February 2012 Prepared for: The Ministry of Economy, Trade and

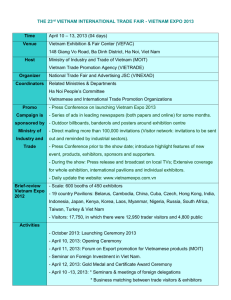

advertisement