the agenda - Euromoney Conferences

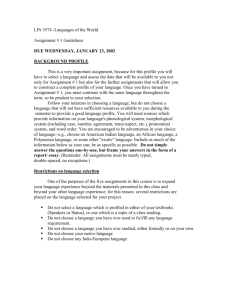

EuroHedge Summit 2009 Programme

Venue: Palais de la Bourse

Location: Paris

Dates: Tuesday, 28 April 2009 - Wednesday, 29 April 2009

Programme

Monday 27 April 2009

17.30 -19.30

Wine tasting and pre event registration, sponsored by BNP Paribas

Tuesday 28 April 2009

08.00 - 09.15 Doors open, breakfast and registration

09.15 - 10.00 Macro – Where next after the crash of 2008?

Is the storms in global markets and the turmoil in the financial system coming to an end? Or is there worse to come? And what is the outlook for the global economy? Leading economists and macro traders assess the prospects for the rest of 2009 and beyond – and the big-picture challenges and opportunities from a macro investment perspective.

Speakers:

Sushil Wadhwani, Wadhwani Asset Management

Guillaume Fonkenell, Pharo

Colm O’Shea, COMAC Capital

T. Michael Johnson, Paulson & Co. Inc.

Susan Payne, Emergent Asset Management

Chairman: Gavyn Davies, Fulcrum Asset Management

10.00 - 10.45 Industry restructuring – A new world order

The hedge fund industry is undergoing a period of profound change and restructuring as a result of the turmoil of the last year. How will it look from now on? A panel of top industry figures discuss the challenges and the opportunities and how the hedge fund management business will be impacted in the long term by the problems of the past year.

Speakers:

Nagi Kawkabani, Brevan Howard

Emmanuel Roman, GLG;

Antonio Borges, Hedge Fund Standards Board

John Demaine, James Caird Asset Management

Moderator: David Leahy, Credit Suisse

10.45 - 11.15 Coffee break

11.15 - 12.00

Investor perspectives – All’s fair in love and war?

The poor performance of hedge funds and the measures taken to protect funds during the crisis have led to a major upheaval in the industry. A panel of experienced investors in hedge funds will examine the changing balance of power between investors and managers, the opportunities and risks ahead and what they want to see in the future.

Speakers:

Kevin Gundle, Aurum Funds

Jean-Michel Raynaud, Mn Services

Gideon Nieuwoudt, Silver Creek Capital

Hamlin Lovell, Millenium Global

Moderator: Bob Sloan, S3 Partners

12.00 - 12.45 Keynote speaker: Greg Coffey, Moore Europe Capital Management

Introduced by: Neil Wilson, HedgeFund Intelligence

12.45 - 14.00 Lunch, sponsored by Isle of Man

14.00 - 14.45 CTAs and Quant Strategies – Proving their non-correlation?

Managed futures, CTAs and systematic trading strategies were the star performers in 2008, earning big returns at a time when most other strategies suffered. With CTAs now back on the radar screen big-time for investors, leading practitioners will discuss their different approaches, how they generate uncorrelated returns and the case for CTAs.

Speakers:

Harold de Boer, Transtrend

Aref Karim, Quality Capital

Lawrence Staden, GLC

Tim Wong, Man AHL

Moderator: Duncan Crawford, Newedge

STREAM SESSIONS

14.45 - 15.30

STREAM I: Investor protection – The latest best practices in infrastructure, custody, cash management, valuation and risk control

Following a year which featured the seismic shocks of the Lehman collapse and the Madoff megafraud, attention has been focused as never before on what should be the appropriate standard of best practice in hedge funds. A panel of leading practitioners debate the latest thinking on what is required in terms of infrastructure, custody, cash management, valuation and risk control.

Speakers:

Neil McCallum, Capula

Martin Pabari, CQS

Stephen Oxley, Pacific Alternative Asset Management

H.Joseph Leitch, Rubicon Fund Management

Moderator: David Aldrich, The Bank of New York Mellon

STREAM II: Managed accounts - The major source of future assets?

For many years, some of the leading strategies in alternative investing – such as managed futures – have always raised a significant portion of their assets from managed accounts. But following last year’s markets shocks and generally negative performance, a greater proportion than ever seems to be getting channelled via managed accounts. A panel of allocators and managers discuss how much further this trend can go.

Speakers:

Nathanael Benzaken, Lyxor

Tony Gannon, Abbey Capital

Martin Phipps, Gartmore

Peter Coates, Lighthouse Partners

Francois Bonnin, John Locke Investments

Moderator: Amanda Cantrell, EuroHedge

15.30 - 16.00 Coffee break

16.00 - 16.45

STREAM I: Funds of funds: Is the model broken? Do they need to be reinvented – and, if so, how?

After a year of generally negative returns, capped off by the Madoff scandal, many are suggesting that the fund-of-fund model – with its extra layer of fees – cannot survive in its current form. A panel debate whether the model needs to be reinvented – and if so, in what ways it can or should be revised.

Speakers include:

Ian Morley, Allenbridge Hedge

Kate O’Neill, RBS

Denise Hitchens, Kedge Capital

Francois Langlade-Demoyen, Pamplona Capital Management

Moderator: William Keunen, Citco Fund Services

STREAM II: The African opportunity

Africa is not for the faint-hearted, with recent market swings showing how vicious a lack of liquidity can be when investors pull back. But, for many of the continent’s economies, growth rates are forecast to remain robust in 2009. Dedicated African managers - whether in the more mature South

African space or elsewhere on the continent - believe the long-term story warrants attention from global allocators. They are also pioneering ways to manage risk while tapping into growth.

Speakers:

Tony Christien, IDS

David Damiba, Renaissance Investment Management

Peter Balint, Erste Group

Andrew Wolfson, Cadiz

Moderator: Neil Wilson, HedgeFund Intelligence

16.45 - 17.30

STREAM I: In the new world order, which domiciles will win out?

Following the recent G20 Summit, there is attention and pressure as never before for change in offshore financial centres or socalled ‘tax havens’. While it is unclear as yet what changes will be forthcoming, the industry has been evolving for some time already away from the standard structures

– such as a Cayman vehicle with a Dublin listing – used by most European managers. A panel of experts discuss what ways this evolution will now take going forward.

Speakers include:

Peter Astleford, Dechert

Richard Hay, Stikeman Elliott

Jon Mills, KPMG

Mark Slater, Bridge Asset Management

Moderator: Tom Raber, Alvine Capital

STREAM II: New opportunities, new perspectives

The dramatic events and market upheavals of the past year are requiring all hedge fund managers and investors to think and act in new and different ways. A diverse panel of single-strategy and multistrategy managers explore how their perspectives and strategies are evolving as a result – and the opportunities that they see.

Speakers:

David Hoey, ABC Arbitrage

Daniel Moreno, Odyssey Emerging Markets

Henrik Rhenman, Rhenman Healthcare

Karl-Mikael Syding, Futuris Asset Management

Moderator: Mikael Spangberg, SEB Merchant Banking

17.30 Cocktails, sponsored by Newedge

Wednesday 29 April 2009

08.30 - 09.15 Doors open and breakfast

09.15 - 10.00

Commodities and energy – Riding the rollercoaster

Commodity and energy markets experienced a wild ride in 2008, first booming and then plummeting.

Some say the commodity bubble has burst. Others believe the super-cycle is still very much alive. A panel of specialist traders in oil, energy and commodity markets will discuss the outlook and their strategies for exploiting these most volatile markets.

Speakers include:

Pierre Andurand, BlueGold Capital

Claude Lixi, Galena Asset Management

Shawn Reynolds, Van Eck Global

Frank Holmes, U.S. Global Investors

Stephen Hedgecock, Altis Partners

10.00 - 10.45

Equity strategies – A bonanza for the survivors?

2008 was a brutal year for most long/short equity managers. But a few came through the storm with flying colours and the opportunities in a less crowded space could be spectacular. A panel of managers will assess the outlook for world markets and how they plan to capitalise on the opportunities on offer while continuing to manage the risk.

Speakers include:

Russell Clark, Horseman Capital

Martin Woodcock, Millgate Capital

Charlie Michaels, Sierra Global Management

Roberto Bogoni, Libra Equity

Ragnhild Wiborg, Consepio

Moderator: Nick Evans, EuroHedge

10.45 - 11.15 Coffee break

11.15 - 12.00

Credit and distressed – The best opportunity for a generation?

The current environment looks tailor-made for distressed investing, with the worldwide credit contraction triggering a severe recession and collapse in corporate earnings. At the same time the bombed-out credit markets look ripe for a rally. Top managers in the credit and distressed space will debate the opportunities and the pitfalls to avoid.

Speakers:

Theo Phanos, Trafalgar Asset Managers

Tim Babich, Fortelus Capital

Bob Paine, Advent Capital

Tom Priore, ICP Capital

Moderator: Richard Ernesti, Citi

12.00 - 12.45

Keynote speaker: Elena Ambrosiadou, IKOS

Introduced by: Sujal Kapadia, Barclays Capital

12.45 - 14.00 Lunch

14.00 - 14.45

Shorting and regulation – Shooting the messenger?

The global crisis will bring sweeping change to every area of the financial industry – and hedge funds will be no exception. Leading industry figures will discuss the likely future course of regulation, the political backlash, the impact of short-selling bans and the need for better understanding of the role that hedge funds play in the financial system.

Speakers include:

Jim Chanos, Kynikos Associates

David Yarrow, Clareville Capital

Andrew Baker, AIMA

Martin Cornish, Katten Muchin Rosenman Cornish

Moderator: Giles Williams, KPMG

14.45 - 15.30 Fixed income and currency funds – back on the radar screen

The massive volatility and loss of liquidity in many market sectors in recent months have re-focused investor attention on the most liquid markets and investment strategies. Fixed-income and currency funds are back in favour. A panel of specialist managers will look at different investment strategies for approaching the fixed-income and currency markets.

Speakers:

Lisa Scott-Smith, Millennium Global Investments

Gerard Gardner, North Asset Management

Alan Burnell, Nylon Capital

Chris Brandon, Rhicon Currency Management

David Lofthouse, Prologue Capital

Introduced by: Niki Natarajan, InvestHedge

15.30 - 16.00

Closing Keynote Address: Paul Ruddock, Lansdowne Partners

Introduced by: Nick Evans EuroHedge

16.15 Closing remarks

![For the full programme click here [Word]](http://s3.studylib.net/store/data/007111369_1-4e0187ff3f28659c587dbc936eb75aec-300x300.png)