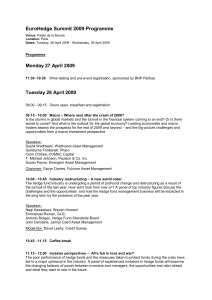

EuroHedge Forum 2005 Programme

advertisement

EuroHedge Forum 2005 Programme Day One - 20 September 8.00: Doors open 9.00: Introduction 9.15: What is the Future for Asset Management? And Where Do Hedge Funds Fit In? Are hedge funds now part of the mainstream asset management world? Moderator: Jon Hitchon, Deutsche Bank Speakers: Nicola Horlick, Bramdean Asset Management; Stewart Newton, Veritas; Manuel Echeverria, Optimal Investment Services; Mark Kary, Polar Capital 10.00: What Do Institutions Really Want From Hedge Funds? How should hedge funds fit within in an overall portfolio? Moderator: Niki Natarajan, InvestHedge Speakers: James Walsh, Hermes; Gumersindo Oliveros, World Bank; Guy Ingram, Albourne; Alasdair Macdonald, Watson Wyatt Partners 10.45: Break 11.15: Hedge Funds and Private Equity: Who Is Eating Whose Lunch? How are the two sides influencing each other? Moderator: Nick Evans, EuroHedge Speakers: Dimitri Goulandris, Cycladic; Michael Cohen, Och-Ziff Management Europe; Nadja Pinnavaia, GSAM; Theo Phanos, Trafalgar Asset Managers 12.00: Corporate Activism: Power & Responsibility The increasing power of hedge funds, and whether it poses new responsibilities Moderator: Glen Mifsud, CSFB Speakers: Colin Kingsnorth, Laxey Investors; Mark Foster-Brown, Altima Partners; Guy Wyser-Pratte, Wyser-Pratte & Co; Matthew Peacock, Hanover Investors; 12.45: Lunch sponsored by Lehman Brothers 2.00: Keynote speaker Paul Ruddock, Lansdowne Partners Introduced by: Neil Wilson, HedgeFund Intelligence 2.45: Do Hedge Funds Have An Image Problem? How Should They Address It? Moderator: Barry Cohen, HedgeFund Intelligence Speakers: Florence Lombard, AIMA; Charles Bathurst, Old Mutual Asset Managers; Kate O'Neill, Henderson Global Investors; Paul Lockstone, Merlin Financial 3.30: Break STREAM SESSIONS Stream I 4.00: Can Institutions Trust The Numbers? As strategies proliferate and increase in complexity, a panel debate how much investors can trust fund valuations Moderator: Neil Wilson, HedgeFund Intelligence Speakers: Michael Ezra, Independent Consultant; Andrew Ashworth, Abacus Fund Administration; Eoin Macmanus, Ernst & Young; Martin Pabari, CQS LLP Stream II 4.00: Volatility: The New Frontier? A new wave of funds makes a strong start, so is it the start of something big? Moderator: Philippe Carrel, Reuters Speakers: Robert Hanna, Mako Investment Managers; Mark Shooter, Shooter Fund Management; Martin Estlander, er Capital Management; Mike Wexler, Maple Leaf Capital 5.00: Debate: Style Drift or Evolution? When is it right - or is it ever right - for managers to stick to their declared strategy, even if it is not working as market conditions change? A panel debate the issue Moderator: Nick Evans, EuroHedge Speakers: Stuart Mitchell, S.W. Mitchell Capital; Nabil Debs, Plutus Capital; David Yarrow, Clareville Capital; Chris Palmer, Gartmore 5.45: Cocktails sponsored by HSBC Day Two - 21 September 8.00: Doors open 8.30: Welcome 8.45: Featured speaker Hector Sants of the Financial Services Authority will continue the debate on hedge funds following the FSA Discussion Paper of 23 June. He will highlight the perceived risks hedge funds pose and discuss potential mitigating actions FSA might take 9.15: Long/Short and Long-Only: Two Worlds Collide More boutiques as well as institutional firms are running both strategy types side by side. A panel discuss Moderator: Donald Pepper, Merrill Lynch Speakers: Michele Ragazzi, Newman Ragazzi; George Luckraft, Framlington; Charles Michaels, Sierra Global; Paul Ross, Arundel Partners STREAM SESSIONS Stream I 10.00 Is Energy Still the Biggest Opportunity? Does the energy and natural resources sector still provide the best opportunities going forward? And if so with what type of strategy? Moderator: Neil Wilson, HedgeFund Intelligence Speakers: Philip Richards, RAB Capital; Peter Andersland, Sector Investments; Henri-Daniel Samama, Exane; Chris Butler, Martin Currie Stream II 10.00: Credit Derivatives: Are They Working As Intended? Recent gyrations have tested the fast-growing credit derivatives market. A panel debate how well the instruments stood up and new ways forward Moderator: Nick Evans, EuroHedge Speakers: Tim Haywood, Julius Baer; Ralph Danielski, Eurex; Marcus Schueler, Deutsche Bank; Tim Frost, Cairn Capital 10.45: Break 11.15: Transparency: The Institutional Requirements? What are the challenges for operations, NAV calculation and reporting - given the greater needs of institutional investors? Moderator: William Keunen, Citco Speakers: Luke Ellis, FRM; Gerard Gennotte, QuantMetrics; Mark George, Ruby Capital; Tim Gascoigne, HSBC Republic Investments 12.00: New Marketing Horizons: How Far Can Distributors Push Hedge Funds? Beyond the mass affluent, how much further? Moderator: Niki Natarajan, InvestHedge Speakers: David Royds, Matrix Group; Richard Burns, Citigroup; John Burridge, Orchid Advisory Ltd; Ian Morley, Dawnay Day Olympia 12.45: Lunch sponsored by Ernst & Young 2.00: Keynote Speaker David Mullins, Vega Asset Management Introduced by: Charlie MacLean, Barclays Capital 2.45: Corporate Finance and Hedge Funds: How Far Can Takeovers and Listings Go? Moderator: Nick Evans, EuroHedge Speakers: Florian Homm, Absolute Capital Management; Charles Williams, Hawkpoint Partners; Brett Bastin, Grail Partners; Colin Barrow, Alpha Strategic 3.30: Break 4.00: Alternatives to Alternatives: Are they Really Still Hedge Funds? Moderator: Neil Wilson, HedgeFund Intelligence Speakers: Diego Wauters, Coriolis Capital; Laurent Segalen, CDC IXIS; John Dickerson, Summit Global Management; Christopher Derricott, Curzon Capital Ltd 4.45: Final comments