Has the U.S. bond market lost its edge to the Eurobond market?

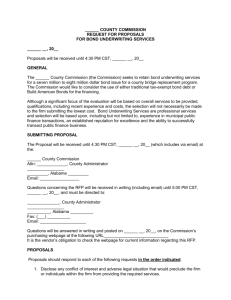

advertisement