Partnership Outline

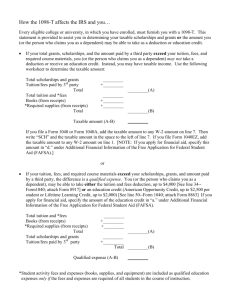

advertisement