India sees growth above 7% despite 'grim' global

advertisement

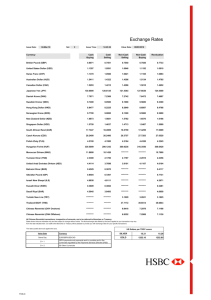

SUNDAY, FEBRUARY 28, 2016 BUSINESS Rollercoaster Irish economy key to election DUBLIN: From Celtic Tiger to collapse and back to growth again, Ireland’s recent economic history has shaped its election as voters looked to have punished Enda Kenny’s coalition for years of austerity despite a recovery. Here is a breakdown of the main events over the past decade: Celtic Tiger The boom years which led to the economy being nicknamed the Celtic Tiger began in the mid-1990s and reached their peak a decade later. This period transformed an island that had been one of Europe’s poorest countries and caused a property bubble that saw house prices quadruple between 1996 and 2006. Ireland saw average annual growth of six percent between 1995 and 2007, slashed unemployment and doubled its GDP in a decade. But as an international financial crisis took hold in 2008, the property bubble burst, taking much of the economy down with it, while banks which had given large loans on property began to totter. The economy slumped 3.5 percent in 2008 and almost eight percent in 2009, while the failure of Anglo Irish Bank summed up many of the problems which led to the bust. Fianna Fail, long Ireland’s dominant political force, suffered a historic defeat in the election of 2011 due to anger over the property crash and economic crisis on their watch. Austerity As turmoil roiled international markets in September 2008, the Irish government guaranteed the debts and deposits of six Irish banks. Ireland was forced to accept a European Union and International Monetary Fund bailout deal in 2010 under which the government received loans in return for imposing cuts and reforms. A series of austerity budgets stripped billions from spending, cutting sectors including public sector pay and pensions, social welfare, the health service, and education. At the same time, taxes were raised, including a new property tax and a water tax that crystallised anger over austerity, sparking mass protests and refusals to pay. Unemployment hit 15 percent in 2012, and over twice that level for young people. Emigration, long a feature of Ireland’s past that was banished by the Celtic Tiger, returned with about 240,000 people moving abroad. Recovery Ireland became the first eurozone country to exit its bailout in 2013. Economic growth returned with a rate of 4.8 percent in 2014, the highest in the European Union. This showed signs of speeding up further in 2015 as seven percent growth was registered in the first nine months. Average wages, which fell or were stagnant since 2008, began to tick upwards. At the election, Prime Minister Enda Kenny campaigned for a second term on his economic record, promising to “keep the recovery going” and attract 70,000 Irish people to return home this year. — AFP Global regulators may propose rules for fintech: Carney RANCHI: Indian construction laborers work on a building site on the outskirts of Ranchi yesterday ahead of the country’s annual Budget. India’s Finance Minister Arun Jaitley is scheduled to present annual Budget for the financial year 2016-2017 in the Parliament tomorrow. — AFP India sees growth above 7% despite ‘grim’ global outlook Govt gears to present reform-oriented budget NEW DELHI: India on Friday offered a cautious forecast for economic growth to exceed 7 percent in the next financial year, as the government prepares to present its budget with clamor for promised reforms growing. The Economic Survey, a yearly report released by the finance ministry ahead of the national budget on Monday, said gross domestic product (GDP) would expand between seven percent and 7.75 percent in 2016-17. The relatively upbeat prediction comes despite a weak global economy, with a slowdown in China that has worried investors, other major emerging markets in recession and sinking global stocks. India’s GDP likely grew 7.6 percent over the 201516 financial year, the government said, making it the world’s fastest-growing major economy. However, Friday’s forecast represents a paring back of expectations from last year’s survey which predicted growth would top eight percent this year. “We’ve learnt from the experience of last year. The forecast for last year went wrong, maybe it was overoptimistic,” said Arvind Subramanian, the government’s chief economic adviser. Last year’s survey did not anticipate how much weak global demand would hurt India’s exports, nor the impact of a second bad monsoon on its vast agricultural sector, he said. “This year’s assessment is really based on looking out at the external environment which seems to be very grim,” Subramanian told reporters. Prime Minister Narendra Modi has made it a priority to boost India’s economic growth, vital for lifting millions out of poverty, since sweeping to pow- Japan inflation falls back to zero in Jan TOKYO: Japan’s inflation rate fell to zero in January, government data showed Friday, in another blow to Prime Minister Shinzo Abe’s three-year attempt to put an end to a years-long battle with falling prices. Japan has suffered deflation-a debilitating drop in prices-off and on since the late 1990s and authorities have introduced various policies to fight it, including record low central bank interest rates. Abe came to power in late 2012 vowing to fix the problem for good through an array of policies dubbed “Abenomics” that include government spending and a massive central bank bond-buying program. The government’s internal affairs ministry announced that Japan’s growth in core consumer prices, which exclude volatile fresh food prices, was unchanged in January from a year ago after two months of tepid 0.1 percent growth. Falling oil prices-resource-poor Japan is a major energy importer-and a recent rise in the value of the Japanese yen are seen as further hampering efforts to achieve moderate price growth. The latest figure underscores Abe’s challenge with the outlook being for further price weakness. “In light of falling import prices and sluggish economic activity, we think that the slowdown in underlying inflation has further to run,” said Marcel Thieliant, senior Japan economist at Capital Economics. While offering pro-business policies, Abe has also pushed Japan Inc to share profits with consumers via wage hikes, saying such a move would be key to boosting consumption, prices and overall growth. Despite incentives, Japanese businesses have remained cautious to invest in their businesses and offer meaningful wage increases, citing the uncertain economic outlook. Last month, the government said Japan’s inflation rate stood at 0.5 percent in 2015, far short of the 2.0 percent target that the BoJ had promised to achieve by early last year. — AFP er in a general election in May 2014. But investors have raised concerns about the pace of promised reforms needed to create jobs for India’s tens of millions of young people. Economists said the wide range of the growth forecast for 2016-17 indicated the government may be hedging its bets. “What jumped out at me is that the government’s estimate has become more cautious,” Hanna Luchnikava, senior economist, Asia Pacific at IHS Economics in Munich, told AFP. “We do not expect any acceleration (in growth) next year, in fact the risks are to the downside,” she said. Challenges ahead While its growth has outpaced that of powerhouse China in recent quarters, Asia’s third-largest economy still faces challenges. After cooling from previously high levels, India’s once exorbitant inflation has ticked up again over the past few months, with prices rising 5.7 percent in January. India’s main stocks index has lost a fifth of its value over the past year, private investment is weak and the rupee is trading at near-record lows against the dollar. The Economic Survey forecast consumer price inflation would ease to 4.5 to 5 percent in 2016-17. It also said India’s services sector remains one of the main engines of growth, expanding more than nine percent in the current fiscal year. Services make up more than half of India’s economy although the government is pushing to increase manufacturing through its Make in India campaign. Investors will be looking to Monday’s budget for concrete reforms from the business-friendly government. There are hopes it will move to overhaul a complex corporate tax regime seen as off-putting to investors. The Economic Survey also said the government probably succeeded in reducing its fiscal deficit to 3.9 percent of GDP in 2015-16 as economists expect. It remains to be seen whether Finance Minister Arun Jaitley will look to relax the stringent fiscal deficit reduction target for next year when he presents the budget. — AFP LONDON: Global regulators may propose rules to prevent “fintech” innovations from destabilising the broader financial system, the G20’s Financial Stability Board said yesterday. FSB Chairman Mark Carney said in a letter to central bankers and finance ministers from the Group of 20 economies meeting in Shanghai that assessing the systemic implications of fintech innovations would form part of the task force’s core policy work this year. It marks the first time that regulators at the global level have begun scrutinising fintech, a sector that includes blockchain, the distributed ledger technology underpinning bitcoin that proponents say could radically change payments systems. So far regulators have been treading carefully as countries such as Britain are wary of crimping a sector that is still tiny compared with banking, but could create many new jobs in future. “The regulatory framework must ensure that it is able to manage any systemic risks that may arise from technological change without stifling innovation,” Carney said. The FSB will discuss its findings in March and consider its next steps, he added. Carney, who is also Governor of the Bank of England, said the more difficult economic and financial conditions since the start of this year partly reflect weaker growth prospects. Banking shares have come under pressure, reflecting concerns that lenders have to do more to adjust their long-term business models to a lower growth, lower nominal interest rate environment, Carney said. Carney said the FSB will repor t in September on whether there has been a reduction in market liquidity and, if so, its extent, drivers and likely persistence. Banks and central bankers have locked horns over why liquidity in secondary bond markets has thinned, with bankers blaming tougher regulation introduced by the FSB and others since the 2007-09 financial crisis. Central bankers say much of the heavier liquidity in markets before the crisis was “illusory” with insufficient evidence so far to show that some of the new rules need rolling back. ASSET MANAGERS IN SIGHT Linked to the liquidity issue is a worry that asset managers could not cope with heavy redemptions, or investors pulling money out of bond funds en masse. “We have prioritised work to analyse structural vulnerabilities in asset management activities and to identify risks that may merit policy responses in four areas,” Carney said. The FSB, which sets global standards implemented by G20 member countries, will issue policy recommendations in September after looking at leverage in funds, and their operational risks and securities lending activities. “An over-optimistic ‘liquidity illusion’ may have been reinforced by the growth of investment products offering redemptions at very short notice,” Carney said. Policies to reduce “fire-sale” risks in open-ended investment funds may also help, he said. Carney said IOSCO, which groups global securities markets regulators, will publish by December a “toolkit” of measures to promote proper conduct by individuals and firms in markets. Global regulators will also consult on more detailed rules to prevent clearing houses, which stand between two sides of a derivatives trade, from becoming “too big to fail” due to their size and reach, Carney said. — Reuters SHANGHAI: Spain’s Economy Minister Luis de Guindos (left) shakes hands with Bank of England Governor Mark Carney (right) as they pose for a photo after sessions of the G20 Finance Ministers and Central Bank Governors Meeting at the Pudong Shangri-la Hotel in Shanghai yesterday. — AFP EXCHANGE RATES Al-Muzaini Exchange Co. Japanese Yen Indian Rupees Pakistani Rupees Srilankan Rupees Nepali Rupees Singapore Dollar Hongkong Dollar Bangladesh Taka Philippine Peso Thai Baht Saudi Riyal Qatari Riyal Omani Riyal Bahraini Dinar UAE Dirham ASIAN COUNTRIES 25.562 4.394 2.865 2.087 2.741 214.230 38.655 3.826 6.303 8.430 GCC COUNTRIES 80.136 82.548 780.535 798.060 81.817 ARAB COUNTRIES Egyptian Pound - Cash 35.250 Egyptian Pound - Transfer 38.423 Yemen Riyal/for 1000 1.402 Tunisian Dinar 148.320 Jordanian Dinar 423.540 Lebanese Lira/for 1000 2.002 Syrian Lira 2.142 Morocco Dirham 31.124 EUROPEAN & AMERICAN COUNTRIES US Dollar Transfer 300.350 Euro 332.190 Sterling Pound 421.240 Canadian dollar 218.360 Turkish lira 102.510 Swiss Franc 304.000 Australian Dollar 217.450 US Dollar Buying 299.150 GOLD 244.530 125.190 63.440 20 Gram 10 Gram 5 Gram UAE Exchange Centre WLL CURRENCIES Australian Dollar Canadian Dollar Swiss Franc Euro US Dollar Sterling Pound Japanese Yen Bangladesh Taka Indian Rupee Sri Lankan Rupee Nepali Rupee Pakistani Rupee UAE Dirhams Bahraini Dinar Egyptian Pound Jordanian Dinar Omani Riyal Qatari Riyal Saudi Riyal TELEX TRANSFER PER 1000 201.91 219.82 306.95 336.85 299.90 431.04 2.67 3.817 4.375 2.083 2.732 2.860 0.08161 0.7970 0.03819 0.4265 0.7788 0.08269 0.07994 Dollarco Exchange Co. Ltd Rate for Transfer US Dollar Canadian Dollar Sterling Pound Euro Swiss Frank Bahrain Dinar UAE Dirhams Qatari Riyals Selling Rate 300.600 224.390 417.695 329.915 300.685 795.235 82.085 83.290 Saudi Riyals Jordanian Dinar Egyptian Pound Sri Lankan Rupees Indian Rupees Pakistani Rupees Bangladesh Taka Philippines Pesso Cyprus pound Japanese Yen Syrian Pound Nepalese Rupees Malaysian Ringgit Chinese Yuan Renminbi Thai Bhat Turkish Lira 80.840 423.450 38.278 2.081 4.374 2.867 3.823 6.310 572.540 3.630 2.365 3.725 72.335 46.310 9.380 100.703 Bahrain Exchange Company CURRENCY British Pound Czech Korune Danish Krone Euro Norwegian Krone Romanian Leu Slovakia Swedish Krona Swiss Franc Turkish Lira Australian Dollar New Zealand Dollar Canadian Dollar US Dollars BUY Europe 0.411552 0.004276 0.040473 0.324126 0.030910 0.086185 0.008916 0.031429 0.295256 0.096854 SELL 0.420552 0.016276 0.045473 0.332126 0.036110 0.086185 0.018916 0.036429 0.305456 0.107154 Australasia 0.206471 0.193484 0.217971 0.202984 America 0.217202 0.296530 0.225702 0.300850 US Dollars Mint 0.296850 0.300850 Bangladesh Taka Chinese Yuan Hong Kong Dollar Indian Rupee Indonesian Rupiah Japanese Yen Kenyan Shilling Korean Won Malaysian Ringgit Nepalese Rupee Pakistan Rupee Philippine Peso Sierra Leone Singapore Dollar South African Rand Sri Lankan Rupee Taiwan Thai Baht Asia 0.003442 0.044474 0.036665 0.004181 0.000018 0.002584 0.003006 0.000234 0.067711 0.002848 0.002715 0.006230 0.000067 0.211367 0.013326 0.001737 0.008929 0.008105 0.004042 0.047974 0.039415 0.004571 0.000024 0.002764 0.003006 0.000249 0.073711 0.003018 0.002995 0.006510 0.000073 0.217367 0.021826 0.002317 0.009109 0.008565 Bahraini Dinar Egyptian Pound Iranian Riyal Iraqi Dinar Jordanian Dinar Kuwaiti Dinar Lebanese Pound Moroccan Dirhams Nigerian Naira Omani Riyal Qatar Riyal Saudi Riyal Syrian Pound Tunisian Dinar Turkish Lira UAE Dirhams Yemeni Riyal Arab 0.780066 0.033474 0.000083 0.000196 0.419746 1.000000 0.000150 0.020405 0.001234 0.773970 0.081815 0.079233 0.001273 0.145251 0.096854 0.080820 0.001357 0.798066 0.037810 0.000084 0.000256 0.427246 1.000000 0.000250 0.044405 0.001869 0.779650 0.083028 0.080183 0.001493 0.153251 0.107154 0.081969 0.001437