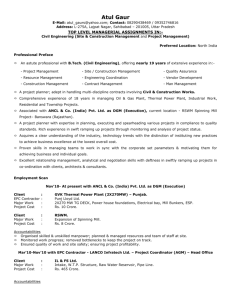

to view/download the PDF

advertisement