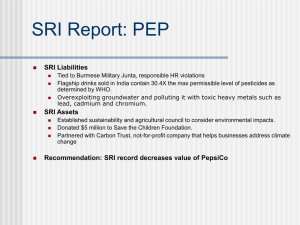

exchange control act foreign exchange manual

advertisement