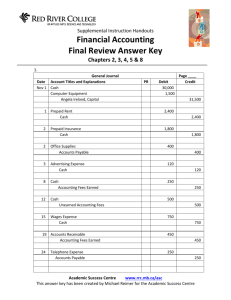

Financial Accounting Final Review

advertisement

Supplemental Instruction Handouts Financial Accounting Final Review Chapters 2, 3, 4, 5 and 8 1. The following is a list of transactions from the bookkeeping records of Angela’s Accounting Firm for the month of November 2012. November 1st: Angela Ireland invests $30,000 and computer equipment worth $1,500 to the business. November 1st: Angela pays $2,400 rent for the next 3 months. November 2nd: Angela purchases a one – year insurance policy for $1,800. November 2nd: Angela purchases $400 worth of office supplies on credit. November 3rd: Angela paid for an advertisement for $120 in the local newspaper to run on the weekend. November 8th: Angela completes a $250 project for a client and immediately receives payment. November 12th: Angela gets paid $500 for work to be completed in December. November 15th: Angela paid her assistant’s wage of $750 for the first half of the month. November 19th: Angela completed a $450 project for a client on credit. November 24th: Angela received the monthly telephone bill for $250. The bill is due by December 10th. November 30th: Angela paid her assistant’s wage of $750 for the last half of the month. November 30th: The customer from the November 19th transaction has come in and paid the outstanding debt. November 30th: Angela pays for the office supplies purchased on November 2nd. Required: Record the transactions on the journal paper provided and no explanations required. Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre 2. Use the following information to prepare the necessary adjusting journal entries for Miller Realty for the year just ended December 31st, 2012: a) An examination of the insurance policies shows that $1,085 has been used during the year. b) A physical count of the office supplies shows that $120 of the original $435 has not been used. c) The annual depreciation on the office equipment is $1,225. d) The December telephone bill had arrived after the trial balance was prepared and the $60 amount was not included in the trial balance. e) A client, who was taking a tour around the world, paid Miller Reality to manage his apartment building for the next year. The contract calls for a $750 monthly fee. Miller Realty started managing the apartment building on December 1st, 2012. The client had paid for six months in advance to Miller Realty. This amount, when originally received, was credited to the Unearned Management Fees account. f) On November 15th, 2012, Miller Realty signed a contract to manage a small office building for $800 a month. This amount is payable to Miller Reality at the end of the contract. g) The four office employees are paid weekly. On December 31st the staff had earned three days of wages. The employees are each paid a wage of $125 a day. Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre 3. Use the following accounts from the Krumbell Wrecking Company to prepare for the year – end of December 31st, 2012: Accounts Payable Accounts Receivable Accumulated Depreciation – Equipment Accumulated Depreciation – Trucks Advertising Expense Cash Copyright Depreciation Expense – Equipment Depreciation Expense – Trucks Equipment Interest Earned Interest Expense Interest Payable Interest Receivable Land Land held for future expansion Long – Term Note Payable – due in 2014 Notes Receivable – due in 2014 Office Supplies Office Supplies Expense Repairs Expense – Trucks Trucks Unearned Wrecking Fees W. Krumbell, Capital W. Krumbell, Withdrawals Wages Expense Wages Payable Wrecking Fees Earned $4,400 $22,000 $5,000 $36,000 $25,000 $11,000 $10,000 $5,000 $9,000 $70,000 $8,000 $12,000 $6,000 $5,000 $20,000 $15,000 $65,000 $30,000 $4,000 $13,000 $8,400 $90,000 $11,000 $133,900 $29,400 $106,000 $5,500 $210,000 Required: Prepare the necessary closing entries. Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre 4) The following are perpetual merchandise transactions for the Richard Company. July 2: Purchased merchandise from the Jay Company for $3,000 under credit terms of 2/15, n/30, FOB shipping point. July 2: Sold merchandise to Terris Co. for $800 under credit terms of 2/10, n/30, FOB shipping point. These goods cost the company $400. July 3: Paid $100 for freight charges on the purchase of July 1. July 8: Sold $1,600 worth of merchandise for cash. These goods cost the company $800. July 9: Purchased merchandise from the Klepis Co. for $2,300 under credit terms of 4/15, n/30, FOB destination. July 12: Received a $200 credit memorandum acknowledging the return of merchandise purchased on July 9. July 12: Received the balance due from the Terris Co. for the credit sale on July 2. July 17: Paid the balance due to the Jay Company for the purchase from July 2. July 19: Sold merchandise to Ultra Co. for $1,250 under credit terms of 2/10, n/30, FOB shipping point. These goods cost the company $625. July 21: Issued a $200 credit memorandum to Ultra Co. for an allowance on goods sold on July 19. July 24: Paid Klepis Co. the balance due from the July 9 purchase. July 29: Received the balance due from Ultra Co. for the sale on July 19. Required: Prepare perpetual merchandising general journal entries for Richard Company. Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre 5) The following information was available to reconcile Eastern Company's book balance of cash with its bank statement balance as of September 30 this year. a. b. c. d. e. f. g. h. After all posting was completed on Sept. 30, the Company's Cash account had a $5,983 debit balance and the bank statement showed a $7,845 balance. Cheques, No. 891 for $306 and No. 897 for $591 were outstanding on the August 31 bank reconciliation. Cheque No. 897 was returned with the September cancelled cheques and cheque No. 891 was not. In comparing the cancelled cheques returned with the bank statement with the entries in the accounting records, it was found that cheque No. 916 for $375 and cheque No. 919 for $150, both drawn in September were not among the cancelled cheques returned with the statement. It was found that cheque No. 903 for the purchase of office equipment was correctly drawn for $619 but was entered in the accounting records as though it were for $691. A credit memorandum enclosed with the bank statement indicated that the bank had collected a $3,000 non-interest-bearing note for us, deducted a $30 collection fee and had credited the remainder to our account. A debit memorandum for $370 listed a $360 NSF cheque plus a $10 NSF charge. The cheque had been received from a customer, Joan Duke and was among the cancelled cheques returned. Also among the cancelled cheques was a $15 debit memorandum for bank services. None of the memoranda had been recorded. The September 30 cash receipts of $1 626, were placed in the bank's night depository after banking hours on that date and their amount did not appear on the bank statement. Required: A) Prepare a bank reconciliation for the company. B) Prepare any necessary entries in the general journal to bring the Company's book balance of cash into conformity with the adjusted balance. Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre A) ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ B) Date General Journal Account Titles and Explanations PR Debit Page ____ Credit Academic Success Centre www.rrc.mb.ca/asc This review has been created by Michael Reimer for the Academic Success Centre