Pertinent Revision Summary 3 Edge at a Glance 6

advertisement

1

Investment Views

Thursday, October 30, 2014

Click to view full story

Click to view synopsis

Pertinent Revision Summary

3

Edge at a Glance

6

Company Comments

Canada

Agellan Commercial REIT

ACR.UN-T

Agnico Eagle Mines Limited

AEM-N, AEM-T

ATCO Ltd.

ACO.X-T

Barrick Gold Corporation

ABX-N, ABX-T

Cameco Corporation

CCO-T, CCJ-N

Canadian Utilities Limited

CU-T

Capstone Mining Corp.

CS-T

First National Financial Corporation

FN-T

Horizon North Logistics Inc.

HNL-T

HudBay Minerals Inc.

HBM-T, HBM-N

Lundin Mining Corporation

LUN-T

MEG Energy Corp.

MEG-T

Methanex Corporation

MEOH-Q, MX-T

PHX Energy Services Corp.

PHX-T

Sherritt International Corporation

S-T

Taseko Mines Limited

TKO-T, TGB-A

Teck Resources Limited

TCK.B-T, TCK-N

Steady Outlook; 2015 Should be a

Better Year

Pammi Bir

21

Tanya Jakusconek

25

Matthew Akman

27

Tanya Jakusconek

29

Ben Isaacson

31

Matthew Akman

37

Mark Turner

39

Phil Hardie

45

Pessimistic Call; Taking Down Our

Estimates

Vladislav C. Vlad

63

Q3/14 Results First Look: An Earnings

Miss but Constancia on Track

Orest Wowkodaw

71

Q3/14 Results First Look: Weak

Performance at Neves-Corvo but

Guidance Unchanged

Orest Wowkodaw

83

Op Cost Reductions Drive Higher

Netbacks

Jason Bouvier

88

Volume Beat; Geismar Capex 27%

Higher

Ben Isaacson

93

Déjà Vu: Record Q's & Capex Bumps

Continue

Vladislav C. Vlad

98

Q3/14 Results Below Expectations

Orest Wowkodaw 107

Q3/14 Financials First Look - Known to

Be Messy

Mark Turner 121

Solid Q3/14 Results & Modest Positive

Guidance Adjustments

Orest Wowkodaw 123

Q3/14 - IFRS Conversion Inflates

Depreciation

Structures Softening

Q3/14 - Mines Perform Well

Valuation Looks More Interesting

Capital Tracking

Another Quarter of Record Operating

Cash Flow; Underpinned by Impressive

PV Cash Costs

Solid Volumes, but Spread

Compression Contributes to Miss

For Reg AC Certification and important disclosures see Appendix A of this report. Analysts employed by

non-U.S. affiliates are not registered/qualified as research analysts with FINRA in the U.S.

2

Investment Views

Thursday, October 30, 2014

Timmins Gold Corp.

EPS in Line; Cash Declines $5.8M

QOQ

Yamana Gold Inc.

Q3/14 - Messy Quarter; Dividend Cut

60%

TMM-T, TGD-A

AUY-N, YRI-T

Ovais Habib 134

Tanya Jakusconek 142

Daniel Chan

51

Unprecedented Rainfall Snags A

Decent Quarter; 2015 Looks Weaker

Ben Isaacson

76

Solid Core Beat in Q3/14

Joanne Smith

79

Q3/14: A Welcome EPS Beat on Solid

Core Results

Joanne Smith

95

Tanya Jakusconek 106

Gavin Wylie

55

Old Media: Analysis of Univision's

Q3/14 Results

Andres Coello

60

Q3: Conference Call Highlights

Andres Coello

92

Ovais Habib 134

Andres Coello 137

Alfonso Salazar 140

U.S.

Flextronics International Ltd.

FLEX-O

Intrepid Potash, Inc.

IPI-N

Lincoln National Corporation

LNC-N

MetLife, Inc.

MET-N

Royal Gold Inc.

RGLD-Q, RGL-T

Q2/F15: INS Weakness Offset by Other

Segments

Q1/F15 - Good Quarter

Latin America

GeoPark Limited

GPRK-N

Grupo Televisa, SAB

TV-N, TLEVISA CPO-MX

Megacable Holdings

MEGA CPO-MX

Timmins Gold Corp.

TMM-T, TGD-A

Totvs SA

TOTS3-SA

Tigana - Pushing to Add >50%

EPS in Line; Cash Declines $5.8M

QOQ

Mixed Q3: Migration to SaaS Worth the

Pain

Usinas Siderúrgicas de Minas Gerais

Q3 Results First Look: Near-Term

SA - Usiminas

Outlook Blurs

USIM5-SA

Equity Event: Telecom & Cable 2015

145

Equity Event: Transportation & Aerospace 2014

146

Equity Event: Canadian Energy Infrastructure Conference

147

Equity Event: Mining Conference 2014

148

3

Pertinent Revision Summary

Thursday, October 30, 2014

Pertinent Revision Summary

(For Rating Changes: 24-Hour SC Pro Personal Trading Restriction Applies)

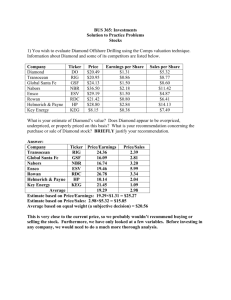

1-Yr

Rating

Risk

Key Data

Target

Year 1

Year 2

Year 3

Valuation

Agellan Commercial REIT (SP) (ACR.UN-T C$9.06)

Steady Outlook; 2015 Should be a Better Year

New -Old --

---

---

FFOPU14E: $1.16

FFOPU14E: $1.18

FFOPU15E: $1.26

FFOPU15E: $1.25

FFOPU16E: $1.28 10.75x AFFO (F'16 estimate)

FFOPU16E: $1.27 11x AFFO (F'15 estimate)

Valuation: 10.75x AFFO (F'16 estimate)

Key Risks to Price Target: Significant unitholder, inability to execute growth, rising interest rates

ATCO Ltd. (SP) (ACO.X-T C$48.66)

Structures Softening

New -Old --

---

$50.00

$52.00

Adj. EPS14E: $3.10

Adj. EPS14E: $3.26

Adj. EPS15E: $3.24

Adj. EPS15E: $3.75

Adj. EPS16E: $3.47

Adj. EPS16E: $4.00

---

Valuation: 20% discount to NAV

Key Risks to Price Target: Interest rates; Regulated ROE; Infrastructure construction

Cameco Corporation (SO) (CCO-T C$18.92)

Valuation Looks More Interesting

New -Old --

---

$24.00

$25.00

Adj. EPS14E: $0.85

Adj. EPS14E: $0.74

Adj. EPS15E: $1.03

Adj. EPS15E: $1.07

-- --- --

Valuation: 1.5x NAV, 13.5x 2015E EBITDA, 23.0x 2015E EPS

Key Risks to Price Target: Uranium S/D; uranium prices; CAD/USD

Canadian Utilities Limited (SO) (CU-T C$40.32)

Capital Tracking

New --

--

--

Adj. EPS14E: $2.21

Adj. EPS15E: $2.45

Adj. EPS16E: $2.60

Old --

--

--

Adj. EPS14E: $2.23

Adj. EPS15E: $2.53

Adj. EPS16E: $2.65

6.6% 2015E Free Cash Yield and 11.8x 2015E

EV/EBITDA

6.7% 2015E Free Cash Yield and 11.4x 2015E

EV/EBITDA

Valuation: 6.6% 2015E Free Cash Yield and 11.8x 2015E EV/EBITDA

Key Risks to Price Target: Interest rates; Regulated ROE; Spark spreads; FX

Capstone Mining Corp. (SO) (CS-T C$2.07)

Another Quarter of Record Operating Cash Flow; Underpinned by Impressive PV Cash Costs

New -Old --

---

---

Adj. EPS14E: US$0.11

Adj. EPS14E: US$0.13

-- Adj. EPS16E: US$0.40

-- Adj. EPS16E: US$0.39

---

Valuation: 50% EV/EBITDA & 50% Adjusted NAV

Key Risks to Price Target: Commodity price, operating, and technical risks, environmental and legal risks

For Reg AC Certification and important disclosures see Appendix A of this report. Analysts employed by non-U.S. affiliates

are not registered/qualified as research analysts with FINRA in the U.S.

4

Pertinent Revision Summary

Thursday, October 30, 2014

First National Financial Corporation (SP) (FN-T C$23.24)

Solid Volumes, but Spread Compression Contributes to Miss

New -Old --

---

$24.00

$24.50

EPS14E: $1.87

EPS14E: $2.00

EPS15E: $2.37

EPS15E: $2.46

EPS16E: $2.65 10.1x 2015E EPS

EPS16E: $2.77 10x 2015E EPS

Valuation: 10.1x 2015E EPS

Key Risks to Price Target: Lower mortgage origination volumes, tighter funding spreads

Flextronics International Ltd. (SP) (FLEX-O US$9.83)

Q2/F15: INS Weakness Offset by Other Segments

New -Old --

---

$11.30

$11.70

EPS15E: $1.02

EPS15E: $0.97

EPS16E: $1.22

EPS16E: $1.15

EBITDA14E: $91

EBITDA14E: $107

EBITDA15E: $100

EBITDA15E: $140

-- 5.5x CY15E EV to EBITDA

-- 5.5x forward EV to FY16E EBITDA

Valuation: 5.5x CY15E EV to EBITDA

Key Risks to Price Target: Margin pressure could lower EPS

Horizon North Logistics Inc. (SP) (HNL-T C$3.20)

Pessimistic Call; Taking Down Our Estimates

New -Old --

---

$4.50

$6.50

-- --- --

Valuation: 6.0x our 2015 EV/EBITDA estimate.

Key Risks to Price Target: Commodity prices, labour supply, access to supplies, weather, contract risk, and FX.

Intrepid Potash, Inc. (SP) (IPI-N US$14.14)

Unprecedented Rainfall Snags A Decent Quarter; 2015 Looks Weaker

New -Old --

---

---

Adj. EPS14E: $0.05

Adj. EPS14E: $0.13

Adj. EPS15E: $0.14

Adj. EPS15E: $0.29

-- 12x 2015E EBITDA, DCF @ 10%, 40% RCN

-- 11x 2015E EBITDA, DCF @ 10%, 40% RCN

Valuation: 12x 2015E EBITDA, DCF @ 10% , 40% RCN

Key Risks to Price Target: Fertilizer supply/demand, crop and energy prices, weather

Lincoln National Corporation (SU) (LNC-N US$52.32)

Solid Core Beat in Q3/14

New --

--

--

Old --

--

--

Operating EPS14E:

$5.70

Operating EPS14E:

$5.51

--

-- --

--

-- --

Valuation: Target P/E of 10x on 2014E (30% weight); Target P/BV of 1.1x on 2014E (70% weight)

Key Risks to Price Target: Credit losses; Rating downgrades; Hedge effectiveness; Interest rate risk; Reserve adequacy; Regulatory risk

MEG Energy Corp. (SO) (MEG-T C$27.95)

Op Cost Reductions Drive Higher Netbacks

New -Old --

---

---

CFPS14E: $4.07

CFPS14E: $3.94

Valuation: 0.9x our risked 2P+RU NAV

Key Risks to Price Target: Commodity prices, timing of projects, and project execution.

CFPS15E: $4.79

CFPS15E: $4.82

-- 0.9x our risked 2P+RU NAV

-- 0.9x our risked 2P+2C NAV

5

Pertinent Revision Summary

Thursday, October 30, 2014

MetLife, Inc. (FS) (MET-N US$52.31)

Q3/14: A Welcome EPS Beat on Solid Core Results

New --

--

--

Old --

--

--

Operating EPS14E:

$5.65

Operating EPS14E:

$5.58

--

-- --

--

-- --

Valuation: Target P/E of 10x on 2014E (30% weight); Target P/BV of 1.1x on 2014E (70% weight)

Key Risks to Price Target: Capital flexibility; U.S. economic weakness; Variable Annuity risk; Regulatory risk; Rating downgr ades

Sherritt International Corporation (SO) (S-T C$2.86)

Q3/14 Results Below Expectations

New -Old --

---

$4.50

$5.00

Adj. EPS14E: $-0.70

Adj. EPS14E: $-0.61

Adj. EPS15E: $-0.28

Adj. EPS15E: $-0.25

Adj. EPS16E: $0.22

Adj. EPS16E: $0.27

---

50% of 7.5x 2015E EV/EBITDA + 50% of 8%

NAV

50% of 8.0x 2015E EV/EBITDA + 50% of 8%

NAV

Valuation: 50% of 6.0x 2015E EV/EBITDA + 50% of 8% NAV

Key Risks to Price Target: Commodity Prices, Operational, Balance Sheet, Political

Teck Resources Limited (SO) (TCK.B-T C$18.42)

Solid Q3/14 Results & Modest Positive Guidance Adjustments

New --

--

--

Adj. EPS14E: $0.87

Adj. EPS15E: $1.19

Adj. EPS16E: $1.62

Old --

--

--

Adj. EPS14E: $0.83

Adj. EPS15E: $1.17

Adj. EPS16E: $1.63

Valuation: 50% of 7.5x 2015E EV/EBITDA + 50% of 8% NAV

Key Risks to Price Target: Commodity prices, currency, operating, development, balance sheet and environmental

Timmins Gold Corp. (SP) (TMM-T C$1.39)

EPS in Line; Cash Declines $5.8M QOQ

New -Old --

---

---

EPS14E: US$0.08

EPS14E: US$0.09

---

-- --- --

Valuation: 1.10x NAVPS

Key Risks to Price Target: Multiple contraction, commodity prices, technical and operational risks, and geopolitical risks

Source: Reuters; Scotiabank GBM estimates.

Table of Contents

6

Edge at a Glance

Thursday, October 30, 2014

Edge at a Glance

Agellan Commercial REIT (ACR.UN-T C$9.06)

Steady Outlook; 2015 Should be a Better Year

Pammi Bir, CPA, CA, CFA - (416) 863-7218

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Agellan reported Q3/14 FFOPU of $0.28 vs. $0.31 last year, slightly below our $0.29

estimate and consensus ($0.29).

Implications

■ Signs point to accelerating leasing & internal growth. Despite the 1.1% drop in SP NOI,

the 100bp QOQ lift in overall occupancy to 91% was encouraging. Based on tenant

discussions, management remains confident of a further 200bp-250bp uptick by mid2015. Should its leasing targets be hit, our ~1.5% 2015E-16E SP NOI may prove light.

■ Expect Parkway expansion update in November; acquisitions teed up. The $48M

expansion plans at Parkway remain intact, with a firm lease with the new dealership

expected in November. As a reminder, we estimate the project could add +3%-4% to our

NAV upon completion by 2017 and 5% to annual AFFOPU. Redeployment of proceeds

from the sale of Kiest is expected before year-end, with ACR targeting TX industrial,

though the timing delay has created a bit of cash drag.

■ Estimates tweaked; stronger growth on deck for 2015. Our revised 2013A (annualized)2015E AFFO CAGR is 4.5% (6.9% 2014E-16E), in line with its diversified peers, albeit

with growth skewed to next year.

Recommendation

■ SP, $10.25 target. Our outlook is unchanged from our recent initiation. At 9.8x 2015E

AFFO/8% implied cap rate/13.8% below NAV, we believe current levels offer longer

term investors a reasonable entry point with a chunky 8.6% and fully covered yield. Add

more actively ~$8.75.

Agnico Eagle Mines Limited (AEM-N US$28.08)

Q3/14 - IFRS Conversion Inflates Depreciation

New

Rating:

Risk:

Target:

1-Yr

Old

---

SP

Med

--

$10.25

FFOPU14E

$1.16

$1.18

FFOPU15E

$1.26

$1.25

FFOPU16E

$1.28

$1.27

New Valuation:

10.75x AFFO (F'16 estimate)

Old Valuation:

11x AFFO (F'15 estimate)

Key Risks to Target:

Significant unitholder, inability to execute

growth, rising interest rates

CDPU (NTM)

$0.78

CDPU (Curr.)

Yield (Curr.)

$0.78

8.6%

Tanya Jakusconek, MSc, Applied - (416) 945-4083

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ AEM reported a Q3/14 loss of $0.07 (FD) and adjusted EPS of $0.01.

Implications

■ Earnings - Adjusted EPS of $0.01 vs. our estimate of $0.13 and consensus of $0.15. The

lower EPS versus our estimate reflects is primarily due to higher depreciation as a result

of IFRS conversion (~$0.11/sh) and exploration expenditures at CM and Amaruk

($0.02). Excluding these two items; EPS would have been ~$0.14/sh.

■ Q3/14 Operating Results - Gold production was 349 koz at total cash costs of $716/oz

vs. our estimate of 325 koz at $744/oz.

■ 2014 Guidance Adjusted - Guidance was adjusted upward slightly to 1.4 Moz from

previous guidance of 1.35-1.37 Moz at total cash costs of $650-$675/oz (unchanged).

AISC is unchanged at ~$990/oz on a by-product basis. Updated 2015 guidance was

reported at 1.6 Moz in line with our estimate. No cost guidance for 2015 was provided.

■ Canadian Malartic - The company expects throughput to average about 51-52 ktpd for

the next 6-12 months with ramp up to the full capacity of 55 ktpd over a one to two year

timeframe. Optimization plan results and updated three year guidance is expected in

February 2015.

■ IFRS Conversion - The conversion has resulted in a revaluation of PPE carrying values

resulting in higher future depreciation expense.

Recommendation

■ EPS was significantly weaker primarily due to the recent conversion to IFRS and higher

exploration. Operationally, Q3 was a good quarter. SO.

Rating:

Risk:

Target:

1-Yr

For Reg AC Certification and important disclosures see Appendix A of this report. Analysts employed

by non-U.S. affiliates are not registered/qualified as research analysts with FINRA in the U.S.

SO

High

US$40.00

Adj. EPS14E:

$1.16

Adj. EPS15E:

$1.34

Adj. EPS16E:

$1.33

Valuation:

1.50x NAV

Key Risks to Target:

Commodity prices; technical and operational

risk; foreign exchange risk.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.32

$0.32

1.1%

7

Edge at a Glance

Thursday, October 30, 2014

ATCO Ltd. (ACO.X-T C$48.66)

Structures Softening

Matthew Akman, MBA - (416) 863-7798

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ ACO reported Q3/14 adj. EPS of $0.74 vs our $0.69 est. ($0.73 Q3/13).

Implications

■ The underlying regulated utility business in ATCO is performing well but is fully offset

by weakness in the Structures business. Performance in Structures may further

deteriorate over the next 12 months, so we are cautious on the stock and continue with

our preference for CU.

■ Utility growth remains robust and growth should sustain at a double-digit pace through

2016/17. With visible 15%+ rate-base expansion in Alberta, the ATCO utilities

businesses rate at a premium. In addition, we think there is potential for operating and

financing cost savings that could boost returns on earnings beyond the rate of capital

expansion.

■ However, the core business in Structures (Modular manufacturing and installations) was

down 20% YOY in the first 9 months and will likely get worse before it gets better.

Several major projects are scheduled for completion over the next 6-9 months (Jansen

Potash, Carmon Creek) and little has been announced in the way of replacement activity.

■ We are significantly reducing our earnings estimates for Structures (from $84M/$91M in

2015/16 to $40M/$40M). As a result, the stock is now trading at a NAV discount of

~10% vs. historical ~20% discount.

Recommendation

■ There is no change to our SP rating because the underlying CU stock is attractive in our

opinion. However, we are reducing our TP by $2 to $50 and maintain our preference for

CU at this time (rated SO).

Barrick Gold Corporation (ABX-N US$12.83)

Q3/14 - Mines Perform Well

New

Rating:

Risk:

Target:

1-Yr

Old

---

SP

Low

$50.00

$52.00

Adj. EPS14E

$3.10

$3.26

Adj. EPS15E

$3.24

$3.75

Adj. EPS16E

$3.47

$4.00

New Valuation:

-Old Valuation:

20% discount to NAV

Key Risks to Target:

Interest rates; Regulated ROE; Infrastructure

construction

Div. (NTM)

$0.89

Div. (Curr.)

Yield (Curr.)

$0.86

1.8%

Tanya Jakusconek, MSc, Applied - (416) 945-4083

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ ABX reported Q3/14 EPS of $0.11 and adjusted EPS of $0.19.

Implications

■ Earnings - Reported adjusted EPS of $0.19 vs. our estimate and consensus of $0.16. EPS

were better than our estimate on operating performance.

■ Operations - Gold production was 1.649 Moz at costs of $589/oz vs. our estimate of

1.577 Moz at costs $615/oz. Copper production was 131 Mlb at $1.82/lb vs. our estimate

of 110 Mlb at $2.03/lb. Better operating performance occurred in Nevada and Porgera

on the gold side. On the copper front, Lumwana also performed well.

■ 2014 Production Guidance Tightened; AISC Lowered - Production guidance was

tightened to 6.1-6.4 Moz (from 6.0-6.5 Moz) at total cash costs of $580-$630/oz

(unchanged). AISC guidance was revised slightly to $880-$920/oz (from $900-$940/oz).

Copper guidance was adjusted upward to 440-460 Mlb (from 410-440 Mlb) at costs of

$1.90-$2.00/lb (from $1.90-$2.10/lb). Capital costs remain ~$2.2B-$2.5B.

■ Thiosulfate Project - Modifications to the autoclave facility for the thiosulfate project are

almost complete and are expected to contribute ~350-450 koz annually over the first full

five years.

Recommendation

■ ABX had a solid operating quarter, leading to better EPS than our forecast. Balance

sheet remains strained with debt of $13.1B and cash and equivalents of $2.7B. Sector

Perform.

Rating:

SP

Risk:

Target:

1-Yr

High

US$17.00

Adj. EPS14E:

$0.63

Adj. EPS15E:

$0.92

Adj. EPS16E:

$1.05

Valuation:

1.00x NAV

Key Risks to Target:

Commodity prices; technical and operational

risk; geopolitical risk.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.20

$0.20

1.6%

8

Edge at a Glance

Thursday, October 30, 2014

Cameco Corporation (CCO-T C$18.92)

Valuation Looks More Interesting

Ben Isaacson, MBA, CFA - (416) 945-5310

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Q3 adjusted EPS of 23¢ is a beat on the Street's 20¢. We were at 22¢.

Implications

■ We think the mild beat to our estimate is due to better-than-expected sales volume, and

production costs at $18/lb vs. our $20.50/lb forecast.

■ Once again, CCO reduced its uranium production guidance for the year, this time to

22.6M to 22.8M, on the back of the McArthur River labour disruption. This is a good

thing, as it partially supports the uranium market as of late.

Recommendation

■ CCO is trading at its lowest P/NAV since Fukushima. It's also trading at near five-year

lows to average P/BV and P/Sales multiples.

■ While 2015E EV/EBITDA and P/E suggest fair value at 11.2x and 18.4x, respectively,

we note the Street will soon roll forward to 2016, where we see the stock trading at 8.8x

and 14.7x, respectively, or quite a bit below long-term multiples.

■ The challenge with a 'more interesting' valuation is that positive catalysts are few and far

between for CCO, which means we're partially back to relying on a sentiment shift to

help our cause. Regardless, at least valuation is more on our side now than before. We

think the stock outperforms the market on a one year out basis. Our target price moves to

$24 on a slightly lower 2015.

Canadian Utilities Limited (CU-T C$40.32)

Capital Tracking

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

High

$24.00

$25.00

Adj. EPS14E

$0.85

$0.74

Adj. EPS15E

$1.03

$1.07

New Valuation:

-Old Valuation:

1.5x NAV, 13.5x 2015E EBITDA, 23.0x 2015E

EPS

Key Risks to Target:

Uranium S/D; uranium prices; CAD/USD

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.40

$0.40

2.1%

Matthew Akman, MBA - (416) 863-7798

(Scotia Capital Inc. - Canada)

Event

■ CU reported Q3/14 adj. EPS of $0.46 vs. our $0.43 est. ($0.43 Q3/13).

Implications

■ The earnings report highlights CU's premium organic regulated utility growth, its

improving business mix and its strategic capital management/deployment plants. The

Power business is predictably softer than last year but Utility is more than offsetting.

■ Adjusted Utility earnings were up organically ~50% YOY or a still robust ~20% even

excluding prior-period catch-up. Good news in that the Alberta regulator has raised the

interim inclusion of capital tracker spending to 90% from 60%. The full inclusion, as

opposed to 60%, is worth about $15M/year (half in our estimates).

■ Premium Utility growth should continue through at least 2017. With another ~$3.5B of

capital investment over the next two years, rate-base growth should average ~15% and

earnings could exceed that pace under Alberta's incentive regulatory framework.

■ The sale of non-core assets (IT, UK Power, Midstream) and re-deployment of capital to

infrastructure in Mexico is logical in our opinion. ATCO already has a strong LatAm

presence with its Structures business and modest diversification from Alberta is prudent.

Recommendation

■ CU's net growth (Utility increase net of Power decline) should rival that of peers FTS

and EMA. Yet, the stock trades at a meaningful discount (forward P/E of ~16x vs.

~19x). We would accumulate at these levels.

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

Low

--

$47.00

Adj. EPS14E

$2.21

$2.23

Adj. EPS15E

$2.45

$2.53

Adj. EPS16E

$2.60

$2.65

New Valuation:

6.6% 2015E Free Cash Yield and 11.8x 2015E

EV/EBITDA

Old Valuation:

6.7% 2015E Free Cash Yield and 11.4x 2015E

EV/EBITDA

Key Risks to Target:

Interest rates; Regulated ROE; Spark spreads;

FX

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$1.10

$1.07

2.7%

9

Edge at a Glance

Thursday, October 30, 2014

Capstone Mining Corp. (CS-T C$2.07)

Mark Turner, MBA, P.Eng. - (416) 863-7484

(Scotia Capital Inc. - Canada)

Another Quarter of Record Operating Cash Flow; Underpinned by Impressive PV Cash Costs

Event

Pertinent Data

■ CS reported strong Q3/14 financial results, broadly in line with our estimates and

consensus (see Exhibit 1). Production and sale volumes had been previously announced.

■ The market's focus was on Pinto Valley cash costs and CS delivered. PV's C1 cash cost

of $1.90/lb for the quarter was 4% better than our estimate and an 11% improvement

over the $2.13 in Q2/14.

Implications

■ Another quarterly record was set for operating cash flow generation. Before changes in

WC the operations generated $57M or $0.14/share, in line with our estimate and

consensus. All-in CS, ended the quarter improving its net debt position to $121M,

including $176M of cash on the balance sheet at the end of the quarter - a 37% QOQ

increase.

■ Adjusted EBITDA of $71.4M was in line with consensus at $72.1M, and modestly

below our estimate of $77.6M on slightly lower revenue and higher operating costs

associated with sales than we had estimated.

■ Operating cash cost in the quarter bettered our estimates at all mines, achieving a

consolidated C1 cash cost of $1.84/lb; 7% better than our estimate and a 9%

improvement over the $2.03 achieved in Q2/14. Full year production was reiterated at

102 kt (225 Mlb) of copper in concentrate (+/-5%) as were C1 cash costs of $1.90 to

$2.00/payable lb.

Recommendation

■ Maintain our Sector Outperform rating and $3.50 target price.

First National Financial Corporation (FN-T C$23.24)

Solid Volumes, but Spread Compression Contributes to Miss

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

High

--

$3.50

Adj. EPS14E

US$0.11

US$0.13

Adj. EPS15E

-US$0.14

Adj. EPS16E

US$0.40

US$0.39

New Valuation:

-Old Valuation:

50% EV/EBITDA & 50% Adjusted NAV

Key Risks to Target:

Commodity price, operating, and technical

risks, environmental and legal risks

Div. (NTM)

C$0.00

Div. (Curr.)

Yield (Curr.)

C$0.00

0.0%

Phil Hardie, P.Eng., MBA, CFA - (416) 863-7430

(Scotia Capital Inc. - Canada)

Event

■ Q3/14 EBITDA pre-FMV (fair market value adjustment) of $0.84/share was below our

estimate of $0.92/share.

Implications

■ Third quarter origination volumes were well ahead of our forecast but core earnings fell

short of expectations. Reported EPS of $0.56 was below our estimate and consensus of

$0.63 and $0.61, respectively.

■ Weaker-than-expected results were impacted by tighter-than-expected net securitization

spreads and higher interest expense offset by a more favourable funding mix. Tighter

mortgage spreads reflecting a highly competitive environment put pressure on

securitized net interest margins (NIMs), but the compression is expected to stabilize.

■ Adjusted net cash of $11.64/sh supports growth, provides a cushion to sustain dividend

during a prolonged slow down, and is a likely source of unrecognized value.

■ FN's multiple appears to be trending in line with its estimated 5-year average while other

non-bank lenders are trading at historical premiums.

Recommendation

■ Reducing target price to $24.00 (was $24.50), but maintaining Sector Perform rating.

Reflecting downward revisions to our estimates, we have reduced our target price.

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Old

---

SP

Med

$24.00

$24.50

EPS14E

$1.87

$2.00

EPS15E

$2.37

$2.46

EPS16E

$2.65

$2.77

New Valuation:

10.1x 2015E EPS

Old Valuation:

10x 2015E EPS

Key Risks to Target:

Lower mortgage origination volumes, tighter

funding spreads

Div. (NTM)

Div. (Curr.)

$1.58

$1.50

Yield (Curr.)

6.5%

10

Edge at a Glance

Thursday, October 30, 2014

Flextronics International Ltd. (FLEX-O US$9.83)

Daniel Chan, MBA - (416) 863-7552

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

Q2/F15: INS Weakness Offset by Other Segments

■ Flextronics reported Q2 results last night.

Implications

■ INS weakness offset by other business groups. Revenue of $6.5B and EPS of $0.26 were

largely in line with our expectations. INS continued to be weak, but was better than

expected. In fact INS, CTG, and HRS all performed better than the company expected,

which offset weaker than expected sales out of the IEI segment due to weakness in the

semicap space. FCF generation was good at $322M for the quarter and the company

bought back 9.3M shares or 1.5% of shares outstanding.

■ Guidance in line with expectations, but shows slowing growth. Revenue guidance of

$6.6B and EPS guidance of $0.26 at the midpoint is in line with expectations, but

indicates slowing growth. The company expects continued growth momentum out of

HRS and IEI, but CTG momentum will be challenging to maintain following strong

product ramps from Google, Microsoft, and Motorola last year.

Recommendation

■ Maintain Sector Perform. An improving business mix and more efficiency should

continue to drive margins higher, but we are cautious on FLEX's ability to maintain its

growth momentum to justify its relatively high valuation. The company does, however,

have the highest FCF yield in the group, which is likely due to the high asset velocity in

the CTG group; the CTG business is a double-edged sword and FLEX's high exposure to

it leave us with a Sector Perform rating on the name.

GeoPark Limited (GPRK-N US$8.65)

Tigana - Pushing to Add >50%

New

Old

Rating:

Risk:

---

SP

Med

Target:

1-Yr

$11.30

$11.70

EPS15E

$1.02

EPS16E

$1.22

New Valuation:

5.5x CY15E EV to EBITDA

Old Valuation:

5.5x forward EV to FY16E EBITDA

Key Risks to Target:

Margin pressure could lower EPS

$0.97

$1.15

Div. (NTM)

$0.00

Div. (Curr.)

Yield (Curr.)

$0.00

0.0%

Gavin Wylie - (403) 213-7333

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ GeoPark reported an impressive uptick to 3P reserves at the Tigana field following

appraisal drilling that indicated the field represented a single / larger combined trap.

Implications

■ Internal gross 3P reserves are now estimated at 45-65 mmboe (45% GeoPark / 55%

Parex) compared to the 14.6 mmboe (gross) estimated at year-end 2013 by an

independent reserve appraiser.

■ We reaffirm our Sector Outperform rating on GeoPark and our one-year price of $14.50

per share, based on our risked NAVPS estimate of $14.27.

Recommendation

■ In our minds, GeoPark's update is further evidence that the company has found its stride

operationally in Colombia and could have further running room on LLA-34.

■ Assuming net 2P reserve adds of ~16 mmbbl, we see the potential for a significant

increase of 23% at year-end versus 2013 net 2P reserves of 70.2 mmboe. We estimate

the value of barrels in Colombia (NPV12) to be $21-24/bbl that could imply an overall

mid-point net increase of 58% to our Base 2P NAVPS that current stands at $10.53.

Rating:

Risk:

Target:

1-Yr

CFPS14E:

CFPS15E:

SO

High

US$14.50

$4.21

$4.22

Valuation:

Based on our risked NAV ($14.27/share) that

also equates to 1.38x our 2P NAV.

Key Risks to Target:

Commodity prices, exploration, project

execution, political/regulatory.

Div. (NTM)

$0.00

Div. (Curr.)

Yield (Curr.)

$0.00

0.0%

11

Edge at a Glance

Thursday, October 30, 2014

Grupo Televisa, SAB (TV-N US$34.77)

Andres Coello - +52 (55) 5123 2852

(Scotiabank Inverlat)

Event

Pertinent Data

■ Univision reported, in our view, soft Q3 results.

Implications

■ Consolidated revenues grew only 5.2% YOY. However, if we exclude the one-off

impact of US$51.4M related to the World Cup, Univision's adjusted revenues would

have fallen 2.2% YOY. Consolidated EBITDA grew 4.4% YOY, or 3.4% if excluding

US$3.1M related to the Cup. On the conference call, management said that, excluding

the World Cup, the Copa de Oro and other items, revenues and EBITDA grew only

1.2% and 4.7%, respectively, in Q3/14 (we understood that adjusted ad revenues we re

actually down slightly from the year before).

■ Of note, while old media struggles to grow at single digit rates (at best), Facebook

reported yesterday a 64.0% YOY increase in ad sales in Q3.

■ Univision managed to lower net debt, but only slightly, from an estimated US$8.37B in

Q2/14 to US$8.14B in Q3/14 (excluding the Televisa convertibles). At 6.7x estimated

net debt to LTM EBITDA, Univision remains one of the most leveraged broadcasters in

the U.S.

■ The company's ratings underperformed the rest of the industry. Primetime audiences

(C7) in the 18-34 group as reported by the company declined 8.7% YOY (vs. -4.9% for

the industry leaders), while in the 18-49 group they declined 7.4% YOY (vs. +0.4% for

the industry). The CAB reported drops in ratings for Univision and Unimas.

Recommendation

■ We value Univision using a generous 11x 2015E EV/EBITDA. Sell TV.

Rating:

Risk:

Target:

1-Yr

US$28.00

EPS14E:

EPS15E:

EPS16E:

MXN 1.70

MXN 2.85

MXN 2.74

Old Media: Analysis of Univision's Q3/14 Results

Horizon North Logistics Inc. (HNL-T C$3.20)

Pessimistic Call; Taking Down Our Estimates

SU

High

Valuation:

DCF - 5 years results, 7.4% WACC, terminal

growth rate of 3.6%

Key Risks to Target:

Decline of broadcast ratings in Mexico and the

U.S.; expensive acquisitions

Div. (NTM)

Div. (Curr.) (ADS)

Yield (Curr.)

US$0.07

US$0.07

0.2%

Vladislav C. Vlad, MBA, P.Eng. - (403) 213-7759

(Scotia Capital Inc. - Canada)

Event

■ Revising our estimates post-Q3 conference call.

Implications

■ No positive takeaways from the call, in our view. Management highlighted an initiative

to develop the market for modular permanent facilities to support manufacturing ops.

(hotels, offices, etc.). While positive from a diversification standpoint, we view this as a

negative read-through for the long-term demand outlook of HNL's core camp business.

While management noted delays on Fort Hills as well as inaccurate cost estimates

(which will see margins closer to 13% vs. 17% for the project), the comments do not

reconcile the divergence from guidance issued three months ago (-20% for 2H/14).

When pushed HNL noted they were previously too optimistic across the board.

■ HNL is calling for net capex in the $30M to $40M range for 2015, or ~500 beds (vs.

previous commentary of 1k-1.5k beds), highlighting the deterioration in visibility. While

no major contracts are expected to roll off in 2015, a handful of small camps will need to

be redeployed (~15% of beds). Our 2014E and 2015E EBITDAs reduce 15% and 28%.

Recommendation

■ We continue to believe LNG could act as a major catalyst for the space, which could

ultimately benefit HNL as they have been building land positions in Kitimat and Prince

Rupert (provided they have the financial flexibility to fund the project). That said, we are

not ready to give HNL the benefit of the doubt, and would look to other names to play

the LNG theme. Our one-year price target is reduced to $4.50 (from $6.50).

Pertinent Data

New

Old

Rating:

Risk:

---

SP

High

Target:

1-Yr

$4.50

$6.50

EBITDA14E

$91

$107

EBITDA15E

$100

$140

New Valuation:

-Old Valuation:

6.0x our 2015 EV/EBITDA estimate.

Key Risks to Target:

Commodity prices, labour supply, access to

supplies, weather, contract risk, and FX.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.32

$0.32

10.0%

12

Edge at a Glance

Thursday, October 30, 2014

HudBay Minerals Inc. (HBM-T C$8.65)

Orest Wowkodaw, CPA, CA, CFA - (416) 945-4526

(Scotia Capital Inc. - Canada)

Q3/14 Results First Look: An Earnings Miss but Constancia on Track

Event

Pertinent Data

■ HudBay released its Q3/14 financial and operating results.

Implications

■ The company reported an adjusted Q3/14 EPS loss of $0.02 vs. our estimate and

consensus of earnings of $0.06.

■ Manitoba production of 9,798t of Cu, 22,653t of Zn, and 18,279 ozs of Au were 6.1%,

9.6%, and 19.9% below our forecast. However, the impact to the results was cushioned

by higher than expected Cu and Zn sales volumes.

■ HudBay reaffirmed its 2014 production and cash cost guidance.

■ Most important, the development of Constancia remains on track for start-up in Q4/14

with an unchanged budget of US$1.7 billion.

Recommendation

■ With an attractive relative valuation, an impressive near to medium term growth

trajectory, and a diminishing development and balance sheet risk profile, HudBay is

rated Sector Outperform. Our 12-month target of C$12.25 is based on a 50/50 mix of

6.0x our average 2015/16E EV/EBITDA ($14.74) and 1.0x our 8% NAV estimate

($9.91). In our view, any weakness in the shares related to the Q3 results represents a

buying opportunity as the re-rate on production growth is within sight.

Rating:

Risk:

Target:

1-Yr

Intrepid Potash, Inc. (IPI-N US$14.14)

SO

High

C$12.25

Adj. EPS14E:

Adj. EPS15E:

Adj. EPS16E:

$0.12

$1.13

$1.75

Valuation:

50/50 mix of 6.0x 2015/2016E EV/EBITDA and

1.0x 8% NAV

Key Risks to Target:

Commodity, operating, development,

financing, political

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.02

$0.20

2.3%

Ben Isaacson, MBA, CFA - (416) 945-5310

(Scotia Capital Inc. - Canada)

Unprecedented Rainfall Snags A Decent Quarter; 2015 Looks Weaker

Event

■ IPI reported a 2¢ loss on Q3. The Street/us were looking for +5¢.

Implications

■ The quarter was actually decent. Top line for potash and langbeinite was 2% and 4%

higher than our forecast, respectively. This was due to volume strength, but partially

offset by a slightly lower realized prices than our estimate (-1% to -3%), although

sequentially higher QOQ. The robust sales volume result was likely due to IPI's

strategically located facilities, access to truck markets, and field warehouses, which

enables it to minimize the impact of domestic rail challenges.

■ Rain rain go away... Rainfall in September led to power outages at Carlsbad, as well as a

one week shutdown at the East facility. This resulted in lower production, and therefore,

elevated cash costs. Potash and langbeinite cash costs were 9% and 7% higher

sequentially QOQ.

■ 2015 looks weaker. Production gains from HB should be offset by lower production at

Wendover (IPI's lowest cost facility). Cash costs are therefore expected to be higher than

previously thought - likely the same as 2014 ($195 to $205/st). This, coupled with a

sustainable price advantage, lower realized prices, and flat sales, leads us to EPS of 14¢

next year.

Recommendation

■ We maintain a SP rating on IPI, as well as a $13.50 target. We think the stock is in fair

value territory, and therefore should remain range-bound

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Adj. EPS14E

Adj. EPS15E

Old

---

SP

High

--

$13.50

$0.05

$0.14

$0.13

$0.29

New Valuation:

12x 2015E EBITDA, DCF @ 10%, 40% RCN

Old Valuation:

11x 2015E EBITDA, DCF @ 10%, 40% RCN

Key Risks to Target:

Fertilizer supply/demand, crop and energy

prices, weather

Div. (NTM)

Div. (Curr.)

$0.00

$0.00

Yield (Curr.)

0.0%

13

Edge at a Glance

Thursday, October 30, 2014

Joanne Smith, CFA - (212) 225-5071

(Scotia Capital (USA) Inc.)

Lincoln National Corporation (LNC-N US$52.32)

Solid Core Beat in Q3/14

Event

Pertinent Data

■ LNC's Q3/14 core EPS of $1.51 increased 22% YOY and exceeded our and consensus

estimates of $1.37 and $1.42, respectively. The upside was primarily related to strong

performance in the Life Insurance business, which benefited from a clean mortality

quarter and continued in-force growth. Positive operating leverage and higher account

values drove better than expected annuity earnings. LNC's other businesses and

corporate expenses were in-line with our expectations.

Implications

■ While sales were weaker than expected and elevated disability claims continued to

impact Group Protection results, overall results were strong, on a 9% rise in account

balances, effective expense control and capital management. In addition, LNC boosted

its quarterly dividend by 25% and the results of the annual actuarial review were

modestly positive.

Recommendation

■ LNC earnings have clearly outperformed our expectations, but they have largely been

driven by a disproportional contribution from annuities. Under a normalized equity

market return scenario, we expect EPS growth to slow. We believe LNC needs to

demonstrate more earnings diversification to justify a higher valuation.

Lundin Mining Corporation (LUN-T C$5.28)

New

Rating:

Risk:

Target:

1-Yr

Old

---

SU

Med

--

$54.00

Operating EPS14E

$5.70

$5.51

Operating EPS15E

-$5.86

New Valuation:

-Old Valuation:

Target P/E of 10x on 2014E (30% weight);

Target P/BV of 1.1x on 2014E (70% weight)

Key Risks to Target:

Credit losses; Rating downgrades; Hedge

effectiveness; Interest rate risk; Reserve

adequacy; Regulatory risk

Div. (NTM)

$0.80

Div. (Curr.)

$0.80

Yield (Curr.)

1.5%

Orest Wowkodaw, CPA, CA, CFA - (416) 945-4526

(Scotia Capital Inc. - Canada)

Q3/14 Results First Look: Weak Performance at Neves-Corvo but Guidance Unchanged

Event

Pertinent Data

■ Lundin released its Q3/14 financial and operating results.

Implications

■ The company reported an adjusted Q3/14 EPS of $0.05 vs. our estimate of $0.04 and

consensus of $0.07 (range of $0.04 to $0.10).

■ Due to relatively weak output at Neves-Corvo, total attributable copper production of

26.4kt was 10.1% below our estimate of 29.4 kt. Cash costs of $1.96/lb were 8.2%

above our estimate of 1.81/lb.

■ Zinc production of 38.0 kt was 7.3% above our estimate of 35.4 kt, although unit costs

of $0.48/lb were higher than our forecast of $0.28/lb.

■ Despite the relatively weak Q3, Lundin reaffirmed its 2014 production, cash cost, and

capital spending guidance.

■ The ramp-up of Eagle continues to make solid progress and is currently ahead of

schedule.

Recommendation

■ Lundin shares offer excellent exposure to Cu-Ni-Zn markets with a reasonable

development and balance sheet risk profile, at a very attractive relative valuation. We

reiterate our Focus Stock rating and our C$7.75 target price. Our C$7.75 target is based

on a 50/50 weighting of 6.0x our 2015 EBITDA estimate (C$8.02) and 1.0x our 8%

NAVPS estimate (C$7.57).

Rating:

Risk:

Target:

1-Yr

FS

High

C$7.75

Adj. EPS14E:

US$0.19

Adj. EPS15E:

US$0.53

Adj. EPS16E:

US$0.66

Valuation:

50% of 6.0x 2015E EV/EBITDA + 50% of 8%

NAV

Key Risks to Target:

Commodity, operating, financing,

development, political

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.00

$0.00

0.0%

14

Edge at a Glance

Thursday, October 30, 2014

MEG Energy Corp. (MEG-T C$27.95)

Op Cost Reductions Drive Higher Netbacks

Event

■ MEG announced Q3/14 results.

Implications

■ A 26% QOQ reduction in non-energy op costs drove higher netbacks. We anticipated

non-energy op costs of $9/bbl going in to Q3/14 with management guiding $8/bbl$10/bbl for 2014E. On the conference call management said that going forward, for

quarters that didn't include a turnaround, a sub-$8/bbl non-energy op cost would be

reasonable. We have reduced our near-term op costs estimate.

■ The 50% MEG Energy-owned Access pipeline was completed in Q3/14. While MEG's

Q3/14 production of 76.7 mbbl/d was in line with consensus, the volumes required to fill

the Access pipeline reduced MEG's sales volumes by approximately 6.1 mbbl/d of

bitumen.

■ Higher netbacks led to a CFPS beat. Our cash flow estimate, which included the impact

of the line fill, was $0.90/sh, which MEG was able to beat by 18% with higher netbacks.

■ 2014 discretionary spending looks to be cut. MEG had originally guided $1.8B for 2014

capex, including $0.2B in discretionary spending. MEG anticipates 2014 capex to be just

under $1.6B.

Recommendation

■ We maintain our Sector Outperform rating and $47/sh target price.

Jason Bouvier, CFA - (403) 213-7345

(Scotia Capital Inc. - Canada)

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

High

--

$47.00

CFPS14E

$4.07

$3.94

CFPS15E

$4.79

$4.82

New Valuation:

0.9x our risked 2P+RU NAV

Old Valuation:

0.9x our risked 2P+2C NAV

Key Risks to Target:

Commodity prices, timing of projects, and

project execution.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.00

$0.00

0.0%

Megacable Holdings (MEGA CPO-MX MXN 62.15)

Andres Coello - +52 (55) 5123 2852

(Scotiabank Inverlat)

Event

Pertinent Data

■ Megacable held its Q3/14 conference call.

Implications

■ CEO Enrique Yamuni confirmed that the purpose of the coming October 31 meeting is

to convert "A" shares into CPOs. As foreign ownership restrictions were lifted in the

constitutional reform, holders of "A" shares can now take advantage of owning CPOs,

making it easier for them to divest their stake. In our view, the conversion of shares into

CPOs, as well as the exit of the families from the HSBC trust, could simplify a takeout

process.

■ Megacable expects to consolidate PCTV as of October 1, 2014. The asset was valued at

MXN 150M (but Mega bought 66.0%), generating total sales of MXN 17M to MXN

18M per month (including sales to Megacable, so the net figure could be lower), with an

EBITDA margin of ~12%. In our view, this implies a ~6.0x LTM EV/EBITDA multiple,

which we see as attractive given the potential to generate synergies. However, we expect

PCTV to contribute ~0.7% of EBITDA next year, which is not enough to move the

needle, in our view.

■ Management remains confident in sustaining a 42.5% margin going forward, which is in

line with the 42.8% we have in our model.

Recommendation

■ Trading at 10.0x 2015E EV/EBITDA, we believe Mega's share price reflects its solid

fundamentals and a certain M&A premium. We recommend current shareholders

maintain their positions.

Rating:

Risk:

Target:

1-Yr

Q3: Conference Call Highlights

SP

High

MXN 47.00

EBITDA14E:

5,003

EBITDA15E:

5,433

EBITDA16E:

5,879

Valuation:

DCF - 5 years results, 8.3% WACC, terminal

growth rate of 4.0%

Key Risks to Target:

Telmex entry into pay TV; Expensive

acquisitions

Div. (NTM)

Div. (Curr.)

2.24

0.99

Yield (Curr.)

1.6%

15

Edge at a Glance

Thursday, October 30, 2014

Methanex Corporation (MEOH-Q US$59.04)

Volume Beat; Geismar Capex 27% Higher

Ben Isaacson, MBA, CFA - (416) 945-5310

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Adjusted Q3 EPS of 69¢ is a beat on the Street's 64¢. Sales volume was higher than

expected, as MX sold 4% more produced methanol than it created (i.e., a slight

inventory drawdown). Accordingly, we do not view this as a non-recurring beat. The

quarter was fairly uneventful.

Implications

■ The two Geismar plants will cost $300M more than MX thought. At $1.4B, the 27%

increase is ~$100M more than the market expected, or ~$1/sh (pre-tax). Capex rises to

$700/mt for brownfield projects, which adds good support to our $900/mt greenfield

replacement cost estimate.

■ There is little doubt the focus on the call will be what a lower energy complex means for

methanol. MX stated "pricing has been resilient in the wake of the recent drop in oil,"

but we think it takes time for lower energy derivatives like naphtha/LPG to test the

competitiveness of methanol. Other questions we will try to answer include why Chinese

consumption declined last month, what will happen with record coastal methanol

inventory in China, and what is the commissioning status of new merchant MTO plants

in China through 2015.

■ MX posted a higher NA price ($499/mt vs. $482), which signifies the tight Atlantic, due

to temporary supply outages (similar to last year, but less extreme). The November

Asian contract was posted flat at $435/mt.

Recommendation

■ We maintain a SP rating on MX. A full note will follow the call.

Rating:

Risk:

Target:

1-Yr

MetLife, Inc. (MET-N US$52.31)

Q3/14: A Welcome EPS Beat on Solid Core Results

Event

■ MET's Q3/14 core of EPS of $1.52, were 8% and 7% ahead of our and consensus

estimates of $1.41 and $1.42 (excluding a pre-announced tax adjustment in LatAm),

respectively, on improved top-line growth, strong investment margins and good expense

discipline. Underwriting experience reverted back to normal, with the exception of the

dental line, which was below expectations. Normalizing for unusually low corporate

expenses, we would view true core EPS to be $1.48, still a solid beat.

Implications

■ After two consecutive misses, the upside surprise was welcome and reinforced our view

that the misses were attributed to underwriting results that can be volatile on a quarterly

basis. Sales, ex-VA and retail life, were generally strong. The ROE came in at a strong

12.1% annualized and the company repurchased 8.1M shares for approximately $400M,

the first time the company has bought shares since pre-financial crisis.

Recommendation

■ MET remains a top pick in the life sector. We continue to expect the company to

produce strong earnings and an improving ROE over the next few years and that more

significant capital management will be possible as regulatory uncertainty diminishes.

Moreover, we believe the stock remains attractively valued, at 8.5x 2015E EPS and 1.0x

2014E BVPS. Our 12-month price target remains $59.

SP

High

US$72.00

Adj. EPS14E:

Adj. EPS15E:

$4.17

$5.92

Valuation:

7.5x 2015E EBITDA, 12x 2015E EPS, DCF @

10.5%, 100% Adj. RCN

Key Risks to Target:

Natural gas supply security, methanol S/D,

energy prices

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$1.00

$1.00

1.7%

Joanne Smith, CFA - (212) 225-5071

(Scotia Capital (USA) Inc.)

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Old

---

FS

Med

--

$59.00

Operating EPS14E

$5.65

$5.58

Operating EPS15E

-$6.14

New Valuation:

-Old Valuation:

Target P/E of 10x on 2014E (30% weight);

Target P/BV of 1.1x on 2014E (70% weight)

Key Risks to Target:

Capital flexibility; U.S. economic weakness;

Variable Annuity risk; Regulatory risk; Rating

downgrades

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$1.40

$1.40

2.7%

16

Edge at a Glance

Thursday, October 30, 2014

PHX Energy Services Corp. (PHX-T C$11.85)

Déjà Vu: Record Q's & Capex Bumps Continue

Vladislav C. Vlad, MBA, P.Eng. - (403) 213-7759

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Adjusted EBITDA of $24.6M was a record, slightly below our $25.5M expectation (4%) and consensus of $25.0M.

Implications

■ Top line beat offset by softer margin. Revenue of $139M came in 4% ahead of

expectation and is 30% better YOY and 38% better QOQ. This was led by impressive

13% higher than expected ops days in the U.S. (+13% QOQ or +580 days), which was

partially offset by slightly lower than expected days in Canada (-4%) and internationally

(-8%). The margin squeeze was mostly in the U.S. where higher personnel costs (to keep

pace with growth), SG&A associated with the EDR business and likely the costs

associated with field testing new technology (our assumption) weighed on margins.

Also, internationally, weaker activity out of Russia, which is expected to rebound,

placed added pressure on margins. PHX's Peruvian and Colombian operations closed.

■ Market share capture has been impressive on older platform; however, we are getting

excited about the next wave of growth. PHX unveiled one of its new technologies,

Velocity, which is a guidance platform designed to not only improve reliability but also

collect formation measurements to provide real time engineering and enhance the

drilling process. PHX has a fleet of these systems in field tests across NAM and expects

them to be commercial during 2015. Capex bumped to $84M, up $7.5M in anticipation

of future growth.

Recommendation

■ We remain bullish on PHX; degree of share pullback not justified.

Rating:

Risk:

Target:

1-Yr

Royal Gold Inc. (RGLD-Q US$62.98)

Q1/F15 - Good Quarter

SO

High

C$17.00

EBITDA14E:

EBITDA15E:

$76

$89

Valuation:

8.4x our 2015 EV/EBITDA estimate.

Key Risks to Target:

Commodity prices, labour supply, new

technology, and FX.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.84

$0.84

7.1%

Tanya Jakusconek, MSc, Applied - (416) 945-4083

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ RGLD reported Q1/F15 EPS of $0.29 and adjusted EPS of $0.28.

Implications

■ Earnings - Adjusted EPS came in at $0.28 vs. our estimate of $0.26 and consensus of

$0.30. The beat compared to our estimate was due to higher revenue from Cortez.

■ Revenues - Revenue of $69M was up from $56M in Q1/F14, while earnings increased to

$19M from $15M in Q1/F14.

■ Mt. Milligan - This quarter, RGLD received revenue contribution of about $20M.

Thompson Creek Metals (TCM) expects ramp-up of production to reach 80% of design

capacity by calendar year-end.

■ Phoenix Gold - Remains on track for production in mid-2015 with mill construction on

schedule and underground development 24% complete.

■ Euromax transaction - Following quarter-end, RGLD announced that it has entered into

a $175M gold stream transaction with Euromax Resources. See within for more details.

■ Other transaction - RGLD acquired a 2.0% NSR and a 3% NSR on the Tetlin

polymetallic exploration project (Alaska) for $6.0M.

■ Conference Call - conference call at 12:00pm ET. The dial-in numbers are 866-270-1533

(US); 855-669-9657 (Cda) or 412-317-0797 (Intl).

Recommendation

■ FQ1/15 EPS was slightly better than our estimate mainly on higher revenues from

Cortez. Sector Perform rating maintained.

Rating:

SP

Risk:

Target:

1-Yr

High

US$85.00

Adj. EPS15E:

Adj. EPS16E:

Adj. EPS17E:

Valuation:

1.80x NAV

Key Risks to Target:

Commodity prices; non-operator.

$1.32

$1.33

$1.38

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.84

$0.80

1.3%

17

Edge at a Glance

Thursday, October 30, 2014

Sherritt International Corporation (S-T C$2.86)

Q3/14 Results Below Expectations

Orest Wowkodaw, CPA, CA, CFA - (416) 945-4526

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Sherritt released its Q3/14 operating and financial results.

Implications

■ The company reported an adjusted Q3/14 EPS loss of $0.22 vs. our estimate of a loss of

$0.12 and consensus of a loss of $0.08. Adjusted EBITDA of $78.9M was 10.3% below

our forecast of $88.0M.

■ Total attributable nickel production of 8.4kt was 2.5% below our forecast of 8.6kt.

Ambatovy nickel production of 3.7kt increased by 3.9% QOQ, but was 11.5% below our

forecast. Total nickel cash costs of US$6.16/lb were modestly higher than our forecast of

US$5.95/lb.

■ Sherritt slightly reduced its total attributable 2014 nickel production guidance to 31.633.2kt (from 31.8-33.4kt).

■ After further tempering our ramp-up expectations and increasing our LOM cost

assumptions, we now forecast Ambatovy to become free cash flow neutral to Sherritt at

the end of 2015 (previously Q3/15).

Recommendation

■ Sherritt is rated Sector Outperform based on the company's significant leverage to rising

nickel prices, ongoing balance sheet de-leveraging, combined with easing ramp-up risk

at Ambatovy. However, we have reduced our 12-month target to C$4.50 per share (from

C$5.00) to reflect our lower estimates. Our revised C$4.50 target is based on a 50/50

mix of 6.0x our 2015E EV/EBITDA (C$3.27) and 1.0x our revised 8% NAV estimate of

C$5.84 per share.

Taseko Mines Limited (TKO-T C$1.58)

Q3/14 Financials First Look - Known to Be Messy

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

High

$4.50

$5.00

Adj. EPS14E

$-0.70

$-0.61

Adj. EPS15E

$-0.28

$-0.25

Adj. EPS16E

$0.22

$0.27

New Valuation:

-Old Valuation:

50% of 6.0x 2015E EV/EBITDA + 50% of 8%

NAV

Key Risks to Target:

Commodity Prices, Operational, Balance

Sheet, Political

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.07

$0.17

5.8%

Mark Turner, MBA, P.Eng. - (416) 863-7484

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ Q3/14 financials were released Wednesday after market close. Production and sales

volumes had been previously announced.

Implications

■ The high wall movement and shovel availability issues discussed with Q3/14 production

results in mid-October impacted Q3/14 costs more than we expected even when aware

of the longer hauls and contractor miner being moved to maintain mine production. Cash

costs increased 30% from Q2/14 to US$2.75/lb produced and were 11% higher than our

estimate of US$2.47/lb produced (US$2.56 on a C1 basis).

■ The Gibraltar mining fleet has now been moved to higher benches, the contract miner

has been released, and all major shovel maintenance is reported to have been complete

by mid-October. Normal expenditure levels are expected going forward, as per the

revised mine plan. Please see our October 13, 2014, note entitled, "High Wall Instability

Forcing Lower Grades for Next 18 Months".

■ Adjusted EBITDA of $1.9M was well below our estimate of $12.8M, as was adjusted

EPS of a loss of $0.06 compared with our estimate of a loss of $0.02 and consensus at

$0.00 (range -$0.02 to $0.04).

Recommendation

■ We maintain our Sector Perform rating and $2.50 target price ahead of adjusting our

estimates post quarterly conference call.

Rating:

Risk:

Target:

1-Yr

SP

High

C$2.50

Adj. EPS14E:

$-0.04

Adj. EPS15E:

$0.07

Adj. EPS16E:

$0.30

Valuation:

50% EV/EBITDA & 50% Adjusted NAV

Key Risks to Target:

Commodity price, operating, and technical

risks, environmental and legal risks

Div. (NTM)

$0.00

Div. (Curr.)

Yield (Curr.)

$0.00

0.0%

18

Edge at a Glance

Thursday, October 30, 2014

Teck Resources Limited (TCK.B-T C$18.42)

Orest Wowkodaw, CPA, CA, CFA - (416) 945-4526

(Scotia Capital Inc. - Canada)

Solid Q3/14 Results & Modest Positive Guidance Adjustments

Event

■ Teck released its Q3/14 financial and operating results.

Implications

■ The company reported an adjusted Q3/14 EPS of $0.28 vs. our estimate of $0.28 and

consensus of $0.25.

■ Coal production and sales of 6.8 mt and 6.7 mt were 6.3% and 9.8% above our estimates

of 6.4 mt and 6.1 mt. While the realized coal price of US$110/t was in line with our

forecast, cash costs of $88/t were $5/t lower than our forecast of $93/t. Cu producti on

and sales of 78 kt and 82 kt were 6.5% below and in line with our forecasts of 83 kt and

82 kt, while costs of US$1.64/lb were higher than our estimate of US$1.55/lb.

■ Teck modestly improved its 2014 production and cost guidance ranges for coal, Cu, and

Zn. The capex budget was reduced by $0.4 billion.

■ There was no change to the dividend; we believe that the dividend can be maintained for

another 12+ months in the current coal environment.

Recommendation

■ With limited near-term balance sheet and project development concerns, and likely

bottom of cycle pricing for coking coal and copper, in our view, the current share price

represents an attractive risk/reward trade-off. Teck is rated Sector Outperform with a

C$25.00 target. Our C$25.00 target is based on a 50/50 mix of 7.5x our 2015E

EV/EBITDA and 1.0x our 8% NAV of $24.19 per share.

Pertinent Data

New

Rating:

Risk:

Target:

1-Yr

Old

---

SO

High

--

$25.00

Adj. EPS14E

$0.87

$0.83

Adj. EPS15E

$1.19

$1.17

Adj. EPS16E

$1.62

$1.63

New Valuation:

50% of 7.5x 2015E EV/EBITDA + 50% of 8%

NAV

Old Valuation:

50% of 8.0x 2015E EV/EBITDA + 50% of 8%

NAV

Key Risks to Target:

Commodity prices, currency, operating,

development, balance sheet and

environmental

Timmins Gold Corp. (TMM-T C$1.39)

Div. (NTM)

$0.90

Div. (Curr.)

$0.90

Yield (Curr.)

4.9%

Ovais Habib - (416) 863-7141

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

EPS in Line; Cash Declines $5.8M QOQ

■ Timmins reported Q3/14 adjusted EPS of $0.01, directly in line with our estimate and

consensus.

Implications

■ Cash costs for the quarter of $856/oz were 4% below our estimate of $889/oz due to

higher silver credits and a negative inventory adjustment. The company reported AISC

of $994/oz in Q3/14, up from $928/oz in Q2/14 due to higher cash costs offset by lower

corporate G&A expenses.

■ Timmins finished Q3/14 with cash and equivalents of $50.2M, ~$5M less than our

estimate and ~$6M lower than Q2/14. The lower cash position was due to a negative

$3.6M working capital adjustment and capex of $9.7M compared with our estimate of

$3.7M.

■ Recall the company pre-released Q3/14 production of 26.7 koz Au, which missed our

estimate by 8% due to record rainfall in Mexico in September. Open pit access was

restricted, leading Timmins to process lower-grade ore from stockpiles.

■ Timmins expects to achieve the high end of its 2014 guidance range (115-125 koz Au) at

a cash cost of ~$800/oz, and we model 2014 production of 122 koz Au at $798/oz. The

company also anticipates releasing drill results from its regional exploration program

shortly.

Recommendation

■ We rate Timmins Sector Perform with a C$2.00 one-year target price.

New

Rating:

Risk:

Target:

1-Yr

Old

---

SP

High

--

$2.00

EPS14E

US$0.08

US$0.09

EPS15E

-US$0.11

EPS16E

-US$0.07

New Valuation:

-Old Valuation:

1.10x NAVPS

Key Risks to Target:

Multiple contraction, commodity prices,

technical and operational risks, and

geopolitical risks

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.00

$0.00

0.0%

19

Edge at a Glance

Thursday, October 30, 2014

Totvs SA (TOTS3-SA R$36.65)

Andres Coello - +52 (55) 5123 2852

(Scotiabank Inverlat)

Event

Pertinent Data

■ Q3/14 sales were 1.1% above our numbers thanks to strong maintenance revenues

(+16.3% YOY), but EBITDA was weak on the back of migration to SaaS and macro

uncertainty in Brazil (9.2% below our estimates and up only 0.1% YOY). However,

TOTVS confirmed 2013-2016 guidance on margins, R&D, and international sales.

Implications

■ Migrating to SaaS means that customers that couldn't afford a significant down payment

for ERP licenses are now able to access them by paying a monthly fee. In Q3/14,

TOTV's license transactions increased 31.3% YOY, a remarkable figure amidst the

turmoil in Brazil.

■ However, migrating to SaaS also means that while the company has to defer the

recognition of revenues (average ticket down 30.7% YOY in Q3), it immediately faces

the costs of growing more robustly. Our view is that the short-term pain in margins from

migrating to a model where software penetration rises, where cash flows are more stable,

and where the impact of macro changes is reduced, is worth the long-term rewards.

■ With a net cash position of R$16.3M, TOTVS is well positioned to make accretive

acquisitions, especially in Mexico and the Andeans.

Recommendation

■ EBITDA growth in Q3 lagged Oracle and SAP. While the recent sell-off marginally

reduced the valuation premium against the giants, it remains substantial (29.3%). An

overly negative reaction to Q3 results could improve entry levels. We advise investors to

remain alert but neutral.

Rating:

Risk:

Target:

1-Yr

Mixed Q3: Migration to SaaS Worth the Pain

Usinas Siderúrgicas de Minas Gerais SA - Usiminas (USIM5-SA R$5.95)

Q3 Results First Look: Near-Term Outlook Blurs

EBITDA14E:

EBITDA15E:

EBITDA16E:

SP

Med

R$45.00

R$470

R$559

R$645

Valuation:

DCF - five years of results, 9.9% WACC,

terminal growth rate of 5.8%

Key Risks to Target:

Technology obsolescence; migration to SaaS;

price wars; competition

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

R$1.20

R$1.20

3.3%

Alfonso Salazar, MSc - +52 (55) 5123 2869

(Scotiabank Inverlat)

Event

Pertinent Data

■ Usiminas reported Q3/14 EBITDA of R$309M, well below our R$516M estimate driven

by weaker-than-expected revenue. Quarterly EPS of negative R$0.03 missed our R$0.08

forecast due to the lower operating profit and a higher foreign exchange loss of

R$164M.

Implications

■ Total revenue of R$2.9B (6% lower QOQ, 9% YOY, and 7% below our estimate) was

affected by a decline in shipments and prices at the steel and iron ore divisions. Steel

shipments of 1.4M tonnes, down 4% QOQ and 10% YOY, came in 5% below our

estimate, driven by weaker-than-expected domestic demand and an increase in steel

imports. Apparent demand for flat steel in Brazil contracted 5% YOY to 3.3M tonnes, of

which 18.8% was supplied by imports (up from 16% in Q2/14).

■ The average steel price contracted to R$1,911/tonne from R$2,004 in the previous

quarter, and came in 3% below our R$1,976/tonne estimate. EBITDA per tonne at the

steel division fell from R$306 in Q2/13 to R$244 in Q3/14.

■ The mining division reported revenue of R$107M, missing our estimate of R$166M due

to lower-than-anticipated shipments (1.24M tonnes vs. Scotiabank GBM estimate of

1.52M tonnes). EBITDA per tonne at the mining division stood at only R$8.9 (down

from R$46 in Q2/14).

Recommendation

■ Near-term challenges for Usiminas continue to pile up. Reiterate SP.

Rating:

Risk:

Target:

1-Yr

SP

High

R$8.00

Adj. EPS14E:

R$0.47

Adj. EPS15E:

R$0.62

Adj. EPS16E:

R$0.89

Valuation:

30% discount to DCF value per share

Key Risks to Target:

Commodity price, operating, technical,

political, environmental, and legal

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

R$0.00

R$0.00

0.0%

20

Edge at a Glance

Thursday, October 30, 2014

Yamana Gold Inc. (AUY-N US$5.38)

Q3/14 - Messy Quarter; Dividend Cut 60%

Tanya Jakusconek, MSc, Applied - (416) 945-4083

(Scotia Capital Inc. - Canada)

Event

Pertinent Data

■ YRI reported a Q3/14 loss of $1.17 and adjusted EPS of $0.03.

Implications

■ Earnings - Adjusted EPS came in at $0.03 (SC estimate) vs. our estimate of $0.03 and

consensus of $0.06. The main adjustments included impairment and deferred tax charges

totalling ~$1.13/sh.

■ Operations - Actual production came in generally in line at 391 kGEO at total cash costs

of $646/GEO (co-product) vs. our forecast of 394 kGEO at total cash costs of

$637/GEO. YRI had pre-released production of over 390 kGEO at AISC within the

annual guidance range. Copper production was in line with better costs.

■ 2014 Production Guidance Adjusted Slightly - Guidance was slightly adjusted to 1.41.42 MGEO versus previous guidance of over 1.42 MGEO. AISC was also maintained

at $825-$875/oz (by-product).

■ Dividend Cut 60% - The annualized dividend was cut to $0.06/sh from $0.15/sh. We

were not expecting a dividend cut.

■ Impairment Charge - YRI recorded a pre-tax impairment of $668.3M ($635M after-tax)

with respect to its C1 Santa Luz, Ernesto/Pau-a-Pique and Pilar assets. We were

expecting impairment charges.

Recommendation

■ Operationally, Q3 showed an improvement over Q2. Q4 is expected to be stronger. The

annual dividend was cut 60% to $0.06/sh despite better 2015 production growth, lower

capital and low AISC. Shares will likely open weaker. We will review our estimates

after the conference call.

Rating:

Risk:

Target:

1-Yr

Adj. EPS14E:

Adj. EPS15E:

Adj. EPS16E:

SO

High

US$9.00

$0.15

$0.26

$0.29

Valuation:

1.35x NAV

Key Risks to Target:

Commodity prices; technical and operational

risk; geopolitical risk.

Div. (NTM)

Div. (Curr.)

Yield (Curr.)

$0.06

$0.13

2.4%

21

Company Comment

Thursday, October 30, 2014, Pre-Market

(ACR.UN-T C$9.06)

Agellan Commercial REIT

Steady Outlook; 2015 Should be a Better Year

Pammi Bir, CPA, CA, CFA - (416) 863-7218

(Scotia Capital Inc. - Canada)

pammi.bir@scotiabank.com

Rating: Sector Perform

Risk Ranking: Medium

Ganan Thurairajah, MBA - (416) 863-2899

(Scotia Capital Inc. - Canada)

ganan.thurairajah@scotiabank.com

Target 1-Yr:

C$10.25

ROR 1-Yr:

21.7%

Valuation: 10.75x AFFO (F'16 estimate)

Key Risks to Target: Significant unitholder, inability to execute growth, rising interest rates

Event

■ Agellan reported Q3/14 FFOPU of $0.28 vs. $0.31 last year, slightly

below our $0.29 estimate and consensus ($0.29).

Implications

■ Signs point to accelerating leasing & internal growth. Despite the

1.1% drop in SP NOI, the 100bp QOQ lift in overall occupancy to 91%

was encouraging. Based on tenant discussions, management remains

confident of a further 200bp-250bp uptick by mid-2015. Should its

leasing targets be hit, our ~1.5% 2015E-16E SP NOI may prove light.

■ Expect Parkway expansion update in November; acquisitions teed

up. The $48M expansion plans at Parkway remain intact, with a firm

lease with the new dealership expected in November. As a reminder, we

estimate the project could add +3%-4% to our NAV upon completion

by 2017 and 5% to annual AFFOPU. Redeployment of proceeds from

the sale of Kiest is expected before year-end, with ACR targeting TX

industrial, though the timing delay has created a bit of cash drag.

■ Estimates tweaked; stronger growth on deck for 2015. Our revised

2013A (annualized)-2015E AFFO CAGR is 4.5% (6.9% 2014E-16E),

in line with its diversified peers, albeit with growth skewed to next year.

CDPU (NTM)

CDPU (Curr.)

Yield (Curr.)

$0.78

$0.78

8.6%

Pertinent Revisions

New

FFOPU14E

$1.16

FFOPU15E

$1.26

FFOPU16E

$1.28

New Valuation:

10.75x AFFO (F'16 estimate)

Old Valuation:

11x AFFO (F'15 estimate)

Old

$1.18

$1.25

$1.27

Recommendation

■ SP, $10.25 target. Our outlook is unchanged from our recent initiation.

At 9.8x 2015E AFFO/8% implied cap rate/13.8% below NAV, we

believe current levels offer longer term investors a reasonable entry point

with a chunky 8.6% and fully covered yield. Add more actively ~$8.75.

Qtly FFOPU (FD)

2013A

2014E

2015E

2016E

Q1

$0.21 A

$0.30 A

$0.30

$0.32

(FY-Dec.)

Funds from Ops/Unit

Adj. Funds from Ops/Unit

Cash Distributions/Unit

Price/AFFO

EV/EBITDA

EBITDA Margin

EBITDA/Int. Exp

AFFO Payout Ratio

Q2

$0.30 A

$0.29 A

$0.32

$0.33

Q3

$0.31 A

$0.28 A

$0.32

$0.33

Q4

$0.29 A

$0.29

$0.32

$0.31

Year

$1.11

$1.16

$1.26

$1.28

P/FFO

7.9x

7.8x

7.2x

7.1x

2012A

2013A

$1.11

$0.80

$0.72

10.9x

15.1x

54.7%

3.4x

90.7%

2014E

$1.16

$0.84

$0.78

10.8x

13.4x

53.7%

3.2x

92.7%

2015E

$1.26

$0.93

$0.78

9.8x

13.1x

53.9%

3.2x

83.4%