Cyprus Casino Control Law

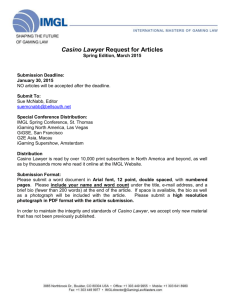

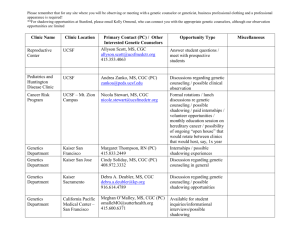

advertisement