MD & A - Guyana Goldfields Inc.

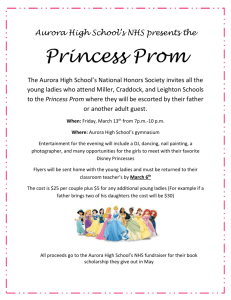

advertisement