system enhancement proposal to prevent dramatic

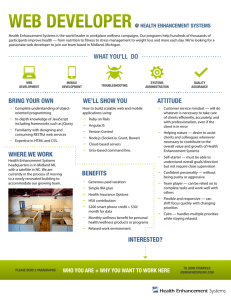

advertisement

Banking & Securities | January 14, 2011 SYSTEM ENHANCEMENT PROPOSAL TO PREVENT DRAMATIC MARKET MOVEMENT ON OPTION EXPIRY On January 11, 2011, the Financial Services Commission ("FSC"), Financial Supervisory Service ("FSS"), Korea Exchange ("KRX") and Korea Financial Investment Association ("KOFIA") issued a joint press release announcing the system enhancement plan proposal prepared by the FSC (the "Enhancement Proposal") to prevent the reoccurrence of drastic market movement similar to the incident on November 11, 2010. The major points of the Enhancement Proposal are summarized below. The press release states that the plan is to implement a large portion of the Enhancement Proposal by amending the relevant KRX regulations in January. However, we understand that the relevant agencies, including the FSC, FSS, KRX and KOFIA, are currently reviewing the Enhancement Proposal and the actual scope of the Enhancement Proposal that will be implemented remains to be decided. 1. Post-Trading Margin System Under the current regulations, a KRX member has the discretion to determine which qualified institutional investor will be subject to the post-trading margin requirement and, in practice, almost all qualified institutional investors have been designated as being subject to the post-trading margin requirement. The Enhancement Proposal imposes pre-trading margin requirement on qualified institutional investors with total assets of less than KRW 500 billion or financial investment companies that have less than KRW 1 trillion of collective investment assets under management, subject to an exception that if the risk management department of a KRX member determines that there will be no settlement risk arising from requiring post-trading deposit, post-margin may be allowed. 2. Daily Order Volume Limit Currently, the limit of orders placed by customers can be determined by the KRX members at their discretion. The Enhancement Proposal contemplates a best practice guideline to be prepared by KOFIA and the daily order volume limit for each customer will be established pursuant to this guideline. KRX members are to consider total assets, amount of assets under management, credit rating and financial condition of the customer in determining its daily order volume limit and institutional investors subject to the post-trading margin requirement will be permitted to trade in an amount up to 10 times their margins within its daily order volume limit. 3. Random End System The current regulations state that the closing auction period will be extended by up to 5 minutes if the difference between the highest (lowest) expected execution price and the expected closing price for a particular stock during the last 5 minutes prior to market close (i.e. 14:55~15:00) amounts to ±5%. Under the Enhancement Proposal, the closing auction period will be extended by up to 5 minutes if the expected closing price is ±3% or more of the immediately preceding price (14:50). No revision to the random end system for the opening of the market is being considered. 4. Program Trading Under the current regulations, it is not possible to engage in program trading after the prenotification deadline (14:45) on expiry dates. Under the Enhancement Proposal, if the amount of sell (buy) order exceeds 75% of the amount of buy (sell) order reported by the pre-notification deadline (i.e., 14:45) and the difference between buy and sell orders is larger than KRW 500 billion, additional price quotation to eliminate the difference between the two sides will be permitted, subject to the caveat that the bid quotation may not exceed the immediately preceding price and the ask quotation must be not less than the immediately preceding price in order to prevent the index from shifting into the opposite direction as a result of the additional program trading. 5. Position (Unsettled Contracts) Limit The net open position limit (5,000 contracts for individuals and 7,500 contracts for institutions) applies only to speculative trading of KOSPI200 futures. The Enhancement Proposal imposes the position limit with respect to KOSPI200 option trades and hedging and arbitrage trades of KOSPI200 futures as well. On expiry dates, the aggregate number of futures and options contracts (whether speculative, hedging or arbitrage trade) will be limited to a maximum of 10,000 contracts for institutions (equivalent to KRW 1.3 trillion in terms of cash position). The current limit of 5,000 contracts will be maintained for individual investors. On any other date, the position limit for unsettled contracts will be 10,000 contracts but will only be applicable to speculative trades of futures or options. 6. Reporting Requirement Under the FSCMA, the requirement to report large holding and changes in holding is applicable only to certain commodity futures (gold and lean hogs futures). The Enhancement Proposal requires reporting of large holding and changes in holding to be applicable to KOSPI200 futures and options as well. If you have any questions regarding this issue, please contact Chang Hyeon Ko chko@kimchang.com +82-2-3703-1003 Sup Joon Byun sjbyun@kimchang.com +82-2-3703-1289 or any of your regular contacts at Kim & Chang. Seyang Building, 223 Naeja-dong, Jongno-gu, Seoul 110-720, Korea Tel: +82-2-3703-1114 Fax: +82-2-737-9091~3 www.kimchang.com E-mail: lawkim@kimchang.com This e-mail service is provided for general informational purposes only and should not be considered a legal opinion of the firm nor relied upon in lieu of specific advice. If this service should be directed to one or more of your colleagues instead of or in addition to you, please let us know by (return) e-mail at finance_news@kimchang.com. [UNSUBSCRIBE] If you would prefer not to receive this e-mail service, please click here. Legal Updates | Banking & Securities