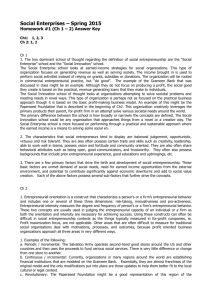

entrepreneurial dimensions - Online Directory Western Illinois

advertisement