Processing Accounting Information

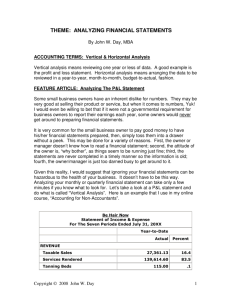

advertisement