Grameenphone Annual Report 2012

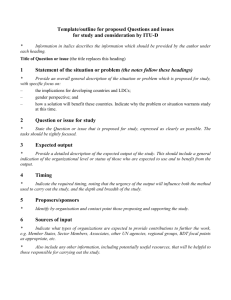

advertisement

YOU FIRST

Grameenphone

annual report

2012

Contents

This is Grameenphone

02

Our Vision, Mission & Values

03

The Shareholders

05

History & Milestones

06

Products & Services

07

Accolades in 2012

09

Performance at a Glance - 2012 (Consolidated)

10

Corporate Information

11

Business Review - 2012

15

Organisational Structure

18

Directors’ Profile

19

Management Team’s Profile

24

Chairman’s Message

28

CEO’s Message

30

33

Corporate Governance in Grameenphone

42

Corporate Responsibility at Grameenphone

44

Climate Change & Green Endeavor for Green Business

Five Years’ Financial Summary

47

Financial Review - 2012

49

Value Added Statement - 2012

50

Contribution to National Exchequer

51

Directors’ Report

52

Audit Committee Report

77

Auditors’ Report & Audited Financial Statements

78

of Grameenphone Ltd.

Subsidiary Profile: Grameenphone IT Ltd.

134

- Directors’ Report

137

- Auditors’ Report & Audited Financial Statements

Useful Information for Shareholders

160

Notice of the 16th Annual General Meeting

164

Proxy Form and Attendance Slip

165

This is Grameenphone

November 11

1996

Awarded a cellular license in

Bangladesh by the Ministry of Posts

and Telecommunications.

March 26

1997

Launched its service

on the Independence Day of

Bangladesh.

November 11

2009

Successfully listed

on the Stock Exchanges in Bangladesh.

August 07

2012

Awarded 2G License by

Bangladesh Telecommunication

Regulatory Commission

After sixteen years

of operation

40.02 million customers and

more than 67 thousand Shareholders as of December 2012 are now

empowered under a single network and touched by

the magic of closeness.

| PAGE 02 | Grameenphone Annual Report 2012

Our Vision

Mission &

Values

Grameenphone Annual Report 2012 | PAGE 03 |

You dream of a better life, we put

our best to make it a reality

History & Milestones

2012

Awarded license for 2G operation for 15 years effective from November 2011; two new affordable packages

‘Amontron’ and ‘Nishchinto’ were launched, 10-second pulse was introduced for all products including helplines; A

GP App was launched to facilitate mobile self service; Reached 40.02 million Subscribers.

2011

Launched ‘My zone’- location based discount on usage, Micro SIM cards for iPhone, Spondon Package with 1-sec

pulse; Grameenphone Branded Handset (C200, QWERTY handset ‘Q100’ and Android Handset ‘Crystal’), Customer

Experience Lab, eCare solution; Completed swapping of 7,272 nos. of BTS; Reached 36.5 Million Subscribers

2010

Launched New Tariff Plan, ‘MobiCash’ Financial Service Brand, Ekota for SME, Baadhon Package, Mobile Application

2009

Listed on Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd.; Launched Internet Modem, Special

Development Contest & Network Campaign; Reached 29.97 Million Subscribers

Olympic Regional Talent Hunt, Stay Green Campaign, Internet Package P5 & P6, Grameenphone Branded Handset

& Studyline; Reached 21 Million Subscribers

2008

Introduced BlackBerry Service; Commissioned Brand Positioning & launched Stay Close & Customer Care Campaign;

2007

Converted to a Public Limited Company; Re-launched Business Solutions; Launched New VAS, Bull Stock

2006

Launched HealthLine, Smile Prepaid & Xplore Postpaid, Cellbazaar, Business Solutions for Business Class &

2005

Launched Electronic Recharge System, djuice Brand Targeting Youth Segment, EDGE & Voice SMS for the first time

2004

Reached 2 Million Subscribers

2003

Launched Prepaid Product with PSTN Connectivity; Reached 1 Million Subscribers

2002

Achieved BD Business Award for “Best Joint Venture Enterprise”

2001

Launched WAP Service

1999

Launched First Prepaid Service in the Country

1998

Launched Mobile to Mobile Service (without PSTN Access)

1997

Commenced Operation on the Independence Day of Bangladesh

1996

Incorporated as a Private Limited Company

Reached 20 Million Subscribers

Information, Missed Call Alert & PayForMe Service; Re-branded djuice; Reached 16 Million Subscribers

Community; Introduced new GP Logo Following Maiden Decade of Operation; Reached 10 Million Subscribers

in Bangladesh; Reached 4 Million Subscribers

Grameenphone Annual Report 2012 | PAGE 05 |

Products & Services

Prepaid

Postpaid

Bondhu

Xplore

Nishchinto

Business Solutions

Adjusted djuice

Ekota

Smile

GP Public Phone

Amontron

Internet SIM

Device

Minipack Pay Per Use

(Max 20 Tk/Day)

Outbound

Roaming

Pay As You Go Pack

Inbound Roaming

Handset (Basic,

Feature &

Smartphone)

Monthly Heavy Internet

Browsing Pack

Aapon

Daily 150 MB Pack

Spondon

3 GB Monthly Pack

Wholesale

Business*

Financial

Services**

GP IT

Modem

International SMS

International MMS

Monthly Night Time

Heavy Internet

Browsing Pack

Shohoj

Adjacent

Businesses

Roaming

Internet

1 GB Monthly Pack

Business Solutions

Minipack 15 MB

Ekota

Minipack 99 MB

GP Public Phone

Value Added

Services (VAS)

Minipack 3 MB

Village Phone

Minipack 1 MB

Internet SIM

Enterprise Solution

Mobile Office

Tracking

Mobile Security

M- Reporting

mCentrex

BlackBerry

Messaging

Web Office

Office Connectivity

Vehicle Tracking

Web SMS

Web Hosting

GP Connect

Team Tracker

Business SMS

Enterprise

Security

Corporate

Bulk SMS

* In compliance with BTRC guidelines, GP is sharing its passive infrastructure with other

operators under “Wholesale Business”.

** Introduced different “Financial Services” in electronic ticketing, bill collection,

electronic lottery and remittance disbursement under the brand “MobiCash”.

| PAGE 06 | Grameenphone Annual Report 2012

Welcome Tune

Instant Messaging

Music News

Mobile Applications

Music Radio

Healthline

News Services

Studyline

Media Services

Messaging

Sports Services

Missed call alert

Religious Services

Pay For Me

Directory Services

Mobile Reporting

Matrimony Service

Stock Update

Partner Services

Entertainment Box

Education Service

Single Short Code 123

Career Service

Online Games

Corporate Services

Quick Search

Social Media Service

Power USSD Menu

Jokes Services

Buddy Tracker

Mobile Backup

Enablers

Call Block

E-care

Voice Chat

Co-Branded Opera Mini

SMS Chat

GP App

GP World

Downloadable Contents

Facebook Services (SMS,

Infotainment

USSD, Java App)

Twitter SMS

Accolades in 2012

In 2012, Grameenphone, with its hard work and determination, was recognized with multiple awards. We always

thrive to move forward and be better as each year passes by. It is recognition such as these that inspires us to move

beyond:

Best Presented Annual Report 2011

Won the award from the Institute of Chartered Accountants of

Bangladesh (ICAB), for publishing transparent reports and

maintaining high standards of Corporate Governance.

Connected World Awards

Received the award for SMS based “Mobile Health Tips”

service at Connected World Forum.

Emerging Market Service Provider of the Year

Won Frost & Sullivan Asia Pacific ICT Awards for second time for

delivering exceptional business performance in 2011.

BESL Investor Relations Award 2012

Awarded by the BRAC EPL Stock Brokerage Ltd.

(BESL) for best Investor Relation Practice.

Best Employer Award 2012

Received the award from BDjobs.com - the largest online job site in Bangladesh.

Grameenphone Annual Report 2012 | PAGE 07 |

You can achieve higher

when there is a helping hand

Performance at a Glance - 2012 (Consolidated)

Revenue

Figures in BDT

91.9 Bn

+3.2%

Gross Profit

52.4 Bn

+2.3%

Operating Profit

33.6 Bn

+3.2%

Profit Before Tax

30.2 Bn

-8.5%

Net Profit After Tax

17.5 Bn

-7.3%

NOCF Per Share

Earnings Per Share

12.96

-7.3%

NAV Per Share

26.26

22.23

-26.1%

-8.8%

NAV- Net Asset Value; NOCF- Net Operating Cash Flow

Grameenphone Annual Report 2012 | PAGE 09 |

Corporate Information

Company Name

Grameenphone Ltd.

Company Registration No.

C-31531 (652)/96

Legal Form

A public listed company with limited liability. Incorporated as private limited company on October 10, 1996 and subsequently

converted to a public limited company on June 25, 2007. Listed on the Dhaka and Chittagong Stock Exchange Ltd. on

November 11, 2009.

Board of Directors

Chairman

Sigve Brekke

Directors

M Shahjahan

Md. Ashraful Hassan

Per Erik Hylland

Parveen Mahmud

Morten Tengs

Hakon Bruaset Kjol

Lars Erik Tellmann

Independent Directors

Health, Safety, Security

& Environment Committee

Per Erik Hylland (Chairman)

M Shahjahan

Dr. Mohammad Shahnawaz

Hasanur Rahman Rakib (Secretary)

Management Team

Vivek Sood, Chief Executive Officer

Fridtjof Rusten, Chief Financial Officer

Tanveer Mohammad, Chief Technology Officer

Quazi Mohammad Shahed, Chief Human Resources Officer

Allan Bonke, Chief Marketing Officer

Mahmud Hossain, Chief Corporate Affairs Officer

Dr. Jamaluddin Ahmed FCA

Rokia Afzal Rahman

Head of Internal Audit

Company Secretary

Statutory Auditors

Hossain Sadat

Audit Committee

Dr. Jamaluddin Ahmed FCA (Chairman)

M Shahjahan

Per Erik Hylland

Hossain Sadat (Secretary)

Treasury Committee

M Shahjahan (Chairman)

Pal Stette

Fridtjof Rusten

Imdadul Haque (Secretary)

Human Resources Committee

Per Erik Hylland (Chairman)

M Shahjahan

Quazi Mohammad Shahed

Hossain Sadat (Secretary)

| PAGE 10 | Grameenphone Annual Report 2012

Emadul Hannan

ACNABIN

Chartered Accountants

Legal Advisors

Hasan & Associates

Sheikh & Chowdhury

Registered Office

GPHouse

Bashundhara, Baridhara

Dhaka-1229, Bangladesh

Business Review - 2012

A YEAR OF MODERATE GROWTH

INNOVATION IN PRODUCTS AND

To make mobile handsets affordable to

2012 ended with number of

SERVICES

rural customers, Grameenphone

achievements despite fierce market

On the back of our “Customer-centric”

competition and regulatory

drive, we continued our efforts to bring

uncertainties. In the year, GP got its

innovation and excellence in our

operating license for 2G services for the

products and services to offer new

As the people around the country are

next 15 years after a long delay.

experiences to our customers.

becoming more internet savvy,

Despite challenges from various corners, To improve consumer value proposition

we added a total of 3.5 million

and to remain competitive in the market,

subscribers to our network in 2012. As a

GP introduced attractive products in

result, our subscriber base reached

2012.

40.02 million at the end of the year and

we continued to remain the most

preferred operator with 41.2% market

share.

An amazing package of GP was “25

partnered with Symphony to offer

Symphony B3 handsets with GP’s new

connections at a very attractive price.

Grameenphone took another initiative

with Symphony to make Tablet

computers available at a very affordable

price.

CUSTOMER FIRST

Paisa Offer”, which enables GP prepaid

Being the largest telecom family, with

subscribers to talk for 40 minutes at BDT

customer centricity at the core of its

10 (excluding VAT) only and enjoy the

heart, GP observed “Customer First Day”

GP earned BDT 9,192 crore revenues in

effective call rate of 25 paisa/minute to

on November 05, 2012. More than 1,000

2012 with a 3.2% rise, compared to the

any GP number.

employees of the Company, including its

previous year. Net profit after taxes for

2012 was BDT 17.5 billion with 19.0%

margin compared to BDT 18.9 billion

with 21.2% margin of 2011. Lower net

profit for this period was mainly due to

recognition of amortization cost of 2G

License, notional interest cost on

payments of 2G License fees and

interest payments on borrowings.

Underlying net profit excluding above

impacts, however, shows positive

GP also introduced a unique offer

named “Wholesale Recharge”. A

customer needs to recharge BDT 25 or

more to avail the special call rate of 7

paisa/10 second from 12am-4pm for any

GP-GP call.

Two other major products were

“Nishchinto” and “Amontron”.

Nishchinto gives the users the

opportunity to make any local voice

development from last year as a result of calls, with a call rate of 15 paisa/10

continuous cost efficiency measures and second. Customers also enjoy 20%

top line growth.

The Company has so far invested BDT

213.4 billion (BDT 21,343 crore) for

network expansion, upgradation and 2G

license & spectrum fees since its

inception in 1997. In 2012 GP invested

BDT 12.6 billion (BDT 1,263 crore) to

retain its preferred network position.

With that GP still remains the largest

cellular network in the country, covering

management members, went out to the

markets to attend customers directly

and get closer to people who use GP

services. The day was celebrated across

all Telenor Business Units, to know what

people think about their service

standards and to better understand the

expectations of the customers.

PREPARING THE NATION FOR THE

INTERNET ERA

GP in collaboration with the leading

Bangla daily newspaper Prothom Alo

instant money back on local voice call

launched the second round of

usage. Amontron gives the facility to talk

‘Grameenphone-Prothom Alo Internet

to other operators at a call rate of 11

Utshab’, a sequel to the immensely

paisa/10 second round the clock. In

successful program that began in 2011.

addition, our product “Bondhu” has

It is an initiative to empower the youth

been very popular with 1 super FnF

with one of the biggest power tools- the

number within GP network with a call

internet. In 2012, the initiative delved

rate of 5 paisa/10 second and 9 FnF

further by hosting 120 events in schools

numbers for any operator.

and colleges of divisional cities as well

In line with a regulatory decision, GP

99.16% of the population and more than also completed the migration of all its

customers to the new tariff plans built

89.10% of land areas.

as those in rural and semi-urban areas.

The Ministry of Education and Support to

Digital Bangladesh (A2I) Project, Prime

on 10-second pulse for all voice and IVR

Minister’s Office, have endorsed the

calls independent of all packages.

program in view of its potentials in

contributing to building ‘Digital

Grameenphone Annual Report 2012 | PAGE 11 |

Business Review 2012

Bangladesh’. Other brand giants such as

traditional royal festival of the tribal

Google, Wikipedia, Facebook, Opera and Bomang community in Bandarban, to

Nokia also proudly backed this grand

uphold the tradition and customs of the

Chartered Accountants of Bangladesh

initiative.

indigenous people.

Corporate Governance.

To spread the power of knowledge and

GP also organized a two-week Jasim Polli GP also received the “Emerging Market

promote the Bangla version of

Mela in Faridpur to commemorate the

Service Provider of the Year” award at

Wikipedia, GP also came up with an

109th birth anniversary of the renowned

the 2012 Frost & Sullivan Asia Pacific ICT

initiative to enable Opera Mini users to

poet of Bangladesh, Jasimuddin. GP also

Awards for the second time for its efforts

access all the contents of Bangla

sponsored a seven-day Sultan Mela in

in delivering exceptional business

Wikipedia. GP also signed agreement

Narail to mark the 87th birth anniversary

performance.

with the Ministry of Education to supply,

of renowned artist SM Sultan and to

service and install 20,500 internet

cherish the local art and culture of

modems to set up multimedia

Bangladesh.

classrooms in around 20,000

educational institutions across the

country.

A JOURNEY TOWARDS FINANCIAL

INCLUSION

As more and more people are getting

used to mobile phones and the

government aims to strengthen financial

inclusion by bringing more people in the

mainstream banking, GP in association

of bKash, an initiative of BRAC Bank,

launched bKash mobile financial

services for the customers. The service

enables a GP customer to access and

enjoy mobile financial services like

money transfer and payment from his or

her mobile handset, from anywhere in

Bangladesh.

GP also signed an agreement with

Dutch-Bangla Bank Ltd. (DBBL) to

STANDING BY THE COMMUNITY

As a responsible company, GP always

stands beside the community and the

environment through various

sustainable programs.

GP partnered with Jaago Foundation to

managed selective network of GP

Mobicash agents.

WIDENING THE REACH TO REMOTE

Connected World Award for GP’s SMS

based “Mobile Health Tips” service at

Connected World Forum, ‘Best Employer

Award 2012’ in the telecom sector by

bdjobs.com and “Best Investor Relations

Award 2012” by the BRAC EPL Stock

Brokerage Ltd.

OUR EXPECTATIONS

Classroom” with the aim to ensure high

network and upgraded our infrastructure

quality education in both sub-urban and

to fulfill the expectations of our

rural areas, the country’s first online

subscribers, who are all set to experience

school being in Tongi as a pilot phase.

the charm of 3G technology. We have to

To bring dermatology care to rural

communities, GP partnered with the

Telemedicine Working Group of

Bangladesh, where around 30% of the

population suffers from a skin disease at

one point during their lifetime. GP is

conducting this pilot project at four of its

Community Information Centers (CIC).

association with Special

Olympics-Bangladesh organized the 1st

Special Olympic South Asian 5-A-Side

Football Festival 2012 in May.

RECOGNITION OF ENDEAVOR

To increase its engagement with all

A number of awards in recognition of our

continuous efforts to bring excellence

communities, GP organized and

have made the year very special for us.

sponsored a number of festivals in

GP won the Award for Best ‘Presented

different remote areas of the country

Annual Reports-2011’ in the

throughout the year. One of such

communication and information

festivals was Rajpunnah, which is the

technology sector from the Institute of

| PAGE 12 | Grameenphone Annual Report 2012

Other recognitions were the prestigious

We have already built a future-proof

AREAS

segments of customers and

and maintaining high standards of

expand its venture named “Online

provide DBBL Mobile Banking Services to Another notable initiative is Special

Olympics across the country. GP in

its customers, who can use it directly

from their handsets by utilizing a fully

(ICAB), for publishing transparent reports

win and win every day to give our

customers the thrill and excitement that

they dreamt for long. We are also

constantly working to improve our

regulatory climate. We have come a long

way with successful resolution in some

areas but we look forward to achieving

more in this area.

February 10, 2013

You drive us to be better each day,

to improve and to innovate

The Shareholders

The shareholding structure comprises mainly two sponsor Shareholders namely Telenor Mobile Communications AS (55.80%)

and Grameen Telecom (34.20%). The rest 10.00% shareholding includes General public & other Institutions.

Grameen

Telecom

(34.20%)

Telenor Mobile

Communications AS

General Public &

other Institutions

(55.80%)

(10.00%)

Telenor Mobile Communications AS (TMC)

TMC, a company established under the laws of the Kingdom of Norway, seeks to develop and invest in telecommunication

solutions through direct and indirect ownership of companies and to enter into national and international alliances relating to

telecommunications. It is a subsidiary of Telenor Mobile Holdings AS and an affiliate of Telenor. Telenor ASA is the leading

Telecommunications Company of Norway listed on the Oslo Stock Exchange. It owns 55.80% shares of Grameenphone Ltd.

Telenor's strong international expansion in recent years has been based on leading-edge expertise, acquired in the Norwegian

and Nordic markets, which are among the most highly developed technology markets in the world. It has substantial

International operations in mobile telephony, satellite operations and pay Television services. In addition to Norway and

Bangladesh, Telenor owns mobile telephony companies in Sweden, Denmark, Hungary, Serbia, Montenegro, Thailand,

Malaysia, Pakistan and India. Telenor has 148 million consolidated mobile subscriptions worldwide as of December 31, 2012.

Grameenphone Annual Report 2012 | PAGE 15 |

The Shareholders

Telenor uses the expertise it has gained at its home and international markets for the development of emerging markets like

Bangladesh.

As part of the conversion of Grameenphone from a private limited to a public limited company, Telenor Mobile Communications

AS transferred 10 shares each on May 31, 2007 to its three (3) affiliate organizations namely Nye Telenor Mobile

Communications II AS, Norway; Telenor Asia Pte. Ltd., Singapore; and Nye Telenor Mobile Communications III AS, Norway.

Grameen Telecom (GTC)

Grameen Telecom, which owns 34.20% of the shares of Grameenphone, is a not-for-profit company in Bangladesh established

by Professor Muhammad Yunus, winner of the Nobel Peace Prize 2006.

GTC’s mandate is to provide easy access to GSM cellular services in rural Bangladesh and create new opportunities for income

generation through self-employment by providing villagers, mostly the poor rural women, with access to modern information

and communication-based technologies.

Grameen Telecom, with its field network, administers the Village Phone Program, through which Grameenphone provides its

services to the fast growing rural customers. Grameen Telecom trains the operators and handles all service-related issues.

GTC has been acclaimed for the innovative Village Phone Program. GTC & its Chairman Nobel Peace prize laureate Professor

Muhammad Yunus have received several awards which include; First ITU World information Society Award in 2005; Petersburg

Prize for Use of the IT to improve Poor People’s Lives” in 2004; GSM Association Award for “GSM in Community Service” in 2000.

As part of the conversion of Grameenphone from a private limited to a public limited company, Grameen Telecom transferred 1

share each on May 31, 2007 to its two affiliate organizations namely Grameen Kalyan and Grameen Shakti.

| PAGE 16 | Grameenphone Annual Report 2012

The Shareholders

Top Twenty Shareholders as on December 31, 2012

Sl No.

Name of Shareholders

Number of Ordinary Shares Held

Percentage

1

Telenor Mobile Communications AS

753,407,724

55.80%

2

Grameen Telecom

461,766,409

34.20%

3

Grameen Bank Borrower’s Investment Trust

11,037,221

0.82%

4

Investment Corporation of Bangladesh

8,848,000

0.66%

5

AB Investment Limited – Investors Discretionary Account

5,470,700

0.41%

6

IDLC Investment Limited

4,570,114

0.34%

7

ICB Unit Fund

3,827,200

0.28%

8

A.K. Khan & Co. Limited

2,398,200

0.18%

9

SSBT For SSB LUX Morgan Stanley Asset Management

2,149,328

0.16%

10

United Commercial Bank Ltd.

2,096,700

0.16%

11

Bangladesh Fund

1,740,000

0.13%

12

NTC A/C Prince Street Opportunities Ltd.

1,474,000

0.11%

13

NTC A/C Prince Street Institutional Ltd.

1,366,000

0.10%

14

Rupali Bank Limited

1,283,800

0.10%

15

SSBT For SS LUX A/C Goldman Sachs Funds – Goldman

Sachs N-11 (R) Equity Portfolio

1,254,000

0.09%

16

Sonali Bank

1,151,400

0.09%

17

Delta Life Insurance Co. Ltd.

1,130,400

0.08%

18

BRAC Bank Limited

1,097,600

0.08%

19

BRAC EPL Investments Limited

978,800

0.07%

20

The City Bank Ltd.

975,600

0.07%

1,268,023,196

93.93%

Total

(as per CDBL records)

Grameenphone Annual Report 2012 | PAGE 17 |

Organisational Structure

Board of Directors

Vivek Sood

Hossain Sadat

Chief Executive Officer

Company Secretary

Fridtjof Rusten

Chief Financial

Officer

Tanveer Mohammad

Chief Technology

Officer

| PAGE 18| Grameenphone Annual Report 2012

Allan Bonke

Chief Marketing

Officer

Mahmud Hossain

Chief Corporate

Affairs Officer

Quazi Mohammad Shahed

Chief Human Resources

Officer

Vacant

Chief Communications

Officer

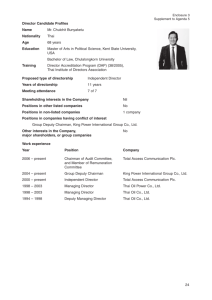

Directors’ Profile

Mr. Sigve Brekke was appointed to the Board on September 1, 2008 and is also the

Chairman of Grameenphone Board. Mr. Brekke has held a number of positions in the

Telenor Group. He joined Telenor Asia Pte. Ltd. in 1999 as Manager of Business

Development and later became the Managing Director. He served as the Co-Chief Executive

Officer (Co-CEO) of Total Access Communication PLC (‘dtac’) from 2002 to 2005, was the

sole CEO and Director from 2006 to 2008 and was elected as the Vice Chairman of dtac

Board in 2008. He also served as Director and CEO of United Communication Industry PLC

from 2005 to 2008. In July 2008, he was appointed as Director and Executive Vice

President of Telenor Group, Head of Asia Region, Telenor. In 2009, Mr. Brekke was elected

as Director of Unitech Wireless Ltd. (‘Uninor’) and the Chairman of DiGi.Com Berhad Board.

He was appointed Managing Director of Uninor in July 2010. Prior to joining Telenor,

Mr. Brekke served as the Deputy Minister (State Secretary) of Defence in Norway

in 1993 and was also an associate research fellow at the John F. Kennedy School of

Government, Harvard University. Mr. Brekke obtained Master’s degree in Public

Administration from John F. Kennedy School of Government, Harvard University.

Sigve Brekke

Mr. M Shahjahan was appointed to the Board on June 26, 2006 and is also Chairman of the

Company’s Treasury Committee. He was appointed as Deputy Managing Director of Grameen Bank

on July 26, 2011. In addition, he has been made responsible to act as Managing Director of the

same organization. Earlier, he served as the General Manager and Head of the Accounts, Finance,

Planning, Monitoring and Evaluation Division of Grameen Bank. Prior to joining the Company, he

served in several executive management positions in Grameen Bank, including Chief of the Audit

Department and Zonal Manager. Mr. Shahjahan is a member of the Board of Directors of

several companies that work in the fields of health, education, agriculture, welfare,

renewable energy and telecommunications. He obtained a Bachelor of Commerce

(Honours) degree in Accounting from the University of Dhaka in 1976, as well as a

Master’s degree in Accounting in 1977 and a Master’s degree in Finance in 1981. He

was awarded ICAB Medal (Silver) for passing the ‘C.A. Intermediate’ examination at the

earliest eligible chance in 1981.

M Shahjahan

Mr. Morten Tengs was appointed to the Board on July 18, 2011. He joined the Telenor Asia

office as a director in June 2011. He is currently a Board member of Telenor in Pakistan and

Total Access Communication PLC (‘dtac’) in Thailand. He has been in the Telenor Group

since 1995, and held a number of management positions such as: Finance Director of

Telenor Global Services, CEO of Telenor Global Services, CEO of Telenor Satellite Services,

CEO of Telenor Cinclus and Senior Vice President of Telenor Corporate Development.

Mr. Tengs holds a Master of Business Administration degree from the Norwegian School

of Management (BI) and an Engineering degree in construction from the Norwegian

Engineer High School.

Morten Tengs

Grameenphone Annual Report 2012 | PAGE 19 |

Directors’ Profile

Mr. Md. Ashraful Hassan was appointed to the Board on January 20, 2010. He currently serves as Managing

Director of Grameen Telecom, and is engaged in promoting and providing easy access to GSM cellular services in

rural Bangladesh. He also serves as Managing Director of Grameen Knitwear Ltd., Grameen Distribution Ltd.

and Grameen Fabrics & Fashions Ltd. He gained extensive and diversified knowledge in various industrial

sectors especially in the field of textile focusing on resource efficient production and energy saving

products having wide exposures in the industrial management, export market, labour management and so

on. Mr. Hassan also acquired wide range of experience for different kinds of project development and

industrial setup. He started his career in Grameen Bank, the Nobel Peace Prize winning organization, in

1984. During his 16 years of tenure with the Bank, he held various key positions including the Chief of

Engineering section. He has gained extensive knowledge in the field of construction engineering

and extended notable contribution to the infrastructural development of Grameen Bank. He

serves as a member of the Board of Directors of several enterprises that play commendable role

in the fields of renewable energy, health care, food & nutrition, information and communication

technology and so forth. He holds Bachelor of Science in Civil Engineering from Khulna

University of Engineering and Technology, Bangladesh.

Md. Ashraful Hassan

Mr. Per Erik Hylland was appointed to the Board on June 25, 2007 and is also Chairman of the

Company’s Human Resources Committee and Health, Safety, Security & Environment

Committee. He is the Senior Vice President in Telenor Asia and serves as Chief

Representative Officer for Bangladesh and Myanmar. Mr. Hylland has professional

experiences in the banking, information technology and telecommunications industries.

He joined Telenor in 1994 and since then has held several senior management positions.

During the past 14 years, he has worked in several countries as a Telenor representative

in Central and Eastern Europe and Asia. During this period, Mr. Hylland acted as a

Director for Telenor companies in Austria, the Czech Republic, Hungary and Slovakia. He

is an engineer in information technology and was educated in the Norwegian Ministry of

Defence.

Per Erik Hylland

Mr. Lars Erik Tellmann was appointed to the Board on December 6, 2011. He is currently the

Senior Vice President for Strategic Development, Telenor Region Asia. He joined Telenor Asia

as Vice President of Performance Management in 2010, after serving as Vice President of

Operational Efficiency in Telenor Group, and previously was a Manager in the Finance division of

DiGi. He has more than 12 years of international ICT experience after having worked in

Scandinavia, Central Eastern-Europe and South East Asia. He joined Telenor Group’s

Business Development Division in 2001 with a primary focus on building and scaling

operational excellence concepts. Currently, he is a Board member of Telenor Pakistan,

Total Access Communication PLC (‘dtac’), Thailand, and DiGi.Com Berhad, Malaysia.

He holds a Master’s Degree in Business Administration (MBA) from Edinburgh

University in Scotland, UK, and a Master’s in Business of Science (M.Sc./Sivilokonom)

from Bodo Business School, Norway.

Lars Erik Tellmann

| PAGE 20 | Grameenphone Annual Report 2012

Directors’ Profile

Ms. Parveen Mahmud FCA was appointed to the Board on October 17, 2012. She is the Managing Director of Grameen Telecom

Trust, which facilitates Social Business for a poverty free world. She is a chartered accountant and a fellow member of the

Institute of Chartered Accountants of Bangladesh (ICAB). In her diversified professional career, Ms. Mahmud worked for a

substantial amount of time with national and international development agencies and was a practicing chartered accountant.

Ms. Mahmud started her career with BRAC, and was the Deputy Managing Director of Palli Karma-Sahayak Foundation

(PKSF), an apex financing institution that works for poverty alleviation through employment

generation, where microcredit plays a key role as a tool for economic and gender empowerment.

She was a partner of ACNABIN, Chartered Accountants. She was the first female President of the

ICAB for the year 2011 and also the first female Board member in the South Asian Federation of

Accountants (SAFA), the apex accounting professional body of the SAARC. Ms. Mahmud was a

Working Group Member of Consultative Group on Social Indicators, UNCTAD/ISAR. She was

the member of National Advisory Panel for SME Development of Bangladesh and founding

board member of SME Foundation and was Convenor, SME Women’s Forum. She has given

inputs to the Technical committee when Microcredit Regulatory Authority (MRA)

in Bangladesh was established. Ms. Mahmud serves in various Boards, and was

the Chairperson of Acid Survivors Foundation. She was awarded Begum Rokeya Shining

Personality Award 2006 for women’s empowerment by the

Narikantha Foundation, Bangladesh.

Parveen Mahmud

Mr. Hakon Bruaset Kjol was appointed to the Board on September 14, 2011. He is the Senior Vice

President and Head of Corporate Affairs of Asia Region, Telenor Group. Mr. Kjol joined the Telenor

Group in 1995, beginning his career in the domestic mobile operations in Norway. Since then, he

contributed to the Group’s growing international presence through his strategic involvement in

Telenor’s international mobile activities where he played significant roles in operational

development and merger and acquisition activities both in Europe and Asia. For the last 12 years,

Mr. Kjol has been based in Asia where he continues to assume a key role in the development of

the Group strategy for Asia, and managing the Asia business environment to include the areas

of public affairs, regulatory management, government relations, strategic communications

and corporate responsibility. He has been a key member of several management

committees and currently the Director of Total Access Communication PLC (‘dtac’),

Thailand; Telenor Asia Pte Ltd, Singapore; Digi.Com Berhad, Malaysia and Telenor India

Pvt. Ltd., India. Mr. Kjol is a former student of the Norwegian School of Management

majoring in Marketing and Communications.

Hakon Bruaset Kjol

Dr. Jamaluddin Ahmed FCA was appointed to the Board on March 19, 2010 as an Independent Director and is also Chairman of

the Board Audit Committee. He is a Partner at Hoda Vasi Chowdhury & Co., Chartered Accountants, which is the associate firm

of Deloitte & Touche in Bangladesh. Dr. Jamal was the President (2010) of the Institute of Chartered Accountants of

Bangladesh (ICAB). He is the elected Vice President of the country’s independent think tank-Bangladesh Economic

Association. He is engaged in assignments in Financial, Banking and Energy Sector industries. He

worked as country specialist in Migrant Remittance Management. He was involved in DFID funded

Cheque Automation, Automated Clearing System and in the development of National Payment

System in Bangladesh. Currently, he is involved with Bangladesh Energy Regulatory Commission for

introducing Uniform Energy Accounting in Bangladesh. Over his professional career,

Dr. Jamal has written copious publications and conducted numerous research papers on

various aspects. Recently, he completed his paper “Demutualization of Stock

Exchanges-Rationale, Comparative Practice and a Roadmap for Bangladesh” and

“Transparency in Financial Reporting of Central Banks-A Comparison of Practices”.

He holds Master’s degree in Accounting from the University of Dhaka, PhD from the

Cardiff Business School, under the University of Wales, United Kingdom, and

is also a fellow of the ICAB.

Dr. Jamaluddin Ahmed FCA

Grameenphone Annual Report 2012 | PAGE 21 |

Directors’ Profile

Ms. Rokia Afzal Rahman was appointed to the Board on December 6, 2012 as an Independent Director.

A leading woman entrepreneur and a former Adviser to the Caretaker Government of Bangladesh,

Ms. Rahman started her agro-based company in 1980 and further diversified her business into insurance,

media, financial institution and real estate. She is currently the President of Metropolitan Chamber

of Commerce and Industries–MCCI, Dhaka; Vice President of International Chamber of Commerce-ICC

Bangladesh; Trustee Board Member of Transparency International Bangladesh–TIB. Ms. Rahman is

founder President of Bangladesh Federation of Women Entrepreneurs–BFWE. Her commitment

to development brought her to the Boards of a number of development organizations. She is

also Chair and Managing Director of R. R. Group of Companies; Chair and Managing

Director of Arlinks Group of Companies. Ms Rahman did her post graduate diploma

in Banking from Pakistan.

Rokia Afzal Rahman

Companies (other than Grameenphone Ltd.) in which GP Directors hold directorship and committee memberships:

Sl No.

1

Name of Director

Mr. Sigve Brekke

2

Mr. M Shahjahan

3

Mr. Morten Tengs

4

Mr. Md. Ashraful Hassan

5

6

Mr. Per Erik Hylland

Mr. Lars Erik Tellmann

Directorship

Unitech Wireless Ltd.(‘Uninor’), India

DiGi.Com Berhad, Malaysia

Total Access Communication PLC (‘dtac’), Thailand

Grameen Telecom

Grameen Shakti

Grameen Uddog

Grameen Fund

Grameen Krishi Foundation

Grameen Kalyan

Grameen Fabrics & Fashions Ltd.

Grameen Credit Agricole Microfinance Foundation

Grameen Employment Services Limited (GES)

Grameen Knitwear Ltd.

Grameen Shikkha

Grameen Communications

Grameen Shakti Samajik Byabosa Ltd.

Member of Board of Trustees

Nobel Laureate Trust

Grameen Trust

Grameen Telecom Trust

Telenor Pakistan

Total Access Communication PLC (‘dtac’), Thailand

DiGi.Com Berhad,Malaysia

Grameen Solutions Ltd.

Grameen Danone Foods Ltd.

Grameen Health Care Services Ltd.

Grameen CyberNet Ltd.

Grameen Veolia Water Ltd.

Grameen Shakti

Grameen Shakti Samajik Byabosa Ltd.

Grameen Employment Services Ltd.

Member of Board of Trustees

Grameen Telecom Trust

None

Telenor Pakistan

Total Access Communication PLC (‘dtac’), Thailand

DiGi.Com Berhad, Malaysia

| PAGE 22 | Grameenphone Annual Report 2012

Member of Board committees

DiGi.Com Berhad, Malaysia

Remuneration Committee

None

dtac, Thailand

Remuneration Committee

Nomination Committee

None

None

None

Directors’ Profile

Sl No.

7

8

9

Name of Director

Ms. Parveen Mahmud

Mr. Hakon Bruaset Kjol

Dr. Jamaluddin Ahmed FCA

Directorship

Member of Board committees

Grameen Krishi Foundation

Grameen Fisheries and Livestock Foundation

Grameen Capital Management

Grameen Health Care Services Ltd.

Grameen Fabrics & Fashions Ltd.

Grameen Distribution Ltd.

Underprivileged Children’s Educational Program (UCEP)

Manusher Jonno Foundation (MJF)

Actionaid International Bangladesh

BRAC

BRAC Sticthing International

MIDAS Financing Ltd.

Linde Bangladesh Ltd.

DiGi.Com Berhad, Malaysia

Telenor Pakistan

Telenor Asia Pte Ltd., Singapore

Telenor India Pvt. Ltd., India

Janata Bank Limited

Power Grid Company of Bangladesh Ltd.

Essential Drugs Company Limited

Dhaka WASA

UCEP- Bangladesh

Finance and Audit Committee

Actionaid International Bangladesh

Finance and Audit Committee

BRAC

Finance and Audit Committee

Linde Bangladesh Ltd.

Finance and Audit Committee

DiGi.Com Berhad, Malaysia

Nomination Committee and

Remuneration Committee

Janata Bank Limited

Audit Committee

Power Grid Company of Bangladesh Ltd.

Audit Committee

Essential Drugs Company Limited

Audit Committee

10

Ms. Rokia Afzal Rahman

R. R. Cold Storage Ltd.

Imaan Cold Storage Ltd.

R. R. Estates Ltd.

Aris Holdings Ltd.

Arlinks Limited

Mediaworld Ltd. (owning company of “The Daily Star”)

MIDAS Financing Ltd.

Mediastar Ltd. (owning company of “Prothom Alo”)

ABC Radio

MIDAS Investment Ltd.

BRAC

Small & Medium Enterprise Foundation (SMEF)

Manusher Jonno Foundation (MJF)

Banchte Shekha, Jessore

Member of Board of Trustees

Transparency International Bangladesh (TIB)

None

Grameenphone Annual Report 2012 | PAGE 23 |

Management Team

Allan Bonke | CMO

Vivek Sood | CEO

Quazi Mohammad Shahed | CHRO

Fridtjof Rusten | CFO

Mahmud Hossain | CCAO

Tanveer Mohammad | CTO

Management Team’s Profile

Mr. Vivek Sood was appointed as Chief Executive Officer (CEO), effective from January 07, 2013. Before

joining Grameenphone he was Executive Vice President and Chief Financial Officer (CFO) of the Indian

mobile operator Uninor. As CFO of Uninor, he was responsible for setting performance measures and

achieving financial goals. His 22 years of experience also includes executive positions in companies

like Tata AIG life Insurance, Hutchison Telecom, Tupperware India and Hindustan Lever Limited

(Unilever). He is a Chartered Accountant by profession.

Vivek Sood | CEO

Mr. Fridtjof Rusten was appointed as Chief Financial Officer (CFO), effective from April 11, 2012.

Prior to joining Grameenphone, he held the position of CFO in Telenor Hungary, where he has also

served as CMO. He has over 22 years of experience in Finance, Marketing and Strategy in Telecom

and Energy Industries. He was also a Senior Vice president with Telenor ASA in Central &

Eastern European Region, and has served as member of Board of Directors of Vimpelcom Ltd.

from 2005-2008. He holds a Master of Science degree in Industrial Economics from

Norwegian University of Science and Technology, Trondheim.

Fridtjof Rusten | CFO

Mr. Tanveer Mohammad was appointed as Chief Technology Officer (CTO), effective from July 01, 2010.

Tanveer has been working with Grameenphone since 1997. In this long journey with Grameenphone, he

has worked with Roll out, Operation and overall network responsibilities. He has played pivotal roles in

developing local entrepreneurs in civil works, tower fabrication, installation and commissioning,

ensuring speed and efficiency for the coverage and capacity expansion of the network. He has also

contributed towards creating the efficiency focus in the operational activities while upholding the

network leadership, through aggressive service level agreements, high customer focus, steep

cost efficiency targets and strengthening the operational teams. He has successfully led the

network modernization bringing in huge efficiency in energy consumption and overall opex

efficiency. Through this process, the network also became ready for future technology. He is

also taking active part in CTO/CMO board in Telenor. Before joining GP, Tanveer worked with

Hyundai Engineering and Construction. He holds a graduation in Engineering from the

Bangladesh University of Engineering and Technology (BUET).

Tanveer Mohammad | CTO

Mr. Allan Bonke was appointed as Chief Marketing Officer (CMO), effective from August 05, 2012.

Before joining Grameenphone, he was Executive Vice President in Uninor, India. While with Uninor, he

was responsible for Uttar Pradesh west (UP) circle operation. He joined Telenor in 2006 and worked as

Director, Business Sales in Telenor Denmark before joining Uninor. Before joining Telenor, he held

senior positions in different Danish ICT companies. He has a financial background from the Danish

banking sector. He holds a diploma education in business economics from Copenhagen Business

School-CBSI with strategy as line of specialization.

Allan Bonke | CMO

| PAGE 26 | Grameenphone Annual Report 2012

Management Team’s Profile

Mahmud Hossain | CCAO

Mr. Mahmud Hossain was appointed as Chief Corporate Affairs Officer (CCAO), effective from March 08,

2010. He started his career in 1990 at the very outset of liberalization of mobile telephony industry in

Bangladesh, when he joined the technical team of the erstwhile Hutchison BD Telecom Ltd.

(presently CityCell). He worked for Grameenphone, at his first spell with the company, as Additional

General Manager at the Network Operations during 2000-2001. In his credibly long career, he also

worked for few other telecom operators before rejoining GP in August 2009. He obtained his

B.Sc. in Electrical & Electronic Engineering from Bangladesh University of Engineering and

Technology (BUET). He obtained his MBA (major in Finance) from the Institute of Business

Administration (IBA), Bangladesh. He also holds a Master’s (Telecom) Degree from Concordia

University, Canada.

Mr. Quazi Mohammad Shahed was appointed as Chief Human Resources Officer (CHRO), effective from

November 01, 2012. Before joining Grameenphone, he was employed by British American Tobacco

(BAT) as Human Resources Lead, Global SAP, Template & Pilot Project in United Kingdom. After

obtaining his Bachelor’s Degree in Mechanical Engineering from Bangladesh University of Engineering

and Technology (BUET), he started his career in BAT Bangladesh. During the early part of his career, he

worked in different roles within Operations and subsequently moved to HR as the Head of HR of BAT

Bangladesh in Dec 2001. He later worked in Iran, Pakistan, Malaysia and UK in different HR

leadership and global project roles. He has an MBA from North South University, Bangladesh.

Quazi Mohammad Shahed | CHRO

Profile of Company Secretary

Mr. Hossain Sadat was appointed as Company Secretary effective from July 01, 2010. Prior to taking up

the above role, he has also worked in Finance of the same organization for several years where he led

Financial Reporting, Budgeting and Control functions among others. Before joining

Grameenphone in mid 2001, he worked in a number of multinational organizations including

Shell Oil & Gas, Cairn Energy PLC and KPMG Bangladesh. He has worked in the areas of financial

management, stakeholder relations, public communications, internal control & compliance

for around sixteen years. Mr. Sadat holds a Master’s degree in Accounting and

is a Chartered Secretary by profession.

Hossain Sadat | Company Secretary

Grameenphone Annual Report 2012 | PAGE 27 |

Message

from the Chairman

A successful 3G licensing will open a new era of high

speed data communication which will benefit the

customers with superior speed, quality and content.

This will fuel the growth of the sector and ultimately

help the government in its vision towards a digital

Bangladesh. Consequently, 3G has opportunities

around it. We look forward to a 3G licensing at a

rationale price and through fair process ensuring

deployment of future investment that results in new

services for the benefit of our customers.

Message from the Chairman

Dear Shareholders,

We have passed a challenging year in a

There are other regulatory issues which

fiercely competitive market. However,

winning team for their persistent

remained unresolved for a long time.

the year ended with an optimistic note

achievements and care for the Company.

Such unsettled issues create

as we have started to gain a strong

unpredictable investment climate and

footing to tackle the challenges more

could influence our decision on further

efficiently on the back of continuous

investment and licensing process.

support of our customers, employees

and valued shareholders.

At the end, I would also like to thank all

our valued shareholders and

stakeholders for being with us in our

journey towards a better tomorrow.

A successful 3G licensing will open a

new era of high speed data

We have further strengthened our

communication which will benefit the

subscriber base in 2012 amid an

customers with superior speed, quality

unpredictable regulatory regime. GP

and content. This will fuel the growth of

witnessed a moderate growth in revenue the sector and ultimately help the

in addition to our relentless efforts to

government in its vision towards a digital

strengthen operational efficiency,

Bangladesh. Consequently, 3G has

product innovation and market

opportunities around it. We look forward

diversification.

to a 3G licensing at a rationale price and

Our revenue increased by 3.2% to BDT

91.9 billion (BDT 9,192 crore) in 2012,

compared to the previous year, backed

by the growth in revenues from voice,

deployment of future investment that

results in new services for the benefit of

our customers.

Although the capital market has been on

businesses.

a continuous downtrend throughout the

2G services for the next 15 years despite

a long delay resulted from various legal

and administrative complexities. On this

occasion, I would like to thank the

Bangladesh Telecommunication

Regulatory Commission (BTRC) and the

February 10, 2013

through fair process ensuring

non-voice, data and adjacent

In 2012, we got our operating license for

Sigve Brekke

Chairman

year, the price of GP shares remained

almost stable. I am pleased to report

that for the financial year 2012, we were

able to give you a 90% Interim Cash

Dividend. The Board of Directors also

recommended 50% Final Cash Dividend

for Shareholders’ approval.

Ministry of Posts and

We believe what our employees say

Telecommunications (MoPT) for

about their company to their friends and

providing us with the 2G license, which, I

families brings us all the appreciations

believe is a gesture of goodwill for us

and accolades. Their relentless

towards future investment and network

commitments and best efforts have

expansion. However, the VAT rebate

earned all the success over the years.

issue is still pending with the court.

Today, I would like to congratulate this

Grameenphone Annual Report 2012 | PAGE 29 |

Message

from the CEO

Grameenphone has passed

the year 2012 with notable successes on

different fronts despite various challenges and

intense competition. We made progress in terms of

both revenue and subscription growth,

and remained as the preferred operator.

Message from the CEO

Dear Shareholders,

On behalf of the Management Team, I

segments under the theme of ‘Clear

am pleased to report to you that

ahead and keep growing to meet the

Cut’, making price plans simpler and

Grameenphone (GP) has passed the

expectations of our customers.

competitive. Besides, we have also

year 2012 with notable successes on

launched diversified promotional offers

different fronts despite various

and innovative value-added services.

challenges and intense competition. We

Finally, I would like to express my sincere

appreciation to all our shareholders and

stakeholders for helping us to make

Our adjacent businesses such as GPIT,

2012 a success. As you have elevated us

Wholesale Business and Financial

to new heights, we are proud to have

Services also brought notable results for

your patronage and support in our

us. GPIT had been profitable in 2012.

A total of 3.5 million new subscribers

journey towards further excellence and

Wholesale Business retained the

were added to our network in 2012 and

to “Go Beyond”.

leading position by providing “Shared

our subscription base reached 40.02

Telecom Infrastructure” to other

million to continue our lead with a 41.2%

operators and businesses. We have

market share.

partnered with bKash and DBBL to offer

made progress in terms of both revenue

and subscription growth, and remained

as the preferred operator.

GP earned BDT 91.9 billion (BDT 9,192

financial services .

crore) revenue in 2012 with a 3.2% rise

GP so far has invested BDT 213,435

compared to the previous year. The

million in network, which is currently

growth in revenue was mainly in voice,

covering 99.16% population. The

non-voice and data revenues due to

network platform has been prepared for

subscription growth and revenues from

3G and new technologies to win the

adjacent businesses.

business in future. Despite energy price

However, net profit margin for 2012 was

19.0% compared to 21.2% of 2011.

Despite growth in operating profit

margin, net profit after tax decreased by

energy cost saving. We also have built

up 72 solar powered sites taking the

total number to 162 at the end of 2012.

GP reshaped its Corporate Responsibility

amortization cost of 2G license and

policy to create an ever-lasting impact

spectrum fees, and notional interest

on the community and to support

expenses against payments of above

sustenance of the projects by creating

fees.

shared value. Tele Dermatology,

BDT 63.6 billion (BDT 6,359 crore) to the

National Exchequer. Since its inception

Ensuring Safe Drinking Water through

SMS Based Solution, Online School and

Earth Hour are a few such projects.

till December 2012, GP contributed a

Another bright spot was the Award for

total of BDT 308.8 billion (BDT 30,876

Best ‘Presented Annual Reports-2011’ in

crore) to the National Exchequer and

the communication and information

remained one of the largest contributors

technology sector given by the Institute

for the last several consecutive years.

of Chartered Accountants of Bangladesh

This year, GP took a massive initiative to

February 10, 2013

hike, we have been able to achieve 42%

7.3% mainly due to recognition of

During 2012, the Company contributed

Vivek Sood

CEO

(ICAB).

revamp its product portfolio with three

Despite the unpredictable regulatory

hero products (i.e. Bondhu, Amontron,

regime and the VAT rebate issue being

Nishchinto) targeting three usage

un-resolved till now, we want to move

Grameenphone Annual Report 2012 | PAGE 31 |

We are there when you

need to take a step up

in your career

Corporate Governance in Grameenphone

Technology

Process

Strategy

Goal

People

Grameenphone (GP) throughout its entire business operations puts

persistent efforts to ensure stakeholders' trust and confidence as

Grameenphone Governance

governance and stakeholders' value are interconnected. With this end in

view, GP has been providing and maintaining innovative, user-friendly

and best-value telecommunications services to create sustainable

stakeholders' value. To reach these objectives, the Board of Directors of

the Company is dedicated to ensuring higher standards of Corporate

Commitment

Transparency

Accountability

Compliance

Governance to keep the Company's business integrity and performance

Community

Economy

Industry Culture

Authority

on the right track. Being a responsible corporate entity, GP maintains

adequate transparency and encouraging sound business conduct both

in its in-house practices and in its external relationship with the community as well as suppliers, customers and

business partners. The Company, at the same time, expects acts of honesty and integrity from its Board of Directors,

employees and suppliers.

GP being a public listed company, its Board of Directors plays a crucial role in upholding the interests of all its

stakeholders. The Board of Directors and the Management Team are also dedicated to maintaining a

well-established culture of accountability, transparency, easy-to-understand policies and procedures to ensure

effective Corporate Governance at every level of its operations. The Board of Directors and the Management Team

also put their best efforts to comply with all the laws of the country and all the internal regulations, policies and

procedures to make GP a thoroughly transparent company. Moreover, recognizing the fact that compliance has been

the corner stone of good governance, the Company meticulously undergoes through the process of statutory audit

and compliance certification as required by laws of the land. As a result, GP has been able to maintain the highest

level of integrity and accountability of global standards over the years.

Board Organization & Structure

a)

Role of the Board

The Directors of the Board are appointed by the Shareholders at the Annual General Meeting (AGM) and

accountable to the Shareholders. The Board is responsible for ensuring that the business activities are

soundly administered and effectively controlled. The Directors keep themselves informed about the

Company's financial position and ensure that its activities, accounts and asset management are subject to

adequate control. The Board also ensures that Grameenphone Policies & Procedures and Codes of Conduct

are implemented and maintained and the Company adheres to generally accepted principles for good

governance and effective control of Company activities.

In addition to other legal guidelines, the Board has also adopted “Rules of Procedure for the Board of

Directors” for ensuring better governance in the work and the administration of the Board. The Board is also

guided by a Delegation of Authority which spells out the practices and processes in discharging its

responsibilities.

b)

Board Composition

The Board in GP is comprised of ten (10) Directors, including the Chairman who is elected from amongst the

members. In compliance with the Corporate Governance Guidelines issued by the Bangladesh Securities

and Exchange Commission (BSEC) the Board of Directors has appointed two (2) Independent Directors. We

believe that our Board has the optimum level of knowledge, composure and technical understanding about

the Company’s business which, combined with its diversity of culture and background, stands as the perfect

platform to perform and deliver.

Grameenphone Annual Report 2012 | PAGE 33 |

Corporate Governance in Grameenphone

c)

Board Meetings

The AoA of the Company requires the Board to meet at least four times a year or more when duly called for

in writing by a Board member. Dates for Board Meetings in a year are decided in advance and notice of each

Board Meeting is served in writing well in advance. Such notice contains detailed statement of business to

be transacted at each meeting. The Board meets for both scheduled meetings and on other occasions to

deal with urgent and important matters that require attention.

d)

Division of work for the Board and Chief Executive Officer (CEO)

The roles of the Board and Chief Executive Officer are separate and delineation of responsibilities is clearly

established, set out in writing and agreed by the Board to ensure transparency and better corporate

governance. To that end, GP has also adopted “Rules of Procedure for Chief Executive Officer”. The CEO is

the authoritative head for day-to-day management in GP. He acts to reasonably ensure that GP operates

business as per the Articles of Association, decisions made by the Board and Shareholders, as well as

according to Grameenphone Policies and Procedures and applicable regulatory legislations.

e)

Subsidiary’s Relationship

The Board of Directors of the subsidiary company of GP is obliged to provide the Board of Directors of GP

with any information which is necessary for an evaluation of the Company’s position and the result of the

Company’s activities. GP notifies the subsidiary company’s Board of Directors about the matters which may

be of importance to the Company as a whole. GP also notifies the subsidiary company’s Board of Directors

about decisions which may be of importance to the subsidiary company before a final decision is made. As

per regulatory guidelines, the minutes of the GP subsidiary Board of Directors are routinely placed before

GP Board meeting and those are reviewed and assessed by the GP Board for regular evaluation and

governance.

f)

Access to Information

The Board recognizes that the decision-making process is highly dependent on the quality of information

furnished. In furtherance to this, every Director has access to all information within the Company.

Throughout their tenure in office, the Directors are continually updated on the Company’s business and the

regulatory and industry specific environments in which it operates. These updates are by way of written

briefings and meetings with senior executives and, where appropriate, external sources.

Board Committees

For better, quicker and furnished flow of information and thereby exercising effective governance, the Board has also

constituted a number of Committees and has delegated certain responsibilities to the Board Committees to assist in

the discharge of its responsibilities. The role of Board Committees is to advise and make recommendations to the

Board. Each Committee operates in accordance with the Terms of Reference (TOR) approved by the Board. The Board

reviews the TOR of the committees from time to time. The Board appoints the members and the Chairman of each

committee. A brief description of each Committee is presented below:

Board of Directors

Audit

Committee

| PAGE 34 | Grameenphone Annual Report 2012

Treasury

Committee

Human Resources

Committee

Health, Safety,

Security &

Environment Committee

Corporate Governance in Grameenphone

a)

Audit Committee

The Grameenphone Audit Committee was established in late 2008 as a sub-committee of the Board and has

jurisdiction over Grameenphone and its subsidiaries. The Audit Committee is comprised of three members of

the Board. The Chairman of the committee is an Independent Director. The Chief Executive Officer, the Chief

Financial Officer, the Company Secretary and the Head of Internal Audit are permanent invitees to the Audit

Committee meetings.

The Audit Committee assists the Board in discharging its supervisory responsibilities with respect to internal

control, financial reporting, risk management, auditing matters and GP’s processes of monitoring

compliance with applicable legal & regulatory requirements and the Codes of Conduct. The Audit

Committee Charter, as approved by the Board, defines the purpose, authority, composition, meetings, duties

and responsibilities of the Audit Committee.

The Audit Committee met 5 (five) times during the year and attendance of the Committee members in the

meetings was as follows:

Name

M Shahjahan

Per Erik Hylland

Dr. Jamaluddin Ahmed FCA

b)

Attendance

4/5

5/5

5/5

Treasury Committee

This committee consists of three members who are appointed by the GP Board. All significant financial

matters which concern the Board are discussed in this committee meeting in detail. Upon endorsement of

the Treasury Committee, such issues are forwarded to the Board for their final review and approval.

The Treasury Committee met 4 (four) times during the year and attendance of the Committee members in

the meetings was as follows:

Name

c)

Attendance

M Shahjahan

3/4

Pal Stette

4/4

Raihan Shamsi (replaced by Mr. Fridtjof Rusten)

1/1

Fridtjof Rusten (effective from April 2012)

3/3

Human Resources Committee

This Committee consists of three members who are appointed by the GP Board. The Committee supports the

Board in discharging its supervisory responsibilities with respect to Company’s Human Resources policy,

including employee performance, motivation, retention, succession matters, rewards and Codes of Conduct.

The Human Resources Committee met 1 (one) time during the year and attendance of the Committee

members in the meeting was as follows:

Name

d)

Attendance

Per Erik Hylland

1/1

M Shahjahan

1/1

Haroon Bhatti (replaced by Mr. Quazi Mohammad Shahed)

0/1

Quazi Mohammad Shahed (effective from December 2012)

0/0

Health, Safety, Security and Environment Committee

This Committee consists of three members who are appointed by the GP Board. The Committee meets

Grameenphone Annual Report 2012 | PAGE 35 |

Corporate Governance in Grameenphone

whenever necessary and supports the Board in fulfilling its legal and other obligations with respect to

Health, Safety, Security and Environment (HSSE) issues. The Committee also assists the Board in obtaining

assurance that appropriate systems are in place to mitigate HSSE risks in relation to the general

environment, company, employees, vendors, etc.

Company Secretary

To ensure effective assimilation and timely flow of information required by the Board and to maintain necessary

liaison with internal organs as well as external agencies, the Board has appointed a Company Secretary. The

Corporate Governance Guidelines issued by the Bangladesh Securities and Exchange Commission (BSEC) also

require a listed company to appoint a full fledged Company Secretary, as distinct from other managers of the

Company. In pursuance of the same, the Board of Directors has appointed Company Secretary and defined his roles

& responsibilities. In GP, among other functions, the Company Secretary:

l

performs as the bridge between the Board, Management and Shareholders on strategic and statutory

decisions and directions.

l

acts as a quality assurance agent in all information streams towards the Shareholders/Board.

l

is responsible for ensuring that appropriate Board procedures are followed and advises the Board on

Corporate Governance matters.

l

acts as the Disclosure Officer of the Company and monitors the compliance of the Acts, rules,

regulations, notifications, guidelines, orders/directives, etc. issued by BSEC or Stock Exchange(s)

applicable to the conduct of the business activities of the Company so as to protect the interests of the

investors and other stakeholders.

Management Team (MT)

The Management Team is the Executive Committee of Grameenphone managing and running the affairs of the

Company. The Management Team consists of the CEO and other key Managers across the Company. The CEO is the

leader of the team. The Management Team endeavors to achieve the strategic goals & mission of the Company set

by the Board of Directors. The Management Team meets on a weekly basis to monitor the business performance of

the Company.

Control Environment in Grameenphone

In implementing and ensuring the right Governance in Grameenphone, the Board and Management Team ensures

the following:

a)

Beyond Budgeting Management Model

GP employs a Beyond Budgeting strategic management model whereby the company reviews its strategy for

the next three years and sets annual and quarterly targets on key KPIs for the upcoming year. The

targets/KPIs are set on relative terms to reflect the changes in business environment and thus ensuring a

performance culture focused on attaining the targets and steering the company towards fulfilling its

strategic ambitions. In every quarter the company also prepares forecast for the next five quarters. These

forecasts are realistic projections of future directions.

The model focuses on initiatives to minimize the gap between the targets (KPIs) and forecasts. The

corporate level initiatives are cascaded down to divisional as well as individual levels. The forecasts on the

key KPIs which serve as radar screen on future directions are reviewed and monitored against targets. This

is a forward-looking and action-oriented approach towards managing the business. The resource

allocations are dynamic and are based on the intended actions linked with the target and strategy. It aims

to build a culture of freedom through responsibility and thereby leading to increased responsiveness to

surrounding changes.

| PAGE 36 | Grameenphone Annual Report 2012

Corporate Governance in Grameenphone

b)

Financial Reporting

Grameenphone has strong financial reporting procedures. Financial statements are prepared in accordance

with International/Bangladesh Financial Reporting Standards (IFRS/BFRS), the Companies Act 1994, the

Securities and Exchange Rules 1987 and other applicable financial legislations. The financial data are

captured from the financial reports generated from Oracle ERP (Enterprise Resource Planning) system.

These financial statements, once prepared, are reviewed by CFO and CEO on a regular basis. Upon

submission to Group in the form of Management Accounts, these financial statements are reviewed by

Group Accounting and Group Finance.

At every quarter, external auditors review the quarterly financial statements prepared in accordance with

local financial reporting policies and company procedures, which consist of the financial performance and

position of Grameenphone as a group. Separate sets of financial statements for both Grameenphone Ltd.

and Grameenphone IT Ltd. are also prepared.

The annual audit is conducted by the external auditors, who are appointed by the Board of Directors

followed by the shareholders’ approval in the annual general meeting.

Apart from the statutory reporting of financial statements, Grameenphone also maintains regular reporting

to its group company Telenor, which consolidates all its subsidiaries’ financial information in its

consolidated financial statements.

c)

Operational Excellence

To ensure better shareholder return on investment, cost efficiency plays a vital role in any organization. In

view of that, Grameenphone keeps operational excellence as one of the key focus areas.

One of its major cost and operational efficiency initiatives has been the swapping of network equipment with

energy efficient equipment and future ready technology. Swapping of the entire network equipment of

7,272 base stations was completed in November 2011. This initiative has not only improved the network

performance in terms of quality and capacity, but also has significantly reduced fuel and power

consumptions by taking out air conditioners from the base stations as well as lowered power requirement of

the equipments.

Moving to its corporate headquarter “GPHouse” and associated benefits such as waste water recycling,

reduced illumination requirement, paperless approval systems and various scale effects are some of the

notable efficiency drives in addition to numerous large and small efficiency initiatives across the company.

Grameenphone has also made significant advancements in green initiatives which have reduced its carbon

footprint and led to increased utilization of solar energy. Since 2011, Grameenphone has undertaken a

company wide cost transformation project which aims towards streamlining GP processes thereby

optimizing costs and making the company more efficient in the years to come. This has given notable

contribution to cost efficiency, along with a structured operational efficiency method that helped the

company to save as high as BDT 2.4 billion in operational cost in the year 2012.

d)

Business Reviews and Financial Reviews

Business reviews and financial reviews are conducted on a quarterly basis by the Group. The purpose of

business review is to ensure strategic control and follow-up of results based on the prevailing strategic

objectives, value drivers and key changes to risk exposure. Financial reviews provide the internal quarterly

results follow-up for the Company. The purpose is to provide an analysis of the economic and financial

situations, which will then form the basis for external reporting and presentations, and to provide quality

assurance for the financial reporting. In addition to quarterly business and financial review with Group, CEO and

CFO review financial results on a monthly basis and set action points to achieve the company business goals.

Grameenphone Annual Report 2012 | PAGE 37 |

Corporate Governance in Grameenphone

e)

Management of Assets

Grameenphone, in its pursuit of best quality network for its subscribers, has been investing in cutting edge

telecom technology since its inception. Transparency and accountability is ensured at all stages from

acquisition to disposal to protect the interest of Shareholders. Internationally accepted safety measures

have been implemented and periodic physical verification is undertaken on a test basis to safeguard the

assets and to ensure representational faithfulness of reported numbers. All the assets are adequately

insured against industrial risks with local and international insurance companies.

f)

Statutory Audit and Certification

Statutory Audit of the Company is governed by the Companies Act, 1994 and Securities and Exchange Rules

1987. As per these regulations, auditors are appointed by Shareholders at each Annual General Meeting