implementing American Express

EMV™ acceptance on a Terminal

™

EMV tools

A MERICAN

E XPRESS

I

P

S

ntegrated Circuit Card

ayment

pecification

The policies, procedures, and rules in this manual are subject

to change from time to time by American Express.

Copyright © 2007 by American Express Travel Related Services Company, Inc.

All rights reserved. No part of this document may be reproduced in any form

or by any electronic or mechanical means, including information storage and

retrieval systems, without the express prior written consent of American Express

Travel Related Services Company, Inc. EMV is a trademark of EMVCo, LLC.

PCI Security Standards Council is a trademark of PCI Security Standards Council,

LLC. All other trademarks and brands are the property of their respective owners.

Implementing American Express EMV Acceptance on a Terminal

CONTENTS

SECTION 1: INTRODUCTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

1.1. Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

1.2. How to Use This Guide . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

1.3. Reference Documents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

1.4. Requirement Notation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

SECTION 2: EMV SPECIFICATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

2.1. Industry Specifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

2.2. AEIPS: American Express Integrated Circuit Card Payment Specification . . . . . . . . . . . . . . . . . 6

SECTION 3: TERMINAL REQUIREMENTS BY EMV TRANSACTION STEP. . . . . . . . . . . . . . . . . 7

3.1. Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

3.2. EMV Transaction Steps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Step 1: Application Selection . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Step 2: Initiate Application Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Step 3: Read Application Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Step 4: Offline Data Authentication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Step 5: Processing Restrictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Step 6: Cardholder Verification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Step 7: Terminal Risk Management. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Step 8: 1st Terminal Action Analysis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Step 9: 1st Card Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Step 10: Online Transaction Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Step 11: Issuer Authentication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Step 12: 2nd Terminal Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Step 13: 2nd Card Action Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Step 14: Issuer Script Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Step 15: Transaction Completion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

October 2007

■

1

Implementing American Express EMV Acceptance on a Terminal

SECTION 4: SPECIAL TRANSACTION PROCESSING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

4.1. AEIPS Requirements During Technical Scenarios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

4.1.1. Fallback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

4.1.2. Premature Card Removal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

4.1.3. Referral Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

4.1.4. Declined Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

4.1.5. Stand-In Authorization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

4.1.6. Reversals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

4.2. AEIPS Requirements During Situational Scenarios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

4.2.1. Refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

4.2.2. Card Not Present . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

4.2.3. Card Not Yet Present . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

4.2.4. Transaction Amount Not Yet Known . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

4.2.5. Card No Longer Present . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

4.2.6. Card Re-Presented for Final Charge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

4.2.7. Adding a Gratuity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

4.3. AEIPS Requirements for Unattended Payment Terminal (UPT) Scenarios . . . . . . . . . . . . . . . . . 29

4.3.1. Cardholder Verification on UPTs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

4.3.2. Fallback on UPTs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

4.3.3. Online Capability with UPTs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

SECTION 5: AEIPS TERMINAL CERTIFICATION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

5.1. Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

5.2. How to Perform AEIPS Terminal Certification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

5.3. AEIPS Terminal Certification Test Plan [AEIPS-TEST] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

5.4. Setting Up the Terminal Prior to AEIPS Terminal Certification . . . . . . . . . . . . . . . . . . . . . . . . . 34

5.4.1. Additional Parameters and Requirements for Stand-In Certification . . . . . . . . . . . . . . . . 35

5.4.2. Mandatory Data for Diagnostics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

5.4.3. Connectivity Test . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

October 2007

■

2

Implementing American Express EMV Acceptance on a Terminal

5.5. Completing the AEIPS Test Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

5.5.1. Documentation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

5.5.2. TVR and TSI Setting Requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

5.6. Overview of AEIPS Terminal Certification Tests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

5.6.1. Mandatory Tests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

5.6.2. Tests That Are Based on the Terminal’s Functionality . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

5.6.3. Tests That Are Performed When There Are Communication Changes . . . . . . . . . . . . . . . 45

SECTION 6: MERCHANT EDUCATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

6.1. Guidance for a Successful Training Program. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

APPENDIX A: CAPK INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

APPENDIX B: DISPLAYABLE MESSAGES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

APPENDIX C: GLOSSARY AND ACRONYMS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53

October 2007

■

3

Implementing American Express EMV Acceptance on a Terminal

INTRODUCTION

SECTION 1: INTRODUCTION

1.1. Overview

This guide is designed to assist you (the Terminal Vendor, Merchant, Reseller, or Third Party Processor) with

implementing American Express EMV acceptance on a Terminal, using the American Express Integrated

Circuit Card Payment Specification (AEIPS). This guide assumes that you have a basic understanding of EMV.

By studying the guide and reference documents, you will gain a sound understanding of the requirements,

policies, and procedures—as well as configuration options—which apply specifically to American Express.

You will also find helpful hints, in the form of “Best Practices,” to aid you in understanding how best to

implement American Express EMV acceptance.

This guide details only the American Express-specific requirements and configurable options for implementing

EMV technology. Unless otherwise detailed within the document, process transactions as described within

the EMVCo specifications. Additionally, this guide outlines only the globally-standard requirements for

implementing AEIPS; there may be additional country-specific or Acquirer-specific requirements.

To learn more details about EMV implementation, please contact your Acquirer or American Express

Representative, or visit the EMVCo website (www.emvco.com).

1.2. How to Use This Guide

While this guide is not a definitive technical specification, it will provide a roadmap to allow you a more

thorough understanding of American Express EMV implementation. You will find additional support in the

technical reference documents cited in 1.3. For your convenience, also included is a “Glossary and Acronyms”

section at the end of this document that you can refer to as you encounter unfamiliar terms, acronyms, or

phrases. Words that are defined in the glossary are capitalized when used in this guide.

1.3. Reference Documents

All documents that are referred to within this guide are listed in Table 1. These documents will be referenced

using the abbreviations provided. This is not an exhaustive list of available documents. Please contact your

American Express Representative to learn about the additional reference documents that are available.

Table 1: Reference Documents

Abbreviation

Full Document Name

Source

[AEIPS-TEST]

AEIPS Test Plan v5.2, American Express

Please contact your

American Express

Representative

[AEIPS-TERM]

AEIPS Terminal Specification (AEIPS 4.1), American Express

Please contact your

American Express

Representative

[AEIPS-CARD]

AEIPS Chip Card Specification (AEIPS 4.1), American Express

Please contact your

American Express

Representative

[ISO-9564]

Banking — Personal Identification Number (PIN) Management

and Security

www.iso.org

October 2007

■

4

Implementing American Express EMV Acceptance on a Terminal

Full Document Name

Source

[ISO-11568]

Banking — Key Management (Retail)

www.iso.org

[ISO-11770]

Information Technology — Security Techniques — Key

Management

www.iso.org

[ISO-13492]

Banking — Key Management Related Data Element (Retail)

www.iso.org

[ISO-15782]

Certificate Management for Financial Services

www.iso.org

[ISO-15408]

Information Technology — Security Techniques — Evaluation

Criteria for IT Security

www.iso.org

[ISO-7813]

Identification Cards — Financial Transaction Cards

www.iso.org

INTRODUCTION

Abbreviation

1.4. Requirement Notation

Throughout this guide, attention is drawn to requirements within the text by using bold and italics on key

words as follows:

B Mandatory requirements are highlighted through the use of the words must, shall, mandatory, or

mandate(s).

B Optional recommendations are highlighted through the use of the words should, optional, or

recommend(s).

This guide seeks to highlight only requirements above and beyond those that are mandatory in the EMV

specifications, as well as options that may be set by the Payment Brands.

October 2007

■

5

Implementing American Express EMV Acceptance on a Terminal

SECTION 2: EMV SPECIFICATIONS

2.1. Industry Specifications

EMV

SPECIFICATIONS

For the purposes of this document, “EMV” is used to describe a set of Chip Card specifications administered

by EMVCo. These specifications facilitate an interoperable framework in which Chip Card-based payment

transactions can be processed globally. The EMV specifications allow Payment Brands and Issuers the flexibility

to customize specific requirements with regards to security, risk management, and Cardholder Verification, in

order to best meet their own objectives.

The EMV specifications apply to virtually every aspect of the Chip Card, including:

B physical characteristics;

B the electronic interface between the Chip Card and Terminal;

B determination of protocols for data communication between a Chip Card and a Terminal; and

B payment application features.

EMVCo details and manages Terminal type approval to ensure compliance with the specifications. The

Payment Brands set their own requirements for EMV implementation and define the testing processes to

certify against these requirements. Banking industry associations in certain countries may also set local

requirements. These tend to be related to national rollouts in order to ensure there is a consistent approach in

a country (e.g., by specifying common requirements for the usage of PIN).

2.2. AEIPS: American Express Integrated Circuit Card Payment Specification

The EMV specifications contain many implementation options that the Payment Brands clarify within their

individual specifications. To enable the most effective usage of EMV technology, American Express has

produced AEIPS. We have divided AEIPS into two separate specifications:

B AEIPS Chip Card Specification [AEIPS-CARD], which defines the technical data elements and functionality

when implementing EMV-compliant Chip Cards.

B AEIPS Terminal Specification [AEIPS-TERM], which outlines the Terminal functionality required to process

American Express EMV transactions.

BEST PRACTICE: It is recommended that you read both the AEIPS Chip Card Specification and the

AEIPS Terminal Specification to fully understand how to implement American Express EMV.

As AEIPS is built on the EMVCo specifications, there are no technical differences between implementing EMV

for American Express than for the other Payment Brands. The only differences that exist are configuration

options that American Express has specified based on the EMVCo specifications. Just as American Express

has configuration differences from other Payment Brands, similar configuration differences exist among other

Payment Brands as well.

Therefore, you can easily implement American Express EMV as you implement other Payment Brands. This

affords you several benefits, including meeting the requirements of all the Payment Brands at once, saving

the effort of adding AEIPS after EMV migration is already underway, and ensuring the satisfaction of potential

customers.

October 2007

■

6

Implementing American Express EMV Acceptance on a Terminal

SECTION 3: TERMINAL REQUIREMENTS BY EMV

TRANSACTION STEP

3.1. Introduction

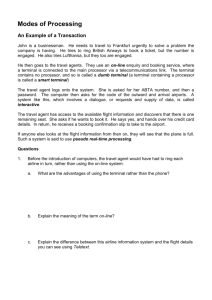

This section examines each step of an EMV transaction. As shown in

Figure 1, American Express is interoperable with the EMV specifications

and also aligns very closely with the other Payment Brands. There are

only four steps within the EMV transaction process flow in which

American Express has configuration differences from the industry.

REQUIREMENTS BY

TRANSACTION STEP

Figure 1: Process Flow for an EMV Transaction

insert card

same as industry

configuration differences

Terminal Risk Management: Of the several Terminal

risk management checks allowed by the EMV specifications, American Express mandates that the Terminal perform Floor Limit checking and random transaction selection. The other checks can be optionally

performed by the Terminal.

offline

transaction

unable to

go online

1

application

selection

2

initiate

application

processing

3

read

application

data

4

offline data

authentication

5

processing

restrictions

6

cardholder

verification

7

terminal risk

management

8

1st terminal

action analysis

9

1st card

action analysis

10

online

transaction

processing

11

issuer

authentication

12

2nd terminal

action analysis

Application Selection: The EMV specifications allow for both complete

and partial Application Identifier selection, and each Payment Brand has

chosen which option to leverage. American Express requires the use of

partial Application Identifier selection for all American Express® Cards,

so the Application Selection Indicator within the Terminal must be set

appropriately.

1st Terminal Action Analysis: There are no technical differences

for handling an American Express Card during this step. Like the

other Payment Brands, American Express has specific Terminal

Action Code values that must be loaded into the Terminal.

Online Transaction Processing: Like the other Payment Brands,

American Express has a unique message format, which may vary by

country. Therefore, the Terminal, Third Party Processor, or Acquirer

will need to ensure that they are able to place the EMV data elements into the appropriate format for each Payment Brand.

13 2nd card action

analysis

October 2007

14

issuer script

processing

15

transaction

completion

remove card

■

7

Implementing American Express EMV Acceptance on a Terminal

3.2. EMV Transaction Steps

Following is a high-level description of each EMV transaction step. For those steps where American Express

has configuration differences, our requirements are noted and described in detail. In some steps, there are

also additional requirements which cover operational functionality outside of the EMV specifications, e.g., PIN

Bypass. These additional requirements are also described in the appropriate steps.

These symbols will help identify the steps that have changes exclusive to AEIPS:

Indicates there is a configuration difference specific to AEIPS

Indicates no customization beyond standard EMV specifications

A general description of the step appears at the beginning of each section, set off in gray borders.

REQUIREMENTS BY

TRANSACTION STEP

Step 1: Application Selection

American Express has configuration differences.

When a Chip Card is inserted into a Terminal, the Terminal determines (and may have the option to display)

a list of applications supported by both the Chip Card and Terminal. This is done by matching an Application

Identifier (AID) loaded into the Terminal with a similar value loaded in the card.

Application Selection on AEIPS-compliant cards is performed according to the EMV specifications.

American Express mandates that Terminals support and are enabled for partial name selection by

setting the Application Selection Indicator.

In partial name selection, the select command is issued with the partial American Express AID loaded

in the Terminal, which is comprised of the American Express Registered Application Provider Identifier

(RID), and the first byte of the Proprietary Application Identifier Extension (PIX).

The American Express RID is: “A0 00 00 00 25,” and the first byte of the PIX for an AEIPS-compliant

payment application is “01.” Therefore, the AID value held within the Terminal for use in partial name

selection shall be “A0 00 00 00 25 01.”

If a Chip Card is inserted into a Terminal and no matching applications can be found—i.e., if the

Terminal is EMV-enabled but not yet certified, or if it is EMV-enabled for other Payment Brands but

not yet for American Express—the transaction must be processed using the magnetic stripe. You

must not process the transaction as Fallback (see section 4.1.1. Fallback for definition). To enable the

transaction to be processed using the magnetic stripe, the Terminal must not perform extended service

code checking, i.e., the Terminal should not prompt for card insertion when a service code that starts

with a 2 or a 6 is detected. In this case, the POS data codes or similar indicators must indicate that the

Terminal did not have chip capability, e.g., Position 1 (card input capability code) ≠ 5 (Integrated Circuit

Card [ICC]). To support this, the Terminal must have the ability to set the POS data code based on the

Payment Brand.

October 2007

■

8

Implementing American Express EMV Acceptance on a Terminal

Step 2: Initiate Application Processing

American Express has the same requirements as the EMV specifications.

When an AEIPS application is selected, the Terminal requests that the Chip Card provide the location of the

data to be used for the current transaction and list the functions supported.

Step 3: Read Application Data

American Express has the same requirements as the EMV specifications.

REQUIREMENTS BY

TRANSACTION STEP

The Terminal reads the necessary data from the locations provided by the Chip Card and uses the list of

supported functions to determine which processing to perform. The information required to perform Offline

data authentication is found within the data read from the Chip Card during this stage of the transaction.

Step 4: Offline Data Authentication

American Express has the same requirements as the EMV specifications. However, additional

requirements that cover operational functionality outside of the EMV specifications are provided.

Offline data authentication validates that the card being used in the transaction is the genuine card that was

issued and that the card data has not been altered. There are different types of Offline data authentication.

The most common are Static Data Authentication (SDA) and Dynamic Data Authentication (DDA). The Terminal

determines whether it authenticates the Chip Card Offline, using either SDA or DDA, based upon the ability of

the Chip Card and Terminal to support these methods.

American Express mandates that Terminals support SDA and DDA; however, support of

Combined DDA / Application Cryptogram (AC) generation (CDA) is optional.

Certification Authority Public Keys (CAPKs) are required to support Offline data authentication. The lack of the

correct CAPKs will lead to Offline data authentication failures and potential transaction declines. Terminals

must be capable of storing up to six CAPKs for each Payment Brand.

Full detail of CAPK expiration dates, required Terminal load dates, earliest Issuer usage dates, and required

key removal dates are detailed in Table 2.

Table 2: CAPK Management Lifecycle

CAPK

Length

Expiration Date

Required Date for

Acquirers to Load

Earliest Date for

Issuers to Use

Required

Removal Date at

Terminals

1024

31 December 2009

31 December 2003

1 January 2004

30 June 2010

1152

31 December 2014

31 December 2005

1 March 2006

30 June 2015

1408

31 December 2017 or

later

31 December 2006

1 January 2007

six months after

expiration

1984

31 December 2017 or

later

31 December 2006

1 January 2007

six months after

expiration

October 2007

■

9

Implementing American Express EMV Acceptance on a Terminal

BEST PRACTICE: American Express, in line with other Payment Brands, reviews the CAPK lifecycle

on an annual basis. Therefore, the expiration dates stated in Table 2 may change. American Express

recommends that Terminals do not store the expiration date, unless it can be easily updated.

American Express CAPKs are emailed to Terminal Vendors when they contact American Express to start AEIPS

Terminal certification. American Express CAPKs are distributed in a fixed format. Both the CAPKs and the fixed

format are detailed in Appendix A.

Step 5: Processing Restrictions

American Express has the same requirements as the EMV specifications.

Step 6: Cardholder Verification

American Express has the same requirements as the EMV

specifications. However, additional requirements that cover

functionality outside of the EMV specifications are provided.

Cardholder Verification is used to determine whether the Cardmember is

legitimate and whether or not the Chip Card has been lost or stolen. In a

typical retail environment, the following Cardholder Verification Methods

(CVMs) are supported by the Terminal:

B Offline enciphered PIN

B Offline plaintext PIN

B Signature

B No CVM required

The actual CVM supported on an AEIPS-compliant Chip Card or Terminal will depend on the implementation of

EMV within the country.

PIN Requirements. The use of PIN—either plaintext or enciphered—with EMV introduces some new

technical and operational requirements. The sections below detail the American Express requirements in

relation to PIN.

B American Express mandates that the Terminal be capable of supporting both plaintext and enciphered

PIN.

B The Terminal shall display the transaction amount (or an accurate estimate) to the Cardmember before

PIN entry.

B PIN Pads should be designed to take into account the requirements of all Cardmembers (e.g., a raised

dot on the 5-key to assist partially-sighted Cardmembers, etc.).

October 2007

■

10

REQUIREMENTS BY

TRANSACTION STEP

The Terminal performs a number of checks to determine whether or not to allow the transaction, or whether

any product-specific geographical (e.g., domestic use only) or service-type restrictions (e.g., cannot be used for

cash withdrawal) apply.

Implementing American Express EMV Acceptance on a Terminal

B PIN Pads should be placed in locations that can accommodate the requirements of all Cardmembers

(e.g., to enable PIN entry from a seated position for wheelchair-bound customers). Also, the Cardmember

should be able to see his or her card at all times.

B If a PIN Pad is present, it must comply with EMV, Payment Card Industry Data Security Standard

(PCI DSS) PIN Entry Device (PED), and local country requirements. American Express has no minimum

requirements for PIN Pads beyond those of EMV, PCI PED, and the local country payment authorities or

regulatory bodies.

PIN Input Errors. When the Cardmember encounters problems entering his or her PIN, prompts are necessary

to guide the Merchant and Cardmember.

PIN Bypass. PIN Bypass is an option to aid the customer experience during the implementation of PIN. It can be

leveraged when the Cardmember cannot remember his or her PIN or may temporarily be unable to enter the PIN.

In this case, the Merchant may have the option to “bypass” PIN entry and enable the chip and Terminal to process

the next CVM, which is likely to be signature.

PIN Bypass shall be able to be performed only if all of the following requirements are met:

B the Terminal is attended;

B the Terminal is configured to provide PIN Bypass;

B the Merchant and Acquirer agree to support it; and

B the Chip Card’s CVM list allows another CVM to be performed, and the Terminal can support this CVM.

When PIN Bypass is used, the TVR shall record that “PIN was required, PIN Pad present and working, but PIN

not entered (Byte 3 Bit 4).”

BEST PRACTICE: American Express recommends making PIN Bypass functionality a configurable option

within the Terminal so that the functionality can be disabled when appropriate, e.g., when a country has

reached PIN maturity.

Important Note: PIN Bypass reduces both the fraud mitigation and operational benefits of using PIN, and

therefore is functionality that should only be used during the transition to PIN as the standard CVM. It is also

important to note that Issuers will be likely to decline PIN Bypass transactions as they appear more risky than

PIN-based transactions.

October 2007

■

11

REQUIREMENTS BY

TRANSACTION STEP

AEIPS-Specific Requirements for PIN Input Errors

When a card is presented to a Terminal and the PIN try counter = 1—i.e., there is one PIN attempt

remaining—then the Terminal should produce a suitable prompt to inform both the Merchant and

the Cardmember of this situation. (For Terminal display messages, see Appendix B.) If the PIN try

counter = 0, the Terminal shall continue the transaction, having set the applicable bits in the Terminal

Verification Results (TVR), indicating that the PIN try counter has been exceeded.

Implementing American Express EMV Acceptance on a Terminal

Step 7: Terminal Risk Management

American Express has configuration differences.

During Terminal risk management, a series of checks based on information provided by the card and the

Acquirer are performed. The EMV specifications detail several checks that can be performed as part of

Terminal risk management.

American Express mandates that Floor Limit checking and random transaction selection be performed; all

other checks are optional based on the Terminal’s configuration. The results of these checks are stored by

the Terminal for later use in the TVR.

Step 8: 1st Terminal Action Analysis

1st Terminal action analysis compares the results of Offline data authentication, processing restrictions,

Cardholder Verification, and Terminal risk management to rules set by the Issuer and American Express. This

process determines whether the Terminal requests that the transaction is approved Offline, sent Online for

authorization, or declined Offline.

The Issuer rules are stored in the Chip Card in fields called Issuer Action Codes (IACs); the American Express

rules reside in the Terminal as the Terminal Action Codes (TACs). The Terminal compares the TVR values stored

during Offline processing with the IACs and TACs to determine whether any of the transaction conditions in

the TVR indicate the Terminal will request that the transaction be declined or sent Online. If this is not the

case, then the Terminal will request that the transaction be approved Offline by the Chip Card.

After determining whether to request the transaction be approved, declined, or sent Online to the Acquirer, the

Terminal requests a Cryptogram from the Chip Card. The type of Cryptogram requested depends on whether the

Terminal requires a Transaction Certificate (TC) for an approval, an Authorization Request Cryptogram (ARQC)

for a request to go Online, or an Application Authentication Cryptogram (AAC) for a decline.

Like the other Payment Brands, American Express has specific TAC values that must be loaded into

Terminals. The TAC values for American Express are detailed in the table below:

Table 3: American Express TAC values

Default

C8 00 00 00 00

Online

C8 00 00 00 00

Denial

00 00 00 00 00

Step 9: 1st Card Action Analysis

American Express has the same requirements as the EMV specifications.

Upon receiving the request from the Terminal, the Chip Card performs the 1st card action analysis. Here, risk

management checks are performed by the Chip Card to determine the appropriate response to the Terminal’s

request. The Chip Card may overrule the Terminal’s request. For example, the Chip Card could receive a request

from the Terminal for an Offline approval, but the Chip Card may return a Cryptogram indicating that either

October 2007

■

12

REQUIREMENTS BY

TRANSACTION STEP

American Express has configuration differences.

Implementing American Express EMV Acceptance on a Terminal

an Online transaction or an Offline decline is required. This is dictated by the Chip Card’s risk management

parameters (as set by the Issuer). The results of this analysis are stored for later use by the Chip Card in the

Card Verification Results (CVR).

Step 10: Online Transaction Processing

American Express has configuration differences.

If the Chip Card or Terminal determines that the transaction requires an Online authorization (and if the

Terminal has Online capability), the Terminal transmits an Online authorization message to the Acquirer. If the

Chip Card or Terminal determines that the transaction requires Offline authorization, the Terminal will proceed

with transaction completion (see Step 15).

The message sent to the Acquirer includes the Cryptogram (e.g., ARQC) generated by the Chip Card, the data

used to generate the Cryptogram, and indicators showing Offline processing results, including the TVR and

CVR.

If the Issuer has successfully validated the Cryptogram provided by the Chip Card, Issuer Authentication

Data (IAD) will be included in the authorization response message. This data includes an Issuer-generated

Cryptogram called an Authorization Response Cryptogram (ARPC) and an Authorization Response Code (ARC)

that details the Issuer’s decision regarding the transaction. The response may also include updates for the Chip

Card, called Issuer Scripts (see Step 14: Issuer Script Processing).

If a Terminal receives an authorization response that contains valid information regarding the transaction

result, but does not contain the required chip data to perform Issuer Authentication, this is known as a

downgraded transaction (see Step 12: 2nd Terminal Action Analysis).

October 2007

■

13

REQUIREMENTS BY

TRANSACTION STEP

If the transaction is required to be sent Online, but the Terminal is unable to send it Online due to technical

reasons, the Terminal will proceed to 2nd Terminal action analysis (see Step 12).

Implementing American Express EMV Acceptance on a Terminal

Like the other Payment Brands, American Express has a unique message format, which may vary by country.

The following table illustrates the mandatory and optional data elements for American Express.

Table 4: Mandatory and Optional Data Elements

Mandatory Data Elements:

AUTHORIZATION REQUEST MESSAGE

• Terminal Capabilities Indicator

• Card Input Method Indicator

• Amount, Authorized (Authorization) / Final Transaction Amount (Settlement)

• Amount, Other

• Application Interchange Profile

REQUIREMENTS BY

TRANSACTION STEP

• Primary Account Number (PAN)

• PAN Sequence Number

• Application Transaction Counter

• ARQC

• Issuer Application Data

• Terminal Country Code

• TVR

• Transaction Currency Code

• Transaction Date

• Transaction Type

• Unpredictable Number

AUTHORIZATION RESPONSE MESSAGE

• IAD (this includes the ARPC and the ARC)

• Issuer Script Data

Optional Additional Data Elements:

AUTHORIZATION REQUEST MESSAGE

• Fallback Indicator

• Application Identifier (Terminal)

• Application Version Number (Terminal)

• Cryptogram Information Data

• CVM Results

• IACs: Denial, Online, & Default

Step 11: Issuer Authentication

American Express has the same requirements as the EMV specifications.

If the authorization response contains an ARPC, it is mandatory for the Chip Card to perform Issuer

authentication by validating the response Cryptogram. Upon receiving an authorization response containing an

ARPC, the Terminal submits the ARPC to the Chip Card, using the external authenticate command. This verifies

that the response came from the genuine Issuer. It also prevents criminals from circumventing the Chip Card’s

security features by simulating Online processing and fraudulently approving a transaction.

October 2007

■

14

Implementing American Express EMV Acceptance on a Terminal

Step 12: 2nd Terminal Action Analysis

American Express has the same requirements as the EMV specifications.

There are three distinct scenarios that a Terminal could face at this point in a transaction:

B EMV data received in the authorization response: When the Issuer has successfully authenticated

the card and returned the IAD, then the Terminal can use either the ARC in the IAD or the authorization

response message to determine whether to request that the Chip Card approve or decline the transaction.

B No EMV data received in the authorization response: When the Terminal does not receive any IAD

in the response message, then it determines whether to request that the Chip Card approve or decline

the transaction. This is determined by using the result of the transaction as indicated in the response

message from the Acquirer.

REQUIREMENTS BY

TRANSACTION STEP

The Terminal must then populate the ARC (EMV tag “8A”) to be returned to the Chip Card from the

Terminal in the 2nd generate AC command, as follows:

• “00” for an approval result (i.e., in ASCII “3030”)

• “02” for a referral result (i.e., in ASCII “3032”)

• “05” for a decline (i.e., in ASCII “3035”)

B Terminal was unable to go Online: When the Terminal is unable to go Online, the Terminal determines

whether or not to request Offline approval or an Offline decline from the Chip Card, depending on the TAC

(default) residing in the Terminal and the IAC (default) read from the Chip Card.

Step 13: 2nd Card Action Analysis

American Express has the same requirements as the EMV specifications.

Following the completion of 2nd Terminal action analysis, the Terminal will ask the Chip Card to either approve

or decline the transaction. The Chip Card then performs its own action analysis and makes the final decision as

to whether or not the transaction is approved or declined.

The Chip Card may decline an Issuer-approved transaction based upon the Issuer authentication results and

Issuer encoded parameters in the Chip Card. The Chip Card generates a Cryptogram of type TC for approved

transactions and of type AAC for declined transactions.

Step 14: Issuer Script Processing

American Express has the same requirements as the EMV specifications. However, additional

requirements that cover operational functionality outside of the EMV specifications are provided.

Within EMV, the Issuer has the ability to send updates to the Chip Card via scripts sent in the authorization

response message. An Issuer Script is a collection of card commands constructed and sent by the Issuer for

the purpose of updating and managing Chip Cards.

Detailed below are American Express’ requirements for Issuer Script processing:

B The Terminal shall process the script, whether the transaction was approved or declined. The Terminal

passes commands defined in the script to the Chip Card, either before or after it has returned the final

AC, depending on the type of script sent.

October 2007

■

15

Implementing American Express EMV Acceptance on a Terminal

B The Terminal shall process Issuer Scripts with the Chip Card, irrespective of whether Issuer authentication

is successful or the transaction is approved or declined. The Terminal shall not display any message to the

Merchant indicating either the end of the transaction or card removal until the Chip Card has processed the script.

B In any authorization response, the Issuer can send multiple scripts. These scripts may contain multiple

commands, which shall be processed in the order that they appear within the script. If the card responds

to a command with an Issuer Script indicating success or a warning, then the Terminal must continue to

process the remaining commands. If the card responds with an error, then the Terminal must terminate

processing of any remaining commands.

B Terminals shall support the processing of Issuer Scripts during this step of the transaction, as well as in

Step 13 before the 2nd generate AC command (i.e., support tags “72” and “71”).

REQUIREMENTS BY

TRANSACTION STEP

The following is an example of a trace of an Issuer Script with multiple commands.

Trace Data

72459F18048000000086158424000210FEBF34F00B7CE770DC

61DA847BFB1E59862504DA8E00200000000000000000420141

035E031F020000000000000000AC7F4DF1D624A0E

Table 5: Data Elements in the Issuer Script

Data Element

Description

72

Script tag

45H (69D)

Length

9F18

Tag

04H (4D)

Tag length

80000000

Script ID

86

Command tag

15H (21D)

Length

8424

PIN change command

0002

P1 P2

10H (16D)

Length

FEBF34F00B7CE770

Data

DC61DA847BFB1E59

MAC

86

Command tag

25H (37D)

Length

04DA

Put data command

8E00

CVM list update

20H (32D)

Length

0000000000000000420141035E031F020000000000000000

Data

AC7F4DF1D624A0ED

MAC

H = Hexidecimal

D = Decimal representation of the hexidecimal value

October 2007

■

16

Implementing American Express EMV Acceptance on a Terminal

The following is an example of a trace of an Issuer Script with a single command.

Trace Data

72179F180400004000860E04DA9F580900C7356286E3779889

Table 6: Data Elements in the Issuer Script

Description

72

Script tag

17H (23D)

Length

9F18

Tag

04H (4D)

Tag length

00004000

Script ID

86

Command tag

0EH (14D)

Length

04DA

Put data command

9F58

CVM list update

09H (9D)

Length

00

Data

C7356286E3779889

MAC

REQUIREMENTS BY

TRANSACTION STEP

Data Element

H = Hexidecimal

D = Decimal representation of the hexidecimal value

Step 15: Transaction Completion

American Express has the same requirements as the EMV specifications. However, additional

requirements that cover operational functionality outside of the EMV specifications are provided.

The Terminal performs final processing to complete the transaction. It is also at this point in the transaction

that, if the signature has been determined as the CVM, the receipt is printed and the Cardmember is asked to

sign it.

October 2007

■

17

Implementing American Express EMV Acceptance on a Terminal

AEIPS Receipt Requirements. Certain format and data requirements must be met with regards to transaction

receipts. These are outlined in the following tables and accompanying text.

Key to contents in Table 7, column titled M/P/O/C—M: Mandatory (always needed), P: Preferred (best

practice), O: Optional (can be present), or C: Conditional (dependent on the situation)

Table 7: Receipt Data Table

M/P/O/C

Merchant Number

M*

Merchant Name

M*

Merchant Address

M*

Transaction Type e.g., Sale, Refund

M*

PAN

M*1

Expiration Date of Card (MMYY)

M*

Transaction Data Source e.g., Swiped, Manual Entry, Chip

M*

Date of Transaction

M*

Terminal Number (Terminal ID)

M*

Transaction Number

M*

Transaction Response e.g., Authorization Code

M*

Amount of Transaction (Including Currency Symbol)

M*

Request for Signature (Not Required for PIN Transaction)

C

Space for Signature (Not Required for PIN Transaction)

C

Declaration e.g., Please Debit My Account

M

Retention Reminder

M

PIN Statement (Only required for PIN) e.g., PIN Verified, PIN Locked

C

AID

M

Gratuity Amount

O

Diagnostic Message

P

Start Date of Card (MMYY)

P

Time of Transaction

P

Application Preferred Name

C2

Payment Brand Name/Application Label

M

Card Type

O

Cardmember Name

O3

Courtesy Message

O

Tax Registration Number

O

Receipt Number (Not Transaction Number)

O

Goods Amount

O

Goods Description

O

October 2007

REQUIREMENTS BY

TRANSACTION STEP

Field Description

■

18

Implementing American Express EMV Acceptance on a Terminal

Field Description

M/P/O/C

Tax Rate

O

Exception File Version Number

O

Terminal Software Version Number

O

Cryptogram Type/Value

P

*Indicates data elements that must be stored electronically during a PIN transaction

Notes on Table 7

1. The PAN on the Cardmember’s receipt must be masked per PCI DSS and local legal requirements.

REQUIREMENTS BY

TRANSACTION STEP

2. Where the application preferred name is present and the Terminal supports the relevant Issuer

code table index, then this data element is mandatory.

3. The Cardmember name, if printed, should be printed according to [ISO-7813]. The Cardmember

name is received from the chip for an EMV transaction, or from track 1 for a magnetic stripe

transaction.

BEST PRACTICE: Printing of a receipt should begin as soon as possible, so as to overlap with the

transaction process. Doing so will minimize the time that the Merchant and Cardmember spend waiting.

AEIPS Receipt Layout Requirements. The only mandatory requirement pertaining to the layout of text on

a receipt is that the signature and amount are adjacent to one another. Every effort should also be made to

ensure that other information is presented logically and clearly (e.g., place date and time adjacent to each

other as well as the masked card number and expiration date, etc.).

October 2007

■

19

Implementing American Express EMV Acceptance on a Terminal

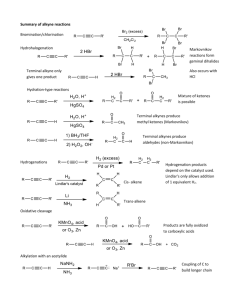

The receipt layout shown in Figure 2 highlights the additional requirements for a Terminal processing American

Express Chip Cards. The red text indicates layout requirements specific to EMV.

Figure 2: Receipt Layout Reqirements

Receipt Layout

Receipt Data

LOGO(S) WHERE APPLICABLE

RETAIL STORE

154 EDWARD STREET

BRIGHTON

BN2 2LP

Merchant Name

Merchant Address

Merchant Number

Terminal Number (Terminal ID)

BATCH# 0001

ROC# 125

XXXXXXXXXXX1003 – (C)

Transaction Number

Masked PAN and Transaction Data Source:

(S) Swiped (M) Manual Entry or (C) Chip.

Card Type and Expiration Date

AMERICAN EXPRESS

EXPIRES 05/12

AMEX GOLD

A000000025010001

OCT 19, 07 15:33

SALE

RRN: 1234567890

ITEM NAME / DESCRIPTION (OPTIONAL)

ITEM NAME / DESCRIPTION (OPTIONAL)

USER ID: 9999 (OPTIONAL)

BASE

£

TIP

£

TOTAL

£

250.00

PIN VERIFIED

X__________________________________

E SMITH

REQUIREMENTS BY

TRANSACTION STEP

MERCHANT ID: 999 999 999

TERMINAL ID: 12345

Application Label, or Application Preferred Name

Card Application Identifier (AID)

Time and Date of Transaction

Transaction Type

Receipt Number

Amount of Transaction (Including Currency Symbol)

Gratuity Amount

PIN Statement or

Space for Signature and

Request for Signature

Cardmember Name

TC – A2E51245C4D7E551

AUTHORIZATION CODE: 252525

Cryptogram Type and Value

Transaction Response e.g., Authorization Code

I AGREE TO PAY THE ABOVE TOTAL AMOUNT

ACCORDING TO THE CARD ISSUER AGREEMENT.

Declaration

MERCHANT COPY

October 2007

■

20

Implementing American Express EMV Acceptance on a Terminal

SECTION 4: SPECIAL TRANSACTION PROCESSING

Despite EMV’s significant impact on Terminal hardware and software, the processes involved in handling a

standard Cardmember transaction are very similar for magnetic stripe and EMV. However, there are some

transactions that occur during unique scenarios that, with the introduction of EMV, and especially PIN, require

special consideration. This section details American Express requirements in such circumstances.

4.1. Technical Scenarios

4.2. Situational Scenarios

4.3. Unattended Payment Terminal

Scenarios

4.1.1. Fallback

4.2.1. Refunds

4.3.1. Cardholder Verification on UPTs

4.1.2. Premature Card Removal

4.2.2. Card Not Present

4.3.2. Fallback on UPTs

4.1.3. Referral Transactions

4.2.3. Card Not Yet Present

4.3.3. Online Capability with UPTs

4.1.4. Declined Transactions

4.2.4. Transaction Amount Not

Yet Known

4.1.5. Stand-In Authorization

4.2.5. Card No Longer Present

4.1.6. Reversals

4.2.6. Card Re-Presented For

Final Charge

4.2.7. Adding a Gratuity

4.1.1. Fallback

When an American Express certified Terminal successfully performs application selection but cannot complete

the EMV transaction due to technical reasons, the Terminal is allowed to process the transaction by using a

less secure method (e.g., magnetic stripe); this is known as Fallback. The Terminal is allowed to use Fallback

as long as the technical error occurs before the card responds to the 1st generate AC command. If the error

occurs after this step, the transaction must be declined and Fallback is not allowed. Additionally, before

Fallback is allowed, multiple attempts to use the chip must be performed (i.e., a first attempt and retries).

American Express recommends that in the event of a chip read failure, a Terminal make two further attempts

to read the chip before processing the transaction as Fallback.

The Terminal should respond to the first and second unsuccessful attempts by displaying a meaningful

message (e.g., “INSERT AGAIN”). After the final unsuccessful attempt, the Terminal shall prompt the

Merchant to revert to reading the magnetic stripe as the Fallback option (e.g., “PLEASE SWIPE”).

If the transaction falls back from EMV technology, the standard checks performed on any magnetic stripe card

must be performed.

Fallback shall not take place if:

B the card is blocked;

B all applications present are blocked;

B the EMV transaction has already been declined; or

B the transaction occurs at an Unattended Payment Terminal (UPT).

October 2007

■

21

SPECIAL TRANSACTION

PROCESSING

4.1. AEIPS Requirements During Technical Scenarios

Implementing American Express EMV Acceptance on a Terminal

Identifying Fallback. The Terminal to Acquirer interface shall include an indicator to explicitly identify Fallback

transactions. There are two ways in which Fallback transactions can be indicated to American Express:

Option 1: Fallback Indicator

• E.g., POS data code position 7 (card data input mode code) = 9 (Fallback)

Option 2: Derived Indicator (Leveraging POS Data Codes)

• Position 1 (card input capability code) = 5 (ICC)

• Position 6 (card present code) = 1 (card present)

• Position 7 (card data input mode code) ≠ 5 (ICC). Some examples of possible values include:

• 2 (magnetic stripe read)

• 6 (key entered)

• S (keyed Four-Digit Card Security Code [4CSC] or Four-Digit Batch Code [4DBC])

BEST PRACTICE: American Express recommends that you apply Option 1, as it more accurately

identifies Fallback transactions.

PAN Key Entry. If the transaction cannot be completed by the chip or magnetic stripe, the transaction may be

completed with PAN key entry, subject to agreement with the local Acquirer.

4.1.2. Premature Card Removal

In an EMV transaction, the card must remain in the Terminal for the duration of the transaction; if the

Cardmember or Merchant removes the card before the Terminal has reached transaction completion, the

Terminal shall cancel the transaction.

If an authorization has taken place, the Terminal shall send a reversal message if the Acquirer and Terminal

support reversals.

If it is not possible to send a reversal message, then the Terminal shall cancel the transaction, and no

settlement data will be sent.

4.1.3. Referral Transactions

As in the current magnetic stripe environment, the Issuer may respond to an

authorization request with a referral. Not all Terminals support referrals, in which

case the Terminal shall treat a referral response as a decline response.

In these circumstances, American Express has the following requirements:

The card shall be removed from the Terminal and retained by the Merchant for

use during the referral process, as information may be required during the referral

call that is not on the Terminal receipt (for example, 4CSC on the front of the

card). However, the Terminal must complete the transaction with the card before

displaying any message that indicates the removal of the card.

October 2007

■

22

SPECIAL TRANSACTION

PROCESSING

Floor Limits. American Express mandates a zero Floor Limit for all Fallback transactions, meaning all Fallback

transactions must be sent Online for authorization.

Implementing American Express EMV Acceptance on a Terminal

There are two options for how a Terminal can do this:

Option 1: The transaction is completed by the Terminal and the chip as though it had been declined (i.e., the

Terminal requests an AAC).

• The Terminal must retain the transaction data until the status of the transaction has been determined.

• If the transaction is subsequently approved, the Terminal must allow the Merchant to enter the approval

code during transaction completion. The approval code must then be included in the submission, along

with the ARQC that was generated by the card prior to Online authorization.

• If the transaction is subsequently declined, the transaction must be declined within the Terminal, with no

further card processing.

Option 2: The transaction is completed by the Terminal and the chip as though it had been authorized (i.e., the

Terminal requests a TC).

• The Terminal must retain the transaction data until the status of the transaction has been determined.

• If the transaction is subsequently approved, the Terminal must allow the Merchant to enter the approval

code during transaction completion. The approval code must then be included in the submission, along

with the TC that was generated by the card.

further card processing.

BEST PRACTICE: American Express recommends that you apply Option 1, as it is more technically

correct. At the point of referral, the transaction has not actually been approved.

4.1.4. Declined Transactions

In normal circumstances, when an Issuer declines a transaction, the Terminal still performs 2nd Terminal and

card action analysis.

When the transaction is declined, the Merchant is made aware of this on the Terminal display. In cases where

a transaction is declined by the card, Terminal, or Issuer, it shall not be reprocessed using alternative data

entry (i.e., magnetic stripe or PAN key entry).

Decline and Retain. In exceptional circumstances, the Merchant may be requested (through a response code)

to retain the card, which is referred to as “decline and retain” (also known as “decline and pickup”). This code

will normally be sent in conjunction with an Issuer Script, which prevents the Chip Card from carrying out

further EMV transactions. The retained card message shall not be displayed to the Merchant until the chip

has processed the script.

4.1.5. Stand-In Authorization

When the Chip Card and Terminal have determined that a transaction needs to be sent Online, and the

American Express Acquirer cannot be contacted due to technical reasons, the IAC and TAC default values

are checked to determine whether or not the transaction is to be approved or declined. The Merchant has no

October 2007

■

23

SPECIAL TRANSACTION

PROCESSING

• If the transaction is subsequently declined, the transaction must be declined within the Terminal, with no

Implementing American Express EMV Acceptance on a Terminal

control over this process; however, in the magnetic stripe environment, a Merchant could decide to accept a

similar transaction at his or her own risk (subject to Merchant contract). This is called Stand-In authorization.

American Express has developed a process that would allow those Merchants who currently perform StandIn authorization to continue to perform it in the EMV environment. In the event that the American Express

Acquirer cannot be contacted, and the Merchant wishes to allow Stand-In authorization, there are three steps

that a Terminal must perform:

Step 1: Stand-In Eligibility Check. The Terminal shall contain a list of all partial or full AIDs for which it

supports Stand-In. The Terminal will compare the AID on the card to the AIDs stored within this list. If a match

is found, then the card is eligible for Stand-In.

If the Terminal belongs to a Merchant or Acquirer who wishes to support Stand-In authorization for American

Express, then the Terminal must hold an indicator to show that Stand-In authorization is allowed for all valid

American Express payment applications.

If the Terminal identifies an application that is eligible for Stand-In authorization, it must perform Stand-In

authorization as described in steps 2 and 3. In the event that the result of the eligibility check indicates that

Stand-In processing is not to be performed, then transaction processing continues using the TAC and IAC

default values.

SPECIAL TRANSACTION

PROCESSING

Step 2: Stand-In Action Code (SAC). A Terminal supporting Stand-In authorization shall hold a dedicated

SAC specifically for the purpose of processing Stand-In authorization (one SAC per supported AID). In order

to process Stand-In authorization, the Terminal shall check the TVR against the SAC for that AID; and if any

of the corresponding TVR bits are set, then the Terminal must request that the Transaction be declined. The

following table provides the default settings of American Express SAC.

Table 8: Default Settings for American Express SAC*

Byte

Bit

Value

1

8

Offline Data Authentication not Performed

1

7

Offline SDA Failed

1

6

ICC Data Missing

1

5

Card Appears on Terminal Exception File

1

4

Offline DDA Failed

2

7

Expired Application

2

5

Requested Service not Allowed for Card Product

3

8

Cardholder Verification was not Successful

3

6

Offline PIN Try Limit Exceeded

3

4

Offline PIN Required, PIN Pad Present but PIN not Entered

4

6

Upper Consecutive Offline Limit Exceeded

*This table corresponds to an SAC hexadecimal value of “F8 50 A8 20 00.”

October 2007

■

24

Implementing American Express EMV Acceptance on a Terminal

Step 3: Amount Check. The final check a Terminal performs as part of Stand-In authorization is against the

transaction amount, referred to as an amount check. The Terminal shall hold a dedicated (non-zero) StandIn Floor Limit for use in the Stand-In authorization process. For a transaction to be approved using Stand-In

authorization, the transaction amount must be below this Stand-In Floor Limit. If the transaction value exceeds

the Stand-In Floor Limit, then the transaction must be referred.

Other Stand-In Requirements. The other requirements that American Express has for the Stand-In process

are detailed below.

a. Additional Validation at Terminal During Transaction Acceptance

The requirements defined above do not replace the standard validation that must occur as part of the

Stand-In process; this includes Stand-In Floor Limits.

b. Terminal Displays to Cardmembers

Messages displayed by Terminals to Cardmembers and Merchants shall be no different from those used

when the system is able to conduct Online authorization with the Acquirer. In a small number of cases,

a supervisor approval or voice authorization may be required, but this will usually be for high-value

transactions where such intervention is likely to be considered normal.

4.1.6. Reversals

Reversals are used to undo—or reverse—transactions that have been performed in error (e.g., the transaction

has already been sent for authorization when the Merchant or the Cardmember notices that the amount of the

transaction is incorrect). Terminals need to send reversal messages only if the transaction is aborted at a point

after which communication has begun with the Acquirer.

Depending on the particular reversal message protocols used, the reversal message may or may not contain EMV

data, as EMV data is optional in reversal messages. If EMV data is present in the reversal message, then it

shall be a copy of the EMV data presented in the corresponding authorization message that is being reversed.

The Terminal should not initiate any new communication with the chip in order to process a reversal.

In all cases, the Terminal shall void the transaction and produce a receipt for the Cardmember, showing that

the original transaction has been voided.

October 2007

■

25

SPECIAL TRANSACTION

PROCESSING

c. Approval Codes

When possible, the Terminal should generate a random, downtime approval code for display at the

Terminal and for printing on receipts. This pseudo-approval code must not be incorporated with the

submission data for the transaction for which it was created.

Implementing American Express EMV Acceptance on a Terminal

4.2. AEIPS Requirements During Situational Scenarios

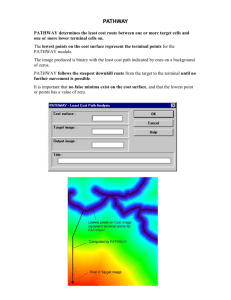

Table 9: Examples of Situational Scenarios

Scenario

Example

$ $

$

B Mail orders and telephone orders

1

5

Card Not Present

4

4.2.2.

B Refund of a sale

3

Refunds

2

4.2.1.

6

7

8

B Deposits taken on telephone bookings for hotels or vehicle rentals

0

9

3

4

2

B Hotel bookings

1

5

Card Not Yet Present

6

7

4.2.3.

8

9

0

B Vehicle rentals

4.2.4.

B Gasoline pump

Transaction Amount

Not Yet Known

B Opening a bar tab

CHECK-IN

B Hotel check-in

B Rental vehicle pick-up

4.2.5.

B Hotel express checkout

Card No Longer Present

EXPRESS

4.2.6.

Adding a Gratuity

CHECKOUT

B Face-to-face hotel checkout

SPECIAL TRANSACTION

PROCESSING

4.2.7.

Card Re-Presented

for Final Charge

B Vehicle rental returns

B Face-to-face vehicle return to same rental site

B Hair salon/barber

B Restaurant sales

4.2.1. Refunds

$ $

$

Refund transactions are less at risk for fraudulent activity than regular transactions. Therefore, American

Express has fewer restrictions on refund processing. Refunds can be processed using the chip, the magnetic

stripe, or by manually entering the PAN into the Terminal.

If you choose to use the chip, it is not necessary to perform all of the steps that are possible in an EMV

transaction. There are two ways in which a refund can be processed using EMV; in either option the Terminal

must not indicate that the transaction has completed after the Cryptogram is returned in response to the 2nd

generate AC command:

Option 1: Full EMV Transaction. If you choose to perform a full EMV transaction, American Express

recommends that the Terminal request that the card approve the transaction Offline (i.e., requests a TC).

However, refunds can be processed Online if necessary (i.e., with an ARQC). If for any reason the card declines

the refund, then the AAC should be discarded and the ARQC submitted for the refund. The Terminal should

treat the transaction as though it has been approved.

Option 2: Track 2 Data. If you choose not to perform a full EMV transaction, the Terminal must read the track

2 data off the chip and use it to process the refund transaction. In constructing the refund transaction, either

use track 2 component parts or extract the components from the track 2 image, but do not use the track 2

image itself, as the 4CSC on the magnetic stripe and in the chip are not required to be the same. Also, there

is a PCI DSS requirement that the entire contents of the track 2 data shall not be stored after a transaction

October 2007

■

26

Implementing American Express EMV Acceptance on a Terminal

hascompleted. Having your Terminals extract the application PAN and expiration date from the chip (rather

than using all the track 2 data) helps ensure the PCI DSS requirement is met.

BEST PRACTICE:

• American Express recommends that the Terminal perform refunds using Option 2.

• American Express recommends that Terminal risk management and Online authorization not be

performed for refund transactions.

3

4

2

1

5

6

7

4.2.2. Card Not Present

8

9

0

Some transactions may need to be authorized and settled without the Merchant ever having access to the

Chip Card to take advantage of its security features. As such, there are no requirements on card not present

transactions, and Merchants should process such transactions using existing processes.

BEST PRACTICE: When processing card not present transactions, Merchants should ensure that

they are using the existing security features available to them, such as address verification and the 4CSC.

3

4

2

1

5

6

7

8

9

0

In some cases, a Merchant’s business may be such that he or she requires some assurance as to the validity

of a card account before actually having access to the card. For this reason, Merchants may wish to take card

details from the Cardmember before the card is present. As such, there are no requirements on card not yet

present transactions, and Merchants should process such transactions using existing processes.

BEST PRACTICE: American Express recommends that card not yet present transactions be performed

for a minimum transaction amount, in order to avoid inconveniencing the Cardmember by unnecessarily

reducing his or her available card funds.

4.2.4. Transaction Amount Not Yet Known

CHECK-IN

In some cases, a Merchant may only have access to the card to perform an EMV transaction at a time before the

final amount of the transaction is known. In a transaction amount not yet known scenario, an estimate can be

displayed, but the Merchant must then inform the Cardmember that the value is an estimate and is therefore

subject to change. If the difference between the actual value of the transaction and the initial authorization

amount is greater than 15%, then the Merchant must submit an additional authorization request for the

difference between the two amounts.

If a Terminal is not able to store EMV transaction data, then any incremental authorizations will either require

the Cardmember to re-present his or her card, or the authorization must be entered in PAN key entry format.

BEST PRACTICE: American Express recommends that all relevant EMV transaction data from the

Authorization be stored for the settlement process, including the Cryptogram produced by the card.

October 2007

■

27

SPECIAL TRANSACTION

PROCESSING

4.2.3. Card Not Yet Present

Implementing American Express EMV Acceptance on a Terminal

4.2.5. Card No Longer Present

EXPRESS

On occasion, the Merchant will only know the final amount to charge a Cardmember after he or she has

left the premises, and therefore, the Chip Card will no longer be present. The only EMV transaction data

the Merchant will have access to is the data gathered during the initial authorization and any subsequent

incremental authorizations. If a Terminal is not able to store EMV transaction data, then the final transaction

may be processed in PAN key entry format.

BEST PRACTICE:

B American Express recommends the final transaction be submitted for settlement using the EMV data

from the most recent authorization.

B The presentment message should include:

• the ARQC;

• the estimated or top-up amount that relates to that ARQC; and

• the final transaction amount.

CHECKOUT

In cases where the Chip Card was originally used to authorize a transaction before the amount was known,

and is then re-presented to the Merchant after the transaction amount has been finalized, the transaction is

completed as follows:

B If the difference between the actual value of the transaction and the initial authorization amount is

greater than 15%, then a normal EMV transaction must be completed with the card for the full amount,

and any previous authorizations must then be cancelled, where possible.

B If the difference between the actual value of the transaction and the initial authorization amount is equal

to or less than 15%, then the transaction should be completed without going Online. There are two

options for how this could be achieved:

Option 1: Full EMV Transaction. If you choose to perform a full EMV transaction, American Express

recommends the Terminal request that the card approve the transaction Offline (i.e., requests a TC).

However, if the transaction is sent Online, American Express recommends that, where possible, it is

sent as an advice message.

Option 2: Track 2 Data. If you choose not to perform a full EMV transaction, the Terminal must read the

track 2 data off the chip and use it to process the transaction. In constructing the transaction, use track

2 component parts, or extract the components from the track 2 image, but do not use the track 2 image

itself, as the 4CSC on the magnetic stripe and in the chip are not required to be the same. Also, there is

a PCI DSS requirement that the entire contents of the track 2 data shall not be stored after a transaction

has completed. Having your Terminals extract the PAN and expiration date from the chip (rather than

using all of the track 2 data) helps ensure the PCI DSS requirement is met.

BEST PRACTICE: When possible, the EMV data from the authorization should be attached to the

transaction data in the clearing message.

October 2007

■

28

SPECIAL TRANSACTION

PROCESSING

4.2.6. Card Re-Presented for Final Charge

Implementing American Express EMV Acceptance on a Terminal

4.2.7. Adding a Gratuity

In certain Merchant categories such as restaurants, it is standard practice

to enable customers to add a gratuity to the amount of the transaction.

There are many different ways in which a gratuity can be added. American

Express does not define any specific methods for adding gratuities.

BEST PRACTICE: American Express recommends that Terminal software enables the Cardmember to

add the gratuity amount to the transaction before entering his or her PIN. This enables the transaction to

be processed as a normal, “card present” transaction.

The introduction of EMV technology and its associated security features greatly increases the business case

for UPTs. Card Authentication and Cardholder Verification—which previously relied on the manual observation

of the card and signature by staff—can now be performed through direct interaction between a Chip Card and

a Terminal.

An EMV transaction is processed in essentially the same way in a UPT as in a standard Terminal, with a few

notable exceptions. The sections below detail these exceptions, as well as the related American Express

requirements for UPTs.

4.3.1. Cardholder Verification on UPTs

The introduction of the Offline PIN capability provided by EMV greatly increases the potential for Cardholder

Verification at UPTs. CVM Fallback shall not be supported at UPTs (i.e., if the highest supported CVM in both

card and Terminal is PIN, PIN must be used or the transaction must be declined).

4.3.2. Fallback on UPTs

If the Terminal is EMV-enabled but not yet certified, or if it is EMV-enabled for other Payment Brands but not

yet for American Express, the transaction must be processed using the magnetic stripe. The Terminal must not

process the transaction as Fallback.

Fallback to magnetic stripe shall not be available at AEIPS-enabled UPTs. These Terminals shall reject a

magnetic stripe card with a service code that starts with a 2 or a 6 (indicating EMV-capable) when the chip

cannot be read.

October 2007

■

29

SPECIAL TRANSACTION

PROCESSING

4.3. AEIPS Requirements for Unattended Payment Terminal (UPT) Scenarios

Implementing American Express EMV Acceptance on a Terminal

4.3.3. Online Capability with UPTs

Depending on the environment in which they are deployed and the type of transactions performed, some

of your UPTs may have Online capability. The Terminal shall include indicators in the authorization and

submission messages that the transaction was processed at a UPT.

BEST PRACTICE:

B If your UPT has Online capability, we recommend that it have a zero Terminal Floor Limit and that it

attempt to perform all transactions Online.

B If the UPT is capable of Online operation, we recommend that it have the capability to capture the

card at the Issuer’s request.

B If your UPT has no Online capability, we recommend the use of Exception Files and the validation of

card details (including expiration date) before the transaction is allowed to proceed.

SPECIAL TRANSACTION

PROCESSING

October 2007

■

30

Implementing American Express EMV Acceptance on a Terminal

SECTION 5: AEIPS TERMINAL CERTIFICATION

5.1. Introduction

Integrating EMV into Terminals and host systems can add complexity and the potential for interoperability