Maslovskoe Deposit

advertisement

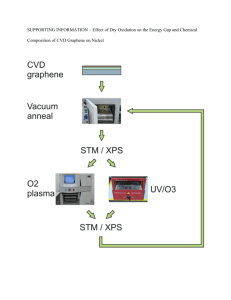

Investor Presentation July 2012 Disclaimer The information contained herein has been prepared using information available to OJSC MMC Norilsk Nickel (“Norilsk Nickel” or “NN”) at the time of preparation of the presentation. External or other factors may have impacted on the business of Norilsk Nickel and the content of this presentation, since its preparation. In addition all relevant information about Norilsk Nickel may not be included in this presentation. No representation or warranty, expressed or implied, is made as to the accuracy, completeness or reliability of the information. Any forward looking information herein has been prepared on the basis of a number of assumptions which may prove to be incorrect. Forward looking statements, by the nature, involve risk and uncertainty and Norilsk Nickel cautions that actual results may differ materially from those expressed or implied in such statements. Reference should be made to the most recent Annual Report for a description of the major risk factors. This presentation should not be relied upon as a recommendation or forecast by Norilsk Nickel, which does not undertake an obligation to release any revision to these statements. This presentation does not constitute or form part of any advertisement of securities, any offer or invitation to sell or issue or any solicitation of any offer to purchase or subscribe for, any shares in Norilsk Nickel, nor shall it or any part of it nor the fact of its presentation or distribution form the basis of, or be relied on in connection with, any contract or investment decision. 1 Norilsk Nickel At a Glance Key highlights Key financials World leader in nickel and palladium with top 5 positions in platinum, cobalt, rhodium and a strong presence in copper US$ mln 2006 2007 2008 2009* 2010* 2011 Revenue 11,923 17,119 13,980 8,542 12,775 14,122 EBITDA 7,736 10,253 5,807 4,198 7,209 7,239 Long-life, low-cost, vertically integrated producer margin (%) 65 60 42 49 56 51 Net income 5,965 5,276 -555 2,504 5,234 3,626 Strong portfolio of growth opportunities both domestically and internationally margin (%) 50 31 nm 29 41 26 Net debt -1,388 4,064 4,445 1,685 -2,608 3,514 Solid financial standing and balance sheet supported by hefty free cash generation ability Net debt/ EBITDA -0.2 0.4 0.8 0.4 -0.4 0.5 Committed to returning capital to shareholders Extensive worldwide operations Kola MMC Source: Note: Company data * Financial results of discontinued operations (OGK-3 and Stillwater) were deconsolidated for 2009-2010 Revenue mix by products & destinations Polar Division Harjavalta NN Corporate Headquarters NN Europe, UK Chita Copper Project Overseas, Switzerland Palladium 15% NN Beijing NN USA NN Shanghai NN Hong Kong Mining operations Development projects Smelting/refining operations Headquarters and sales offices $ 13,297 mln Tati Nickel Nkomati Nickel Black Swan Lake Johnston Cawse Waterloo Source: Norilsk Nickel 2 Norilsk Nickel – Market Positions by Production Norilsk Nickel is a world leader in nickel and palladium production with strong positions in platinum, copper, cobalt and rhodium 5% Aquarius NN Implats 11% 11% Lonmin 21% 1,000 Angloplats (koz) 32% 2,000 0 Copper Source: GFMS, Brook Hunt, CRU, companies’ results announcements, Norilsk Nickel Marketing Department, estimates from company reports Notes: 1 Cobalt metal KGHM NN S.Copper Rio Tinto A.American BHP Xstrata 2,000 11% 9% 1,500 6% 5% 1,000 4% 4% 4% 3% 2% 500 0 Codelco Freeport Murrin NN Xstrata Catanga Sherritt Chambishi 5,000 15% 13% 4,000 12% 11% 10% 3,000 8% 2,000 6% 1,000 0 Jinchuan (tonnes) 4% Northam 12% 6% Aquarius 15% NN Implats 100 Lonmin 23% Angloplats (koz) 5% Cobalt 1 300 35% 0 12% 6% 500 0 Rhodium 200 16% 1,500 (kt) BHP Xstrata Jinchuan Vale 0 NN 100 4% Lonmin 5% Stillwater 7% 3,000 3,500 41% 2,500 NN 8% 200 (koz) 14% Platinum Implats 18% SMM (kt) 300 Palladium Angloplats Nickel 3 Production Update 1Q 2012 production results 2012 production outlook Nickel output increased by 7% q-o-q due to superior performance of Russian divisions (+3%), launch of Lake Johnston in Australia and better loading rate of Harjavalta refinery in Finland Nickel 295-305kt including 235-240kt from Russia Copper 365-370kt including 355-360kt from Russia Palladium 2.7-2.75mln oz incl 2.6.-2.65mln oz from Russia Copper production decreased by 6% q-o-q due to anticipated decline of output at Russian divisions Platinum 675-685koz including 650-660koz from Russia Palladium output was lower by 5% q-o-q as a result of accumulation of unfinished metal at Russian operations Nickel, ‘000 tones 71 76 Copper, ‘000 tones 94 681 88 233 236 237 Palladium, ‘000 ounces Platinum, ‘000 ounces 170 649 166 235240 Russian operations Norilsk Nickel International Source: Company data 4 Russian Operations: Key Investment Priorities 2012 total capital expenditures budget for Russian operations is more than US$ 3 bn 1. Key industrial assets 5. Social obligations Construction, expansion and launch of facilities Reduction of sulfur dioxide emissions and improving utilization of sulfur by Polar Division Continue implementation of the incentive program for acquiring continental property for employees on beneficial terms Shift to roasting-free briquetting of concentrates 2. Provision of reliable energy supply Development of Pelyatkinskoye gas condensate field and construction of new gas and condensate pipe lines Reconstruction of power generation Creation an emergency power supply control system 3. Company’s transport autonomy improvement Construction of proprietary transshipment terminal in Murmansk Continuing of construction of “Arena - Norilsk Sports and Entertainment Center” in Norilsk 6. Other Development of polymetallic deposits in Zabaikalsky Territory Finalization of design of Bystrinsky mining and processing works and go forward with design of Bugdainsky mining and processing works Continue construction of rail road to Bystrinsky mining and processing works, complete design and begin construction of road to Bugdainsky mining and processing works 2011 CAPEX Breakdown 4. Support and development of the mineral resources Geologic prospecting of areas adjacent to operating mines in Taimyr and Kola Peninsula Source: Norilsk Nickel data 5 Financial Results Solid Financial Performance Strong financial performance driven by efficient cost management Revenue Source: Note: EBITDA EBITDA margin Company data * Financial results of discontinued operations (OGK-3 and Stillwater) were deconsolidated for 2009-2010 7 EBITDA Analysis Adjusted EBITDA increased up to US$ 7,239 mln in 2011 Growth of cost metal sales largely explained by: − absolute growth of labor expenses − increase of cost of raw materials bought from 3d parties due to growth of purchased volumes Export customs duties mostly on nickel and copper increased by US$ 469 mln accounting for major part of growth of SG&A expenses Depreciation & amortization charge amounted to US$ 761mln (-5% y-o-y) CAPEX amounted to US$ 2,232 mln Adjusted EBITDA bridge, US$ mln Source: Company data 8 Costs Analysis In 2011 cash costs increased by US$ 629 mln mostly due to following: − US$ 307 mln – growth of purchased semiproducts to enhance loading rates at Company’s plants − US$ 88 mln – spike of social security tax rate (from 26% in 2010 up to 34% in 2011), growth of wages Proprietary fleet and improvements in logistics contributed to decrease in transportation expense by US$ 22 mln 3d parties services cost decreased by 9% due to shift to in-house services instead of third party services Bridge of cash costs1, US$ mln Source: Note: Company data 1 Before netting by-product sales for metal divisions 9 Debt & Liquidity Position As of 2011 year-end, total debt equaled US$ 5.1 bn, on back of US$ 1.6 bn cash pile Erosion of cash pile in 2011 was due to buy backs implemented in order to return capital to shareholders Current level of leverage below 0.5x Net debt/EBITDA is comfortable Recommended annual dividend for pay-out in 2012 is US$ 6.2 per share Cash & debt dynamics, US$ mln Source: Company data 10 Strategic Update Strategy Goals … allowing the management to move the Company to a strategically new level . 1 Become a TOP-5 major international miner by market capitalization and EBITDA 2 Implement upside potential through organic and M&A growth at world class deposits in regions of core competitive advantage 3 Ensure growth of production while maintaining EBITDA margin for current assets and obtaining EBITDA margin similar to top-5 peers at new projects with average margin of 50% at mid cycle prices 4 Ensure stability and security of core Russian operations by warranting infrastructure and services’ costs at levels competitive to any third party suppliers 5 Safeguard Company's key competitive advantage as the lowest cash-cost nickel producer 6 Diversify through expanding in Russia and internationally at assets that either industry Tier 1 7 assets (first cost quartile, first quartile in terms of annual production), or meet Company’s investment goals Distribute capital to shareholders in amounts exceeding Company's investment and funding requirements while preserving robust balance sheet Source: Norilsk Nickel Strategy 12 Key Strategic Pillars Growth of output in .Russia and Finland (000s t) Nickel +19% 287 300 342 150 0 2011 2025 Copper +49% (000s t) 546 500 363 250 0 2011 2 Product diversification 3 International expansion Adding new metals to current basket: iron ore, coal, molybdenum, etc Strong existing footprint forming a firm base for future development Lowering revenue volatility and diversifying revenue mix International expansion as function of product diversification (Australia, Indonesia, etc.) Creating additional shareholder value through implementation of new projects International growth to be driven by high return projects 2025 PGMs +41% 200 (tonnes) 1 150 106 100 0 2011 2025 Source: Norilsk Nickel Strategy 13 Metal Production by Russian Divisions & NNH Copper production outlook, kt Nickel production outlook, kt 400 600 350 550 300 500 250 450 200 400 150 350 100 2011 2012 2013 2014 2015 2016 2017 2018 Russian Divisions own production 2019 2020 2021 2022 NNH production 2023 2024 2025 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Total Russian Divisions own production PGMs production outlook, t Chita project Growth of metal output will be achieved through: 150 140 — growth of mined ore tonnages at existing mines and brownfield projects 130 120 — launch of Chita Project (copper) 110 100 — development of Maslovskoe deposit (PGMs) 90 — improvements of enrichment and smelting technologies 80 70 — efficient smelting and refining capacity loading of Polar Division and Kola MMC 60 50 2011 300 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Russian Divisions own production Source: Norilsk Nickel Strategy 14 Maslovskoe Deposit: Emergence of New Mining District Mineral resource base of Maslovskoe deposit comprises 215 mln tonnes of ore Map of Maslovskoe deposit Norilsk-1 deposit Construction includes: — mine – over 7 mln tonnes ore pa — enrichment plant – 6 mln tonnes ore pa — tailings’ infrastructure — other infrastructure Total construction period including additional exploration works – ca 12 years Capital budget – ca $2.0 bln Potential for partial use of existing infrastructure of Zapolyarny mine In-depth ore-bearing intrusion contour Exploration and prospecting wells Maslovskoe deposit Mineral resource base of Maslovskoe deposit Reserves under categories С1 +С2 Metal grades Palladium (‘000 ounces) 35 462 4.56 g/t Platinum (‘000 ounces) 12 475 1.78 g/t 1 122 0.51 % Nickel (‘000 tonnes) 728 0.33 % Cobalt (‘000 tonnes) 34 0.016 % 1 318 0.19 g/t Copper (‘000 tonnes) Gold (‘000 ounces) Source: Norilsk Nickel Strategy 15 Maslovskoe Deposit: Delivering Growth of Production Development timeline 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Mine Enrichment plant Tailings pit Geological exploration Feasibility study Construction documentation Mine construction Construction of concentrator Construction of tailings dump Commissioning & ramp-up Projected metals’ output Nickel, ‘000 tonnes Copper, ‘000 tonnes PGMs, tonnes Source: Norilsk Nickel Strategy 16 Chita Project: Development of World Class Mining District Chita project is being implemented as public private partnership – Norilsk Nickel is responsible for development of deposits, government – for railroad construction Partnership Passport after amendments envisages 80.4 bln RUR Norilsk Nickel’s investments, including 8.06 bln RUR railroad construction, as well as 72.3 bln RUR deposits’ development and construction of plants Railroad to be commissioned by 2011 year-end, construction works have started NPV – ca 7bn RUR, discounted payback period – less than 15 years Norilsk Nickel’s capex under Chita project, mln RUR1 Preparing for full scale construction works in region… 17,247 13,356 13,439 8,726 6,706 2012 2013 Bystrinsky plant 2014 Bugdainsky plant 2015 2016 Railroad construction Source: Norilsk Nickel Strategy Notes: 1 Not including VAT 17 Chita Project: Snapshot on Deposits Mineral reserves of Bystrinskoe deposit under categories B+С1+C2 – 292 mln tonnes of ore, including: — copper 2 073k tonnes @ 0.71% — gold 236 tonnes @ 0.81 g/t — iron ore 68 mln tonnes @ 23.2% — silver 1.1k tonnes @ 3.63% Map of south-eastern part of Zabaikalsk Region Mineral reserves of Bugdainskoe deposit under categories B+С1+C2 – 813 mln tonnes of ore, including: — molybdenum 600k tonnes @ 0.08% — gold 11 tonnes @ 0.28 g/t — silver 194 tonnes @ 4.96 g/t Estimated annual production: — ore 26 mln tonnes (16 mln t – Bugdainskoe, 10 mln t – Bystrinskoe) — copper in concentrate 66k tonnes — molybdenum in concentrate 12k tonnes — iron ore concentrate @ 61% 2 136k tonnes — gold 7 tonnes Mine life – over 30 years Source: Norilsk Nickel Strategy 18 Chita Project: Implementation Timeline In 2H 2011 active construction works have started at Bystrinsky plant Comprehensive engineering roadmap is being finalised for Bugdainsky plant with construction works to be launched in 2012 Bystrinsky mining and enrichment plant to be commissioned in 2015 Bugdainsky mining and enrichment plant to be commissioned in 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Bystrinsky plant Bugdainsky plant Railroad construction Electricity grids Exploration works Prefeasibility study Feasibility study Construction Commissioning Source: Norilsk Nickel Strategy 19 Key Infrastructure Development Areas Gas supplies Ramp-up of Pelyatkinskoe gas condensate field to secure energy raw materials supplies to Norilsk region Construct gas condensate pipeline from Pelyatka and Dudinka Planned investments till 2025 – US$ 4 billion Transport Construct Arctic sea fleet to enhance transport independence Upgrade sea and river fleet Build logistics hub in Murmansk region Build fuel terminal in Arkhangelsk for proprietary ice breaking tanker Planned investments till 2025 – US$ 3.2 billion Auxiliary infrastructure Utilities Modernise facilities and equipment of supporting subsidiaries: Polar Construction Company, Norilsk Support Facility, Norilsknikelremont, Norilsk Industrial Transport, etc. Planned investments till 2025 – US$ 5.7 billion Modernise generating facilities in Norilsk region (Thermal Power Plants – 1, 2, 3 and UstKhantayskaya Hydro Power Plant) Upgrade electricity grid to increase throughput from Kureyskaya and Ust-Khantayskaya Hydro Power Plants Planned investments till 2025 – US$ 2.1 billion Source: Norilsk Nickel Strategy . 20 Metal Markets Nickel Market Outlook 3 key areas to watch out: Level of Chinese nickel pig iron production: Nickel supply, ‘000t - potential additions of new pig iron capacity in next 12 years with lower operating costs - appreciation of RMB against US Dollar and rising costs for energy, labor and transport to push high cost operations to $9-12/lb in the medium term - Indonesia’s taxes on raw materials exports and introduction of export ban starting from 2014 Ramp-up of new big greenfield projects: - Looming oversupply as a result of successful commissioning of up to 300ktpa additional capacity Nickel consumption, ‘000t - Strong track record of persistent delays and technical failures, reconfirmed by recent forcemajeure at Vale’s flagship Goro project Demand outlook: - Macroeconomic instability is taking its toll - Likely pick-up in stainless steel production in US - Continuing growth in global consumption from nonstainless steel applications, namely non-ferrous alloys (superalloys) in aerospace sector due to increase in aircraft build rates Source: Deutsche Bank, Macquarie research 22 NPI: Key Swinging Factor in Nickel Market Equation NPI emerged as response to nickel price escalation in mid2000s and is currently produced and consumed by China only Cash cost composition BF vs EAF NPI is high cost production due to significant energy intensity of process and transportation costs for ore sourced from Philippines and Indonesia Key components of cash costs for BF – coking coal (58%), ore (15%), transportation (13%), for EAF – power (30%), ore (26%), coking coal (20%) and transportation (17%) 2011 nickel industry cost curve Brook Hunt estimates that at price level $18.3k/t Ni, production of 110kt of Ni in form of NPI is uneconomic and cash burning Announced export taxes (25% in 2012, 50% in 2013) to be followed with export ban on nickel ore from Indonesia in 2014 (53% of Chinese ore import in 2011) provide efficient long-term floor to nickel price Nickel ore imports to China Source: Brook Hunt, HSBC 23 Palladium Market Balance Primary palladium consumption exceeds its production due to a number of fundamental factors Global supply & demand balance Gap in consumption and production has been mitigated by deliveries from the Russian state stockpile In recent years, oversupply was absorbed by strong emergence of investment demand Since 2011, no influence on the market is expected to come from deliveries of Russian palladium reserves In long run, consumption growth rate should continue to exceed production growth rate and move palladium market into sustained deficit Pt to Pd ratio in European autocats in 2009-2011 Palladium consumption by industry & regions Chemicals 5% Electronics 20% Dental 9% Jewelry 8% Other 1% China 16% North America 24% Other 18% Autocats 57% Japan 19% EU 23% Source: Johnson Matthew, Renaissance Capital, Deutsche Bank, HSBC, Macquarie research 24 Palladium Demand: Consumption Palladium consumption is projected to grow driven by the auto industry (66% of gross palladium demand): US car sales are holding up well… continuing growth of palladium demand in autocats as EM and US car markets have favorable outlook full implementation of Euro-V in light duty vehicles return to normal mode of operation by Japanese car industry post devastating earthquake in March 2011 continued growth of palladium content in diesel and heavy trucks engines growth of car market in China, mostly represented by gasoline-powered vehicles whose catalysts tend to be more palladium intensive (70% of all light vehicles production globally) Wider recognition of palladium as a metal of choice by high-end jewellery … and car ownership in China is yet to catch up Car ownership per 1,000 people (units) end-user demand should continue to grow strongly over the medium term due to tighter emissions regulations Modest increase in palladium demand for electronics, chemical, and glass industries Source: Norilsk Nickel Marketing Department, VTB Research, Renaissance Capital, Deutsche Bank, Macquarie research 25 Investments: Source For Additional Growth In Palladium Demand In 2010-2011 number of palladium ETPs increased from 2 to 9 New surge of investor interest to palladium After reaching historic highs in Jan 2011 palladium ETP holdings declined to 1.6 moz by year-end Despite this, fundamentals for palladium remain robust – stagnating supply, evaporation of sales from Russian state stockpile vs continuing growth of car production especially in EM Net long positions have recently bounced sharply due to combination of factors – short covering and new inflows Since beginning of 2012, palladium ETF demand has already partially recovered and is expected to continue growing Bounce back of Nymex speculative net longs In long run price gap between palladium and platinum is envisaged to further narrow Source: Norilsk Nickel Marketing Department, Bloomberg, VTB Capital 26 IR Contact Details Alexey Ivanov Investor Relations MMC Norilsk Nickel Sergey Belyakov Investor Relations MMC Norilsk Nickel Tel: +7 495 786 83 20 Fax: +7 495 797 86 13 e-mail: ivanovavl@nornik.ru, belyakovSS@nornik.ru, ir@nornik.ru 22, Voznesensky Pereulok, Moscow, Russia, 125993 27