why governments tax or subsidize trade

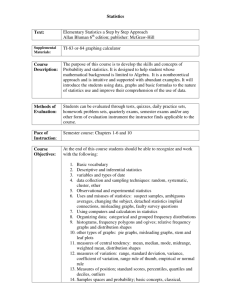

advertisement