.50. ••UK

UK:

UK Centurion Energy (LSE: 3316867) buy at

156-stop; stop: 137.50. Monterrico Metals (LSE: 3169500)

buy at 420-stop; stop: 369. Schroders (LSE: SDR) sell or sell

short at 610; stop: 670. Gamblers sell short small size at

mkt. ••USA

USA:

USA AT&T Corp (NYSE: T) sell short at 13.60-stop;

stop: 15.23. Chevrontexaco Corp (NYSE: CVX) buy strength

after dip to 90.00; stop: 83.00. Innovative Solutions & Support (Nasdaq: ISSC) buy at 24.30-stop: stop: 21.00. Spec.

iShares Gold Sch Sftwr (AMEX: IGV) sell short at 35.50; stop:

39.05. iShares Lehm 20+ Trs (AMEX: TLT) sell short bit at

mkt; stop: 92.50. Spec. Mine Safety Appliances (NYSE:

MSA) buy strength after dip to 32.50; stop: 29.00. Omega

Fin’l Corp (Nasdaq: OMEF) sell short at 29.60-stop; stop:

33.05. Gamblers sell short mini size at mkt. Penn Virgini

Res Ptr (NYSE: PVR) buy at 38.30-stop: stop: 34.50. The German Fd (NYSE: GER) sell short at 6.25-stop; stop: 7.00.

Gamblers sell short mini size at mkt. Western Gas (NYSE:

WGR) buy mini size at mkt; buy again if dips to 26.00; stop:

23.40. Westmoreland Coal (AMEX: WLB) buy strength after

dip to 21.00; stop: 18.90. Olympic Steel (Nasdaq: ZEUS) buy

strength after dip to 19.00; stop: 17.00.

CLOSED POSITIONS

HSL recom’s are followed by a wide selection of investors, ranging from

novice traders to professional fund managers. And, many Hslm’s have requested we give partial profit taking signals (at intermediate resistance levels) to

allow incremental exit from medium to large share positions. Thus, recom’s to

take partial profits can be given up to 3 times before a position is finally exited.

••Per

Per HSL641

+102 Ballast Nedam

HSL641:

641 Maurel & Prom +102%;

+48%; Amedisys +31%;

+48%

+31% Lincoln Elec +23%;

+23% Shuffle Master

+19%;

+19% Canico +18%;

+18% Helen Of Troy +18%;

+18% Ascom +15%;

+15%

Delta Petro +15%;

+15% Total +14%;

+14% Great Canadian Gaming

+12%;

+12% Silver Standard +12%;

+12% Cadbury Sch. +10%;

+10% Cott Corp

+10%;

+10% Western Gas +10%;

+10% Orpea +9%;

+9% Schoeller Bleckman

+9%.

Per Full FMU 07/11:

+40% Silver

+9% ••Per

07/11 Ballast Nedam +40%;

Standard +27%;

+27% Delta Petro. +23%;

+23% Urban Outfitters +21%;

+21%

Ascom Holding +19%;

+19% Canico Res. +17%;

+17% Great Canadian

Gaming +17%;

+17% Western Gas +15%;

+15% Imperial Oil +10%;

+10%

10

HARRY SCHULTZ LIFE STRATEGIES

Schoeller & Bleckman +7%.

Profit taking or stopped out:

+7% ••Profit

out

Swiss Steel +42%;

+42% Nuco2 +24%;

+24% Lincoln Elec +14%;

+14% Silver

Standard +12%;

+12% Amedisys +10%;

+10% Shuffle Master +10%;

+10%

Helen of Troy +9%;

+9% Cott Corp +4%;

+4% Cadbury Sch. +3%;

+3%

Twentsche Kabel –5%; Mentor Corp –9%; Arch Coal –10%;

Ati Technologies –10%; Drew Ind –10%; Engineered Support –10%; Gen-Probe –10%; Gentiva –10%; Unit Agresso –

10%; Synaptics Inc –12%; Canarc Res. –22%.

HSL MODEL PORTFOLIO

NOTE: USA stops are INTRADAY. All others are a 1-day close beyond stop price.

S/C/O: stop close only; LT: Long-term; MT: Medium-term; ST: Short-term

STOCKS

Australia

Rio Tinto

Canada

Gammon Lake

Silver Standard

France

Maurel & Prom

Netherlands

Ispat

So.Africa

Durban Roodepoort

Gold Fields

U.K

British Telecom (short)

Jkx Oil & Gas

U.S.A

Agnico Eagle (NYSE)*

Glamis (NYSE)*

Petroleum Dev Corp

Price

Paid

Aug

7/04

14.00

37.68 LT: 31.50

+169%

6.85 LT: 4.60 S/C/O

16.84 LT: 12.30 S/C/O

+167%

+361%

2.56

3.65

49.50

STOPS

110.50 LT: 80; MT: 72

Gain/

Loss

+123%

6.00

19.35 LT: 12.00 S/C/O

+222%

1.19

4.75

2.42 LT: 2.00 S/C/O

10.80 LT: 9.00 S/C/O

+103%

+127%

125.50

45.50

6.50

3.27

13.20

32.90 LT: 37.00

126.75 LT: 77.00

+74%

+179%

12.85 LT: 10.00 S/C/O

15.50 LT: 12.29 S/C/O

27.65 LT: 22.00 S/C/O. *Take P/P

+98%

+374%

+109%

FUNDS

USA

Piranha Fund