Year-end tax

planning toolkit

Year-ending 30 June 2015

May 2015

The contents of this document are for general information only and do not consider your personal circumstances or situation.

Furthermore, this document does not contain a detailed or complete explanation of the law, as provisions or explanations have been

summarised and simplified. This document is not intended to be used, and should not be used, as professional advice.

If you have any questions or are interested in considering any item contained in this document, please consult with your Pitcher Partners

representative to obtain advice in relation to your proposed transaction. Pitcher Partners disclaims all liability for any loss or damage

arising from reliance upon any information contained in this document.

© Pitcher Partners Advisors Pty Ltd, May 2015. All rights reserved. Pitcher Partners is an association of independent firms. Liability limited

by a scheme approved under Professional Standards Legislation.

Contents

Pitcher Partners – Year-end tax planning toolkit

This page is intentionally left blank.

5

Introduction

Welcome to the Pitcher Partners

30 June 2015 year-end tax planning toolkit.

Year-end tax planning

As the financial year draws to a close, it is time to start thinking about whether your year-end tax planning is in order.

Tax planning not only requires consideration of income and deductions for the year, but also requires you to consider

whether your compliance requirements have been met. This includes whether appropriate elections are made within

the time requirements, the preparation and maintenance of appropriate documentation (such as trust minutes) and

forward planning of your tax affairs. Our tax toolkit is here to assist you in this process.

Interactive PDF

This document has been created as an interactive PDF. This means you can check boxes, record notes and submit this

back to Pitcher Partners for discussion.

What this document does

This document provides an outline of the tax issues that should be considered before year-end. This document has

been updated for new developments and (where relevant) the 2015/16 Budget announcements. This toolkit is

specifically tailored to address the taxation concerns of taxpayers in the middle market and includes checklists covering

both corporate taxpayers and private groups.

What this document doesn’t do

This toolkit is not intended to be a comprehensive document covering all taxation issues that require consideration.

This is because every taxpayer’s circumstances are unique. Instead, this document is only intended to provide you with

a broad range of issues for consideration before the end of the financial year.

Take care about tax planning

Tax planning may often result in a taxpayer paying less income tax in a given income year. It is noted that the definition

of a tax benefit under the tax anti-avoidance provisions is broad enough to cover a deferral of income tax. Therefore

the tax anti-avoidance provisions must always be considered as part of your year-end tax planning. Given that the

general anti-avoidance provisions have recently been expanded, taxpayers must always consider these provisions. We

have included a number of anti-avoidance or integrity provisions for your consideration in Chapter 13 of this toolkit.

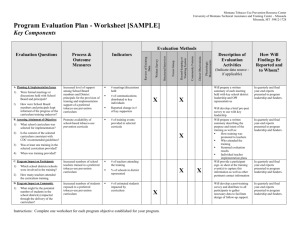

How will you find what you are looking for?

To assist you in quickly locating the area of tax that is relevant to you, this document has been divided into chapters.

The chapters either relate to a specific type of taxpayer (e.g. a company or trust) or to a specific tax topic (e.g. capital

gains tax). Furthermore, Chapter 2 of this toolkit provides a summary of all of the questions contained in Chapters 3 to

13 of this toolkit. The following diagram provides a simplified outline of how this toolkit is arranged.

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

6

SUMMARISED YEAR-END PLANNING CHECKLIST

[Chapter 2]

Income

[Chapter 3]

Deductions

[Chapter 4]

CORE SECTIONS

Individuals

Trusts

Companies

Partnerships

[Chapter 5]

[Chapter 6]

[Chapter 7]

[Chapter 8]

ENTITY SPECIFIC QUESTIONS

Capital gains

tax

[Chapter 9]

Finance

issues

[Chapter 10]

International

tax

Super

& GST

Integrity

provisions

[Chapter 11]

[Chapter 12]

[Chapter 13]

SPECIALIST TOPIC QUESTIONS

We trust you will find this document useful when considering your 30 June 2015 tax

planning. Please talk to your Pitcher Partners representative if you would like more

information or clarification of some of the issues raised in this document.

Disclaimer

The contents of this document are for general information only and do not consider your personal circumstances or

situation. Furthermore, this document does not contain a detailed or complete explanation of the law, as provisions or

explanations have been summarised and simplified. This document is not intended to be used, and should not be used,

as professional advice.

If you have any questions or are interested in considering any item contained in this document, please consult with

your Pitcher Partners representative to obtain advice in relation to your proposed transaction. Pitcher Partners

disclaims all liability for any loss or damage arising from reliance upon any information contained in this document.

© Pitcher Partners Advisors Pty Ltd, May 2015. All rights reserved. Pitcher Partners is an association of independent

firms. Liability limited by a scheme approved under Professional Standards Legislation.

Pitcher Partners – Year-end tax planning toolkit

7

Summary checklist

Enter your details

If you are completing this document as a checklist and wish to submit this back to your Pitcher Partners representative,

please complete your details in the following check boxes.

Enter entity name

Enter contact details

Background

The following simplified checklist contains a high level summary of the planning items that are covered in more detail

in this toolkit. We have provided a reference link to the detailed discussion of each of these tax planning items.

We recommend that you work your way through this summarised checklist at first instance. Where items appear

relevant, those items should be “tagged” using the check boxes. The detailed item can then be reviewed in more detail

to determine whether the planning opportunity is relevant to your circumstances.

Income

This section deals specifically with the treatment of income that you may have received or derived during the income

year and whether such income should be attributed to the 2015 income year or deferred to the 2016 income year

and subsequent years.

Business income — If you derive business sales income, you may be able defer sales invoicing or bring forward

sales invoicing (in appropriate circumstances). If you are a small business entity, such income could be taxable at

the lower tax rate (28.5% for a company, and a 5% discount for an individual capped at $1,000) in the 30 June 2016

year. — Chapter 3B

Accrued / unearned income — If you record accrued or unearned income in your accounts, you may be able to

defer recognition of that income for tax purposes. — Chapter 3C

Trade incentives — Discounts and other incentives on trading stock or services are typically brought to account in

a different income year for tax as compared to accounting. — Chapters 3D and 3E

Disputed amounts — It may be possible to defer the recognition of disputed income amounts until you have

settled the dispute. — Chapter 3F

Construction contracts — Where you enter into construction contracts that are not your trading stock, you may be able

to utilise one of the different methods of income recognition allowed by the ATO for tax purposes. — Chapter 3G

Insurance proceeds — If you received insurance proceeds, you should examine whether the proceeds are in fact

assessable and when you need to bring the proceeds to account for tax purposes. — Chapter 3H

Grants, bounties, subsidies — If you receive grants, bounties or subsidies, you should examine whether they are in

fact assessable and when you need to bring the proceeds to account for tax purposes. — Chapter 3I

Disaster relief money — Exemptions may be available for disaster relief money received. — Chapter 3J

Interest income — For interest received around year-end, examine the timing of interest income closely for tax

purposes as interest is typically assessable on a receipts basis. — Chapter 3K

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

Make sure you also take into account franking credits in your tax planning. — Chapter 3L

Shareholders and their associates/former associates – If you are a shareholder [an associate or former associate

of a shareholder] in a private company and have received a loan from, had an expense paid by or undertaken any

other transaction with that company or a related trust during the year then you may be deemed to have received a

taxable dividend from this company. — Chapter 7E

Retail premiums — If you received a retail premium as a non-participating shareholder during the year, this

amount may be treated as an unfranked dividend. — Chapter 3M

Trust distributions — Year-end tax planning should take into account the expected tax distribution that you may

receive from trusts (rather than the expected accounting / cash distribution amount). — Chapter 3N

Rental / leasing income — Consider whether your rental income activities are passive (and therefore on a cash

basis) or constitute a business (and therefore possibly on an accruals basis). This can have an effect on the timing

of income brought to account. — Chapter 3O

Foreign taxes — If you received foreign income subject to foreign tax, make sure you claim your foreign tax offsets

and ensure you gross-up the foreign income for planning estimates. — Chapter 3P

Non-assessable amounts — Consider whether any income you have received this year can be treated as nonassessable. — Chapter 3Q

Personal services income — If you provides services through a trust or company, there is a risk that the income

could be your personal services income and attributed to you directly. You should consider the personal services

income rules appropriately before year-end. — Chapter 3R

Extraordinary items — If you have received extraordinary (or significant) receipts during the year, these items

must be examined closely from a tax perspective. — Chapter 3S

Notes — Review notes taken in relation to the chapter. — Chapter 3T

Deductions

This section deals specifically with the expenses that you may have incurred during the income year and whether such

expenses can result in a deduction for the 2015 income year or need to be deferred to the 2016 income year and

subsequent years.

General rules — Consider all material expense items to determine whether there is any risk that certain items may

not be deductible (e.g. they are of a capital nature). You should ensure an appropriate review of all such expenses

to determine their deductibility and any opportunities that may exist for such expenses. — Chapter 4A

Capital expenditure — If you have identified non-deductible capital expenditure, you should consider your ability

to claim a blackhole deduction over five years or (alternatively) include the costs in your cost base of an asset. The

Budget announced that an immediate deduction may be available for a range of professional expenses incurred by

a start-up business from 1 July 2015. — Chapter 4B

Bad debt deductions — If you have doubtful debts, you can possibly bring forward deductions if you are able to

write those amounts off as bad debts for tax purposes before 30 June 2015. — Chapter 4C

Trading stock valuation — Where you hold trading stock, you can choose to value trading stock at year-end at

cost, market selling value, replacement value or obsolete stock value. This can have the effect of either bringing

forward deductions or shifting the amounts to the following year. — Chapter 4D

Depreciating assets (all entities) — If you have depreciating assets, there are a number of options that allow you

to accelerate depreciation claims for the current year. — Chapter 4E

Pitcher Partners – Year-end tax planning toolkit

8

Dividend income — Dividends accrued may not be assessable at year-end if they are only declared by not paid.

9

Depreciating assets (small business entities) — If you have depreciating assets and you are a small business entity,

further tax incentives can apply to provide a higher deduction claim for the current year. — Chapter 4F

Project pools — If you have identified non-deductible capital expenditure, you should consider your ability to claim

the capital expenditure as a project pool cost over the life of the project. — Chapter 4G

Internal labour costs — Where you internally construct assets, you may be required to capitalise labour costs for

tax purposes. This may defer deductions claimed (i.e. over the depreciable life of the asset). — Chapter 4H

Employee bonuses — Consider whether your accrued employee bonus plan for 30 June 2015 can be treated as

deductible for the current year by changing aspects (e.g. approval timing) of your plan. — Chapter 4I

Exempt income deductions — If you derive exempt type income, a number of your expenses are likely to be nondeductible. This should be reviewed to determine the correct position. — Chapter 4J

Foreign exchange — Consider whether the (tax) foreign exchange provisions will give rise to significant

adjustments at year-end. Consider if there are any opportunities to reduce compliance under the provisions by

making certain elections before year-end. — Chapter 4K

Gifts and donations — Review your deductions (or proposed deductions) for gifts and donations and their impact

on your tax losses. — Chapter 4L

Prepaid expenditure — There are still some opportunities for some prepayments to be fully deductible upfront if

they: are made by individuals and small businesses; or represent excluded expenditure for all other taxpayers.

— Chapter 4N

Service fees — If there are management fees and service fees charged between your group entities, you should

ensure all paper work or agreements are put into effect before year-end and that the fees are commercially

justifiable. The ATO has been targeting these items in recent years. — Chapter 4O

Capital support payments — The ATO takes the view that capital support payments made by a parent to its

subsidiary will be on capital account and non-deductible. Accordingly, consider whether it is better to structure the

arrangement as an appropriate arm’s length service fee. — Chapter 4P

Trade incentives — if you provide discounts and trade incentives on your sales, these items are generally

deductible at a different time for tax as compared to accounting. — Chapters 4R and 4S

Tax losses for infrastructure projects — If you are involved in large scale infrastructure projects, there are

provisions which may allow certain entities to recoup early stage losses for approved projects. — Chapter 4T

Retirement villages – potential retrospective opportunity – The ATO agreed to a changed view that could allow a

deduction for payments by retirement village operators to outgoing residents for 30 June 2015 and prior years.

– Chapter 4U

Notes — Review notes taken in relation to the chapter. — Chapter 4V

Individuals

This section considers specific year-end taxation issues associated with individuals.

Tax rates — The tax rates for 30 June 2015 will be higher than for 30 June 2014 (due to the increase in the

Medicare Levy to fund Disability Care of 0.5% and the Temporary Budget Repair Levy of 2.0% for income over

$180,000 applying from 1 July 2014). The top marginal tax rate is therefore 49%. For an individual resident

taxpayer, $133,920 of taxable income (which equates to a fully franked dividend of $93,744) provides an average

tax rate of 30% for 30 June 2015. — Chapter 5A

Medicare levy — As part of your ordinary tax planning, understand your Medicare levy and consider any

opportunities that may reduce this levy. — Chapter 5A

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

lodgement of your income tax return. This can either increase or decrease the total amount payable on lodgement

of your individual return. — Chapter 5B

Rebates and offsets — A large number of different rebates and offsets are available to reduce taxable income. You

should consider the availability of these items for the current year. — Chapter 5C

Work expenses and substantiation — Ensure you have documentation to substantiate claims of $300 or more.

You should understand what claims are covered by the substantiation requirements. — Chapter 5D

Work expenses under ATO target — The ATO are targeting work expense claims for: (a) overnight travel; (b)

motor vehicle expenses for travelling between home and work; and (c) the work related proportion of use for

computers, phones and other electronic devices. They are also targeting amounts reported under the Taxable

Payments Annual Report in the construction industry and internet sales income that is not being disclosed.

— Chapter 5E

Work related car expenses — Ensure that you record your odometer readings for 30 June 2015 and consider a logbook for your car (to maximise options for car expense deductions). — Chapter 5F

Work related travel expenses — Examine whether any additional travel (local, interstate, overseas) expenses are

deductible for the 30 June 2015 income year and ensure you have satisfied the substantiation requirements.

— Chapter 5G

Work related clothing, laundry and cleaning — Consider whether you can claim a deduction for the cost of buying

or cleaning: occupation specific or protective clothes; or unique, distinctive uniforms. — Chapter 5H

Other work related expenses — Consider the deductibility of other work related expenses including home office

expenses, occupancy expenses, work related development and support, tools and equipment and overtime meal

allowance expenses. — Chapter 5I

Specific industries — If you work in a specific industry, you should consider the ATO’s guide on work related

expenses that applies to that industry. — Chapter 5J

Self-education expenses — Review whether education expenses are deductible and apply the non-deductible

threshold of $250 to appropriate expenses. — Chapter 5K

Work related expenses you cannot claim — Review whether there are specific rules that will deny a deduction for

your work related expenses. — Chapter 5L

Prepaid expenses — Consider whether you can prepay certain expenses before 30 June 2015 to bring forward

deductions to the current income year. — Chapter 5M

Salary sacrifice — Ensure that you have appropriately considered the requirements for an effective salary sacrifice

arrangement (e.g. into superannuation). — Chapter 5N

Employee share schemes — If you have received shares and/or options/rights as an employee, you need to consider

the employee share scheme provisions and whether an amount will be assessable to you. — Chapter 5O

Foreign employment income — You will need to review the income tax and FBT consequences where you have

performed foreign employment. — Chapter 5P

Non-commercial losses — If you carry on business in your own name, losses related to the business activities may

not be deductible under the non-commercial loss provisions. — Chapter 5Q

Living away from home allowance (LAFHA) changes — If you have received a LAFHA during the 30 June 2015

income year, you should consider a review of these amounts. — Chapter 5S

Notes — Review notes taken in relation to the chapter. — Chapter 5T

Pitcher Partners – Year-end tax planning toolkit

10

Private health insurance rebate — Please note that the private health insurance rebate is now adjusted for on the

11

Trusts

This section considers specific year-end taxation issues associated with trusts.

ATO compliance activity — The ATO is continuing its trust compliance activities during the current income year.

You should therefore carefully review all of your trust requirements before year-end. — Chapter 6A

Trustee tax rate — To avoid a trustee tax rate of 49%, ensure that you make beneficiaries entitled to all of the

income of the trust before 30 June 2015 (or an earlier time if required by the trust deed). — Chapter 6B

Trustee resolutions — Distribution resolutions or distribution plans must be completed before year-end (or earlier

if required by the trust deed) and evidenced. — Chapter 6C

Meaning of income — Review the trust deed to determine how income is defined to ensure the distribution

resolutions are effective in distributing all trust income (to avoid a trustee assessment). You will also be required to

disclose income per your deed in your 30 June 2015 tax return. — Chapter 6D

Distribution of timing differences (general) — The ATO has been focusing compliance activity on taxpayers taking

advantage of timing differences between a trust’s net income for tax purposes and its income for trust purposes by

using a corporate beneficiary to avoid top-up tax in the hands of individuals. Care needs to be taken if you expect

taxable income to exceed accounting profit. — Chapter 6E

Distribution of timing differences (Unit trusts) — As beneficiaries of unit trusts can be taxable on a distribution of

timing differences, consider whether it may be possible to align tax and accounting by defining income as “taxable

income” for the current income year. — Chapter 6F

Trust to company distributions — Ensure that you have appropriately considered Division 7A where your trust

distributes (directly or indirectly) to a corporate beneficiary — Chapters 6G and 7E

Trust to trust distributions — Consider the rule against perpetuities to ensure that trust to trust distributions are

not invalidated. — Chapter 6H

Eligible beneficiaries — Make sure that the beneficiaries you have identified are eligible under the trust deed

before finalising your trust resolutions. — Chapter 6I

Trust streaming — Legislation only specifically allows streaming for capital gains or franked dividends. You should

ensure you comply with these rules if you wish to stream for the current year. — Chapter 6J

Capital gains versus revenue gains — If you have derived substantial capital gains, you need to consider the ATO’s

ruling that may seek to treat those gains on revenue account (and not subject to a 50% discount). — Chapter 6K

Trust losses and bad debts — Trust losses and bad debt deductions may be denied if a family trust election is not

made, or if the trust loss provisions are not otherwise satisfied. Consider these rules if you are expecting to make a

tax loss or if you are recouping tax losses. — Chapter 6L

Franking credits — If you receive dividends through the trust, franking credits may not flow through the trust

unless the trust makes a family trust election. — Chapter 6M

Injection of income — If there is more than one trust in your group, trust to trust distributions to take advantage

of losses in a trust may create taxation issues if a family trust election is not made. — Chapter 6N

Interest expenses and distributions — Interest deductions may be denied where finance is used to fund

distributions to beneficiaries. You may consider alternatives to help protect interest deductions. — Chapter 6O

Family trust elections — Critically review your family trust election requirements for the year to ensure you

protect bad debts, carry forward losses and franking credit flow-through. Make sure all new trusts have made an

election to be within the family group. — Chapter 6P

TFN withholding — The trustee must obtain TFNs from beneficiaries before 30 June 2015, which have not previously

been reported, to avoid penalties. This needs to be reported to the ATO by 31 July 2015. — Chapter 6Q

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

appropriate for the type of distribution resolutions that you now want to make / may want to make in the future.

— Chapter 6R

Superannuation deductions — Consider carefully the deductibility of payments for superannuation contributions

made for directors of a trustee company. — Chapter 6S

Trust distributions to a superfund — Non-arm’s length income derived by a superfund (which may include

discretionary trust distributions or private company dividends) can be taxed at 47% in a superfund. — Chapter 6T

Notes — Review notes taken in relation to the chapter. — Chapter 6U

Companies

This section considers specific year-end taxation issues associated with companies.

Payment of dividends — If the company has current year losses, or prior year retained losses, a dividend paid by

the company may not be frankable unless you fall within the ATO’s guidelines. — Chapter 7A

Franking distributions — You should appropriately manage your franking account balance to ensure that you do

not create a franking deficit at year-end (and incur franking deficit tax). — Chapter 7B

Distribution statements — If you have paid (or will pay) dividends for the current year, you need to ensure

compliance with the distribution statement requirements (otherwise the dividend will not be frankable).

— Chapter 7C

Debt that can be treated like equity — All loans made to companies should be reviewed to ensure that they are

on terms that allow them to be treated as debt for tax purposes and are not inadvertently treated as equity (and

thus interest will be non-deductible). This will typically require a 10 year repayment period or an appropriate

interest rate. — Chapter 7D

Division 7A — You should review Division 7A before year-end to ensure that you do not inadvertently trigger a

deemed unfranked dividend to a shareholder or associate for any loans, payments or debt forgiveness transactions

provided by the company. — Chapter 7E

Company losses — If you are utilising prior year tax losses, or have tax losses in the current year, you will need to

consider the carry forward tax loss provisions. — Chapter 7F

Share capital transactions — If your share capital account has moved for the current year, you should examine

those movements very carefully. They may result in an unfranked dividend or untainting tax liabilities. You may be

able to correct these if identified before year-end. — Chapter 7G

Tax consolidation — choice to consolidate — If you are making a choice to consolidate, you need to keep a

separate hand written choice. You will also need to consider whether tax funding and tax sharing agreements are

put in place before (or close to) year-end. — Chapter 7H

Tax consolidation — change in members — If members have joined or left during the income year, you are

required to notify the ATO within 28 days. You are also required to update your tax funding and tax sharing

agreements. — Chapter 7I

Tax consolidation — updating tax costs — If entities have joined a tax consolidated group during the year, you

should ensure that you have recalculated the tax cost base of assets and liabilities, as this could materially impact

your 30 June 2015 tax calculation. — Chapter 7J

Tax consolidation — disposal of entities — If entities have left a tax consolidated group, the cost base of the

shares needs to be recalculated based on the underlying tax cost of assets and liabilities of the leaving entity. This

can have a material impact on any capital gain or loss on sale of the leaving entity. — Chapter 7K

Pitcher Partners – Year-end tax planning toolkit

12

Review trust deeds — Consider reviewing your trust deed before year-end to ensure that the deed is still

13

Tax consolidation – proposed retrospective measures – If a tax consolidated group has acquired new entities

since 14 May 2013, additional tax may be payable for liabilities held by the joining entity. — Chapter 7L

Research and development (R&D) — Consider the effect of the R&D tax incentive provisions on your R&D

deductions for 30 June 2015. — Chapter 7M

R&D — ineligible companies — If you carry on R&D activities and you have more than $100 million of R&D expenditure,

legislation has been passed that will restrict an R&D tax incentive claim for 30 June 2015. — Chapter 7N

R&D — feedstock adjustments — If you claim R&D related to feedstock expenditure, you may be required to

include an adjustment in your assessable income. — Chapter 7O

Reportable tax positions — Consider whether you need to prepare the reportable tax position schedule in the tax

return. To avoid disclosures, you may need to ensure that you have appropriate opinions on material tax issues.

Consider implementing an appropriate tax risk management procedure. — Chapter 7P

PAYG instalments — Determine whether the PAYG instalment for the fourth quarter for 30 June 2015 can be

varied. — Chapter 7Q

Director penalty regime — Ensure that you are up to date with super and PAYG payments and consider

implementing control procedures dealing with the director penalty regime. — Chapter 7R

Tax transparency — The ATO is required to publicly report information about corporate tax entities with a total

income of $100 million or more. An entity's total income is the accounting income reported by the entity in its

company income tax return. If your income is close to this threshold, you could review your accounting policies to

determine if your tax return disclosures are correct. – Chapter 7S

Notes — Review notes taken in relation to the chapter. — Chapter 7T

Partnerships

This section considers specific year-end taxation issues associated with partnerships.

Professional practices with trusts as partners — The ATO is reviewing professional practices that report a trust as

a partner in the tax return. There may be ways in which to mitigate this risk. — Chapter 8A

Professional practices (unincorporated and incorporated) — If your professional practice has a practicing member

that is not a natural person, the ATO has indicated that it will not stand by its “no goodwill” view for incoming and

leaving members. There may be ways in which to mitigate this risk. — Chapter 8B

Varying distributions — For common law partnerships, consider the ability to vary distribution entitlements before

30 June 2015. — Chapter 8C

Equity contributions — You should appropriately consider equity contributions made to a partnership by a

company and the Division 7A treatment of such contributions. — Chapter 8D

Notes — Review notes taken in relation to the chapter. — Chapter 8E

Capital gains tax

This section considers a number of year-end considerations for capital gains that may have been derived during the

income year.

General — Ensure that you have considered all contracts and capital receipts for the year to determine whether a

capital gain or loss has occurred. — Chapter 9A

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

ability to reduce capital gains under the small business concessions. — Chapter 9B

CGT discount — Consider whether assets disposed of were held for over 12 months and thus qualify for the CGT

discount. If the amounts are material, you may need to review whether the ATO may treat the amounts as being

on revenue account (and not eligible for the 50% discount). — Chapter 9C

CGT discount (non-residents) — Non-resident individuals no longer qualify for the CGT discount. The provisions

may allow for a full or partial discount in certain cases. Taxpayers should consider obtaining a market valuation of

their taxable Australian property held at 8 May 2012 or assessing the discount available based on the days on

which they were an Australian resident compared to the total period of ownership of the asset. — Chapter 9C

Earnout arrangements — The capital gain on the sale of a CGT asset can be deferred if you qualify for the earnout

rules. — Chapter 9E

CGT exemptions and rollovers — Consider the many CGT exemptions and rollovers that may apply to reduce your

capital gain or loss. — Chapter 9F

Main residence exemption — Ensure you have applied the main residence exemption correctly for any sale of

residential property and adjacent land. — Chapter 9G

Notes — Review notes taken in relation to the chapter. — Chapter 9H

Finance issues

This section considers a number of year-end considerations for financial transactions and financial type entities for

the income year.

Loan rationalisation and debt forgiveness — You may wish to consider rationalising inter-entity loans at year-end,

to simplify loan arrangements and Division 7A compliance. However, consider the tax consequences that may

occur on a loan rationalisation or debt forgiveness during the year. — Chapter 10A

Interest deductibility — If you have significant interest or debt deduction costs during the year, you should closely

consider whether you are precluded from deducting such amounts. — Chapter 10B

Capital protected borrowings — Interest deductions may be denied in respect of the funding of capital protected

shares, units or stapled securities. — Chapter 10C

TOFA — general — On an annual basis, you need to consider whether the TOFA provisions will start to apply to

your entity or group of entities. — Chapter 10D

TOFA — elections — TOFA can provide taxpayers with a number of elections that allow tax to be aligned with

accounting for financial instruments. If such elections are of interest, they need to be made before year-end.

— Chapter 10E

TOFA — consolidated groups — If your group is subject to TOFA, and an entity has joined your tax consolidated

group, make sure that you have applied the special TOFA rule to liabilities of the joining entity (which treats such

amounts as assessable). — Chapter 10F

TOFA — compliance issues — If your group is subject to TOFA, the ATO is conducting ongoing compliance activity.

Accordingly, you should ensure you are comfortable with your TOFA positions. — Chapter 10G

FATCA compliance – If you have US investments, have beneficiaries or controllers that are US citizens, or if you

simply have an entity that invests in Australian funds FATCA could apply. You should carefully consider your FATCA

obligations. — Chapter 10H

Notes — Review notes taken in relation to the chapter. — Chapter 10I

Pitcher Partners – Year-end tax planning toolkit

14

Small business CGT concessions — Where you conduct a business (either directly or indirectly), consider your

15

International tax

This section considers a number of year-end considerations where you have international transactions, or inbound or

outbound investments.

Non-resident individual tax rates — We have outlined the tax rates for individuals for the 30 June 2015 income

year. — Chapter 11B

Tax residency and source — You should carefully consider whether the relevant entity is a tax resident for the

current year, and (where non-resident) whether foreign sourced income has been excluded. — Chapter 11C

Temporary resident concessions — If you are a foreign citizen and an Australian resident, consider whether you

can apply the temporary resident concessions and reduce your taxable income. — Chapter 11D

Change in residence — A change in residence may have significant tax implications and may also require elections

to be made. You should consider your residency status for the income year. — Chapter 11E

Foreign accumulation funds — If you own any non-controlling interests in foreign companies or trusts, you should

consider how you will be taxed on those investments. — Chapter 11F

Controlled foreign companies — You should consider whether the controlled foreign company provisions will

result in an accrual of underlying income in your foreign investment, even if your individual interest is a minority

interest. — Chapter 11G

Transfer pricing — New transfer pricing provisions apply from 1 July 2013, which can apply to reprice all of your

international dealings. The provisions also require documentation to be in place by lodging your tax return. It is

therefore critical to ensure that you review your transfer pricing policies and documentation. — Chapter 11H

International dealings schedule — Completion of the international dealings schedule for the 30 June 2015 tax

return should be consistent with your transfer pricing documentation for the current year. It is therefore critical to

ensure transfer pricing documentation is in place. — Chapter 11I

Conduit foreign income — If the Australian company is a conduit between foreign entities, the conduit foreign

income provisions may allow unfranked dividends to be paid to non-residents tax free if you meet certain

conditions in the relevant income years. — Chapter 11J

Foreign income tax offsets — Consider your FITO position for 30 June 2015 to determine whether there are any

excess FITOs that will be wasted. Strategies can be put in place to help reduce FITO wastage. — Chapter 11K

Non-resident distributions — Consider whether distributions from non-residents (including capital reductions) can

or have been made to an Australian entity in a tax free manner. This is particularly important in 2014/15 as the

rules for determining the assessability of distributions changed during the year. — Chapter 11L

Non-residents and asset sales — Non-residents and temporary residents can dispose of certain (e.g. non-land rich)

Australian assets without tax consequences. However, non-residents and temporary residents are no longer

eligible for the 50% CGT discount. — Chapter 11M

Deductions in earning foreign income — Deductions may be denied where a foreign operation in the group

produces exempt or non-assessable non-exempt income to the group. This may be relevant if you carry on a

branch (or hold shares in a subsidiary) in a foreign country. — Chapter 11N

Deemed dividends — Related party transactions may result in deemed unfranked dividends where benefits are

provided by a CFC to a shareholder or associate of the shareholder (similar to Division 7A). — Chapter 11O

Thin capitalisation — If you are an inbound or outbound entity, the thin capitalisation provisions may deny

interest deductions. You should consider reviewing your thin cap position before year-end as significant changes

apply from 1 July 2014 to the thin capitalisation provisions which will both: (i) exclude a larger number of taxpayers

from the rules; and (ii) make it harder for those still within the rules to claim interest deductions. Addressing your

tax gearing ratios before 30 June 2015 may also place you in a much better thin capitalisation position for the 30

June 2016 year. — Chapter 11P

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

compliance with the withholding tax provisions may result in deductions being denied for the income year.

— Chapter 11Q

Non-resident beneficiaries — If you stream classes of income to non-residents (e.g. interest) you should consider

the ATO’s views on streaming and the risk that the current provisions may not support streaming such income.

— Chapter 11R

Non-resident trusts — If you have an interest in a foreign trust for the 30 June 2015 income year, you may need to

disclose income in your tax return under the accrual provisions. — Chapter 11S

Offshore assets — If you have offshore assets or investments that you have not previously disclosed to the ATO,

you should consider making a voluntary disclosure to minimise steep penalties and the risk of criminal prosecution

for tax avoidance. — Chapter 11T

Investment manager regime — If you are a non-resident widely held fund or an Australian investment manager,

broker or custodian, you should consider the possible application of the new IMR regime which can exempt certain

Australian passive income from Australian tax. — Chapter 11U

Managed investment trust fund payments — The withholding tax rate on fund payments to non-residents during

the 2015 income is equal to 15% for EOI countries and 30% for non-EOI countries. A special rate of 10% applies to

certain energy efficient buildings funds. — Chapter 11V

Notes — Review notes taken in relation to the chapter. — Chapter 11W

Super and GST

This section considers a number of year-end considerations for Superannuation and GST.

Deductions for contributions — You may be able to claim a deduction for superannuation contributions by paying

the amounts to the fund (i.e. received by the super fund) before year-end. — Chapter 12A

Super guarantee — Ensure that you have complied with the superannuation guarantee requirements, especially

for bonuses paid and payments made to contractors, consultants or members of the board who are not paid via

the payroll. — Chapter 12B

Contribution caps — Make sure you have complied with the annual concessional and non-concessional

contribution caps. — Chapter 12C

Non-concessional contribution caps — Please note that the non-concessional contribution limit remains at

$180,000 p.a. and $540,000 over a fixed three year period for 2014/15 for individuals under the age of 65.

— Chapter 12C

Personal contributions — Consider whether the individual is eligible to make a deductible concessional

contribution before 30 June 2015 and ensure notice requirements are met within time. — Chapter 12D

Excess contributions — When reviewing your superannuation strategy for year-end, carefully consider whether

payments are within your contributions cap. — Chapter 12E

Increase in contributions tax for higher income earners — The contributions tax increases from 15% to 30% for

individuals who have income of more than $300,000. Individuals should consider this when making contributions

for the 2015 year. — Chapter 12F

Employment termination payments — If you have received an ETP during the 30 June 2015 income year, you

should review the concessional taxation treatment of such payments. — Chapter 12G

Legal settlements on employee termination — Consider whether amounts received in respect of legal costs

incurred in disputes concerning the termination of employment can be treated as an eligible termination payment

(which may be subject to concessional treatment). — Chapter 12H

Pitcher Partners – Year-end tax planning toolkit

16

Withholding tax and deductions — If you pay interest, royalties or other income subject to withholding tax, non-

17

GST adjustments for bad debts written off — If you write off a bad debt during the year, you may need to make a

GST adjustment in the relevant BAS. — Chapter 12I

Accounting for GST on a cash or accruals basis — If you currently account for GST on a cash basis you should

consider whether you still satisfy the eligibility requirements for cash basis accounting. — Chapter 12J

Financial acquisitions threshold — If you make financial supplies, you should consider whether you have exceeded

the financial acquisitions threshold and whether you can claim full input tax credits. — Chapter 12K

GST adjustments for change in use — If you have changed the extent to which an acquisition or importation is

used for a creditable purpose, you should consider whether a change in use adjustment is required in the BAS for

the period ended 30 June. — Chapter 12L

Reporting requirements for construction — If you are in the building and construction industry, you need to

consider the reporting requirements for payments made to contractors before 30 June. Pitcher Partners has

software that enables direct upload for ATO reporting. — Chapter 12M

Notes — Review notes taken in relation to the chapter. — Chapter 12N

Integrity measures

This section considers a number of integrity measures that should be considered with your year-end planning.

General anti—avoidance (Part IVA) — You should consider Part IVA in relation to any material tax planning

strategy that may be implemented for the 30 June 2015 income year. — Chapter 13A

Promoted schemes at year-end — Be careful of schemes that are promoted to taxpayers to reduce their taxable

income for the income year. Consider the ATO guidance on what to look out for. — Chapter 13B

Related party transactions — Where tax planning arrangements involve related party transactions, consider

carefully the application of the anti-avoidance provisions that may deny deductions incurred by one of the related

parties. — Chapter 13C

Wash sales — Consider the ATO’s view on wash sale arrangements where assets are disposed of for a loss or gain

and substantially the same assets are re-acquired. — Chapter 13D

Franking credit trading arrangements — You should review any arrangements that purport to provide a return

that is calculated with reference to franking credits as such arrangements may fall foul of anti-avoidance

provisions. — Chapter 13E

Trust streaming to exempt entities — Consider the impact of the anti-avoidance rules on distributions from trusts

to exempt entities. — Chapter 13F

Trust distributions — The ATO has released a fact sheet indicating that it may apply the trust stripping provisions

more broadly to family trust arrangements. Care needs to be taken where income is distributed to a beneficiary,

where it is unlikely that the beneficiary will ever call on the funds (or be paid those funds). — Chapter 13G

Notes — Review notes taken in relation to the chapter. — Chapter 13H

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

General rules on income

A taxpayer is required to include all income derived for an income year in their assessable income. Generally speaking,

business activity income is typically brought to account on an accruals basis, while passive income and personal

services income are typically brought to account on a cash basis. However, as outlined below, some types of passive

income have their own special timing rules. Furthermore, taxpayers in the business of deriving passive income (e.g. a

finance entity) would need to bring such income to account on an accruals basis.

Business income

The accruals method is generally used to include income that has been derived from the sale of goods, commodities or

from business activities.

Where income is from a professional practice, it is not always clear whether such income is from personal services or

from a business activity1. This issue should be reviewed on an annual basis.

A taxpayer will typically derive business income when an invoice has been raised, or where the taxpayer is legally

entitled to the amount. All trade debtor amounts at year-end are generally included in the assessable income of a

taxpayer deriving business income. Taxpayers should also carefully consider accrued income accounts to determine

whether such amounts are assessable income at year-end (see Chapter 3C).

It is noted that income derived by a small business entity [SBE] in the 30 June 2016 income year will be able to access

the 1.5% cut in the company tax rate. Furthermore, to the extent that such income is derived by individual taxpayers

with business income from an unincorporated business which is a SBE, a discount of 5% will apply on the income tax

payable on the business income received from the unincorporated SBE (capped at $1,000 per individual).

Year-end planning considerations

Determine whether you have brought income to account in the correct year. Some income is brought to account

on a cash basis (e.g. interest), while other income is brought to account on an accruals basis (e.g. business income).

Consider invoices to be issued in June 2015 and July 2015 and whether they are in the appropriate period.

Accrued and unearned income

Taxpayers carrying on a business may often record income as either accrued or unearned. You should carefully

consider the tax treatment of those types of income, as the tax treatment will not always follow the accounting

treatment.

Accrued income

It may be possible to defer the recognition of accrued income to the following income year. Special consideration

should be given to such amounts identified for accounting purposes where an invoice has not been issued. Such

income may, or may not, be derived for tax purposes depending on the legal entitlement to the amounts at the time.

For example, work in progress amounts will not generally give rise to assessable income until there is a recoverable

debt. If, under a contract or arrangement, a recoverable debt may be created without the need to bill the client, then

the amount will generally be derived once the work is wholly completed 2. Furthermore, the accounting basis for

accruing income can sometimes be held to be acceptable. The ATO place a lot of emphasis on these two factors and

1

2

TR 98/1: Income tax: determination of income; receipts versus earnings

TR 93/11, para 6

Pitcher Partners – Year-end tax planning toolkit

18

Income

19

may seek to tax unbilled income in various cases even if an invoice has not been issued3. As a final note, construction

contract income may be derived on a different basis than on a billings basis (see Chapter 3G).

Unearned income

An exception to the ordinary derivation rule can occur where amounts are received or receivable in advance of goods

or services being supplied or provided (i.e. unearned income amounts).

Generally, if a contract or arrangement requires that the fee be paid in advance, the income is derived in the income

year in which the work is completed (or the part of the work) to which the fee relates (even if invoiced). On the other

hand, if the client simply pays early, the fee income is generally only derived when a recoverable debt arises or would

have arisen if the client had not paid early4. The tax treatment also considers the accounting and commercial treatment

of the relevant income. Accordingly, if one is seeking to defer such income, it is prudent to record such income as

“unearned” in the accounts (subject to limitations imposed by accounting standards).

Note that not all unearned income will qualify for deferral. There have been many cases where the principle has been

distinguished. Where this amount is material, you should consider this opportunity further.

Year-end planning considerations

Identify whether an amount of accrued income or unearned income has been recorded in the accounts in a prior

year, or is expected to be recorded in the accounts at 30 June 2015.

Determine whether such amounts have been derived for tax purposes and whether a tax adjustment should be

made for the 30 June 2015 balance.

Trade incentives (purchase of stock)

Trading stock acquired may be subject to a trade incentive (e.g. volume rebate, trade discount, promotional rebate

etc.). This discount amount may either give rise to assessable income to the purchaser, or can reduce the cost of

trading stock5, depending on the nature of the trade incentive.

For unconditional trade incentives (e.g. a 10% unconditional rebate for all stock purchased) relating directly to the

purchase of trading stock, the amount is treated as a reduction in the cost of trading stock. However, other incentives

generally do not reduce the purchase price, but are treated as income at the time when the incentive is provided. For

example, conditional incentives, promotional incentives, and volume rebate or trade discounts.

In this case, the purchase of trading stock is to be recorded at the full (undiscounted) price (see Chapter 4R).

Accordingly, these discounts can be deferred until derived by the taxpayer and do not have to be included in income at

year-end.

Year-end planning considerations

Identify whether your business receives conditional discounts or trade incentive discounts from your suppliers. If

so, you may be able to defer recognition of this income for taxation purposes.

Trade incentives (sale of stock)

Where you sell trading stock and offer trade incentives, the treatment of the discount component predominantly

follows the treatment in Chapter 3D.

3

See ATO ID 2012/15

TR 93/11, para 8 and Arthur Murray (NSW) Pty Ltd v FCT (1965) 114 CLR 314. See also TR 2014/1, para 5.

5

TR 2009/5

4

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

An incentive that is not directly related to the sale of trading stock or is not virtually certain, such as conditional

incentives and promotional incentives will be treated as a deductible amount when the incentive is actually provided.

Accordingly, the sales income must be recorded as the gross (undiscounted) price for tax purposes.

Year-end planning considerations

Identify whether your business provides unconditional discounts or trade incentive discounts to your customers. If

so, you may be able to reduce the income recorded for taxation purposes by the discount component.

Customer disputed amounts

When accounting for income on an accruals basis, income that is subject to a dispute with the customer may be

deferred until the dispute is settled6. Generally, this treatment will need to be consistently applied in the accounts of

the taxpayer.

Year-end planning considerations

If you have an unsettled dispute in relation to an amount of income from a customer that relates to a sale in the

2015 income year, you may be able to defer the recognition of income until settlement of the dispute in the

subsequent year.

Construction contracts

The ATO administratively provides taxpayers with a number of methods for bringing to account construction contract

income where construction activities are carried on by a taxpayer that is separate to the land-owning taxpayer (i.e. the

taxpayer does not hold trading stock or a revenue asset).

The various methods available include the basic approach (billings method) or the estimated profits basis (the

accounting method)7. While the method chosen must be applied consistently, each method can result in income being

recognised in very different periods. For example, the billings method may allow for deductions to be claimed upfront

whereby income would only be assessable once a recoverable debt is created (e.g. on issue of an invoice). On the other

hand, the estimated profits basis may recognise income during the project as it is completed (even where no amount

has been billed).

In this regard, the ATO requires not only consistency of treatment for all years during which a particular contract runs,

but consistency of treatment for all similar contracts entered into by you and by all entities that are part of your

group8.

Year-end planning considerations

Where you entered into a long term construction contract during the year that does not relate to your trading

stock, you should consider the various methods (i.e. basic approach and the estimated profits basis) to determine

the effect each method has on your taxable income for 2015 (subject to the consistency requirement).

If a construction contract does relate to the construction of trading stock for you, consider the possibility of

splitting the construction entity and the stock holding entity going forward.

6

BHP Billiton Petroleum (Bass Strait) Pty Ltd v FCT 2002 ATC 5169

IT 2450

8

IT 2450, para 13

7

Pitcher Partners – Year-end tax planning toolkit

20

That is, for unconditional trade incentives relating directly to the sale of trading stock, the amount is treated as a

reduction in the sales proceeds. This treatment is allowed for tax purposes if the trade incentive is virtually certain,

effectively allowing an upfront deduction for the discount provided.

21

Insurance proceeds

The treatment of insurance proceeds will depend on the reason for the payment. If insurance proceeds directly

compensate for the loss of income that would otherwise have been assessable (e.g. income protection insurance) or

compensate for the loss of revenue assets (e.g. trading stock), such proceeds may be regarded as ordinary income.

Where such amounts are not ordinary income, specific statutory provisions may include such receipts as income where

they relate to trading stock9 or where they relate to a loss of an amount of income 10.

Where these provisions do not apply and insurance proceeds relate to the loss or destruction of a capital gains tax

asset or a depreciating asset, the amount may be taken to constitute proceeds on the disposal of those assets11. Where

the proceeds do not constitute ordinary income or statutory income, the receipt of insurance proceeds can be an

“assessable recoupment”12.

It is noted that the relevant provisions mentioned above also have their own timing rules for when insurance proceeds

are to be brought to account13. Where the loss event, claim and insurance receipt straddle the year-end, you should

consider the applicable provision closely to determine when the gain must be brought to income.

Year-end planning considerations

Where the loss event, claim and insurance receipt straddle the year-end, you should consider the applicable

provision closely to determine whether the gain must be brought to income in this year or in a later income year.

Where an asset has been lost or destroyed, you may be able to claim a loss in respect of the asset and you may be

able to claim rollover relief if the proceeds are used to acquire a replacement asset.

The Government has passed legislation that will allow CGT exemptions to apply to compensation or insurance

payments received through a trust from 1 July 2005.

Grants, bounties and subsidies

The treatment of Government grants or subsidies is complex and will depend on the nature of the grant 14. An amount

will be treated as ordinary income where the amount is for the expected reduction in income, to assist with operating

costs, to compensate for a loss of profits or to evaluate the entity’s current operations.

Where the amount is not ordinary income, but rather a bounty or subsidy in relation to your business that is of a

capital nature, the amount will constitute statutory income when received 15. Amounts received in relation to

commencing a business activity or acquiring new assets may also be assessable depending on the circumstances.

The timing of the amount as income will again depend on the nature of the amount, however generally the amounts

are included on a receipts basis. Where the grant is conditional, it is possible to defer bringing the amount to income

until the conditions are satisfied. If an amount is repaid, the recipient can also treat the original receipt as nonassessable and not exempt income (NANE)16.

You should also ensure you have considered the operation of the provisions relating to insurance (Chapter 3H) and

disaster relief (Chapter 3J) closely.

9

Section 70-115 of the ITAA 1997

Section 15-30 of the ITAA 1997

11

TD 31 and ATO ID 2011/82

12

Sections 20-20 and 20-30 of the ITAA 1997

13

For example, section 15-30 requires the amount to be received.

14

TR 2006/3

15

Section 15-10 of the ITAA 1997

16

Section 59-30 of the ITAA 1997

10

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

Where Government grants have been received, determine whether such amounts will be assessable income or

whether an exemption may apply.

Examine whether it is possible to defer the recognition of the income amount under a grant, for example, where

the receipt of the grant can be deferred or where there are conditions imposed on amounts already received.

Disaster relief

There are a number of grants that have been provided to individuals, small businesses and primary producers in

relation to natural disasters that are not taxable. Furthermore, events can be declared a disaster, to ensure people in

communities affected by the events can receive tax deductible donations.

There are also special rules that may apply where the receipt is disaster relief money (received from charities, to which

local, State or Federal Government or their agencies have made payments). In some cases, such amounts may not

constitute income to the taxpayer17. Furthermore, rollover relief may apply for certain pre-CGT assets replaced after a

natural disaster18.

Finally, the ATO has released guidelines that allow concessions to taxpayers affected by disasters where they are

required to reconstruct records or make reasonable estimates19.

You should also ensure you have considered the operation of the provisions relating to insurance (Chapter 3H) and

grants, bounties and subsidies (Chapter 3I) closely.

Year-end planning considerations

Consider whether special tax treatment may occur for money that has been received relating to a natural disaster

or assets replaced due to a natural disaster.

Consider whether you can access the ATO’s concessions for reconstructing records or making reasonable estimates

for your income or deductions.

Interest income

Interest income is usually included on a cash basis. The timing of derivation will typically be when the interest income is

received or applied for the benefit of the taxpayer. However, if the receipt of interest is within your ordinary activities

(e.g. the taxpayer is a financial institution, or the interest is charged on trade debts), interest income will generally be

included in assessable income on an accruals basis. Furthermore, deferred interest can be accrued under the TOFA

provisions, which can apply where accrued interest is not received for 12 months (e.g. on a discounted bond – see

Chapter 10D).

You should consider reviewing interest income to determine whether amounts “accrued” can be deferred to the 2016

income year.

Year-end planning considerations

Review interest income and determine whether any “accrued” interest can be deferred until the 2016 income year.

17

For example, TD 2006/22

Section 124-95(6) of the ITAA 1997

19

PSLA 2011/25

18

Pitcher Partners – Year-end tax planning toolkit

22

Year-end planning considerations

23

Dividend income

Dividends are included in assessable income when they are paid (which includes the crediting of the dividend by the

company). This is irrespective of whether the share investment activities of the taxpayer constitute a business or not. If

any part of the dividend is franked, that amount will also constitute assessable income. You should closely consider the

timing of dividends that you receive around year-end — especially where the dividends received are under a dividend

reinvestment plan.

We note that the meaning of dividend is broad and that the taxation provisions can also deem you to have derived

dividends in many other cases (e.g. from a share buyback or in respect of a loan from a private company under Division

7A – see Chapter 7E).

Year-end planning considerations

Consider the timing of dividends received around year-end. This should include a review of dividends under

dividend reinvestment plans or private company dividends. Depending on the payment date of the dividend, the

amount may either be income of the 2015 or 2016 income year.

Consider whether you have participated in a share buyback plan and whether any amount of the buyback is

considered a dividend for taxation purposes.

Retail premiums

Retail premiums are amounts paid to non-participating shareholders that do not take up rights to subscribe for shares

offered by a company. The amount of the premium is the difference between the clearing price (i.e. the price at which

these unexercised rights are offered to institutional investors) and the offer price (i.e. the price at which existing

shareholder can take up these rights). A retail premium to a non-participating shareholder may constitute a dividend or

ordinary income. However, where the payment is treated as a dividend, it will be treated as unfrankable 20.

Year-end planning considerations

Consider whether you received a retail premium during the 2015 income year in relation to shares that you have

held during the year. Note that the ATO do not allow franking credits to be utilised in respect of such amounts.

Trust distributions

A beneficiary is taxable on their share of the underlying taxable income of a trust. Where you have received a trust

distribution for 30 June 2015 (or will be entitled to receive trust distributions by year-end) you should estimate the

amount of the taxable distribution in your year-end tax planning. Where this amount is uncertain, you should consider

contacting the trustee for an appropriate estimate of this amount.

Year-end planning considerations

As part of your tax planning and tax estimation, estimate the amount of taxable trust distributions that you will

receive (or be entitled to receive) at year-end. This may not be the same as the cash amount or cash entitlement

from the trust.

Rental or leasing income

Income from renting or leasing a property will generally be included in assessable income when the rent or leasing

income is actually received (i.e. on a cash basis). However, such income may be treated on an accruals basis if the

taxpayer is considered to be in the business of renting or leasing. You should therefore consider whether “accrued”

rental income needs to be included in your 30 June 2015 taxable income.

20

TR 2012/1

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

Consider whether rental or lease income “accrued” at 30 June 2015 can be deferred for taxation purposes (e.g.

where a cash basis is an appropriate method for the taxpayer).

Foreign taxes paid on your behalf

Where foreign taxes have been withheld from an amount of income you have earned, you are required to gross-up

your income for tax purposes. You may then be able to claim a foreign income tax offset (FITO) for the amount of

foreign taxes paid21. Refer to Chapter 11K for considerations relating to FITOs.

Year-end planning considerations

In considering your budgeted 30 June 2015 taxable position, you should consider any foreign income that you may

derive (grossed up for foreign taxes paid on your behalf).

Income that is not otherwise assessable

A number of provisions treat receipts as not being assessable income. Examples include non-portfolio foreign dividends

and distributions derived by companies, first home saver account income, mutual receipts received from members,

income derived by temporary residents, certain windfall amounts, subsequent unfranked dividends to offset a Division

7A dividend, certain income derived by foreign residents subject to withholding tax (see Chapter 11L) and amounts

remitted as GST.

Year-end planning considerations

Consider whether any income you have derived during the income year should be excluded being either exempt or

not assessable.

Personal services income

Personal services income (PSI) is income that is mainly a reward for an individual’s personal efforts or skills for doing

work or producing a result. For example, this may include income from professional services.

If an individual operates through a trust, company or partnership, the PSI regime may apply to attribute such income to

the individual. Furthermore, deductions claimed in respect of PSI may also be limited. The results test, unrelated clients

test and business premises test are common tests used to determine whether a taxpayer is conducting a personal

services business (PSB). A taxpayer that conducts a PSB does not fall foul of the PSI rules.

However, even if the PSI rules do not apply, the ATO has indicated that it could still seek to apply Part IVA where

services income is not derived personally (e.g. where the amounts are derived through a trust or company and are not

“distributed” to the individual during the year of income). In particular, the ATO are actively considering this issue with

respect to professional service firms where it believes insufficient income is being distributed to the principal or

included in their assessable income.

21

This amount is ordinary income under section 6-5 of the ITAA 1997

Pitcher Partners – Year-end tax planning toolkit

24

Year-end planning considerations

25

Year-end planning considerations

Where you have provided services and you have operated through an entity (e.g. a trust or company), you need to

consider the possible application of the PSI rules before 30 June. These provisions could have a material impact on

your assessable income and deductions claimed.

If you operate in professional services through a trust or company, you need to consider the extent to which

income should be distributed to you for 30 June 2015.

You should consider whether it is worthwhile obtaining a private ruling from the ATO on the application of the PSI

rules or Part IVA to your arrangements.

Extraordinary items

Where extraordinary or abnormal amounts have been received during the income year, you should consider whether

such amounts are assessable and (if so) the timing of the assessment (e.g. the sale of a business / asset or the

settlement of a legal dispute). Due to the size and nature of such amounts, these will typically come within ATO

scrutiny. You should consider whether the amounts represent ordinary income, statutory income, capital gains or

exempt amounts.

Year-end planning considerations

Where you have received extraordinary and abnormal receipts during the income year, you should ensure that

such amounts have been appropriately reviewed for tax purposes.

Notes relating to items in this chapter

Place any notes or additional information here for further reference with your discussion with your Pitcher Partners

representative.

Pitcher Partners – Year-end tax planning toolkit

Pitcher Partners – Year-end tax planning toolkit

General rules of deductibility

A taxpayer can only claim a general deduction for losses or outgoings that are incurred in that year, where the purpose

is to earn assessable income or in carrying on a business of earning assessable income 22.

No deduction is available for expenses that are not related to earning assessable income, are of a capital nature, are of

a private nature, or are incurred in earning exempt type income. A taxpayer will incur expenses in the 2015 income

year if an amount is actually paid or where the taxpayer becomes definitively committed to pay the amount.

However, where the general rule is not satisfied, a deduction may be available under a specific provision that allows

the deduction.

A taxpayer must keep all relevant documentation and evidence to prove that the expense has been incurred 23. It is

noted that only the taxpayer actually incurring the expense can claim a deduction.

Year-end planning considerations

Review all your expenses and payments during the year to determine whether you may be able to claim a

deduction for the expense.

Determine whether the expense can be claimed in the current year (e.g. whether you have made a payment,

incurred an obligation, or prepaid amounts).

Keep documentation so that you can prove that you have in fact incurred the expenses before year-end.

Capital expenditure

Expenses should be reviewed annually to determine whether the amounts are capital in nature and therefore nondeductible. This may include a review of legal expenses, repairs and maintenance expenditure, restructuring costs,

equity raising costs and the cost of acquiring or developing capital assets.

Where capital expenditure costs are non-deductible, you should consider whether the cost can (instead) be included in

the cost base of a capital gains tax asset or claimed over five years under the business black-hole provisions24.

The Federal Government announced in the Budget that it will introduce legislation with effect from the 2015/16

income tax year to allow start-up businesses to immediately deduct a range of professional expenses associated with

starting a new business.

The professional expenses mentioned in the Government announcement include both legal and accounting advice.

Year-end planning considerations

Review expenditure incurred during the year to determine whether the amounts are capital (e.g. repairs and

maintenance, legal costs, or restructuring expenditure incurred during the year).

Where costs are capital (and otherwise non-deductible) consider whether the amount can be included in the cost

base of an asset or alternatively deducted under the black-hole expenditure provisions over five years.

If you are planning to start-up a new business, you may be able to deduct professional fees incurred after 1 July

2015 in establishing that new business.

22

Section 8-1 of the ITAA 1997

See for example Re Sobel Investments Pty Ltd and FCT [2012] AATA 180 and AAT Case [2012] AATA 174

24

Section 40-880 of the ITAA 1997 and TR 2011/6

23

Pitcher Partners – Year-end tax planning toolkit

26

Deductions

27

Bad debt deductions

A taxpayer can only claim a deduction for bad debts if the debts: (i) are written off as bad before year-end; and (ii) have

previously been included in the taxpayer’s assessable income. A taxpayer must keep written records to prove that such

debts have been written off as bad before year-end. However, it is not necessary to physically post any journal entries

before year-end. Care needs to be taken to ensure that the original debt is being written off (for example, issues may

arise if you have capitalised the debt or interest into another loan).

Taxpayers that carry on finance activities may wish to consider opting into the TOFA provisions, which can also provide

an appropriate treatment for bad debts for financing arrangements.

Year-end planning considerations

Before year-end, review the debtor’s ledger and write off any bad debts to ensure that the amounts can be

deducted for the 2015 income year. Keep written records approving the write-off.

Be careful in capitalising doubtful debts (including interest) into other loan accounts, as this may give rise to a new

debt and may jeopardise a bad debt deduction.

If there are doubts on claiming the bad debt, consider whether the TOFA provisions may provide a more

appropriate outcome.

Trading stock valuation

Trading stock can be valued using different methods for taxation purposes, being cost, market selling value or

replacement value. The only requirement regarding changing methods is that the closing stock value at the end of one

tax year must become the opening trading stock value for the next year. The provisions allow a choice to be made for

each individual item of trading stock.

Changing the valuation method at year-end for tax purposes can either bring forward or defer an amount of your

taxable income. Furthermore, a lower value can be used where stock is obsolete 25, giving rise to tax deductions for the

taxpayer.

Year-end planning considerations

Consider the possibility of valuing trading stock at either market selling value, replacement value or identifying

obsolete stock at year-end.