lock-in effect within a simple model of corporate stock trading

advertisement

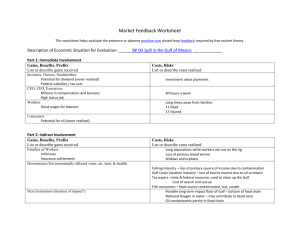

National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 LOCK-IN EFFECT WITHIN A SIMPLE MODEL OF CORPORATE STOCK TRADING** DONALD W. KIEFER* ABSTRACT gains tax cuts in Congress in 1990 is widely expected. This article presents an overview of a The capital gains tax has important efsimple simulation model of the lock-in efficiency effects because it affects the rate fect of the capital gains tax on trading corof return on investing in capital assets and porate stock. The results of simulations of the cost of switching capital assets, reseveral policy changes are reported, the ferred to as the "lock-in" effect. The repolicies include a 15 percent flat capital sponses of investors to these effects also gains tax rate, President Bush's 1989 caphave "feedback" effects on tax collections. ital gains tax cut proposal, and taxation of If the lock-in effect were large enough, a accrued capital gains at death higher capital gains tax rate could actually result in lower capital gains tax receipts because of the reduced level of gains rrHE tax on capital gains was increased realizations. 2 Conversely, a capital gains JL by the Tax Reform Act of 1986 by retax cut could actually raise tax revemoving the exclusion of 60 percent of the nue. gains on assets held longer than 6 months. There have been numerous attempts to Combined with the tax rate changes in the measure the magnitude of the lock-in efAct, this revision increased the maximum fect of the capital gains tax using crossmarginal tax rate on capital gains from section analysis,' time-series analysis,' 20 percent to 28 percent for the highest analysis of Vooled time-series and crossincome taxpayers (the rate is 33 percent section data, and panel data.6 While these for some upper-income taxpayers). studies have contributed significantly to The capital gains tax increase is one of our knowledge of the responsiveness of the most controversial elements of the capital gains realizations to tax rate 1986 tax reform. In 1989 Congress serichanges, they also suffer from important ously considered four proposals to reverse limitations. One limitation is that there it.1 President Bush proposed cutting the are virtually no data on several impormaximum tax rate on long-term gains to tant variables-for example, the amount 15 percent; he also proposed gradually ofaccrued but unrealized capital gains or lengthening the holding period to qualify the amount of accrued gains passing for the favorable treatment to tbxee years. through estates-and only very limited Congressman Rostenkowski, Chairman Of data are available on the holding periods the House Ways and Means Conunittee, of capital assets. proposed indexation of the basis of capital A second limitation is that the econoassets along with a minimum basis rule metric studies have been largely unable for assets held at least five years. The to investigate the time pattern of the capHouse of Representatives passed a capital ital gains realization response. It is gengains tax cut that would have lasted two erally agreed that the long-run response years and would have been followed by of realizations to a tax rate change should indexation. A capital gains tax cut Prodiffer from the short-run response beposal that would have provided lower tax cause the realization of capital gains derates for longer holding periods received pends, in part, on the level of unrealized 51 votes in the Senate, but failed to reaccrued gains on currently-held assets, ceive the 60 votes required to break a filwhich will change gradually. Since only ibuster. Further consideration of capital annual data on capital gains realizations however, a time-series *Congressional Research Service, LibrM ,f c,,n@ are available, gress, Washington, DC 20540. regression on post-war data does not have 75 National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 76 NATIONAL TAX JOURNAL sufficient degrees of freedom to explore extended lags. 7 Furthermore, the econometric models have not been derived from models of capital gains realization behavior. The estimation models are generally rather ad hoc and are presumed to represent reduced forms of the actual capital gains realization process. Indeed, while there have been attempts to model some aspects of this process,' there is no known model which attempts to trace the time pattern of.the adjustment of capital gains realizations to changes in tax rates. These limitations of the econometric approach suggest the potential usefulness of an attempt to model the capital gains realization process. While such an effort would necessarily be somewhat conj*ectural and would have to be greatly simplified from the real world, it may provide insights which the econometric approach has not. It may also provide testable hypotheses for further econometric work. This paper presents an overview of a simple simulation model that has been developed to represent the capital gains realization process. The model focuses on the trading of common stock, the largest source of taxable capital gains.' To explore relationships within the model, the results of simulations of several tax policy changes are reported. Section I of the paper briefly summarizes the model. Section II discusses the parameterization of the model and reports the results of a base simulation. Section III displays the results of using the model to simulate the response of capital gains realizations and tax receipts to a tax rate cut. Section IV provides econometric results based on model simulations and compares the results to the study by the Congressional Budget Office (1988). Section V summarizes results of a simulation of the capital gains tax cut proposal put forward by President Bush early in 1989. Section VI examine the effects of taxing capital gains at death, and the final section offers conclusions. 1. The Model The simulation model contains three principal elements: the representation of [Vol. XLIII investors, a model of the investor decision to hold or trade shares, and a system of accounting for all the stocks in the market which traces the value of shares and the accrual and realization of capital gains. The Investors The model includes 40 cohorts of investors, assumed to range in age from 30 to 69. All investors in the model die at the end of their 69th year; life expectancy is known and is factored into the trading decision. Investors in each cohort buy shares and inherit shares from dying investors. The portfolios of investors in the first cohort consist entirely of shares held only one year. Portfolios of investors in the older cohorts consist of shares acquired in each previous year that have not yet been sold (e.g., investors in the 20th cohort hold 20 different vintages of stocks). The investors are all assumed to face the same tax rates on capital gains. The Trading Decision The model contains a representation of the investor decision to hold or trade shares; trading here means selling a share and buying another one. The selling of shares to finance consumption, and the decision regarding the amount of the investor's portfolio used to finance consumption versus the amount left to heirs, are not modeled.10 All investors are assumed to share a common expectation regarding the best rate of return available during the next year on shares they do not currently own (alternative investments). On the other hand, investors are assumed to have varied expectations regarding the likely rates of return on the stocks in their portfolios during the next year. As investors receive new information on companies in which they have invested, their expected returns on these stocks can go up or down and can be lugher or lower than when they bought the stocks. To capture this effect, the model divides each cohort of investors into 20 "probability classes" for each vintage of stocks. National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 LOCK-IN The expected rate of return during the coming year on stocks in investor portfolios is assumed to be normally distributed with a specified standard deviation, a." Given this standard deviation and the mean of the distribution, K (the determination of which is discussed below), investors are arrayed into 20 classes, each containing 5 percent of the probability density of the distribution." The rate of return corresponding to the midpoint of the class (in terms of probability) is used as the expected rate of return for the whole class. For example, the expected rate of return assigned to investors in the first class is the rate below which 2.5 percent of investors would expect the rate to lie, given the parameters of the normal distribution. The expected rate in the second class is the rate below which 7.5 percent of investors would expect the rate to lie, and so forth. Expectations with regard to each stock in an investor's portfolio and each year are assumed to be independently distributed. To the extent that the expected rate of return on a stock (both stocks in the investor's portfolio and alternative investments) during the coming year deviates from the average rate of return in the market, the model assumes that the investor expects the rate to move gradually toward the average market rate. While some stocks might be expected to earn higher or lower than market rates of return for some period of time, these market inefficiencies should also be expected to diminish over time. The expected rate of return on a stock t years after its purchase, rt, is determined in the model as follows: rt = r. + rele d(l -t) where: (1) rm = the expected average rate of return in the stock market r., = the expected excess rate of return on the stock in the first year it is held (rl can be negative) e =the base e, (approximately equal to 2.71828) EFFECT 77 d the parameter that determines the rate at which the expected rate of return approaches the market rate Hence, with regard to a stock that is in the investor's Portfolio, the rate of return expected over the next year adjusts from Year to year as new information is received. Whatever the expected rate during the next year, however, it is expected to approach the market average rate over the long term. The investors in the model face an almost infinite variety of potential investment strategies, ranging from holding their current stocks until death to trading their stocks for new ones in the current Year and every year until death. Since the alternative strategies involve holding different investments over different time periods, the only time period necessarily shared by the strategies is the time until death- Hence, the model assumes that each investor selects the strategy for each stock in his POrtfOliO that appears to be consistent with the goal of wealth maximization at the time of death. The model does not evaluate all of the potential strategies available to an investor, but does evaluate a large subset of them.13 For strategies that involve trading the current stock for an alternative investment, the model calculates teminal wealth resulting from holding the altemative stock until death; it also evaluates holding periods for the alternative stock of one year, two years, etc., up to one half of the investor's remaining life, and, for each holding period, trading the alternative stock once twice, etc., up to the maximum nurnberof trades possible in the investor's remaining life. The value, VT at the end of the investors life yielded by trading the current stock for an alternative stock which is to be held for t years is determined in the model by the following equation: VT @ P(l tg@9)[Mat(I ' [Maf(l tgd) + tgd] where: p t,.) + tg.1' (2) the price of the stock National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 NATIONAL TAX JOURNAL 78 t,, g M, t,,, n [Vol. XLHI currently in the invesrent stock is held for h years and then tor's portfolio that is to traded, the value at the end of the invesbe traded toes life, Vh, is: = the current capital gains tax rate th(l - 9)] = the portion of p that is Vh = PIM@h(l - th) + n[Maf IMt(i accrued capital gain tg.) + tgl (1 - td) = a multiplierindicating (4) + td] the growth in the value of the alternative stock where: Mh a multiplier indicating held for t years, deterthe growth in the value mined in accord with of the current stock equation I when held h years de= the expected capital termined in accord with gains tax rate when the equation 1 alternative stock is to be th the expected capital traded gains tax rate when the = the number of times alcurrent stock is to be ternative stocks are to be traded turned over during the investor's remaining lifetime M.f = a multiplier indicating the growth in the value of the alternative stock in the final holding period after the last trade, determined in accord with equation 1 tgd = the expected capital gains tax rate at the time of death For strategies that involve holding the stock currently in the investor's portfolio rather than trading, the model calculates the terminal wealth resulting from holding the stock until death, VH, as follows: The structures of equations 2 through 4 make clear one of the advantages of using a structural model rather than a reduced form model. In most reduced form models, the tax rate enters the model in linear, log linear, or quadratic form (see, for example, the equations in section IV below). The way in which the tax rate enters the trading decision in equations 2 through 4, however, is more complex. Furthermore, not only the current tax rate, but also expected future tax rates are important to the trading decision. For each vintage of stocks held by each probability class of each cohort of investors, the model identifies the trading strategy and holding strategy expected to maximize terminal wealth. A stock is (3) traded if any trading strategy dominates VH = PIM(@d(l - tgd) + tgd(I - 9)] all of the holding strategies; otherwise it where: Ald = a multiplier indicating is retained. The trading strategies are the growth in the value reevaluated each year; a dominant stratof the current stock egy one year does not necessarily carry when held until death over into the following year. All after-tax determined in accord proceeds from stock sales are reinvested with equation I in shares of the alternative stock. 14 In its initial solution, the model allows The model also evaluates holding the current stock for one year, two years, etc., the overall turnover rate of stocks in the up until the year before death; for each market to be set. Given the values of the holding period the model considers each other parameters, the model solves iterof the trading strategies described in the atively for the value Of III the mean of the paragraph preceding equation 2 once the distribution of expected rates of return on current stock has been traded. If the curshares currently owned, such that in National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 LOCK-IN EFFECT equilibrium shares will be traded at the specified turnover rate." Once this value of li is determined, it is held constant in further model solutions exploring the effects of alternative settings of the policy parameters. The Stocks For simplicity and to focus on the effects of tax changes rather than other effects, stock prices are assumed to grow at a constant rate in the model rather than var)nng substantially as actual stock prices do." Also, dividends and losses are ignored. Investors are assumed to buy and sell shares based solely on their expected capital gains. For each investor cohort, the model traces the market value and the tax basis of each vintage of stocks in the investment portfolio. Vintage 1 contains stocks purchased and inherited at the beginning of the current year, vintage 2 contains stocks obtained at the beginning of the previous year, and so on. The investors in cohort 40 are assumed to die at the end of each year. The shares remaining in their portfolios are inherited by younger investors with a steppedup basis. 11. Parameterization and Base Simulation The model does not have a sufficient number of control parameters to exactly match actual stock market data for any specific year. Nonetheless, an attempt was made to parameterize the model as closely as possible to data for 1981, since this is a year for which considerable data on capital gains are available from tax returns. 17 The initial turnover rate was set at 15 percent (for the tax rates in effect in 1981). While this is closer to the average turnover rates in the market during the 1950s and 1960s than in the early 1980s," most of the increase in trading activity in the last 15 years has been in institutional trading, not trading by individual investors.19 For the simulations reported here, 79 the prices of common stocks in the market were assumed to increase at a rate of 7.0 percent per year, which is close to the average growth rate of the S&P 500 stock index from 1950 to the end of 1988. The expected rate of return on alternative investments (in the first year of ownership) was arbitrarily set equal to 8.0 percent. The distributions of new stock purchases and inheritances of stocks across the cohorts of investors were set so the resulting distribution of share ownership across age cohorts would approximate the observed distribution .20 The rate at Which expected rates of return are assumed to approach the market rate (d in equation 1) was arbitrarily set at .075 for the simulations reported here. Simulations were performed for several values of (r to examine the results under different assumed degrees of sensitivity. The smaller the value of or, the more responsive are capital gains realizations to tax rate changes within the model. With a smaller value of u, the different expected rates of return on stocks in investors' portfolios are clustered more closely together. Hence, a given tax rate cut, for example, will cause more shares held by investors to be traded rather than retained. Selected data from simulations assuming a = 0.2 11,which seem to be the most consistent with observed data, will be reported to illustrate the behavior of the model. Line 1 of table 1 reports the data for the base simulation of 1981 tax law (the data in the other lines of the table are discussed in the sections below). The tax law is characterized in the simulations by four features: the holding period requirement, the tax rate on short-term gains, the tax rate on long-term gains, and the tax rate on gains at death. For 1981 law, these amounts are assumed to be 1 year, 70 percent, 24 percent, and 0." The turnover rate of 15 percent, shown in line 1, column 1, of the table, was assumed in the base simulation. The value of R, the mean of the distribution of the expected rate of return during the next year on stocks in investors' portfolios, required to achieve this turnover rate given National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 Table 1 Summary of Simulation Policy 1. 2. 3. 4. 5. 6. 1981 28% 15% Bush Tax Tax Turnover Rate (1) Tax System Flat Tax Flat Tax Proposal at Death (28%) at Death (12.5%) .150 .197' .308 .229 .324 .384 National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 Result Average Holding Period (2) Average Market Gains (3) Traded Stock Gains (4) 3.24 2.24 2.27 2.81 2.45 2.34 .277 .290 .182 .217 .191 .141 .192 .135 .137 .164 .146 .141 E National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 LOCK-IN EFFECT the values of the other parameters is .0839; the expected rates in the highest and lowest probability classes of investors, given iL and the assumed value of (y, are .1169 and .0510. Column 2 in the table reports the average holding period on stocks sold in the market. The average of 3.24 years is lower than the actual average holding period of 5.3 years for stocks with capital gains sold in 1981. The simulated pattern of sales by holding period differs from the actual pattern in two respects. First, in the simulation there are substantially fewer sales of stocks held only one year. Second, there are also fewer sales of stocks held for long time periods. While actual data reveal some stock sales after holding@ periods of 20 years, 25 years, and even 30 years, in the simulation no stock held longer than 15 years is sold. There are reasonable explanations for both deviations from reality. The difference regarding short-term sales is probably due to the absence of losses in the model. Real investors have stocks with accrued losses. An optimal investment strategy usually involves realizing short-term losses. An investor with short-term losses can realize short-term gains (up to the amount of the losses) with no tax consequence. Investors in the model do not have this opportunity. The lower sales of stocks held for long periods in the model is probably due primarily to three factors. First, all stocks in the model grow in value at a constant rate. Thus, all stocks held for long periods have sizeable accrued gains, and trading them is costly. Real investors may have some stocks held for long periods with small gains or losses, so the tax cost of trading them is small or negative. Second, the model does not include sales of stock to finance consumption. Some sales of longheld stock are, no doubt, to finance bigticket items such as childreres education or to finance retirement consumption of older investors. The third reason for lower sales of long-held stocks is that all investors in the model know they will die at age 70. Real investors may have much longer life expectancies (hopes) and therefore factor in longer periods of time 81 for an alternative investment to recoup the tax cost of trading. A variant of the model allows specifying a longer life expectancy, and, as would be expected, this results in a longer average holding period for stocks. The third and fourth columns in the table report accrued gains as a proportion of total value for all stocks and for traded stocks. In this simulation, accrued gains equal 27.7 percent of the aggregate value of all stocks, but only 19.2 percent of the value of traded stocks, reflecting the tendency not to trade stocks with high accrued gains. Columns 5 and 6 report that in the first simulation, realized gains each year in equilibrium equal 2.87 percent of the total value of all stocks in the market, and the capital pins tax paid equals 0.70 percent of the total value of stocks. The last two colunms report that the value of net bequests equals 4.15 percent of the total value of stocks and the step-up in basis on bequested stocks equals 2.18 percent of the total value of all stocks (53 percent of the value of bequested stocks). In equilibrium, the amount of realized gains plus the basis step-up each year will equal the growth in accrued gains multiplied by 1 minus accrued gains as a fraction of total stock value. 22 Expressing each amount as a fraction of total stock value, growth in accrued gains in the simulation equals 7 percent (the assumed growth rate). Accrued gains are .277328 of total stock value; 1 minus this amount is .722672. Muitiplication by the growth rate yields .050587. This equals the sum of realized gains (.028742) plus basis stepup (.021844). In this case basis step-up amounts to 31 percent of annual accrued gains, very close to the 30 percent level estimated in U.S. Department of the Treasury (1985, p. 103). If realizations increase permanently as a result of a tax cut, then in equilibrium, basis step-up will decrease and/or accrued gains as a fraction of total stock value will decrease. 111. The Simulated Effects of a Capital Gains Tax Cut The principal advantage of a simulation model, of course, is that it can be used National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 [Vol. XLIII NATIONAL TAX JOURNAL 82 to isolate and study phenomena that cannot be isolated in the real world. 'fhe model presented here can be used, for example, to study the effects of a capital gains tax cut isolated from other influences on capital gains realizations (e.g., stock market fluctuations) and from the effects of other tax changes (during the last two decades, the tax treatment of capital gains has been changed, on average, every other year). To this end, the model was used to examine the patterns of capital gains realizations and tax collections generated by a tax cut from a flat 28 percent capital gains tax to a flat 15 percent tax. Simulations were performed using five different values of a, ranging from 0.05 p to 0.4 @L,to explore different degrees of sensitivity. The capital gains realization response is graphed in figure 1 and the tax revenue response is graphed in figure 2. The graphs plot realizations and revenue as fractions of the total value of stocks in the market each year. The values plotted on the vertical axis have been normalized so Simulated the level prior to the tax cut is set equal to 1 (the tax cut occurs at year 0). The last two digits of the variable names indicate the assumed value of or (as a multiple of ii). The plots for a = 0.2 IL are shown by the dark solid line in each graph, and the beginning and ending equilibrium values for this simulation are shown in lines 2 and 3 in table 1. The patterns in Figure 1 suggest that the response to a capital gains tax cut in the model seems to have three phases: the first-year, when realizations jump sharply upward; an intermediate phase lasting from 2 to 5 years, during which realizations decline; and a longer-term phase, during which realizations rise gradually, not reaching their new equilibrium level until about 20 years after the tax cut. Each of these effects is more pronounced for lower values of a. The patterns of tax revenues shown in figure 2 mirror those of the realizations in figure 1. For the smallest two values of or, tax revenues increase in the first year Capital Gains Realizations 2 ............ After a Tax Cut .. .. .......... ............. ...... ................ 1.6 ------------------------------------........... I., ................................................ 1.4 --------------------------I ............... ..................... ........ ......... Gains 05 1.2 Gains 10 Gains.20 -r777i Gains 30 Gains 40 0.8 -6 . . . *0 . . . . @5 . . . * 2,0 . . . . i5 Years Figure 1 30 National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 1] LOCK-IN EFFECT Simulated Capital Gains 83 Tax Revenue ... .......... .......... ---------- After a Tax Cut ................ ...... ... ---------- --------------- 0.9- -------------------- --------------------- ------------------- 07 ... Tax.06 Tax 10 06 Tax.20 0.5 0.4-1-5 Ttx.30 Tax 40 . . . . . . . . . . . . . . . . . . . 5 10 15 20 . . 25. . . . 30 Years Figure 2 of the tax cut because of the large jump in realizations. In all of the simulations, revenues are lower than prior to the tax cut during the intermediate phase and the first several years of the longer-term phase. For the smallest value of cr, however, revenue is higher in the long run than prior to the tax cut. Understanding the dynamics of the patterns shown in irigures 1 and 2 is aided by the information plotted in figure 3, which traces several of the variables in the simulation with a = 0.2 R. The immediate effect of the tax cut is that more alternative investments are attractive relative to existing investments because the tax cost of trading has declined. Hence, trading increases. The jump in trading disproportionately affects shares that have been held for longer time periods because these are the shares for which the tax cut results in the biggest decrease in trading costs (because they have the largest accrued gains). In the simulation with cr = 0.2 R, for example, in the first year after the tax cut, trading of shares in vintage 2 (across all cohorts) increases by 19 percent; trading of shares in vintage 10 more than quadruples. Thus, in figure 3, in the irirst year the turnover rate jumps upward and so does the average holding period for stocks sold (the average level of gains on the sold stocks, "Traded Gain," follows the pattem of the holding period). The first-year jump in realizations in figure I is attributable to both of these factors: higher sales and higher realized gains per sale. The intermediate phase of the response to the tax cut could be said to result from a "vintage effect." The pattern of realizations during this phase is dominated by a decline in the average gain realized per share traded, as shown in figure 3; this decline results from the shift of shares in the market toward the lower vintages. Beginning the second year after the tax cut, a higher number of later-vintage stocks have been sold the previous year and reappear as vintage-1 stocks. In any National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 NATIONAL 84 Simulated TAX JOURNAL [Vol. XLIII Market Responses After a Tax Cut .. ........ . ...... ........ .. ... .. . .. ... ... ....... ... .. Turnover 14 Holding Period Traded Cain 1.2 --- Basis Step-up Mark!L.@@ 0.8 ............... ------------------------------------............... ....................... 0.6 0.4 -5. . . . . 0. . . . . 5. . . . . 10. . 15 20 25 30 Years Figure 3 given year, a higher proportion of lowvintage stocks is sold (because of smaller gains), so as the distribution of shares shifts toward the lower vintages, the turnover rate continues to increase, as shown in figure 3. The average holding period of sold stocks decreases, however, also because of the higher concentration of low-vintage stocks among those traded. As the average holding period decreases, so does the average level of capital gain per trade. The lower average gain per trade results in a decrease in realizations during the intermediate phase of the response to the tax cut (see figure 1), despite the continuing rise in turnover. The longer-term phase of the response to the tax cut could be said to result from a "cohort effect." The pattern of realizations during this phase is reflected by the decrease in the step-up in the basis of stocks held by dying investors and the decrease in the average level of accrued gain on shares in the market, both of which are shown in figure 3. These two changes result primarily from the year-by-year movement up through the investor cohorts of stock portfolios that have been traded largely under the new lower tax rate. The declining step-up in basis of shares held by dying investors results from two changes. First, older investors in the cohorts just prior to the last one trade slightly more shares as a result of the lower tax rate. This effect is limited, however, because these investors are largely locked into their investments even at low tax rates. Investors in the 39th cohort, for example, trade just 0.03 percent of their shares the year before the tax cut; the first year after the tax cut they trade 1.9 percent. The comparable figures for the 35th cohort are 7.0 percent and 14.1 percent. The second change that results in the declining step-up in basis of shares of dying investors is that, under the lower tax rate, aging investors have portfolios with reduced levels of accrued gains because the portfolios have been traded more actively during the investors'younger years. This, of course, is an effect that can occur only National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 LOCK-IN EFFECT over a lengthy time period, as stock portfolios that have been traded under the lower tax rate move up through the cohorts. The lower accrued gains in portfolios of older investors not only directly reduce basis step-up, but also further increase turnover of older investors' portfolios because the tax cost of trading is decreased. In the 35th cohort, for example, accrued gain as a fraction of the total portfolio decreases from 38.4 percent in the year of the tax cut to 21.6 percent twenty years later because of the more active trading by the investors in that cohort (as they moved from cohort 16 to cohort 35) during the twenty years under the lower tax rate. As a result, their turnover rate increases from 14.1 percent immediately after the tax cut to 24.2 percent twenty years later. The diminished amount of accrued gain in the portfolio of each cohort, of course, reduces the total amount of accrued gain in the market. Realizations continue to increase until a new equilibrium is established at a higher level of realizations and at lower levels of basis step-up and average accrued gains in the market. The data reported in lines 2 and 3 of table I provide a more detailed impression of the beginning and ending equilibria for the simulation in which (r = 0.2 @L. The turnover rate increases by 56 percent in this simulation. Despite the higher turnover rate, the average holding period of traded stocks (and the average gain on traded stocks) increases slightly. The higher concentration of stocks in the lower vintages and the higher turnover rate disproportionately affecting the upper vintages both increase the overall market turnover rate, but almost exactly offset each other in influencing the average holding period of traded stocks. The average accrued gain on shares in the market declines by 37 percent because of the higher concentration of shares in the lower vintages. Realized gains are 58 percent higher in the new equilibrium than prior to the tax cut. For this reason, equilibrium tax revenues drop by only 15 percent in this simulation instead of the 46 percent revenues would drop in the absence of any market 85 response to the tax cut. The amount of basis step-up on shares passing through estates decreases by 35 percent. As stated in the introduction, the econometric research on the subject has been largely unable to investigate the time pattern of the response of capital gains realizations to a change in the tax rate. Most of the econometric models assume explicitly or implicitly that the response is immediate or that it occurs within two years. Indeed, some of the policy analysis also seems to assume an immediate response .21 If the model developed here captures the essential aspects of the actual market adjustment, however, the adjustment is far more complex and extends over a very lengthy time period. The implications of these findings for the econometric research are explored in the next section. IV. Econometric Results One test of plausibility of the model is to see whether it can simulate the results of time-series econometric studies. For this purpose, the 1988 study by the Congressional Budget Office (CBO) was chosen. The basic equation estimated by CBO had the following form: log (LTG) = C + bi log (Bi) + + b,, log where: (Bn) + bn+IMTR (5) LTG = Net long-term capital gains C = A constant Bi =A non-tax independent variable MTR = The weighted average marginal tax rate on capital gains The non-tax independent variables used by CBO were the price level, the real value of corporate equity held by individuals, real GNP, and the change in real GNP. The tax rate used by CBO was the weighted average marginal tax rate on capital gains reported on individual income tax returns. The equation was estimated for the period 1954-1985, and the National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 NATIONAL 86 TAX JOURNAL estimated value of b,,,, was -0.0310 (MTR is stated as a percent rather than a decimal value). The model was used to simulate capital gains over a similar historical period and a regression equation was fit to the resulting data. Since the model was calibrated to the statutory tax rate, the max imum marginal tax rates on capital gains, as reported by CBO for 1954-1988,' were used in the model simulation over a 35year period (assuming cr = 0.2 @L).Then the following re ession was run on the simulated data:' F [Vol. XLIII - 2.9611 + 1.0107 (-5.3) (21.0) - log (value) - 0.03061MTR (-31.4) + 0.00290MTR(-1) (2.98) log (gains) where: (7) MTR(-l) = The maximum marginal tax rate lagged one year W = 0.9997 RHO = 0.939 In this regression the coefficient of the lagged tax rate is significant. On the other log (gains) 2.6032 + 0.9843 hand, the t statistic of the coefficient is (-9.6) (40.4) substantially smaller than the t statistics of the other coefficients. The t statistics log (value) - 0.02977MTR (6) and R2s for these regressions are much (-28.7) larger than normally observed because the data are artificial; there is no "noise" in where: gains = Simulated realized this system. It is not difficult to believe gains in the model value= The total value of that in a "noisy" real world setting which yielded more normal values for the t stastocks in the model tistics of the other coefficients, the influMTR The maximum marginal tax rate on cap- ence of the lagged tax rate term could be obscured and its coefficient would not be ital gains significant. .9997 This single test of the ability of the RHO 0.871 model to simulate the time series relat statistics are shown in parentheses tionships observed in the econometric In the model there are no influences on studies, therefore, does not reject the model the realization of capital gains other than as being unreasonable. the dynamics of the market and the tax The CBO study also examined alterrate. Hence, the log of the total value of native equation forms for the relationship stocks serves as the only non-tax inde- between the tax rate and capital gains pendent variable in the regression. The revenue by performing time-reries coefficient of MTR is of the same order of regressions using different forms for the magnitude and, in fact, is quite close to tax rate variable in equation 5. The simthe CBO estimate based on actual data. ulation model can be used to explore the CBO also did a regression which in- fit of different equation forms directly. cluded a lagged tax rate variable to test Figure 4 plots the relationship between for a time pattern in the response to the revenue and the tax rate for rates rangtax rate change. In this regression, the ing from 0 to 50 percent. The values for coefficient of the lagged tax rate variable revenue at the various tax rates have been was not significant, and the values of the normalized by setting the revenue at a tax other coefficients did not change much. rate of 20 percent equal to 1. Because the graphs in the previous secThe heavy line in the graph plots simtion clearly show a time pattern in the ulated equilibrium tax revenue in the capital gains response in the model, a model at the various tax rates in simuregression including a lagged tax rate was lations assuming u = 0.2 @L.The model is also run on the simulated data. The re- clearly consistent with the notion of a sults were as follows: revenue maximizing marginal tax rate; National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 1] LOCK-IN EFFECT Revenue-Tax Rate 87 Relationship 1.4 1.2 I zs Q@ 0.8 Equklibrium 0.6 Revenue lanear Estimate --- After-Tax Rate Estimate Quadratic Estimate 0.4 0.2 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.6 Tax Rate Figure 4 in this case the revenue maximizing rate is 24 percent (the graph plots values only at increments of 5 percentage points). The other lines in the graph plot the relationship between tax rates and revenue estimated using three different regression equations applied to the simulated data for the period 1954-1988. The three lines are nearly coincident. The dotted line is the relationship between tax revenue and the tax rate estimated in equation 6 above, in which the tax rate variable enters the equation linearly. CBO explored two other equation forms that are consistent with a revenue maximizing marginal tax rate. In the first form, the log of 100 minus the tax rate (expressed as a percentage) was entered as the tax rate variable in the regression. A similar regression was performed on the simulated data;16 the dashed line in the graph plots the revenue-tax rate relationship from this estimated equation. CBO also explored a quadratic relationship between the tax rate and revenue. The dot-dashed line in the graph plots the revenue-tax rate relationship based on a quadratic equation fit to the simulated data." Figure 4 shows that the regression equations have a rather curious property. The marginal tax rate on capital gains over the period 1954 to 1988 used in the simulation ranged from 20 percent to 35 percent. The figure reveals that the regression equations fit the actual tax raterevenue relationship almost perfectly for tax rates ranging from 0 to 20 percent. For rates above 20 percent, however, the equations increasingly overestimate revenues. Hence, the regression equations fit the equilibrium relationship outside of the sample range (merely a coincidence) and do not fit within the sample range! The three regression equations imply revenue maximizing marginal tax rates between 31.6 percent and 33.6 percent, whereas the actual equilibrium revenue maximizing rate is 24 percent. The pattern of capital gains tax rates over the sample period and the time pattem of the revenue response to a change in the tax rate explain this anomaly. The maximum tax rate on capital gains was National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 88 NATIONAL TAX JOURNAL stable at 25 percent until 1968. Beginning that year, the rate increased each year, reaching 35 percent in 1972. The rate remained at that level until it was reduced to 28 percent in 1978; it was further decreased to 20 percent in 1982, where it remained until being increased to 28 percent in 1987. The revenue response to a capital gains tax rate increase in the model is the mirror image of the pattern shown in figure 2; revenues first rise above the equilibrium level and then slowly approach the new equilibrium. Hence, as the tax rate rises, then falls, then rises again in the simulation, the revenue response is greater than in the long-run relationship. The observed data, therefore, reflect the intermediate phase of the revenue response to the tax rate change, but not the longerterm response. The intermediate phase may be the most relevant for making revenue estimates for tax legislation, since the forecast period is usually 5 years and the tax rate is likely to be changed again before the long-run relationship is attained anyway. Nonetheless, if the tax rate-revenue relationship in the model accurately reflects reality, then regressions based on the observed time-series data may overestimate the long-run revenue responsiveness to a tax rate change (that is, they may underestimate the longrun responsiveness of realizations to a tax rate change). While the implications of the response pattern of capital gains realizations and revenue to a tax rate change are most obvious for time-series estimation, there are also potentially important implications for cross-section studies. The premise of cross-section analysis is that the relationships between the variables that are observed in the cross-seetion sample are the long-run relationships that would be observed in response to changes in the independent variables. This presumption is not justified, however, if the cross-section sample is taken at a time when the relationships are not at their long-run equilibrium levels. If the relationship between two variables takes a long time to adjust to a change in the independent variable, then the results of [Vol. XLHI a cross-section study of the relationship can be affected by when the cross-section sample is taken. This is particularly true if the change in the independent variable has not affected all observations in the same way. Most of the cross-section studies of the effect of a change in the tax rate on capital gains realizations have used sample data from years closely following changes in the capital gains tax rate. 21 These observations suggest that the results of both the time-series and the crosssection studies of the response of capital gains realizations to tax rate changes may have been strongly influenced by shortterm or intermediate-term effects and may not reflect long-run relationships. V. The Bush Capital proposal Gains Tax As stated in the introduction, four capital gains tax cut proposals were considered by Congress in 1989. These proposals were among the most controversial items considered by Congress during the year, and further debate on capital gains taxation is expected in 1990. None of the specific proposals, however, seemed to have achieved a dominant position by the time Congress adjourned its 1989 session. This section illustrates use of the model in policy analysis by simulating effects of the first proposal placed before Congress in 1989, the one advanced by President Bush in his fiscal year 1990 budget proposals. For purposes of the simulation, the essential features of the proposal are that it would reduce the maximum tax rate on capital gains to 15 percent on qualifying assets held for the required holding period. Corporate stock would be among the qualifying assets. The required holding period initially would be one year; it would increase to two years on January 1, 1993, and to three years on January 1, 1995. Among the claims made by the Administration for the proposal is that it would prckinote long-term, rather than short-term, investment. Additionally, the Administration claimed that the tax cut would so substantially reduce lock-in that tax revenue actually would increase rather than National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 LOCK-IN EFFECT No. 11 decline. These effects can be studied witlun the model. The simulated effects of the proposal are shown in figure 5. The proposal is assumed to go into effect at time zero. The two-year holding period requirement goes into effect in year 4, and the three-year requirement becomes effective in year 6. Two different simulations were performed. In the first, taxpayers are assumed to react to tax rate changes as they occur without any anticipation. The results for this simulation are shown with the solid line for the path of realized gains and the dashed line for the path of revenues. In the second simulation, taxpayers are assumed to take into account the expected tax rate one year hence in making their investment decisions (investors are not assumed to be able to anticipate implementation of the tax cut before it is enacted, however). Any legislated tax rate changes more than one year in the future are assumed to be fully discounted. The results for this simulation are shown by 89 the two dotted lines that eventually become coincident with the solid and dashed lines. The movements of pins and revenues in this simulation are somewhat greater than without anticipation, particularly during the phase in of the longer holding periods, but the patterns do not differ substantially. The effects of the lengthened holding period requirements are visible in the patterns of gains realizations and revenues. In years 4 and 6, when the longer required holding periods become effective, gains and revenues decline because of lower turnover of the vintage of stocks that has been made short-term for the first time .2' The following year gains and revenues pick up again as the deferred sales occur and the stocks have higher accrued gains because of the 1-year delay in their turnover. Aside from the more sawtoothed intermediate phase, the overall pattern of adjustment is similar to those shown in figures 1 and 2. Data for the market equilibrium under the Bush proposal are shown in line 4 of Simulated Effects of Bush Capital Gains Tax Proposal on Realizations and Revenue 2 1.6 1.4 1.2 ----------------------------------------------08 - Realized Gains 0.6 Tax Revenue 0.4 0.2 --5 . . . . . 0 . . . 5 . . . . ;o . . . . 15 . . . . 20 25 30 Year Figure 5 National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 90 NATIONAL TAX JOURNAL table 1. The simulated data (compared to line 2, the 28 percent flat tax) are consistent with the claim that the proposal would promote longer-tenn investment while at the same time reducing lock-in, since the average holding period increases from 2.24 years to 2.81 years while the turnover rate increases from 19.7 percent to 22.9 percent. Given the parameters used for this simulation, however, the results suggest that the proposal would yield somewhat lower long-run tax revenues. Long-run revenues decline from 0.75 percent of the total value of stocks to 0.72 percent, a decline of only 4 percent in the face of a 46 percent decline in the tax rate. The revenue decline is substantially less than that resulting from the flat 15 percent tax rate shown in line 3 of table 1; this difference is due to the three-year holding period that results in higher realizations per trade under the Bush proposal. VI. Taxation of Gains at Death An alternative approach to reducing the lock-in effect is to tax capital gains at death. While the advantage of deferral would remain, the very strong lock-in effect on older investors resulting from the prospect of a zero tax rate on gains passing through their estates would be eliminated. Two simulations were performed to explore the effects of taxing gains at death. In the first, the 28 percent flat tax rate assumed to apply to realized capital gains in the simulation reported in line 2 of table 1 was also assumed to apply to unrealized gains on assets held at death. The results of this simulation are reported in line 5 of table 1. Taxation of gains at death results in a substantial increase in trading, raising the turnover rate from 19.7 percent (in line 2) to 32.4 percent (in line 5). Despite the higher trading activity, the average holding period for traded shares rises slightly from 2.24 years to 2.45 years. This is because the biggest effect of taxing gains at death is on sales of shares with large gains (that is, shares that have been held for a long time) owned by older investors. Tax payments more than double in this simulation, reflecting the 77 [Vol. XLIII percent increase in realizations plus the taxation of gains at death that previously escaped tax. The unrealized gain on shares passing through estates in this simulation is only about 41 percent of such gain in the second simulation, reflecting the lower vintages of stocks in the portfolios of dying investors resulting from more active trading later in investors' lives. Net bequests also decrease because of the tax payment on unrealized gains at death. The second simulation exploring the effects of taxing gains at death was an attempt to find the tax rate that, when applied to both realized gains and unrealized gains on assets held at death, would raise the same tax revenue as the flat 28 percent tax rate in simulation 2 in table 1. A tax rate of 12.5 percent (very nearly) achieved this equality. This simulation is reported in line 6 of the table. In this simulation, the turnover rate has nearly doubled compared to the flat 28percent tax rate simulation. By design, tax collections remain the same. All of the other results are similar to those for simulation 5, except that lock-in is reduced even more because of the lower tax rate. VII. Conclusion This paper has developed a simple model of the lock-in effect of the capital gains tax on trading corporate stock. 'fhe model includes 40 cohorts of investors who trade or hold shares each year attempting to maximize end-of-life wealth. The investors are assumed to have common expectations regarding the rate of return available on shares they do not currently own. The expected rate of return on stocks in investors' portfolios is assumed to be normally distributed with a specified standard deviation that determines the sensitivity of the model to changes in tax rates. The model is intended to supplement the knowledge derived from the econometric analyses that have so far dominated research into the effects of the capital gains tax. The model simulations include variables for which there are little or no real world data, for example, the amount of accrued but unrealized capital gains and National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 LOCK-IN EFFECT the amount of accrued gains passing through estates. The model enables examination of the time pattern of capital gains realizations in response to a tax change. The econometric studies have largely been unable to investigate this time pattern because of limitations in the available data. Furthermore, the model is a simplified attempt to model the capital gains realization process rather than rely on an ad hoc, reduced form representation. Equations 2, 3, and 4 in the text, which are the basis of the trading behavior in the model, show that the tax rate enters the realization decision in a more complex way than has been incorporated in the reduced form econometric models. Model simulations presented in the paper provide several insights. The response of capital gains realizations to a tax cut in the model has three distinct phases: the first-year, when capital gains realizations jump sharply upward; an intermediate phase lasting from 2 to 5 years, during which realizations decline; and a longer-term phase, during which realizations rise gradually, not reaching their new equilibrium level until about 20 years after the tax cut. The initial jump in trading disproportionately affects shares that have been held for longer time periods because these are the shares for which the tax cut decreases trading costs the most. The decreasing realizations during the intermediate phase result from the shorter average holding periods of traded shares during this phase. The increase in realizations during the longer-term phase results partially li7om somewhat more active trading by older investors due to the lower tax rate on gains. Most of the change, however, results from more active trading by younger investors; as they become older investors with the passage of years, they take with them portfolios with lower levels of accrued gains because they have been traded more actively due to the lower tax rate. The lower accrued gains in portfolios of older investors directly reduce basis step-up and also further increase turnover of older investors@ portfolios because the tax cost of trading is decreased. 91 The simulation results make it clear that one should not expect a fixed relationship between market turnover rates and the average holding period of traded shares or the amount of accrued gain on traded shares, as has been assumed in some earlier modelling efforts such as Bailey (1969). A tax cut, for example, will increase the turnover rate but will also more than proportionately increase the trading of long-held shares because these are the ones for which the tax cut reduces trading costs the most. Indeed, in several of the tax cut simulations, the turnover rate increased and so did the average holding period of traded shares. Econometric results based on a model simulation of capital gains realizations over the period 1954-1988 parallel reasonably closely the results obtained by the Congressional Budget Office (1988). The analysis suggests that the intermediate phase of the capital gains response to a tax rate change drives the econometric results (at least over this period of frequent tax rate changes). This further suggests that regressions based on the observed time-series data may overestimate the long-run revenue responsiveness to a tax rate change (that is, they may underestimate the long-run responsiveness of capital gains realizations to a tax rate change). The time pattern of the capital gains response to a tax rate change in the model also implies that most of the crosssection econometric studies may not have measured the long-run relationship between the tax rate and capital gains realizations. A simulation of the capital gains tax cut proposed by President Bush in 1989 produced results that are consistent with the claim that the proposal would promote longer-terin investment while at the same time reducing lock-in (a claim that, in the absence of a model like the one reported here, might seem self-contradictory). The simulation results suggest, however, that the proposal would yield somewhat lower long-run tax revenues. Simulations of a policy of taxing capital gains at death imply that this approach could substantially reduce the lock-in effect. With the current capital gains tax National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 NATIONAL TAX JOURNAL 92 rate, the policy would also raise ad(litional revenue. Alternatively, the tax rate could be reduced to a revenue-neutral level and an even greater decrease in lock-in could be achieved. The development in the paper points to several further avenues of research that might prove fruitful. The first is to learn more about investor behavior in trading stock. While there are competing models in the finance literature regarding how investors should behave, there seems to be very little solid information about how investors actually do behave. We have little knowledge regarding investor motivation in stock trading and formation of the expectations on which trading decisions are based. Such information would permit making models such as the one developed in this paper more representative of the actual stock trading process. There are also several potential enhandements to the model that would make it more representative and permit stud y ing a wider range of issues. The decision of how much of an investor's portfolio to use to finance consumption versus leaving as a bequest, as well as stock sales to finance the consumption, could be included in the model. Uncertainty could be incorporated into the model, both with regard to expected rates of return and expected life. Dividends could be included to focus on shifts between "growth" stocks and "income" stocks as the capital gains tax rate changes. Losses could be incorporated in the model to study the effects of the loss offset rules. Finally, the model could be embedded within a more general model of the flow of funds between alternative investment markets to study the effects of the capital gains tax on realizations and tax revenue across different types of investments. ENDNOTES **The views in this paper are those of the author and do not necessarily represent the position of the Congressional Research Service or the Library of Congress. The author wishes to gratefully acknowledge helpfW comments from Gerald Auten, Jane Gravelle, John Greenlees, Andrew Lyon, Peter merrill, Larry ozarme, [Vol. XLIII and Eric Toder on earlier versions of the model. Comments from two anonymous referees were also helpful ill@repaxing For th! final draft of the paper. summaries and analyses of the first three of these proposals see Kiefer (1989a) and Kiefer (1989b). 21n fact, Lindsey (1987) argues that the higher capital gains tax rate in the Tax Reform Act will have this effect. 'See: Feldstein and Yitzhaki (1978), Feldstein, Slemrod, and Yitzhaki (1980), Minafik (1984), and U.S. Department of the Treasury (1985). 'In addition to U.S. Department of the Treasury (1985), see: Lindsey (1986), U.S. Congressional Budget Ofrice (1988), Darby, Gillingham, and Greenlees (1988), and Jones (1989). 'See: Lindsey (1986), and Gillingham, Greenlees, and Zieschang (1989). 6See: Auten and Clotfelter (1982), and Auten, Burin7', and Randolph (1989). For a further discussion of this problem, see: U.S. Congressional Budget Office (1988), p. 102-103. 8See: Sprinkel and West (1962), Holt and Shelton (1962), Bailey (1969), and Stiglitz (1983). 9In 1981, for example, gains oD corporate stock constituted 28 percent of total capital gains reported on individual income tax returns and 35 percent of the total ignoring gains on personal residences, most of which is not taxable. See: Clark and Paris (1985-86). 'oMe model is not nemmnly lumted to those stocks intended to be bequeathed, however. Some investors y fi,.ce consumption late in life by borrowing against the value of appreciated capital assets, or by borrowing against or selling other assets, to avoid paying the capital gains tax before death. Furthermore, in the real world, because of uncertainty of the date of death, some investors no doubt die with stocks in their portfolios that, had they lived longer, would have been used to finance consuraption. In terms of investment strategy, the only distinction bet-een these stocks and those intended to be bequeathed is the date on hich their value is to be ma2dmized. Since this date is beyond the date of death, the representation in the model closely approximates the trading decision for these shares. (A variation of the model allows the expected date of death for investors to be set up to 10 years beyond the actual date of death, resulting in shares being traded somewhat later in the investors' lives.) "The distribution of expected rates of return on portfiolio stocks can be viewed alternatively as a representation of differences among investors in inclination to trade the shares for whatever reason. The reasons could be differences in assessment of risk, different tax positions of investors, more or less aggressive trading behavior, etc. 12 While the expected rate of return is assumed to be distributed normally among investors, each investor is assumed to have deternumsuc expectations. That is, investors in the model do not take uncertainty into account in calculating expected returns from alternative investment strategies. "The model does not incorporate trading strategies that depend on use of options or futures, that may, in "perfecv' capital markets, enable investors to avoid the capital gains tax. For analyses of such strategies see: Constantinides, and Scholes (1980), Constantinides (1983), and Stiglitz (1983). Such stmtegies do not, National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 No. 11 91: LOCK-IN EFFECT in fact. seem to be used very heavily; see: Poterba (1986) "In aggregate terms, of course, the sum of stock purchases must equal the sum of stock sales. Hence, in addition to shares purchased fi-om reinvested funds, new share purchases equal in value to the aggregate amount of capital gains taxes paid are assumed each year. "Equilibrium is defined as a setting in which all values expressed as fractions of the total value of stocks in the market remain constant from one year to the next. 16N%le this assumption greatly simplifies the model, it does suppress some behavior. In the real world, the tax system creates an incentive to sell stocks with the smallest gains among those that have been held for a given period. In the model, however, all stocks held for the same period have the same capital gain. There is a somewhat uncomfortable inconsistency between the assumption that the prices of all shares in the market grow at the same constant rate and the assumed trading behavior, which is based on the belief on the part of investors that they can select superior stocks. But this inconsistency seems to mirror reality. There seems to be ample anecdotal evidence that substantial numbers of investors trade and select stocks on the basis of expected superior performance. While one might speculate about how investors maintain faith in the ability to select superior stocks in the face of performance that, for most investors, over the long term approximates the averagethey might, for example, take disproportionate satisfaction in the stocks that perform well (or the periods during which their portfolios perform well) and discount the poor performance of other stocks (or periods)-this quandary will not be addressed further here. "See: Clark and Paris (1985-1986) "See: New York Stock Exchange, Fact Book 1988, p. 73. "See: Henderson (1989), especially Appendix D, "Data on Transactions Volume." 'The distribution achieved in the model places somewhat too much share ownership in the oldest cohorts. The actual distribution of share ownership by age bracket and the distribution within the model are as follows: Mean Value of Shares Owned Ratio to First Age Bracket Age Bracket Less than 35 years $ 8,934 1.00 35 to 44 years 16,376 1.83 45 to 54 years 21,830 2.44 4.98 55 to 64 years 44,526 65 years and 4.73 over 42,265 Data for mean value of shares owned from: Bureau of the Census (1986), table 3, p. 14. Ratio Within Model 1.00 1.87 2.43 4.98 5.37 U.S. "The tax rate used in the model is the maximum rate on capital ganis in the lughest tax bracket, where gains am heavily concentrated. The maximum tax rate on long-term gains was reduced from 28 percent to 20 percent for gains realized after June 20, 1981 in the Tax Equity and Fiscal Responsibility Act of 1981; the rate used here is the average of the two rates, 22Let ut@l be aggregate unrealized accrued gains at a fractioii of total stock value in year t + 1. Then: -@i - ut - (r + b)Vt + 9vt where: Vt+ 1 Ut = the aggregate amount of unrealize( gains at time t (measured before re alizations and basis step-up) r = realized gains as a fraction of tota stock value b = basis step-up as a fraction of tota stock value g = the rate of growth of stock prices Vt = total stock value at time t In equilibrium, ut@l = ut = u, so Ut = uVt. Substi tuting these terras into the equation and simplitrini yields: r + b = g(l - u). 23See: Ross (1989) 24The mainrnurn marginal tax rates are reported ii U.S. Congressional Budget Office (1988), table 7, p 36. The rates including the ordinary and aiternativ( tax were used. The 1985 Treasury study used similai tax rates; it used the marginal tax rate on capital gam on tax returns with adjusted gross income equal tA $200,000 or more (in 1982 dollars). 'Me Cochrane-Orcutt procedure was used in all o the regressions to correct for serial correlation. 'In terms of statistical properties, CBO found thi equation form to be virtually indistinguishable fron equation 6 in the text. The regression on the simu lated data yielded similar results, as follows: log (gains) = -12.6447 + 0.9805 Iog (value) (49.9) (-32.4) + 2.16348 log (100 - MTR) (28.1) R2 = .9996 RHO -- 0.834 "CBO found the quadratic equation form to be un satisfactory; while the overall statistical propertie remained about the same, the coefficients of the ta) rate term and the squared tax rate term were not Big nificant. When a similar regression was performed ox the simulated data, the squared tax rate term was no significant; the tax rate term was significant, but ha( a far lower t statistic than the coefficients in the othe regressions. The result was as follows: log (gains) 2.6155 + 0.9842 log (value) (-9.0) (39.9) - 0.028729MTR - 0.0000195MTW (-3.53) (-0.13) le = .9997 RHO = 0.869 'See, for example: Feldstein, Slemrod, and Yit zhaki (1980), Auten and Clotfelter (1982), Minaril (1984), and U.S. Department of the Treasury (1985) 'Me actual reaction to the longer holding perioc requirements would also include increased realize National Tax Journal, Vol. 43, no. 1, (March, 1990), pp. 75-94 94 NATIONAL TAX JOURNAL tions the year before the longer period became effective. Under the Bush proposal, for example, gains on a stock bought on October 1, 1991, would be long-term if the stock were sold between October 1, 1992, and December 31, 1992. If the stock were sold between January 1, 1993, and October 1, 1993, however, the gains would again be regarded as short-term. This recharacterization of gains would provide an incentive for investors with stocks that recently qualified for long-term treatment to realize the gains before the longer holding period went into effect. This aspect of the reaction to the longer holding periods is not captured in the model because, in effect, trading occurs in the model only once each year at the end of the year. REFERENCES Auten, Gerald E., Leonard E. Burman, and William C. Randolph, "Estimation and Interpretation of Capital Gains Realization Behavior: Evidence From Panel Data," OTA Paper 67, Ofrice of Tax Analysis, U.S. Department of the Treasury, May 1989, 28 p. Auten, Gerald E. and Charles T. Clotfelter, "Permanent Versus Transitory Tax Effects and the Realization of Capital Gains," Quarterly Journal of Economics, November 1982, p. 613-631. Bailey, Martin J., "Capital Gains and Income Taxation" [in] Harberger, Arnold C. and Martin J Bailey [ed.sl, The Taxation of Income From Capd@al,The Brookings histitution, Washington, D.C, 1969, p. 11-49. Clark, Bobby and David Paris, "Sales of Capital Assets, 1981 and 1982," SOI Bulletin, Department of the Treasury, Winter 1985-86, p. 65-89. Constantinides, George M., "Capital Market Equilibrium With Personal Tax," Econometrica, May 1983, p. 611-636. Constantinides, George M. and Myron S. Scholes, "Optimal Liquidation of Assets in the Presence of Personal Taxes: hnphcations for Asset Pnmng" The Journal of Finance, May 1980, p. 439-452. Cook, Eric W. and John F. OHare, "Issues Relating to the Taxation of Capital Gains," National Tax Journal, September 1987, p. 473-488. Darby, Michael, Robert Gillingham, and John S. Greenlees, "The Direct Revenue Effects of Capital Gains Taxation: A Reconsideration of the Time-Series Evidence," Research Paper No. 8801, Office of the Assistant Secretary for Economic Policy, U.S. Department of the Treasury, May 24, 1988, 9 p. Feldstein, Martin, Joel Stemrod, and Shlomo Yitzhaki, "The Effects of Taxation on the Selling of Corporate Stock and the Realization of Capital Gains," Quarterly Journal of Economics, June 1980, p. 777-791. Feldstein, Martin, and Shlomo Yitzhaki, "The Effects of the Capital Gains Tax on the Selling and Switching of Common Stock," Journal of Public Economics, February 1978, p. 17-36. [Vol, XLIII Gravelle, Jane G., A Proposal for Raising Revenue by Reducing Capital Gains Taxes,? Congressional Research Service, U.S. Library of Congress, June 30, 1987, 10 p. Gillingham, Robert, John S. Greenlees, and Kimberly D. Zieschang, "New Estimates of Capital Gains Realization Behavior: Evidence From Pooled CrossSection Data," OTA Paper 66, Office of Tax Analysis, U.S. Department of the Treasury, May 1989, 31 p. Henderson, Yolanda K., "Capital Gains Rates and Revenues," New England Economic Review, Federal Reserve Bank of Boston, Jan./Feb. 1989, p. 320. Holt, Charles C. and John P. Shelton, -The L-ock-In Effect of the Capital Gains Tax," National Tax Journal, December 1962, p. 337-352. Jones, Jonathan D., "An Analysis of Aggregate Time Series Capital Gains Equations," OTA Paper 65, Office of Tax Analysis, U.S. Department of the Treasury, May 1989, 20 p. Kiefer, Donald W., The Bush Capital Gains Tax Proposal, Congressional Research Service, U.S. Library of Congress, June 2, 1989a, 28 p. Kiefer, Donald W., Capital Gains: the Rostenkowski and JenkinsIPlippolArcher Tax Cut Proposals, Congressional Research Service, U.S. Library of Congress, August 15, 1989b, 18 p. Lindsey, Lawrence B., "Capital Gains: Rates, Realizations, and Revenues," NBER Working Paper Series, No. 1893, April 1986, 43 p. Lindsey, Lawrence B., "Capital Gains Taxes Under the Tax Reform Act of 1986: Revenue Estimates Under Various Assumptions," National Tax Journal, September 1987, p. 489-504. Minarik, Joseph J., "The Effects of Taxation on the Selling of Corporate Stock and the Realization of Capital Gains-. Comment," Quarterly Journal of Economics, February 1984, p. 91-110. Poterba, James M., "How Burdensome Are Capital Gains Taxes?," NBER Working Paper Series, No. 1871, March 1986, 33 p. Ross, Dennis E., Acting Assistant Secretary (Tax Policy), Department of Treasury, Statement Before the Committee on Finance, United States Senate, March 14,1989. Sprinkel, Beryl W. and Kenneth West, "Effects of Capital Gains Taxes on Investment Decisions," Journal of Business, April 1962, p. 122-134. Stiglitz, Joseph E., "Some Aspects of the Taxation of Capital Gains," Journal of Public Economics, July 1983, p. 257-294. U.S. Bureau of the Census, Current Population Reports, Series P-70, No. 7, Household Wealth and Asset Ownership: 1984, 1986. U.S. Congressional Budget Office, How Capital Gains Tax Rates Affect Revenues: The Historical Evidence, March 1988, 106 p. U.S. Department of the Treasury, Report to Congress on the Capital Gains Tax Reductions of 1978, September 1985, 199 p.