MLL221 Corporate Law Exam Notes Chapter One

advertisement

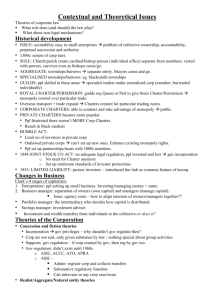

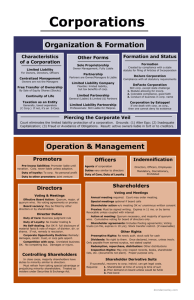

MLL221 Corporate Law Exam Notes Chapter One: Regulatory Framework Study objectives • EXPLAIN WHAT A COMPANY IS o A company is an artificial entity recognised by the law as a legal person with its own rights and liabilities o Company and Corp are interchangeable o A company is a separate entity distinct from its shareholders, its directors who control its management and its officers and employees – therefore company may own property, enter into contracts and sue and be sued in its own name • Understand what is meant by the following: o The company is separate legal entity ! Meaning company has a lifespan that is potentially unlimited ! Directors and shareholders may change but does not affect ! the company’s existence as a legal person Company is an artificial entity – same legal capacity and powers as a human being – same rights as an individual SEPARATE LEGAL ENTITY • On registration, a company becomes a separate legal person • S 119 a company comes into existence • S 124 a legal capacity of: " A natural person " Own property " Contract " Sue and be sued " BODY CORP " Issue shares " Grant a charge o Perpetual succession ! Company will continue regardless if shareholders or directors change o Limited liability ! Important characteristic of companies and is often one of the main reasons why people choose to form a company to ! conduct business LL means shareholders are not personally liable for their company’s debts ! • Limited to the amount they have not paid on the share Question the strict application of the shareholder primacy model of in company law o Transferability of shares is another significant characteristic which distinguishes company from partnership o Shareholders able to transfer or sell shares free of any restrictions and free transferability of shares is a requirement for listing on a stock exchange • Understand the significance of stakeholders other than shareholders o • Apply the statutory provision dealing with groups of companies to identify holding companies and subsidiaries o Companies that operate large businesses, organize affairs in a corp group structure with a holding company that controls a number of subsidiary companies o Each company in a corp group is a legal entity separate from other group members o Company formation (registration) is where company fills application for registration with ASIC and paying the prescribed fee. o o Then it is a legal entity and can operate anywhere in aus Corporations Act makes formal distinction b/w ownership and control of companies o Required to have shareholders regarded as owners of company The Corporations Act 1989(Cth) which was designed to enable the Commonwealth to assume complete control over all aspects of corporate law, could not take affect because the HC rules that the Cth has no constitutional power to legislate in respect of the formation of trading and financial companies The corporations Act 2001(Cth) was enacted by the Cth government after the states agreed to refer their powers over corporations to it HISTORICAL DEVELOPMENT o Earliest incorporated bodies with legal personality were in England; monasteries and local govn authorities o They required that ownership of property be conferred on a legal entity separate from individuals and that this legal entity continued to exist beyond lifespan of individuals o Medieval orgs were incorporated by Royal Charter o From early times business enterprises created by either by Act of Parliament or Royal Charter or formed adapting the partnership form so they possessed corp characterizes and suited to investment o The Bubble Act was passed in 1720 to prohibit the formation of unincorporated joint stock companies sos that only corps incorporated by charter could be formed • Explain the constitutional crisis created by s 51(xx) of the AC o th Lack of uniformity in 20 century in aus company law as cth parl was not given a clear power by AC o Closest power is s 51(xx) – gives cth power to make laws with respect to foreign corp’s and trading and financial corp’s formed within the limits of cth o HC then adopted a narrow interpretation of s 51 power – denying the cth power to make laws with respect to formation of companys: Huddart Parker & Co Pty Ltd v Moorehead (1901) Conclusion based on strict interpretation of the word ‘formed’ – meaning already in existence o From 1960s onwards the cth and state entered inot various agreements aimed at achieving greater uniformity in the regulation of companies throughout aus • Analyse the impact of NSW v Comm (1989) on the constitutionality of commonwealth legislation regarding company or corp legislation o The only issue that was considered in this case wwas whether or not the provisions in the Corp Act 1989 (Cth) concerned company incorporation were constitutionally valid o The HC held that the Cth did not have the power under s 51(xx) of the AC to pass laws providing for the incorporation of trading and financial corps and therefore the Cth did not have the power to take over corp regulation in Aus • Critically analyse the current arrangement of the referral of powers under s 51(xxxvii) of the const 1900 o The constitutional validity of the Corporations Law scheme was successful challenged in a number of HC cases, creating legal uncertainty that led to an overhaul of the regulatory scheme o In 2000, the states and NT agreed in principle to refer to the Cth their constitutional powers to make and amend laws dealing with companies and securities o S 51(xxxvii) of the Const gives the Cth the power in relation to any matter referred to it by states • Explain the role, functions and powers of ASIC, and ASX, the Takeovers Panel, Financial Reporting Council, AASB, AuSB, Companies Auditors and Liquidators Disciplinary Board, CAMAC and the Parliamentary Joint Committee on Corp and Financial services ASIC (Australian Securities and Investments Commission) ROLE: main cth authority responsible for administering the Corp’s Act FUNCTION + POWER: S 11(1) of the ASIC Act provides that ASIC has such functions and powers as conferred on it by or under the corp legislation. S 5(1) defined term ‘corp legislation’ to mean the ASIC Act and the Corp Act. S 11(2) and (3) of the ASIC Act ASIC is given following functions: ! Provide staff and support facilities to the Takeovers Panel and the Companies Auditors and Liquidators Disciplinary Board ! Advice minister about changes to Corp legislation ! Advise minister and make recommendations about corp law reform ! Compel a person to produce any book or record ! Can institute civil or criminal proceedings against the errant party o ASX (Australian Stock Exchange) ROLE: operates Australia’s main financial markets for equities including shares, derivatives and fixed interest securities. Major role ensure integrity of financial markets so that they operate in a fair, orderly and transparent manner FUNCTION + POWER: plays important role in corporate governance regulation. Continuous disclosure regime incorporates both legislative regulation and ASX Listing Rule requirements. Listen entities must inform the ASX of information concerning company… plays a key role in promoting an informed and transparent market Takeovers Panel ROLE: Takeovers panel was established under the predecessor of the ASIC Act. The panel was set up as the primary forum for dealing with takeover disputes to ensure such disputes can be resolved quickly by a specialist body and to prevent the various parties involved in a takeover from slowing up the process by initiating court litigation as either a defensive or aggressive takeover strategy. FUNCTION + POWER: members appointed by the govn on basis of knowledge or experience in bus, financial markets, law, eco and accounting. Therefore takeover experts. The Corp Act gives panel broad powers in relation to takeovers. Can declare circumstances in relation to takeover or control of company, unacceptable circumstances: s 657A. Financial Reporting Council ROLE: Amendments made by Corp Legislation Act 2012 give the FRC additional function of providing the Minister and profession accounting bodies with strategic policy advice and reports in relation to the quality of audits conducted by Aus auditors FUNCTION + POWER: designed to ensure that while it had broad oversight over the standards-setting process, it is not able to determine the content of particular standards. FRC does not have any influence over AASB or AuASB Australian Accounting Standards Board (AASB) ROLE: office of AASB established under s 226 of ASIC Act as body that sets accounting standards. Broad strategic plan and priorities are subject to FRC approval. FUNCTION + POWER: AASB must follow the FRC’s broad strategic and general policy directions: s 232. Must take into advice on matters of general policy given by the FRC. Auditing and Assurance Standards Board (AuASB) ROLE: AuASB was established under s 227A of the ASIC Act. FUNCTION + POWER: functions and power mirror those of the AASB. Main function is to make the auditing standards which are given legal effect by s 336 of the Corp Act. The AuASB also required to participate in and contribute to the development of a single set of auditing standards for worldwide use: ASIC Act s 227B Companies Auditors and Liquidators Disciplinary Board ROLE: established under Pt 11 of the ASIC Act is a disciplinary body which acts upon applications made to it by ASIC in respect of the conduct of registered auditors and liquidators Corporations and Markets Advisory Committee (CAMAC) ROLE: main corporate law reform advisory body of the corporations Act scheme. Under s 148 of the ASIC Act CAMAC’s primary function is to advise ad make recommendations to the govn on any matter connected with the operation, administration and reform of the corp’s legislation. Following enactment of Corporations Legislation Amendment Act 1990 (cth) (the Corp Law Scheme)… the corp law was a law of each individual Australian state and territory but operated as commonwealth law Parliamentary Joint Committee on Corp and Financial services ROLE: Part 14 of the ASIC Act provides for the appointment of a Parliamentary Joint Committee on Corps and Financial Services at the commencement of the first session of each parliament. The purpose is to add an additional level of parliamentary supervision over the Corps Act scheme. S 243 of ASIC says duties are to inquire and report into the operation of the corps legislation generally, ASIC and the Takeovers Panel Chapter 2: Registration and its Effects Study objectives • Appreciate the importance of the limited liability corp o LL means the shareholders are not personally liable for their company’s debts o The extent of a shareholder’s liability depends on the type of company; s 112 o It is only when the comp has insufficient assets to pay its debts that o the issue of whether shareholders may be liable arises Effect of LL is that risk of bus failure is largely transferred from company’s shareholders to its creditors o LL achieves various goals " Facilitating enterprise " Reducing monitoring " Promoting market efficiency • " Encouraging equity diversity Understand what is meant by the following: o Registration or incorporation of a company " Creditors are more prepared to lend large amounts of money to companies b/c the comp’s assets are partitioned and shielded from the personal creditors of the company’s shareholders " Locking in shareholders capital allows comp’s to enter into long term relationships with various outside parties and to develop org structures and intellectual capital o Separate legal entity " Corp Act sets out various characteristics described above, clear that original companies legislation was drafted primarily to meet the needs of large scale bus’s with large numbers of investors • Appreciate the significance of the company as a separate legal entity • Analyse the case of Salomon v Salomon & Co Ltd (1987) and its significance as far as company law is concerned o Mr. Salomon was a cobbler and sole trader – decided to incorporate the company and transfer assets to company o At the time of case, needed to be more than 1 shareholder – he wanted to maintain control of company … did this by giving himself 20,000 shares and 6 shares to Salomon family o Previously he was 100% now he is 99% - he was also director of company and his two sons were fellow directors – effective controller and owner of company o o Company had contract to make army boots Lets try recover debt from Salomon directly – he said no not going to pay these are company debts not my debts o Court said ‘HE WAS RIGHT’ – liability, as shareholder was limited… o Famous case Salomon – full implications of concept that a company is a separate legal entity was clarified – especially in relation to what were in reality one-person companies o The Corp Act allows the formation of public or proprietary companies with a single shareholder: s 114 o Principle of Salomon’s case has been applied in many cases so that its operation has expanded to include many situations which the HoLords judges would not have anticipated HELD o Company is a separate legal entity even though a single person manages o and controls it A company can contract with its controlling participants Compare Salomon and Lee v Lee’s Air Farming Ltd (1961) o Company owned by Mr. Lee, one share owned by solicitor because legislation at the time said company had to have more than one shareholder o Lee was director, shareholder and pilot and employed by company as a crop duster – plane crashed and he died o Mrs Lee worried, doesn’t know what to do, where is she going to get income – decides to make workers compensation claim – legislation at the time provided employees of companies to get compensation if they die/injured at work o Mrs. Lee said she’d bring the claim, in the course of doing his job that he died o Insurance company in control rejected workers compensation claim b/c it said Mr Lee and Lee’s company were the same thing and you can’t enter into a contract with yourself you cant be employer and employee at the same time – not entitle to claim o A one-person company is a separate entity from its controller who o may also be its sole employee The recognition of a company as a separate legal entity may work against the person responsible for the formation of the company HELD o Company is a separate entity from its controller – who may also be its sole employee o Company is a separate legal entity and a person may concurrently have a variety of legal relationships with that company Even if all shareholders and officers of company dies, companies existence is unaffected Macaura v Northern Assurance Co Ltd o Mr. Macaura owned a forest, he owned a forest (lumberjack) o Wanted to take out an insurance policy to protect assets from fire or damage o Took out an insurance policy IN HIS OWN NAME o Assigned his rights to the timber to a company he was the sole shareholder of o Low and behold there was a fire, forest burnt down, tried to claim on his insurance policy o At the time there was insurance legislation in place, saying you had to have an insurable interest – only take it out over something you own o Insurance company refused to pay on the claim because after he assigned his interest in the trees he had effectively lost his insurable interest HELD o Once you assigned interest of the trees to the company, it was a companies interest and a company is a separate legal entity o Therefore no insurance money • Explain why companies in a group of companies are still seen as separate legal entities o The shareholder of a one person company does not have a legal or equitable interest in the companys property o Companies in a group are treated as separate legal entities even though they are part of a group o Directors of a comp that is a member of a group cannot act in the best interests of the group and disregard the interests of that company’s shareholders and creditors PIERCING THE CORPORATE VEIL o Obligations of the company is not obligations of shareholders o The recognition that a company is a separate legal entity is often referred to as the ‘veil of incorporation’ or ‘corporate veil’ o This is b/c once a company is formed, the courts usually do not look behind the ‘veil’ to inquire why the company was formed or who really controls it o When the separate entity concept is coupled with LL the corp veil ensures that shareholders are not personally liable to creditors for their comp’s debts o In the case of a company limited by shares, their liability is limited to the amount unpaid on the nominal value of their shares: s 516 o Eg. Moneybags Pty Ltd only has $2 assets, may be liable for much more but that’s all it has … can Mr. Bump ‘pierce the corp veil’ to recover damages from wealthy Moneybags? Answer is no – obligations remain with the company and can’t be imposed onto shareholders o Court will look behind the veil of incorporation if authorized to do so by legislation o Corporate veil wont be lifted simply because a company cannot pay its debts CRIM LIABILITY OF A COMPANY AND A COMPANY’S LIABILITY IN TORT o The application of Salomon’s principle to corp groups has enabled holding companies to avoid liability to tort creditors of subsidiary companies b/c the holding company si a separate legal entity distinct from its subsidiaries and therefore not liable for the debts of it subsidiaries o Where they are tort creditors rather than contract, raises a number of complex eco, social and ethical questions, especially where the subsidiary is under-capitalised and cannot meet its tort liability Where company used to avoid existing legal duty • Corporate veil may be pierced where company formed for sole or dominant purpose of avoiding an existing legal duty – OK to form a company to limit personal liability for future obligations, but not to avoid existing obligation Gilford Motor Co Ltd v Home - company formed for sole or dominant purpose of avoiding a noncompete clause • Jones v Lipman - company formed for the sole or dominant purpose of avoiding a contract for the sale and purchase of land INSOLVENT TRADING • Insolvency = company cannot pay its debts as they fall due for patment • Corp act lifts corp veil when company trades while insolvent and imposes personal liability on directors for the company’s debts (s 588G) • S 588G: Directors become personally liable if the fail to prevent the company incurring a debt when there are reasonable grounds to suspect the company is insolvent • Lifting the corp veil of group companies “…the court is not free to disregard the principle of Salomon merely because it considers that justice so requires. Out law for better or worse, recognizes the creation of subsidiary companies, which though is on sense the creatures of their parent companies, will nevertheless under the general law fall to be treated as separate legal entitled with all the rights and liabilities that would normally attach to separate legal entities: Adams v Cape Industries SITUATIONS WHERE LEGISLATION HAS LIFTED CORP VEIL IN CORP GROUP • Taxation consolidation • Consolidated financial statements • Holding company’s liability for insolvent trading by subsidiary • The benefit of the group as a whole • Pooling in liquidation REFER TO TEXT BOOK FOR DEFINITION OF THEM COMPANY LIABILITY for crimes and tots Can a company be liable for a crime or negligence? • VICARIOUS LIABILITY o Legislation may provide that company may be convicted for actions of its agents without the need to impute a guilty intent to the company o Under common law, an employer (company) is vicariously liable for the acts of its employees in the court of employment o • Actor is personally liable and company is vicariously liable DIRECT LIABILITY – organic theory o Company may be primarily liable when the act/intent of a person are taken under the ‘organic theory’ to be the act/intent of the company itself o Company liable for the act/intent of employees ‘who represent the directing mind and will of the company, and control what it does’ HL Bolton (Engineering) v TJ Graham and Sons Ltd (1956) o Whether person constitutes the mind and will of the company determined on case-by-case basis o Seniority is key factor Tesco Supermarkets Ltd v Nattras (1972) • Tesco Supermarket chain, own half of the UK • Shop assistant in UK, 1000 of shops, who was low in hierarchy of company • Offering sale on shopping powder, put out there at a higher price then advertised, was a problem because it was an offence under legislation to sell things at a higher price then they are advertised • Tesco was prosecuted – run argument that we as a company can’t be liable for crime, not our fault the shop assistant did this, obviously not controlling mind of company THE PROCESS OF REGISTRATION (OR INCORPORATION) How to create a company • Lodge application from 201 with ASIC & pay fee • S 117 CA sets out the prescribed contents of the application: