B2B Marketing – Top Spenders

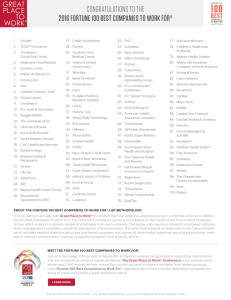

advertisement