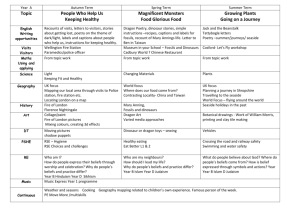

Jan14 Guidance Statement GS 002

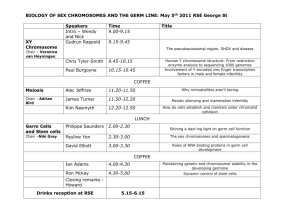

advertisement