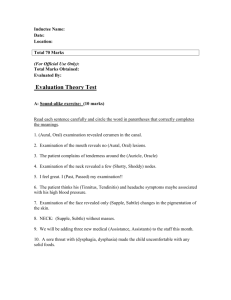

ICAN PE II May 2014: Financial Reporting & Ethics Exam

advertisement