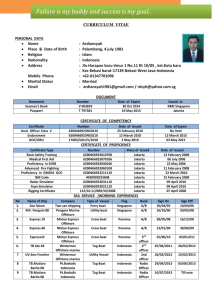

to go beyond the range of possibilities - corporate

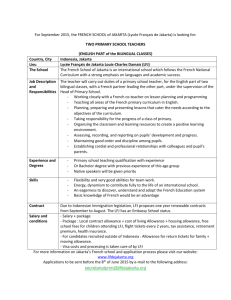

advertisement