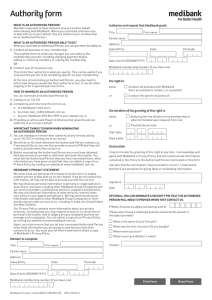

fund rules

advertisement