CIT Group Inc. NYSE: CIT

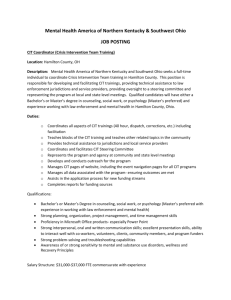

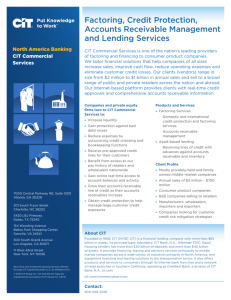

advertisement

Providing Lending, Leasing and Advisory Services to the Small Business, Middle Market and Transportation Sectors. CIT Group Inc. NYSE: CIT Transportation & International Finance Aerospace Finance We provide customized leasing and secured financing to operators of commercial and business aircraft. Our financing services include operating leases, single investor leases, leveraged financing, sale and leaseback arrangements, as well as loans secured by equipment. International Finance We offer equipment financing and leasing to small and middle market businesses in China and the U.K. Maritime Finance We offer senior secured loans, saleleasebacks and bareboat charters to owners and operators of oceangoing cargo vessels, including tankers, bulkers, container ships, car carriers, and offshore vessels and drilling rigs. Rail We are an industry leader in offering customized leasing and financing solutions and a highly efficient, diversified fleet of railcar assets to freight shippers and carriers throughout North America and Europe. North America Banking Commercial Banking We provide lending, leasing and other financial and advisory services to the middle market with a focus on specific industries, including: Aerospace & Defense, Business Services, Communications, Energy, Entertainment, Gaming, Healthcare, Industrials, Information Services & Technology, Restaurants, Retail, Sports & Media and Transportation. Commercial Real Estate We provide senior secured commercial real estate loans to developers and other commercial real estate professionals. We focus on stable, cash flowing properties and originate construction loans to highly experienced and well capitalized developers. Commercial Services We are a leading provider of factoring services in the United States. We provide credit protection, accounts receivable management services and assetbased lending to manufacturers and importers that sell into retail channels of distribution. Equipment Finance We provide financing solutions to small businesses and middle market companies in a wide range of industries including Technology, Office Imaging, Healthcare, Industrial and Franchise. We assist manufacturers and distributors in growing sales, profitability and customer loyalty by providing customized, value-added finance solutions to their commercial customers. The LendEdge platform, in our Direct Capital business, allows small businesses to access financing through a highly automated credit approval, documentation and funding process. We offer both capital and operating leases. Legacy Consumer Mortgages This portfolio includes single-family residential mortgages and reverse mortgages, which are indemnified from certain losses based on an agreement with the FDIC. Non-Strategic Portfolios This portfolio consists primarily of an equipment financing portfolio in Brazil, which was under a definitive sale agreement as of June 30, 2015. About CIT Founded in 1908, CIT (NYSE: CIT) is a financial holding company with more than $65 billion in assets. Its principal bank subsidiary, CIT Bank, N.A., (Member FDIC, Equal Housing Lender) has more than $30 billion of deposits and more than $40 billion of assets. It provides financing, leasing and advisory services principally to middle market companies across a wide variety of industries primarily in North America, and equipment financing and leasing solutions to the transportation sector. It also offers products and services to consumers through its Internet bank franchise and a network of retail branches in Southern California, operating as OneWest Bank, a division of CIT Bank, N.A. cit.com Products and Services CIT Group Inc. NYSE: CIT ■■ Accounts receivable collection ■■ Factoring services ■■ Acquisition and expansion financing ■■ Financial risk management ■■ Asset-based loans ■■ Import and export financing ■■ Asset management and servicing ■■ Insurance services ■■ Cash management and payment services ■■ Investment advisory services ■■ Credit protection ■■ Letters of credit / trade acceptances ■■ Debt restructuring ■■ ■■ Debt underwriting and syndication Mergers and acquisition advisory services ■■ Debtor-in-possession / turnaround financing ■■ Payment solutions ■■ Private banking ■■ Deposits ■■ Residential mortgage loans ■■ Enterprise value and cash flow loans ■■ Secured lines of credit ■■ Equipment leases ■■ Small Business Administration loans Financing and Leasing Assets1 by Obligor - Industry Healthcare 3.5% Finance and Insurance 2.2% Oil and Gas Extraction/Services 4.2% Energy and Utilities 4.2% First three boxes: 55 0 0 perspective: 0 extrude: 35 Commercial and Regional Airlines 27.9% Wholesale 4.5% 3D Values Real Estate 4.8% Service Industries 7.4% Retail 8.2% Manufacturing 13.0% 2 Other 9.2% Transportation 10.9% Financing and Leasing Assets1 by Country Philippines 1.4% Brazil 1.5% Indonesia 1.2% Russia 1.1% 3 Mexico 1.7% England 2.8% China 2.8% Ungrouped Chart 3D Values First three boxes: 55 0 0 perspective: 0 extrude: 35 Australia 2.8% Canada 6.8% U.S. 60.7% All other countries 17.2% Data Driven Graph Corporate Headquarters 1 CIT Drive Livingston, NJ 07039 973-740-5000 Global Headquarters 11 West 42nd Street New York, NY 10036 212-461-5200 Securities and investment banking services offered through CIT Capital Securities LLC, an affiliate of CIT. © 2016 CIT Group Inc., CIT and the CIT logo are registered service marks of CIT Group Inc. 1/6/16 1 Financing and leasing assets by obligor. Portfolio assets as of June 30, 2015, include finance receivables (loans and leases), operating lease equipment and assets held for sale. Does not include OneWest Bank assets. 2 No industry greater than 2%. 3 Most of the balance represents operating lease equipment. Contacts: Investor Relations: Barbara Callahan Senior Vice President 973-740-5058 Barbara.Callahan@cit.com Media Relations: Matt Klein Vice President 973-597-2020 Matt.Klein@cit.com