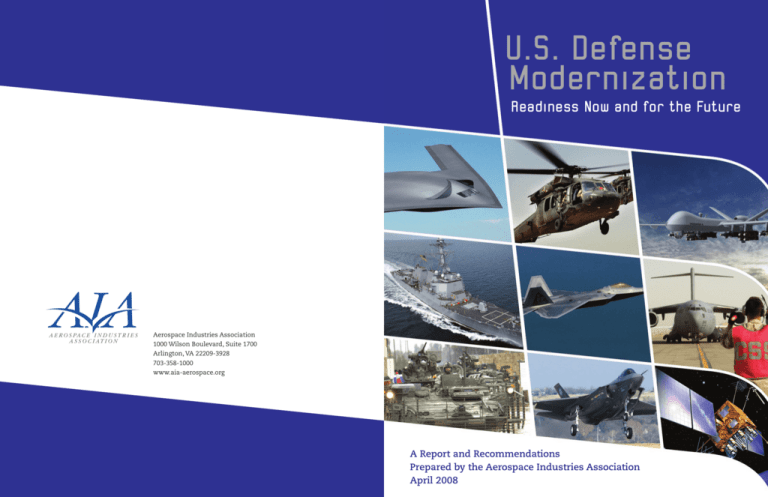

U.S. Defense

Modernization

Readiness Now and for the Future

Aerospace Industries Association

1000 Wilson Boulevard, Suite 1700

Arlington, VA 22209-3928

703-358-1000

www.aia-aerospace.org

A Report and Recommendations

Prepared by the Aerospace Industries Association

April 2008

An AIA Report and

Recommendations:

U.S. Defense

Modernization

Readiness Now and for the Future

This study was produced under the direction

and leadership of the Aerospace Industries

Association’s National Security Council and the

Defense Policy and Budget Committee.

Introduction: Defense Budget

Challenges Ahead

The Aerospace Industries Association is deeply

concerned that three ongoing developments

within the defense budget will give U.S.

decisionmakers far less latitude and flexibility to

respond to long-deferred defense modernization

and recapitalization needs and requirements.

They are:

Inexorable growth in operations and

maintenance costs.

Rising personnel expenditures, including

future costs of recent increases in active

duty end strength.

Simultaneous needs for reset and

recapitalization.

These three developments, working in

combination, will require the next U.S.

administration to carefully formulate a

national strategy for sustained, adequate

and balanced resourcing for national

defense capabilities.

We present here an AIA Report on U.S.

Defense Modernization, a study and

recommendations based on our analysis

of this important national security matter.

U.S. Defense Modernization

“Modernization of

key national defense

capabilities will

require a generationlong national security

investment strategy

providing sufficient

and stable resourcing

to recapitalize all

defense sectors,

including aerospace.”

The preamble to the U.S. Constitution declares that

one of the fundamental purposes for which our form

of government was adopted is “to … provide for the

common defense.” The world of the 21st century is

increasingly dangerous — no nation can isolate itself

from the expansive set of threats emanating from

around the globe. Consequently, our national defense

must be an abiding concern and funding priority in

the years ahead.

For several generations America’s national security

has depended on sustained military superiority.

Whether monitoring suspected terrorist camps,

moving relief supplies to disaster areas or enforcing

no-fly zones, the United States has long relied on

possessing the world’s most advanced aerospace

systems. Manned flight was invented here, and air

power is now an enduring national asset.

That asset, however, is now in serious danger. Across

the fleet, aircraft are aging as never before. All of our

military services are in need of modernization and

recapitalization as a result of deferred procurement

following the fall of the Soviet Union. But the need

is particularly acute for the air arms of our military

forces. Emerging national security challenges of

the 21st century require renewed national focus

on the relevance of air power and attention to

accomplishing long-delayed defense modernization.

Upgrading key national defense capabilities and

maintaining readiness will require a generation-long

national security investment strategy that provides

sufficient and stable levels of resources to enable the

recapitalization of all our defense sectors, especially

aerospace.

At the same time, the political inheritance of the

next administration will be the Global War on

Terrorism (GWOT) and the need to continue devoting

sufficient resources to prevail in that conflict.

Given the likelihood of a growing competition for

national security resources, it is critical that defense

decisionmakers understand the nature of the crisis

and accept the implications that future resource

decisions will have on the totality of the U.S. defense

establishment and the defense industrial base

that supports it.

The forthcoming resource competition will pose

critical defense policy and planning choices for the

next administration. The United States has a long

history of demonstrated ability to fund defense at

much higher levels than its current 4 percent share

of Gross Domestic Product (GDP). However, federal

deficits, growing entitlement programs, pent-up

demand for other domestic spending and the cost

of the GWOT will place increased pressure on future

defense spending.

Indeed, there could be domestic political pressures

to level off, if not pull back, defense spending as

U.S. involvement in Iraq is reduced. In a larger

sense, national budgetary forces are present

that, if not addressed, will structurally inhibit

our ability to effectively supply the modernized

military equipment essential for maintaining our

technological advantage over the long term.

AIA is deeply concerned that three ongoing

developments within the defense budget will give

U.S. decisionmakers far less latitude and flexibility to

respond to long-deferred aerospace modernization

and recapitalization needs and requirements. The

three are:

I nexorable growth in operations and

maintenance costs.

ising personnel expenditures, including

R

future costs of recent increases in active

duty end strength.

imultaneous needs for reset and

S

recapitalization.

These three developments, working in combination,

will require the next administration to carefully

formulate a national strategy for sustained,

adequate and balanced resourcing for national

defense capabilities.

AIA believes that while the investment resources

proposed in the fiscal 2008-2013 Future Years Defense

Program (FYDP) represent a modest start towards

assuring future national security needs, the FYDP

itself doesn’t effectively address growing structural

challenges within the U.S. defense budget or the

mounting modernization and recapitalization bills

coming due as a result of years of deferred investment.

During the past 45 years, investment spending has

gone through peaks and valleys — exhibiting a cyclical

pattern largely consistent with that of overall defense

spending. Twice during this period investment spending

has dipped significantly — with the end of the Vietnam

War and the end of the Cold War. These were periods

in which defense spending also fell in real terms.

Investment spending rose during the late Cold War

years of the 1980s and post-9/11 period as defense

spending itself was increased and sustained politically.

Despite recent increases, base budget procurement is

still running well below the historic averages shown

prior to the end of the Cold War (see Figure 1 and

Table 1).

The procurement account dropped in real terms for

a 12-year period between fiscal 1986 and fiscal 1997,

only to slowly rise again beginning in fiscal 1998.

Since then, there have been moderate increases in

investment spending, heavily influenced recently by

growth in RDT&E and transformational programs.

These increases — while welcome — have come

against a smaller investment spending base that has

not kept up with long-term recapitalization demands.

Congressional Budget Office analysis indicates the need

for steady procurement funding of $120–150 billion per

year, in constant dollars, to modernize the current force.

While the investment accounts have been increasing,

procurement is still well below the required level and

comprises only about 20 percent of the defense budget.

There still is much catching up to do that will require

additional resources well above the current level.

This brief analysis underscores that the health of

investment spending is highly dependent on the

overall level of defense spending. It is our view

that the next administration must be much more

aggressive in bolstering out-year defense funding

projections, which have been constrained to meet tax

policy and deficit reduction objectives at the expense

of defense modernization requirements.

“DoD requires steady

procurement funding

of $120–150 billion

per year, in constant

dollars, to accomplish

modernization of the

current force.”

Now is the time to stabilize defense spending and

the investment portfolio and focus on modernization

and recapitalization for the future. The next

administration should focus priority attention on this

issue and also show increased diligence in addressing

the resource challenges within the defense budget

that could negatively impact force modernization.

Funding Challenges for

Defense Modernization

Even if the country were to increase defense spending,

the next administration will have to address emerging

resource challenges internal to the DoD budget. Several

ongoing trends portend an historic and critical shift

in DoD’s spending priorities and, ultimately, the size

and composition of the defense investment portfolio.

They must not be permitted to cascade uncontrollably

to the point that they inhibit our ability to sustain a

robust defense acquisition program and a responsive

industrial base.

The fact is, however, that these trends are already

observable. Funding for investment is gradually

being squeezed from the baseline defense budget as

military personnel and operations and maintenance

costs take an increasing share of defense resources.

By 2013, over a 25-year period, the operations and

support element of the budget will have more than

doubled — faster than the growth in the defense

budget itself. In contrast, investment will increase by

slightly more than 50 percent, well below the growth

path of the general budget.

These growth trends translate into a structural shift

in which investment will decline to only 35 percent

Figure 1. DoD Investment Funding in Constant FY2008 Dollars, Excluding GWOT Supplementals

Procurement

RDT & E

Korean War

250

9/11

200

Reagan Era

Buildup

WWII

F

Y

Vietnam

150

Post-Cold War

Deferred

Procurement

0

8

$

100

B

50

08

05

FY

02

FY

99

FY

96

FY

93

FY

90

FY

87

FY

84

FY

81

FY

78

FY

75

FY

72

FY

69

FY

66

FY

63

FY

60

FY

57

FY

54

FY

51

FY

48

FY

FY

FY

45

0

Source: Office of the Under Secretary of Defense (Comptroller), National Defense Budget Estimates for FY2008, March

2007, Table 6-8, pp. 113-115. GWOT Supplementals are excluded.

of the defense budget by 2013, well below the 41

percent level of fiscal 1988 (see Table 2).

defense plans and in budget guidance to the next

Quadrennial Defense Review (QDR).

This isn’t a mere percentage shift. It translates

into tens of billions of dollars migrating from the

investment portfolio into operations and support

(O&S) costs. These trends suggest an ongoing,

permanent change in composition of the defense

budget, one in which operations and support

consumes an ever-increasing share of the defense

budget. Continuing this trend beyond current

projections will make it even more difficult for

defense planners to adequately resource the

investment spending upon which our military

superiority and technological edge depends. The

next administration should address this serious

future resource challenge in developing long-range

The United States cannot afford to pull back

investment spending as it has done during past postwar defense drawdowns — the nature of the security

environment strongly mitigates against taking

such a risk during what may be a generation-long

war on terrorism. Instead, the next administration

should seek to reform DoD business management

practices and processes to ensure that they support,

rather than compete with, long-range defense

modernization and recapitalization requirements.

Inexorable Growth Trends in Operations and

Maintenance (O&M) Costs. For more than 40 years we

have seen steady growth in defense O&M costs above

the rate of inflation, despite continued efforts of

several administrations to constrain that growth (see

Figure 2). Future sources of further O&M cost growth

include rapid escalation in health care costs, growth in

non-capital purchases (supplies and material, energy,

facilities and equipment repairs), installation O&M

backlogs, improved pay for DoD civilians, O&M costs

associated with growth in active duty end strength and

funding for equipment reset. Left unchecked, these

inexorable O&M growth trends will generate more

funding demands than the current FYDP can support.

Therefore, unless the defense top line rises accordingly,

funding will likely have to migrate from materiel

investment to O&M to cover the cost growth.

AIA believes that the next administration, in order to

minimize pressures on the investment portfolio, must

make a dedicated effort to contain O&M costs and

eliminate the root causes of O&M cost growth above the

rate of inflation. A concerted effort should be made to

develop a long-term plan to reduce O&M costs by a few

percent annually by promoting DoD-wide management

efficiencies (including expansion of competitive

sourcing, performance-based logistics, performancebased agreements, service contracting, more energyefficient systems, etc.) and adopting more integrated

supply chain management. For example, DoD studies

indicate that sustainment accounts for up to 75 percent

of a weapon system’s life cycle cost and that broadly

applying government/industry partnerships integrating

cost containment principles across all phases of

weapon system life cycles could reduce O&M costs by

at least 20 percent.

Rising Personnel Expenditures. The recent decision to

increase the active duty end strength of the Army and

Marine Corps through fiscal 2012 (65,000 and 27,000,

respectively) was largely related to the increased

operating tempo in the wars in Iraq and Afghanistan.

The number of Army Brigade Combat Teams (BCTs)

will increase from 42 to 48 and Marine Expeditionary

Forces (MEF) will grow from 2.5 to 3.0 balanced MEFs.

The Congressional Budget Office (CBO) estimates the

total incremental cost of the end-strength increase

between fiscal 2007 and fiscal 2013 as being $108 billion

above previously planned levels (see Table 3). CBO also

identified the overwhelming majority — more than 75

percent — of the costs as unrelated to the investment

portfolio (military personnel, O&M,

military construction and family

housing). For this reason, the

fiscal 08-13 FYDP was increased to

accommodate these end-strength

costs. Without such an increase,

the modest investment growth

path that was laid out could not

have been sustained.

Table 1. FY1965–2010 Investment Spending, in Billions of Constant FY08 Dollars

FY

1965

FY

1970

FY

1975

FY

1980

FY

1985

FY

1990

FY

1995

FY

2000

FY

2005

FY

2010

Procurement

87.5

89.8

56.5

77.7

162.5

114.9

55.4

65.4

103.7

110.0

Proc as

% DoD

23.2%

20.4%

16.6%

21.0%

30.2%

24.2%

15.1%

17.7%

19.6%

22.1%

End-strength increases bring

RDT&E

37.9

36.0

29.0

29.8

54.0

52.8

44.6

46.3

74.1

73.8

with them the added costs of

RDT&E

10.0% 8.2%

8.5%

8.0%

10.0% 11.1% 12.2% 12.6% 14.0% 14.8%

as %

training, health care and force

DoD

modernization associated with the

Invest125.4 125.8 85.5

107.5 216.5 167.7 100.0 111.7 177.8 183.8

expansion of the force. These costs

ment $B

are “must pay” bills and, unlike

DoD

377.3 440.0 339.8 369.4 538.1 474.5 366.1 368.7 528.8 498.0

procurement and RDT&E, are not

Total $B

as amenable to annual funding

Invest33.2% 28.6% 25.2% 29.1% 40.2% 35.3% 27.3% 30.3% 33.6% 36.9%

ment %

adjustments. Consequently, the

DoD

decision to increase active duty

Source: Office of the Under Secretary of Defense (Comptroller), National Defense Budget Estimates for

end strength carries with it added

FY2008, March 2007, Table 6-8.

long-term cost burdens if the

DoD top line is not sustained or

increased — additional end strength ultimately

Table 2. Operations and Support Versus Investment as Percent of

DoD Budget

translates into an increase in fixed personnel costs

in the form of pay and benefits. These increased

FY2008

FY2013

costs must be accommodated via an increasing top

Budget Category

FY1988

Request

Projection

line in order to preclude erosion of investment and,

DoD Budget Total

$283.8B

$483.2B

$548.5B

hence, creation of a hollow force.

Military Personnel

76.6

118.9

145.2

In a volunteer military system, raising and sustaining

larger military forces is more expensive than in

the past. Even after recent increases, however, we

currently have a much smaller military than those

that fought in WWI, WWII, the Korean War, the

Vietnam War, the Cold War and even the Gulf War.

To counter the dangers of the 21st century with

highly capable but historically smaller forces,

the U.S. military must be equipped with modern

hardware that multiplies their force effectiveness

and provides greater reliability and survivability.

Our emphasis should continue to be on leveraging

the application of advanced military technologies to

maintain our superiority. The investment portfolio

should not be viewed as a discretionary bill

Operations &

Maintenance

81.6

165.3

196.0

Operations &

Support (O&S) Total

158.2

284.2

341.2

O&S Percent of DoD

Total

55.7%

58.8%

62.2%

Procurement

80.0

101.7

125.2

RDT&E

36.5

75.1

68.1

Investment Total

116.5

176.8

193.3

Investment Percent

of DoD Total

41.1%

36.6%

35.2%

Source: Office of the Under Secretary of Defense (Comptroller), National

Defense Budget Estimates for FY2008, March 2007, Table 6-8.

payer. Rather, modernization programs should be

resourced and managed in a manner that continues

to foster technological innovation and sustains

military lead-time advantages over our adversaries.

At the same time, U.S. defense planners must

provide for a balanced defense posture across all

services, capabilities and portfolios.

Simultaneous needs for both reset and recapitalization.

The DoD base budget is a peacetime budget.

Base budget expenditures must fit within

annual discretionary spending limits set by the

administration and Congress. Combat operations

in Iraq and Afghanistan, however, are treated as

emergency spending and are not subject to annual

discretionary spending ceilings. These combat

operations currently cost on the order of $170–190

billion per year. Within that total figure, procurement

for war-related replacement of materiel consumed,

destroyed or prematurely worn out by the war in

the fiscal 07 and fiscal 08 supplementals amounts

to $50–70 billion per year. Thus far, supplemental

appropriations to separately fund replacement of

war-related losses have protected the recapitalization

program in the baseline defense budget.

Absent a significant top line increase, any attempt

to fund reset requirements out of the baseline

budget (i.e., without supplementals) would place

tremendous stress on other service investment

needs by forcing absorption of wartime reset and

recapitalization within the normal budgeting process.

Such an approach could ultimately break essential

modernization programs. Thus, reset must be funded

as an increment above baseline defense needs through

supplemental defense appropriations. As former Army

Chief of Staff Peter Schoomaker noted in testimony

before the House Armed Services Committee in June

2006, “Reset is a cost of war … that must not be borne

at the expense of our modernization efforts. We must

not mortgage the future readiness of the force by

focusing our resources solely on current challenges.”

Supplementals should continue as long as necessary

to reconstitute wartime losses of all the services,

especially the Army and Marine Corps. The

current operational tempo in Iraq and Afghanistan

will require continued supplementals for reset

and recapitalization for several years after the

redeployment of U.S. forces.

Figure 2. O&M Costs Per Service Member, in Constant FY2008 Dollars

180,000

GWCT

160,000

1973: Beginning

of All Volunteer

Force

140,000

1967: Buildup to

463,000 US troops

in Vietnam

120,000

100,000

Demobilization

spike

After WW II

$ 80,000

60,000

March 8, 1965:

First US combat

troops (3500

Marines) land in

Vietnam

1975: Fall

of Vietnam

Reagan

Era

Buildup

1991

Gulf War

40,000

20,000

FY

4

FY 5

4

FY 7

4

FY 9

5

FY 1

5

FY 3

55

FY

5

FY 7

59

FY

6

FY 1

6

FY 3

6

FY 5

6

FY 7

6

FY 9

71

FY

7

FY 3

75

FY

7

FY 7

79

FY

8

FY 1

8

FY 3

8

FY 5

8

FY 7

8

FY 9

9

FY 1

FY 93

9

FY 5

9

FY 7

99

FY

0

FY 1

0

FY 3

0

FY 5

07

0

Source: AIA Analysis of data in Office of the Under Secretary of Defense (Comptroller), National Defense Budget

Estimates for FY2008, March 2007, Tables 6-8 and 7-5.

The Role of Air Power in the 2010

QDR and Defense Planning

AIA believes that the United States needs to

conduct within the context of the 2010 QDR a full

reassessment of the proper role of air power as the

most versatile component of national security. The

2006 QDR, with its primary emphasis on irregular

warfare, defeating terrorist networks and weapons

of mass destruction, tilted toward the kinds of

operations currently experienced in Iraq and

Afghanistan. Consideration of needs for the rest of

the broad spectrum of conflict has been minimized,

with procurement planning discussed largely in the

context of a hedge against any potential near-peer

competitor.

The 2010 QDR should assess the appropriate

balance among security challenges, such as

planning for near-peer regional conflicts while

also engaging in the Global War on Terrorism. The

enduring role of air power needs to be thoroughly

re-examined as a part of this assessment. In

particular, the 2010 QDR should re-evaluate the role

of air power in all potential conflict regions.

Modernization of military aerospace should be

done in a manner that eliminates the decadeslong phenomenon in which entire sectors are

out of production and not being modernized.

All military services face substantial aerospace

recapitalization funding challenges in the decade

ahead. Thus, the next administration’s plan should

address modernization requirements across all

key aerospace sectors of all the military services

— airlift, unmanned air vehicles, rotary wing

aircraft, missiles, space launch, precision-guided

munitions and command, control, communications,

computers, intelligence, surveillance and

reconnaissance (C4ISR) systems.

Resource Planning for Aerospace

Modernization

Maintaining U.S. technological superiority and

industrial pre-eminence in military aerospace

requires sustained investment. Air Force Secretary

Michael W. Wynne captured the problem succinctly:

“We’ll take delivery this coming year of about 60

aircraft. With a fleet of about 6,000 aircraft, this

makes a 100-year recapitalization rate.”

Our country’s current path for military aerospace

modernization is not viable. It won’t be possible to fix

the situation without additional, sustained resource

investment over the long term. The investment

requirements for major aircraft procurements,

their support equipment and sustainment are large

— often exceeding several billion dollars annually

for a single major aircraft program and hundreds

of millions for missiles, munitions and space

programs. In particular, the Air Force has a seriously

underfunded aircraft recapitalization program

when gauged against age parameters and mission

requirements (a fleet averaging 24 years old with 14

percent grounded or flying with mission-limiting

restrictions). Aerospace recapitalization is a national security

issue that deserves the attention of the 2008

presidential candidates and the next administration.

In developing a long-range strategy to modernize

the military, AIA recommends the following resource

planning approach:

Sustain a national consensus to adequately fund

national defense capability and readiness as a

high and enduring priority. We live in dangerous

times, and without robust national security there

can be no economic, social or cultural security.

The next administration should support growth

in the DoD top line to adequately fund military

personnel, operations and maintenance, and

modernization of systems and equipment to

provide required capabilities, credible deterrence

and force effectiveness across the full spectrum

of conflict. Investment must not become the bill

10

11

payer for a top line too low or

for operations and support costs

that are insufficiently funded.

Table 3. Incremental Costs of Army and USMC End Strength: Increase

Above QDR 2006 Force Level

Acknowledge that defense

2007

2008

2009

2010

2011

2012

2013

Total

modernization is already

Army - $ ES Level

$4.5B 9.5

12.1

12.9

11.2

10.0

9.4

$69.6B

36K

43K

50K

57K

64K

65K

65K

long overdue. We must not

USAR & ANG/ES

$0.0B 0.8

1.0

1.1

1.3

1.5

0.9

$6.7B

fall into the trap of thinking

_

1.3K

2.6K

3.9K

5.3K

6.8K

9.2K

that our military need be

USMC -$

$2.2B 4.1

5.3

5.7

5.9

5.0

3.5

$31.7B

capable in only that portion

ES Level

9K

14K

19K

24K

27K

27K

27K

of the spectrum of potential

Total/Yr

$6.7B 14.4

18.4

19.7

18.5

16.5

13.9

$107.9B

conflict in which it finds itself

Source: CBO, Estimated Cost of the Administration’s Proposal to Increase the Army’s and the Marine

currently engaged. To meet

Corps’ Personnel Levels, April 16, 2007, p.2

21st century challenges and

sustain our military superiority

in all areas of potential conflict,

Foster innovation and stability in DoD

modernization must be a priority across the

investment planning. This can be best

board. As part of adequately funding national

accomplished by establishing for the fiscal

defense, DoD needs to increase annual

2010 budget submission a Stable Program

procurement spending to a steady state range

Funding Account, similar to that proposed

of $120–150 billion, in constant dollars, simply

by the Defense Acquisition Performance

to modernize an aging, increasingly obsolete

Assessment Panel, for all Acquisition Category

and potentially vulnerable force. Defense

I programs from Milestone B through initial

modernization is the predicate for military

operating capability. A pilot program for

aerospace modernization.

capital budgeting is currently underway in

DoD. The time is right to apply this proposal

Realistically address the growing bow wave

on a broader scale in order to bring enhanced

of modernization requirements in military

budget and program stability to the DoD

aerospace. This should be done by providing

acquisition process.

growth and stability in not only aerospace

procurement but also in RDT&E. Aerospace

Support the concept of a floor for defense

technologies are integral to the electronics

spending. Incorporate into broad national

revolution occurring in military capabilities

budget planning the goal of defense being no

whether they are in aircraft, missiles, precision

less than 4 percent of GDP in order to prevent

munitions or the command and control,

the budget being drawn down to increase

communications, computers, intelligence,

funding for non-defense programs following

surveillance and reconnaissance systems

the eventual withdrawal of forces from Iraq

essential for future combat operations. The

and Afghanistan — the precise time when

next administration should develop a coherent

modernization and recapitalization of our

modernization plan to realistically address

forces will be most critical to our national

aerospace requirements that can last for

security.

decades to come.

AIA will provide extended discussion and support

for these positions for consideration by the next

administration. Also, the association is prepared to

assist the Defense Department by providing data

concerning industrial capacity and industry’s ability

to respond to increased resource investment.

AIA

Member Companies

L-3 Communications

3M Company

LAI International, Inc.

Accenture

LMI Aerospace, Inc.

Ancon Gear & Instrument

Corporation

Aerojet

Lockheed Martin Corporation

Arkwin Industries, Inc.

AeroVironment, Inc.

Lord Corporation

AirLaunch LLC

Martin-Baker America Inc.

Arrow/Zeus Electronics,

A division of Arrow Electronics

Agilent Technologies, Inc.

Meggitt Vibro-Meter Inc.

Allfast Fastening Systems, Inc.

Micro-Coax, Inc.

American Pacific Corporation

MicroSat Systems, Inc.

AmSafe Aviation

McKechnie Aerospace

AMT II Corporation

MOOG Inc.

Astronautics Corporation of

America

Hitachi Consulting

Rubbercraft

Hi-Temp Insulation Inc.

AVChem, Inc.

Sanmina-SCI Corporation

Hobart Machined Products, Inc.

Avnet Electronics Marketing

Hughes Bros. Aircrafters, Inc.

Sample Machining, Inc. dba

Bitec

Ballistic Recovery Systems, Inc.

IDD Aerospace Corp.

Banneker Industries, Inc.

Blenheim Capitol Services

Industrial Metals International

LTD

Brogdon Tool & Die, Inc.

Infotech Enterprises America

Sechan Electronics, Inc.

Brookfield Atlantic

Inmedius

Brush Wellman Inc.

Integrated Sourcing

SELEX Sensors and Airborne

Systems US Inc.

BTC Electronic Components

ION Corporation

Burton Industries Aerospace

Heat Treating, Inc.

JRH Electronics, LLC.

AUSCO, Inc.

B&E Group, LLC

The NORDAM Group

BAE Systems, Inc.

Barnes Aerospace

Northrop Grumman

Corporation

B/E Aerospace, Inc

NYLOK Corporation

The Boeing Company

Omega Air Inc.

Celestica Corporation

Oracle USA

California Manufacturing

Technology Consulting

Click Bond, Inc.

Pall Aeropower Corporation

Capo Industries Inc.

Click Commerce

Parker Aerospace

Celltron Inc.

Cobham

Pinkerton Government

Services, Inc

Chandler/May, Inc.

Crane Aerospace & Electronics

Curtiss-Wright Corporation

Curtiss-Wright Controls

Systems, Inc.

Metal Improvement Company

Dassault Falcon Jet Corporation

Doncasters, Inc.

DRS Technologies, Inc.

Ducommun Incorporated

Proficiency Inc.

Raytheon Company

Remmele Engineering, Inc.

Rockwell Collins

Rolls-Royce North America Inc.

RTI International Metals, Inc.

Satyam Computer Services Ltd

Renaissance Services

Athena Technologies, Inc.

National Machine Group

National Machine Company

National Aviation Products,

Inc.

National Technical Systems

PRIMUS Technologies

Corporation

Heartland Precision Fasteners

Aerospace Plating Company

Astronic

Natel Engineering Co., Inc.

Computer Sciences

Corporation

REMEC Defense & Space,

Inc.

Rodelco Electronics

Corporation

Andrews Space

Aurora Flight Sciences

HDL Research Lab, Inc.

Heizer Aerospace

Analytical Graphics, Inc.

ATK

Harvard Custom

Manufacturing

Cherokee Nation Distributors

Cincinnati Machine, A UNOVA

Company

CMC Electronics

Coalition Solutions Integrated,

Inc.

KPMG LLP-Risk Advisory

Services

Kreisler Manufacturing

Corporation

Kulite Semiconductor Products,

Inc.

Meyer Tool Inc.

Microsemi Corporation

Mid-State Aerospace Inc.

Consolidated Precision

Products

Morris Machine Company, Inc.

Mil Spec Sales Co.

MPC Products Corporation

Eaton Aerospace

SITA

Cytec Engineered Materials

Eclipse Aviation

Dassault Systems of America

EDS

Space Exploration Technologies

Corporation

Elbit Systems of America

Sparton Corporation

Data Conversion Laboratory,

Inc.

Embraer Aircraft Holding Inc.

Spirit AeroSystems

Dayton T. Brown Inc.

O’Neil & Associates, Inc.

Erickson Air-Crane

Incorporated

Textron Inc.

Delphi Corporation

Ohio Aerospace Institute

Timken Aerospace

Transmissions, LLC Purdy

Systems

Designed Metal Connections

Orion Industries

Doyle Center for

Manufacturing Technology

P3-North America, Inc.

United Technologies Corporation

Hamilton Sundstrand

Pratt & Whitney

Sikorsky

DynaBil Industries, Inc.

PCA Aerostructures

East West Associates

PCC Airfoils, LLC

EDAG Inc.

Vought Aircraft Industries, Inc.

Electronic/Fasteners, Inc.

Performance Software

Corporation

Woodward Governor Company

Emhart Teknologies, A Black &

Decker Company

Perillo Industries, Inc.

Plexus Corporation

General Electric Company

AIA Associate

Member Companies

Endicott Interconnect

Technologies, Inc.

GKN Aerospace

ADI American Distributors, Inc.

Goodrich Corporation

AirBorn Operating L.P.

Exotic Metals Forming

Company LLC

W.L. Gore & Associates, Inc.

Air Industries Machining

Corporation

Evergreen International

Exostar LLC

Flextronics International USA

FlightSafety International Inc.

General Atomics Aeronautical

Systems, Inc.

General Dynamics Corporation

Groen Brothers Aviation, Inc.

Harris Corporation

Hawker Beechcraft Corporation

HEICO Corporation

Hexcel Corporation

HITCO Carbon Composites

Honeywell Aerospace

IBM Corporation

ITT Corporation

Kaman Aerospace Corporation

Airfasco Industries, Inc.

Servotronics, Inc.

Sigma Metals, Inc.

Signal International

Southern California Braiding

Company

Spectralux Corporation

Spirit Electronics, Inc.

Science Applications

International Corporation

Esterline Technologies

Service Steel Aerospace

Spincraft

DuPont Company

ESIS, Inc.

Senior Aerospace

McCann Aerospace Machining

Corporation

Millitech, Inc.

Crestwood Technology Group

SEAKR Engineering

M/A-COM, Inc.

Co-Operative Industries

Defense, LLC

CPI Aero, Inc.

Sea Air Space Machining &

Molding

Navigant Consulting, Inc.

New Breed Corporation

NMC Group, Inc.

Nor-Ral Plastics Inc.

Norfil Manufacturing, Inc.

Parkway Products, Inc.

PGM of New England, LLC

Starwin Industries

Tedopres International, Inc.

TEK Precision Co. Ltd

Telephonics Corporation

Therm, Inc.

Thermal Solutions, Inc.

TIGHITCO, Inc.

Tiodize Co., Inc.

TMX Aerospace

Tri Polus Inc.

TTI, Inc.

TTM Technologies

TW Metals

UGS

UMA, Inc.

Unicircuit Inc.

United Performance Metals

Universal ID Systems, Division

of Commerce Overseas

Corporation

University of Tennessee –

Aerospace Defense Clearing

House

Unlimited Innovations

Vishay

Plymouth Extruded Shapes

Vulcanium Metals

Incorporated

Plymouth Tube Company

Waer Systems

Powerway, Inc.

Welding Metallurgy, Inc.

Fenn Technologies

Precision Gear

The Ferco Group

Precision Aircraft Machining

Company

West Cobb Engineering & Tool

Co. Inc.

ENSCO, Inc.

Albany Engineered Composites

Ferguson Perforating and Wire

Company

Alcoa Fastening Systems

Forrest Machining, Inc.

Alken Industries Inc.

Allegiant Global Services, LLC

Frontier Electronic Systems

Corporation

Allen Aircraft Products, Inc.

GEAR Software

American Brazing

Greene, Tweed & Company

AMETEK Aerospace & Defense

G.S. Precision, Inc.

Anaren Microwave, Inc.

GuardianEdge Technologies

H&S Swansons’ Tool Company

Precision Machine &

Manufacturing Co.

The Wharton School –

Executive Education

Wind River Systems

Precision Tube Bending

Windings, Inc.

PRTM Management

Consultants, LLC

World Graphics, Inc.

PTC

QuEST

Radant Technologies, Inc.

Ranal

Xerox Corporation

X-Ray Industries

XyEnterprise

Yarde Metals

The following is a list of images used in this report:

Cover: top row (l. to r.)

• Next-Generation bomber (Boeing artist’s rendition)

• UH-60 Black Hawk helicopter (U.S. Army photo)

• Predator B unmanned aircraft (Courtesy of General Atomics

Aeronautical Systems, Inc. All rights reserved.)

center row (l. to r.)

• Arleigh Burke-class guided missile destroyer (U.S. Navy photo)

• F-22 Raptor fighter (U.S. Air Force photo)

• C-17 Globemaster III transport (U.S. Air Force photo)

bottom row (l. to r.)

• Stryker armored vehicle (U.S. Army photo)

• F-35 Lightning II fighter (Lockheed Martin photo)

• Global Positioning System 11R-M satellite (Lockheed Martin

artist’s rendition)

Pg. 2:

F-35 Lightning II fighter (Lockheed Martin photo)

Pg. 4:

B-2 Spirit bomber (U.S. Air Force photo)

Pg. 6:

top to bottom

• Seawolf-class nuclear-powered attack submarine (General Dynamics

Electric Boat photo)

• Atlas V rocket (United Launch Alliance photo)

Pg. 8:

top to bottom

• U.S. Navy F/A-18C fighter (U.S. Navy photo)

• CV-22 Osprey tiltrotor (Bell Boeing photo)

• USS Enterprise nuclear-powered aircraft carrier (U.S. Navy photo)

Pg. 10:

top to bottom

• C-130J transport (Lockheed Martin photo)

• Shipboard Combat Direction Center (U.S. Navy photo)

• Patriot missile launcher (U.S. Army photo)

The Aerospace Industries Association of America

The Aerospace Industries Association of America

(AIA) was founded in 1919, only a few years after

the birth of flight.

Today, some 270 major aerospace and defense

companies and suppliers are members of

the association, embodying every hightechnology manufacturing segment of the

U.S. aerospace and defense industry from

commercial aviation and avionics, to manned

and unmanned defense systems, to space

technologies and satellite communications.

AIA represents the nation’s leading

designers, manufacturers and providers of:

Civil, military, and business aircraft

Helicopters

Unmanned aerial vehicles

Space systems

Aircraft engines

Missiles

Materiel and related components

Equipment

Services

Information technology

Aerospace Industries Association

1000 Wilson Boulevard, Suite 1700

Arlington, VA 22209-3928

703-358-1000

www.aia-aerospace.org