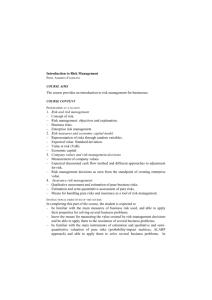

Methods of Handling Pure Risk…

advertisement

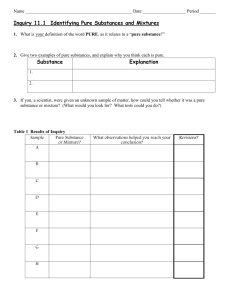

RISK 1 Objectives In this chapter, we will explore four major points: 1- The concept of risk, especially those areas particular to risk management 2- Why risk matters in our lives 3- How risk can be measured and evaluated 4- Methods to manage risk, including insurance 2 Outline Nature of Risk Attitudes Toward Risk Measurement of Risk Elements of Pure Risk Methods of Handling Pure Risk 3 Nature of Risk A. Definition: variability in future outcomes B. Speculative Risk: possibility of gain as well as loss or no loss C. Pure Risk: only loss or no loss D. Loss, which is disappearance or reduction in an economic value, is the outcome of concern E. For risk to exist, it must be possible for loss to occur, which implies unpredictability F. A risk manager’s job is to minimize the negative aspects of not knowing the future. 4 Attitudes Toward Risk A. Many people are risk averse – willing to pay in excess of the expected return in exchange for some certainty about the future B. Risk aversion is important because it may result in lost opportunities 5 Measurement Of Risk A. Specific Measurement Techniques 1. Average value: best guess of the future 2. Variability: can be measured using range, variance, standard deviation and coefficient of variation 3. Data sources: often events under consideration are rare, making data collection difficult 6 Measurement Of Risk… B. Law of Large Numbers: As a sample of observations is increased in size, the relative variation about the mean declines 1. There is greater confidence in estimates that use larger samples 2. Used by risk managers to estimate future outcomes for planning purposes 7 Elements of Pure Risk A. Exposure: opportunity for loss 1. Personal loss exposures: death, disability, sickness, unemployment, and old age 2. Property loss exposures: direct loss is the cost to repair or replace property; consequential loss is the loss of use during repair or replacement 3. Liability loss exposure: legal suits claiming damage to others 8 Elements of Pure Risk… B. Perils: immediate causes of loss such as death and fire 1. Natural: people have little control over i.e. hurricanes, lightning 2. Human: people have control over i.e. suicide, theft 3. Economic: recessions, employee strikes, arson for profit 9 Elements of Pure Risk… C. Hazards: conditions that increase the probability and/or severity of loss 1. Physical: tangible conditions of the environment that affect the frequency and\or severity of loss i.e. slippery roads 2. Intangible: attitudes and cultures affecting probability and severity of loss a. Moral: dishonesty on the part of insureds b. Morale: attitudes of carelessness and lack of concern 10 Methods of Handling Pure Risk A. Avoidance 1. Avoid activities that may lead to loss 2. Avoid ownership or responsibility that may be lost 11 Methods of Handling Pure Risk… B. Loss Prevention and Reduction 1. Definition: prevention reduces loss frequency; reduction lessens loss severity 2. Goal: reduce losses to the minimum level that is compatible with a reasonable degree of human activity and expense; a standard which will change through time 12 Methods of Handling Pure Risk… C. Retention 1. Definition: when losses are paid from an individual’s or organization’s own funds 2. Why it occurs: a. Ignorance of risk b. Significance of risk underestimated c. Maximum dollar losses small d. Able to predict losses 13 Methods of Handling Pure Risk… D. Transfer 1. Definition: shift risk to someone else 2. Modes of Transfer: a. Formation of a corporation b. Contractual arrangements (i). Guarantee (ii). Bailment (iii). Lease and rental agreements (iv). Contracts of suretyship c. Insurance: the most important transfer mechanism used by risk managers 14 Methods of Handling Pure Risk… E. Combination Use a combination of avoidance, loss prevention and control, retention, and transfer techniques, as the most feasible and efficient way to manage risk 15