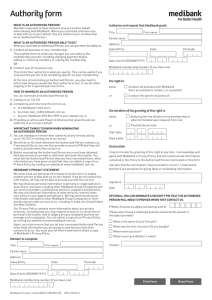

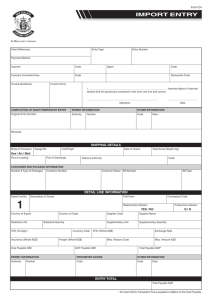

fund rules

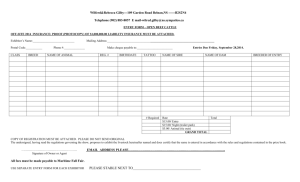

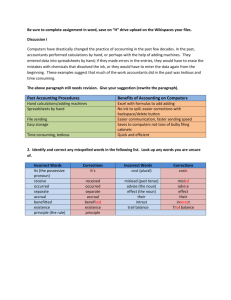

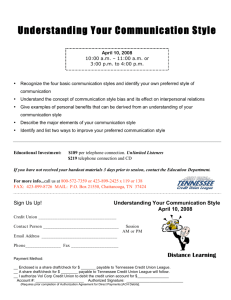

advertisement