adb sme developmentta

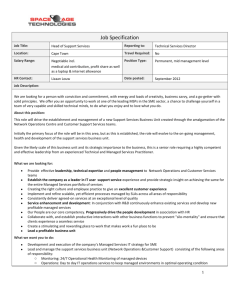

advertisement