FINAL REPORT

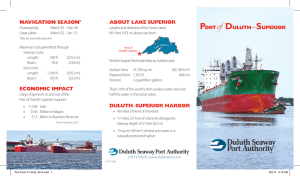

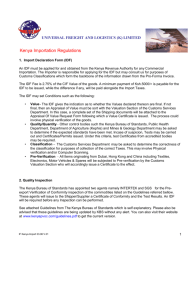

advertisement