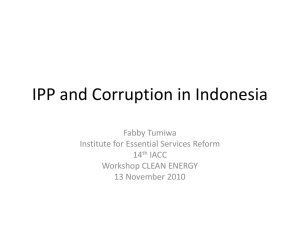

1. Introduction 2. Background

advertisement

Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 INDONESIA - ANNEX 3 1. Introduction This Annex sets out our findings in relation to the current status of implementation of the IPP Principles in Indonesia. In relation to each Principle the current status of implementation is described. Where possible and appropriate, we have identified potential barriers or impediments to improved implementation of the Principles. These findings reflect research carried out in the period January – April 2000. The sensitive nature of IPPs in Indonesia at present created significant difficulties in obtaining information regarding the terms and conditions of either existing or proposed IPPs in Indonesia. 2. Background 2.1 Recent developments in the Indonesian electricity sector After many years of strong economic growth and expansion, Indonesia has suffered substantial losses as a result of the Asian economic crisis. From 1991-1995, the country’s GDP growth rate rose an average of 8% per year. But in 1998, Indonesia’s GDP rate became negative at –13.5%. The IMF has recommended that Indonesia implement economic reform including the creation of greater transparency in the issuing of government loans and subsidies, and enforcing laws and regulations in the area of government procurement. The government has announced several reform initiatives since receiving IMF assistance, including the planned privatisation of several sectors of the economy. Indonesia has an installed capacity estimated at 21.3 GW, with 82% coming from thermal sources, 15% from hydro sources, and 3% from geothermal sources. Electricity is supplied by the vertically integrated monopoly Perusahaan Listrik Negara (PLN), the state owned energy corporation. PLN is responsible for the majority of Indonesia’s generation, and is the monopoly provider of transmission, distribution and supply of electricity. It is the sole buyer and seller of electricity in the power market, currently purchasing approximately 80% of the power produced by IPPs. The sharp decline in the GDP of Indonesia and devaluation of the Rupiah has significantly affected the financial standing of PLN. The fact that 60% of the PLN’s costs (ie. fuel purchases and debt payments) are denominated in US dollars while revenues (subsidised tariffs) are earned in Rupiah has increased PLN’s debt significantly. The Rupiah has been significantly devalued due to the financial crisis. Additionally, the inclusion of take-or-pay provisions in PPAs has meant payment obligations to IPPs (in US dollars) remain even though demand has decreased significantly. 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 2.2 The role of IPPs in Indonesia Prior to the occurrence of the Asian financial crisis, Indonesia had plans for rapid expansion of power generation, to be achieved through opening up its power market to IPPs. IPPs provided a solution to the serious shortage of electricity experienced in Indonesia between 1989 and 1991 due to the rapid growth of industry. The bulk of the parties in large IPPs projects were international energy companies (foreign investors) partnered with family and associates of former President Suharto. In early 1997, there were 39 IPP projects (totalling 30,072 MW) under way. A number of these projects had successfully secured debt financing and in the case of one project, capital markets refinancing. As a result of the Asian financial crisis, a number of IPP projects have been cancelled or “put on hold” and those projects which have secured debt financing or have been constructed or partly constructed are perceived to be in difficulty. Given the over-capacity in the Indonesian power sector, further investment in new IPPs is unlikely in the near future. There are now approximately 26 IPP projects that have been signed, involving about US$18 billion in investments and totalling 24,751 MW. A list of operational IPPs in Indonesia is provided in Appendix A. A table of the keys risks associated with IPP projects is provided in Appendix B. All 26 IPPs have entered into Power Production Agreements (PPAs). PLN is counter party to all the PPAs. Characteristics of the PPAs include: • tariff structure and tariff paths; • denomination of prices in $US (prices range from 5.7 cents to 8.4 cents per kWh); • take or pay obligations on PLN (For example under Paiton Energy’s PPA, PLN is obliged to pay Paiton $598 million per year if it does not use power supplies); • applicable law - generally governed by Indonesian law; • arbitration clauses for disputes - dispute resolution clauses may refer parties to an international arbitration; and • force majeure provisions. As a result of PLN’s losses in 1998 and 1999 it has been incapable of making payments to IPPs. Initially the government failed to support PLN, forcing PLN to fail in meeting its payment obligations to some IPPs. This resulted in some IPPs resorting to arbitration in an attempt to recover payments. While the government has now ensured that payments are being made it is generally accepted by industry sources that a renegotiation of nearly all of the PPAs will take place as this is essential for the successful restructure of PLN, the government credibility with foreign investors and the resolution of budgetary shortfalls of the 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Government (arising from these and other subsidies in the energy sector). This issue is currently an extremely sensitive political issue. Case Study on Indonesian PPAs: The CalEnergy Dispute Himpurna California Energy (HCE) in conjunction with Patuha Power (PPL) brought an action against PLN for a breach of the Energy Sales Contract in 1999. The breach involved PLN failing to fulfil their obligations under the contract to pay the IPP for electricity supplied and for breach under the PPA over two 400MW projects. The initial arbitration between the parties was conducted in Jakarta, under the United Nations Commission on International Trade Law (UNCITRAL) Arbitration Rules. Chairing the arbitration was an international attorney, and the panel included an Australian business person and an Indonesian judge. In a unanimous decision by the panel HCE was awarded $391,711,652 and PPL $180,570,322. PLN failed to make the repayment resulting in HCE and PPL demanding repayment pursuant to the sovereign performance undertakings issued by the Minister of Finance on behalf of the Republic of Indonesia. When the Indonesian government refused to make the repayment HCE and PPL took further international action in September 1999. As a result the panel made the following interim awards: • the Republic of Indonesia defaulted under the Terms of Appointment and the UNCITRAL rules that the parties agreed would govern the arbitration; • the tribunal continues to have jurisdiction over the dispute notwithstanding Indonesian court orders purporting to enjoin the arbitration and has jurisdiction to issue final awards in this matter; and • certain Indonesian court orders purporting to prevent the arbitration constitute a denial of justice in violation of generally recognised principles of international law. An international arbitration panel ruled that PLN had to pay MidAmerican Energy, formally CalEnergy, US$572.3 million for breaching the PPA over two 400 MW projects. One of the major challenges facing the promotion of private sector development in Indonesia is the perception that transactions in the past have not resulted from arm’s length dealings or had due regard to the principles of transparency, non-discrimination and fair competition. 2 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 3. Institutional and Regulatory Structures 3.1 Principle 1 – Energy sector policies 3.1.1 Energy sector policies formulated to create a stable framework for power sector development (a) Clear, published and consistent energy sector policies Indonesian energy sector policies have been set out in a number of laws, Presidential Decrees, regulations and policy documents. Many of the energy sector policies were introduced as part of the Indonesian government’s initiative to promote IPP projects. Each is clearly stated and published, but never in a completely formal way (other than by means of formal decree). The main documents setting out the government’s broad approach to energy sector development are described in Appendix C. The objectives of energy sector policies in Indonesia are clear: to attract private sector investment in power production. At a micro level there is little clear consistency with other sector policies. While there have been attempts to encourage investment in all sectors, the electricity industry is the most advanced. (b) Environmental policy objectives Publication and clarity of environmental policies Current government policy suggests that environmental issues will be given greater priority in the future. Indonesia has made significant progress in energy conservation in the past 20 years, both in the area of institutional development and in program implementation. Indonesia launched its first national energy conservation program in early 1980 with a national awareness campaign. In 1982, under Presidential Instruction No. 9, all government ministries and agencies were directed to undertake energy conservation measures. At the end of 1983, the second phase of Indonesia’s energy conservation program was initiated with in-depth audits of energy-intensive industries. In 1987, with financial assistance from the World Bank, PT. Konservasi Energi Abadi (KOMEBA), Indonesia’s National Energy Conservation Company was established. KONEBA made significant accomplishments, including detailed energy audits of over 30 large industrial facilities, energy conservation planning activities, data base development, training, information dissemination, and the procurement and installation of energy saving equipment. By 1990, KONEBA was operating at a profit on a cash-flow basis. However, during the mid-90s KONEBA was unable to maintain self-financing operation. 3 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 In September, 1991, President Soeharto issued a Presidential Decree on Energy Conservation (Decree No. 43), directing that a broad program in energy conservation be undertaken aimed at efficient use of energy and environmental sustainability. The Ministerial Energy Coordination Board (Bakoren) issues general policy guidelines on energy matters. The Technical Committee on Energy (PTE) reports to Bakoren and provides an active forum for consideration of energy-related policy and technical issues. The Permanent Working Group on Energy (PWGE) conducts analysis of energy supply and use on a quarterly basis, serves as a forum for exchange of data and information, and prepares technical reports for PTE. In June 1990, a permanent National Committee on Energy Conservation which also reports to PTE was established with the responsibilities of formulating energy efficiency-related laws, regulations and guidelines, implementing campaigns and taking other actions to promote energy efficiency. Within the Ministry of Mines and Energy, the Directorate General for Electric Power and New Energy (DGENE) has developed substantial capability to conduct energy planning and analysis in electricity, energy conservation and renewable energy. In the late 1980’s, DGENE worked with the US AID-funded ASEAN Building Energy Conservation Program to conduct energy audits and surveys. Fair application of environmental policies The environmental policies are applied fairly to all sector participants, as they are required under the PPA to follow a number of environmental requirements and procedures. The requirements deal with air emissions, water discharges and noise. Additionally the PPA sets out the environmental procedures that IPPs are required to follow for the development of power generators. It is stated that the AMDAL is the responsible body along with the Ministry of Mines and Energy (See Appendix E for an outline of the environmental approvals required). Placing energy efficiency and conservation options on an equal basis with supply-side options, such as through all-source bidding programs PLN’s efforts to limit captive power production have been unsuccessful due to Indonesian government fuel subsidies that encourage the use of diesel-generated power. To some extent there has been a move to more environmental friendly forms of energy: geothermal, combined cycle and nuclear. However, the development of environmentally sensitive generation has been tempered against the need for large load generation that is perceived to be dependent upon domestic coal. (c) Established legislative framework 4 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 There is an extensive legislative regime governing the electricity industry in Indonesia. This regime clearly establishes the respective roles and functions of the government, the industry (principally PLN) and the private sector. The primary laws and regulations applicable to the electricity industry and defining the role of the government in the sector are set out in Appendix C. (d) Regulatory bodies There is no independent regulatory body in Indonesia. The Indonesian electricity industry is regulated principally by the Ministry of Mines and Energy. The Ministry is not independent of direct government control and while a separate entity, is not independent from government owned business (ie. PLN). PLN also exercises a number of regulatory functions. PLN is significantly influenced by the government. Amongst other things, the government appoints the members of the PLN board, and heavily subsidises the activities of PLN. (e) Internal consistency among regulatory structures The process for obtaining a PPA is predominantly coordinated by the Indonesian Ministry for Energy, but there are also a number of permits required from other ministries. Material approvals and regulation are dealt with at the central government level. The approvals required at the local level are, in practice, generally forthcoming once the central government has allowed the project. Local approvals are required in respect of e.g. construction licenses. Appendices D and E provide a detailed description of all permits and approvals required for IPPs. Traditionally, there has been a significant degree of coordination between central and local approvals. This may change as a result of the recent passage of the Decentralisation Law pursuant to which local governments are to receive a greater degree of fiscal authority and independence. (f) Transparency of regulations Regulations are made by Presidential Decree. The process for making regulations is neither clear nor transparent, nor is it subject to independent review. (g) Equal regulatory treatment of utilities and business sector While regulated under the same regime, PLN and IPPs are treated differently. Important issues affecting the relative regulatory treatment of PLN and the business sector are: 5 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 (h) • at present there is no competitive electricity market operating in Indonesia. As a consequence IPPs have no choice but to sell electricity to PLN, as set out in the individual PPAs; • notwithstanding the internal separation of certain generation and transmission functions of PLN (see below), PLN remains vertically integrated; and • PLN is government-owned and heavily subsidised by the Indonesian government. Conclusions It appears that the main difficulties being encountered in Indonesia with the implementation of this aspect of Principle 1 are: • overcoming lack of transparency in the system of government and law-making; • the financial difficulties of PLN; • achieving practical implementation of sector policies. 3.1.2 Energy sector policies formulated to facilitate competition (a) Current status of policies for power sector reform and restructuring Restructuring and privatisation of PLN As part of the reform of the Indonesian electricity industry, PLN is to be privatised. Steps towards privatisation have been taken by the Indonesian government such as the separation of PLN into PT PLN Pembangkitan Tenaga Listrik Java Bali I and II, and the commencement of the restructuring process pursuant to Presidential Decree 139/1998 (see Appendix C). Under this Decree the government has established a committee to advise on the restructuring and rehabilitation of PLN. That committee has established working groups to examine the following issues: • improvement of PLN’s finances; • renegotiation of the PPAs with IPPs; • renegotiation of other long-term contracts; and • improvement of PLN’s operational efficiency. However, the restructuring and privatisation process has been very slow and PLN remains essentially vertically integrated and state owned. Establishment of competitive market The government has also obtained two loans from the Asian Development Bank to assist with establishing a competitive market for electricity. The 6 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 first loan, granted to the Ministry of Finance for US$380 million, is to assist the establishment of a competitive electricity market in the Java-Bali region (market will include multiple buyers and multiple sellers), increase private sector participation and strengthen the regulatory environment. The second loan, granted to Directorate General of Electricity and Energy Development, is for US$20 million and is to assist with establishing market rules, financial settlement procedures, developing computer software, providing support for the development of regulatory capabilities and strengthening consumer participation in a competitive electricity market. As far as we are aware no concrete steps have been taken to implement the introduction of competitive markets. Current status of policies The reform process in Indonesia has halted due to difficulties arising from the Asian financial crisis, and in particular the financial difficulties faced by PLN. No clear indication has been given as to the way forward. (b) Separation between generation and transmission functions Currently, PLN holds a monopoly over transmission and distribution of electricity. Notwithstanding the separation of PLN into PT PLN Pembangkitan Tenaga Listrik Java Bali I and II, and the existence of the IPPs, PLN remains responsible for the production of the majority of power in Indonesia. There is thus no effective separation of generation from transmission. There is no stated or transparent policy regarding separation between transmission and generation. It is not clear how this aspect of the sector will develop, for example whether PLN will be restructured and individual generating companies (Genco’s) will be split off, and whether such entities will be privatised. (c) Complementary development of transmission grids No development of the transmission grid and distribution system is currently being undertaken. This is a major issue because power stations are being built while no transmission lines are being constructed. As electricity sector reform in Indonesia is very much in its infancy, it is difficult to determine the policy approach that the Indonesian government will take in allowing the private sector to be involved in the transmission sector. The Indonesian government’s major stated concern at present is to ensure that electricity is available at a reasonable price to the public. There have been proposals to allow private sector investment in the transmission sector, and thereby promote the development of transmission lines. However it seems that none of these proposals have been progressed. 7 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 (d) Autonomy, accountability and commercial operation of public utilities PLN has been corporatised, and some internal separation has taken place between generation and transmission businesses. Given the large debts it currently faces, it is questionable whether PLN is run on commercial lines. This is difficult to verify as PLN does not publish accounts. Further, PLN’s financial operations remain largely a matter of government policy. It appears that there is a significant subsidisation of domestic tariffs. In general, wholesale tariffs payable to IPPs probably do not reflect the efficient costs of production (e) Competitive market in generation and supply Generation Notwithstanding the existence of the IPPs, there does not appear to be any significant competition at the generation level. All of the IPPs have been executed pursuant to unsolicited tenders, thus the prices and other terms and conditions of PPAs are not the result of an effective competitive tendering process. Further, there is no competition between the IPPs in their supply and delivery of electricity to PLN. The current policy on this issue is unclear. Supply IPPs are entitled to supply local industry, as occurs for example with auto-generation facilities. However, as IPPs are not entitled to access the PLN transmission and distribution grids, all electricity is supplied to consumers by the PLN. It is noted that in September 1998 the government had announced that it proposed to allow IPPs to be able to sell directly to customers. It is understood that this proposal has not been implemented and that there are no concrete plans for its implementation in the near future. Accordingly, it can be concluded that there is no policy in place to facilitate the development of a competitive market for electricity supply. (f) Cross-border interconnection Discussion has occurred about whether to progress the development of interconnection projects. Some argue that small IPPs (eg. on the islands) may be more cost-effective and less complicated than an interconnection project. For example, land acquisition is a major problem for interconnection project because there are no compulsory acquisition laws in Indonesia. Whether it is feasible to develop interconnection will depend on the sources of fuel and electricity market (ie. demand). Interconnection projects that have previously been considered are set out in Appendix F. (g) Conclusions The major difficulties in achieving a competitive electricity market in Indonesia are twofold: 8 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 (i) the financial position of the PLN. Prior to the Asian financial crisis Indonesia had planned to expand the power generation industry, through opening up the power market to IPPs. However, since that point the state owned utility PLN has had difficulty paying for the electricity it agreed to purchase under the PPAs. As a consequence, further expansion has been delayed or halted until the situation can be resolved. (ii) the perception that in the past decisions have been made on the basis of discrimatory criteria that do not reflect transparent pro-competitive policies. 3.2 Principle 2: Commercial viability of electricity utilities (a) Commercial wholesale tariffs Prices received by IPPs for electricity they generate are determined by negotiation between the IPP and PLN. These are set out in the PPAs and are denominated in $US. It is understood that prices range from 5.7 cents to 8.4 cents per kWh. These prices are intended to reflect the cost of capital at the time the PPAs were entered into. However, when compared, for example, with the rates applicable in Thailand (around US2 cents per kWh) they appear to be very high, and it must be doubtful whether they reflect truly arm’s length negotiations or the efficient costs of supply. (b) Fuel supply market The PPAs provide that fuel supply is the responsibility of the IPP. As far as we are aware there are no restrictions in the PPAs on the scope of the IPP to source its fuel competitively. However, under the Presidential Decree No. 16/1994 there is emphasis on local content which is twofold: 1) a requirement to use “domestic products to the maximum”; 2) a requirement that contracts within specific value bands must be tendered to local suppliers or contractors. The prices paid by IPPs for fuel inputs (generally coal or gas) are determined by commercial negotiation, or failing negotiation by a ‘basket’ price. The price agreed to is generally denominated in US dollars (cf. PLN purchases coal for its own plants from domestic mines under medium term Rupiah denominated contracts) and is adjusted annually or by the Ministry of Mines and Energy. (c) Access issues and treatment under tax regime Access to Sites We understand that PLN is able to gain access to sites for the development of generation facilities on more favourable terms that IPPs. Access to fuel markets 9 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 IPPs may determine from which market they obtain their fuel, as set out in the PPAs. However, as noted above, there are certain local content requirements with which all sector participants must comply. These would appear to apply to both PLN and IPPs indiscriminately. Treatment under Tax regime IPPs’ treatment under the tax regime is different to PLN’s as PLN is a state owned utility. (d) Foreign ownership and control of IPPs Foreign investment in Indonesia is regulated by the Foreign Investment Law (Act No. 1/1967 amended by Act No. 11/1970 – the “FCIL”), decrees of the President and Chairman of the Capital Investment Coordinating Board (the “BKPM”), the New Share Ownership Regulation (20/1994 – “Regulation 20”) and its implementing regulation (Decree No. 15/SK/94). The effect of this legislation is to create a partially-regulated investment environment. Foreign interests are permitted throughout Indonesia, however there are certain regulations that prohibit foreign interests from investing in designated sectors of the economy without securing the participation of Indonesian investors as joint venture partners. Pursuant to Article 6 of the Foreign Investment Act (Law No. 1 of 1967), the production, transmission and distribution of electric power to the public may not be fully controlled by a foreign entity. As a result, all IPPs have local partners, generally with around a 10-15% interest in the IPP project. (e) Conclusions Major difficulties experienced with the implementation of this Principle include: • the lack of real transparency; • in the past the vast majority of approvals for power projects have been unsolicited and appear to have been based upon personal interests rather than objective, non-discriminatory criteria. • lack of industry restructuring to ensure that the private sector can have access to the transmission and distribution sector. 3.3 Principle 3: Regulatory framework and process for IPP approvals (a) Consistent regulations and approval processes Appendices D and E outline the various permits and approvals required under Indonesian law. The most significant approvals required in Indonesia are as follows: 10 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 • approval by PKLN/Bank Indonesia of foreign currency loans and the documentation; • foreign investment approval by the Investment Coordinating Board; and • approval by the Ministry of Mines and Energy of the Tariff and PPA. There is no central coordinating body in Indonesia to assist IPPs with the obtaining the necessary regulatory approvals for IPP projects. It is therefore necessary for each IPP to secure regulatory approvals at various levels. (b) Clear, published and transparent approvals process There are many difficulties with the approval processes in Indonesia. In the past, the approval process has been characterised by degrees of delay, uncertainty and lack of transparency. As a result there has been large duplication of effort and large administrative and development costs. The approval and decision making process for an IPP (as at April 1997) has been divided between unsolicited and solicited bids, most being “unsolicited”. There are no published guidelines as to the permits required for a power project. However, a set list of approval requirements is contained in the standard form PPA that has unofficially become the form of permit/approvals required for the financing of projects in that jurisdiction. Consideration has not been given to incorporating in the tender processes mechanisms for granting pre-approvals of projects put out to bid because the bulk of projects in Indonesia have been done on an unsolicited basis as opposed to a tender/competitive basis. (c) Conclusions The main difficulties in achieving the objective of a streamlined approval mechanism in Indonesia largely derive from the development of the IPP process in Indonesia. Given that it is largely developed on an unsolicited basis, as opposed to a competitive basis, there has never been any formal development of mechanisms to assist IPP developers in facilitating projects. Instead, there was development of “ad hoc” assistance and, by the financing of these projects, the setting up of criteria required for successful financing. 4. Tender/Bid Processes and Evaluation Criteria 4.1 Principles 4, 5, 6 and & Tender/Bid processes and evaluation criteria (a) Tendering approach and evaluation The process for the establishment of a private power development project is set out in Appendix G. In summary: 11 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 • a PPA is negotiated between the State Owned Electricity Corporation (PLN) and the project sponsor; • a PPA must obtain approval for investment from the Board of Investment and price approval from the Minister of Mines and Energy prior to being signed by the PLN and Project sponsor; and • implementation of the PPA requires approval from the Off-shore Commercial Borrowing team (PKLN). All but one of the 26 IPP power projects signed by the Indonesian government have been awarded on an unsolicited bid basis, rather than a solicited basis (See: Appendix A for a discussion of solicited and unsolicited projects). Thus, there has not been a great deal of “tendering” of IPPs in Indonesia. It is unclear what information is given to prospective bidders of IPP projects as there have been a limited number of solicited projects. There are no published evaluation criteria, however there is a list of permits and approvals required under Indonesian law in relation to power plant projects (see Appendices D and E). A pre-qualification process is only in place for solicited (competitive tender) projects. As stated, all but one of the projects to date have been placed on an unsolicited tender basis. (b) Conclusions Given that most IPPs have been awarded on an unsolicited basis, there is little evidence of the details of bid processes in Indonesia. Aspects of the assessment process have been drawn up, but a complete framework is not in place and therefore current procedures fall short of the requirements of this Principle. 5. Power Purchase Agreements (PPAs) and Associated Tariff Structures 5.1 Principle 9: Retail tariffs (a) Nature and structure of retail tariffs The price of electricity in Indonesia is set in Rupiahs and controlled by the government. Two separate tariffs are used to determine the selling price of electricity: (i) Basic/Uniform Electricity Tariff This is determined pursuant to Presidential Decree No. 68/1994 and based on the recommendation of the Minister of Mines and Energy. (ii) Periodic Electricity Tariff 12 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 This is determined by the Minister of Mines and Energy. It can be adjusted every 3 months for changes in the: • price of electricity purchased by PLN; • US dollar exchange rate to Rupiah; • CPI, both for foreign and local currencies; • fuel price; and • tax regime and other government regulation (eg.environmental provision). The calculation of prices can be broken down into the following components: (i) Capacity charge component - calculated using financial model and based on the following factors: • Capital cost consisting of cost for Engineering Construction, Testing and Commissioning test; • Development Cost, Working Capital and Land Procurement; • Term and Condition of Loan, Financing Sources, Interest and other Financial Cost; • Debt/Equity Ratio; • Return on Equity; • Availability Factor; • Disbursement Schedule of Loan and Equity; • Taxes and Depreciation based on current regulation; and • Contract Capacity and Contract Term. (ii) Fixed operation and maintenance charge (iii) Energy charge component - The extent of pass-through of this component depends on: • quantity and type of fuel; • specific heat rate (for coal fired); and • fuel price. (iv) Variable operation and maintenance charge. The price for the supply of electricity to domestic consumers is heavily subsidised by the government to ensure that it is at an affordable level for the community, consumers paying approximately 2 cents per kW/h. Owing to the lack of financial information about PLN there is little transparency regarding these subsidies. 13 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Retail tariffs probably do not reflect the economic costs of supply. They are used to support the high electricity prices payable (in $US) to IPPs pursuant to their PPAs (see above). (b) Conclusions The major difficulty at present is influence on retail prices of the structure and implementation of the wholesale prices pursuant to PPAs. The resolution of this issue depends on how the government decides to resolve the restructuring of PLN and the renegotiations with IPPs. 5.2 Principle 10: Transition to competitive markets (a) PPA tariff structures that promote competition The “standard form” Indonesian PPA does not provide a mechanism for a transition to a more competitive market structure. The tariff structure used is a two-part tariffs system: (i) Capacity Payment This payment represents payment for net dependable capacity of the Power Station and consists of Component A and B. Component A Capital Cost Recovery Charge A fee designed to cover Project fixed costs including debt service, and provide a return on investment to Shareholders. Component B Fixed O&M Cost Recovery Charge An agreed Rp/kW for Part 1 (Rupiah costs) An agreed Rp/kW for Part 2 (non-rupiah Costs). (ii) Energy Payment This fee represents payment for kWhs of electrical energy generated by the Power Station and consists of Component C and D. Component C Energy Component Rate This fee covers the cost of fuel required by the Company to generate units of electrical energy. Component D Variable O&M Cost Recovery Charge This is a fee designed to cover Project variable operating and maintenance costs. In addition, the charge includes: • Supplemental Payments 14 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 These payments shall be payable for fuel if a minimum off-take is not achieved. • Transmission line charges The electricity price will also include Component E being the capacity payment for the transmission line. The fee is a capacity cost recovery charge designed to cover fixed costs for the transmission line. If the traditional PPAs remain in their current form, it will be extremely difficult to privatise the PLN because of the high electricity prices it is required to pay to IPPs under the PPAs. It will also make it difficult for privately owned transmission and/or generation companies to enter the market (ie. the high electricity prices may make it prohibitive to enter the market). Thus, it is essential to the development of a competitive market for prices under current PPAs to be renegotiated. (b) Conclusions None of the existing Indonesian PPAs contain mechanisms allowing for a transition to a more competitive market structure. There do not appear to be any policies to facilitate the inclusion of such mechanisms. . 5.3 Principle 11: Allocation of risks (a) Risk allocation under PPAs An indicative table summarising the allocation of the various risks associated with an IPP project between the parties is provided in Appendix B. In summary, the following risks are borne by the government/PLN: • market risk (ie, price shifts due to changes in market structure); • foreign exchange risk (IPPs paid in $US); • changes in fuel prices (ie. PLN is also a generator); • changes in the law; and • political risk. IPPs also assume some of the risk of changes in fuel prices, the law and the political situation. These risks are dealt with by initially adjusting the tariff and if more extreme measures are required (and available) by claiming force majeure (Note: claiming force majeure for a failure breach of contract by PLN (ie. failure to make payments) may result in a buy-out of the IPP). (b) Conclusions At present the government and PLN bear the predominant risks through take-or-pay provisions in the PPA and payment being in US dollars. 15 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 However, due to the political and financial situation in Indonesia the government and PLN have not been able to fulfil their obligations. As a consequence, the IPPs have been forced to renegotiate their PPAs to ensure that they receive payment and can continue their operations. Essentially, the IPPs have been forced to absorb some of the risk as PLN and the government cannot pay the negotiated price. The other alternative to renegotiation is arbitration. However, as the CalEnergy example highlights arbitration does not necessarily result in a satisfactory outcome. 6. Financing and its implications 6.1 Principle 12: Regulatory, taxation and foreign exchange regimes (a) Transparency of taxation regime A complicated, but well defined, taxation regime has been developed to encourage and assist with IPP projects. Certain double tax treaties can be utilised for projects to minimise taxation liability and certain exemptions are granted to IPPs from customs duty and import tax in particular. (b) Conversion of local currency to foreign currency The PPA provides for assistance in the conversion of local currency to foreign currency. Essentially, it is incumbent upon the IPP to seek to convert the currency. If this is not possible, then entering into the relevant FX contract is supported by PLN. However, in practice, this process does not work particularly well given the currency difficulties in Indonesia. (c) Availability and transferability of foreign exchange There are no foreign exchange restrictions as such in Indonesia. Indonesia controls foreign exchange through Presidential Decree No. 59 of 1972 which states that any transaction creating any liability in foreign currency is required to be reported to Bank Indonesia and to the Ministry of Finance. No prior approvals of the Ministry of Finance are required for offshore credit for foreign investment companies unless the state owns a percentage of the company. However, there have been large restrictions on the availability of foreign exchange, purely due to a scarcity of US dollars, in particular, in Indonesia. Whilst there are no restrictions upon the ability to transfer such amounts overseas, there are structural restrictions (such as the approval of US dollar currency loans by the Indonesia Central Bank). Payments to IPPs pursuant to a PPA are denominated in US dollars. In this way, the amounts payable under the PPAs are protected from exchange rate changes. Protection is also provided through the adjustment of the relevant portions of the tariff that are denominated in US dollars. (d) Financial information on power purchasers and other parties 16 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 As discussed above, there is very little information publically available regarding the finances of PLN. IPPs are not subject to any formal financial disclosure requirements. However, they do issue annual reports. (e) Conclusions The main difficulties with implementation of this Principle in Indonesia are: • In practice, there has been great difficulty in the recent Asian currency crisis in the mechanism provided for in the PPA as amounts payable have been in US dollars. PLN, in particular, set an exchange rate which did not reflect the actual exchange rate at the time of negotiating the PPAs. For instance, the rate of exchange was set at approximately 2,450 Rupiah/to US$1 when the actual rate of conversion was something more akin to 8,000/to US$1. • As can be seen by the recent move by PLN to renegotiate all PPAs and the recent arbitration between parties to PPA, the major difficulty is the provision for payment in US dollars, as the region is facing financial hardship. 6.2 Principle 13: Security over project assets (a) Legal framework for creating security over project assets There is a legal framework for creating security over project assets in favour of lenders in Indonesia. The structure is largely derived from Dutch civil law and is very convoluted and inefficient. As a result, assets are commonly transferred offshore to a jurisdiction where security can be obtained. For an outline of the Indonesian security documentation required for a power plant project see Appendix H. The types of security available for IPPs in Indonesia are as follows: (i) Hypothec (Indonesian mortgage over land) (ii) Hypothecs can cover buildings and fixtures placed on the land after creation and must be in notarial form and registered to give priority. Under the scheme, the hypothecs usually contains the power of attorney to sell. This allows the creditor to proceed with a sale of the property upon default by the borrower. Without the power of attorney, the creditor must obtain a court order to sell the property. Personal/Corporate guarantee Personal guarantees are regulated by articles 1820 to 1850 of the Indonesian Civil code and generally work in favour of the guarantor. Essentially, they require that the lender must first exhaust all remedies against the borrower before going against the guarantor. 17 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 (iii) Fiduciary Transfer of ownership Fiduciary assignment is established by the assignment to the assignee of the legal title to the assets. This allows the assignor to retain physical possession of such assets. In the event of the assignor defaulting, the assignee is entitled to sell the assets at a public action. (iv) Assignment of Rights against Indonesian Borrower In Indonesian there is no restriction on assignment. The only practical problem arises in relation to registered hypothecs; in which case, any assignment of a lender’s rights under the hypothec should be effected by the new lender submitting a request in notarial form to the Agrarian Office. The request should include a copy of the assignment and requests that the new bank be substituted in the hypothec for the bank selling its participation. In practice, this procedure is not accepted by the Agrarian Office and it requires that a new hypothec be registered with the assignee being included as a party thereto rather than the assignor. This is the only information regarding assignment and security. Indonesia has an established procedure dealing with bankruptcy. This procedure is set out under the law on bankruptcy promulgated in 1906, and is regulated separately from the Commercial Code. Under the Bankruptcy Law the creditors are ranked as follows: (i) claims for judicial expenses related to enforcement and other efforts to save the assets; (ii) taxes; (iii) claims secured with hypothecation and pledge; (iv) claims for costs and expenses for the preservation of the assets; and (v) unsecured creditors. (b) Conclusions There are significant difficulties in creating an effective security package in Indonesia, largely due to the inadequacy of the legal system. In practice, it has also been difficult to convince the relevant State entities, in particular the PLN, as to the acknowledgment of security or to grant step-in rights. A “standard form” Direct Agreement was established under Paiton I. However, PLN showed no willingness to move away from this structure for future deals or to consider changes to this document. 6.3 Principle 14: Bankability of IPPs (a) Project structure providing a determined income stream 18 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 The income stream (to be) generated by an IPP project is protected by the following aspects of the PPA: Term The PPAs are long-term fixed rate agreements that are capped for a set period and then have a step down in price. Responsibilities during construction Cost overruns or time delays are the biggest risks during construction. Business interruption insurance is taken out to protect against time delays. In addition, responsibility of connecting the IPP to the grid rests with the State and a capacity fee will be imposed on PLN if connection does not occur within the required time frame. (i) Company’s Responsibilities under the PPA • arranging for the design, engineering, supply, construction, testing and commissioning of the Project, including the Special Facilities, in accordance with the design and equipment parameters set out in the PPA; • the acquisition of the Site for Power Station and Special Facilities; • applying for, and obtaining, all consents and GOI authorisations required to be in the Company name contemplated by the Project Documents including the Environmental Impact Assessment; • applying for all work permits, visas and other permits required by Project personnel; • protecting and securing the Site; and • consulting with, and obtaining the approval of, PLN with respect to Special Facilities and the design, construction and installation of the Special Facilities in accordance with the parameters set out in the PPA. (ii) PLN’s Responsibilities under the PPA • assisting the Company to obtain all consents, GOI authorisation and permits required for the Power Station and Special Facilities; • applying for, and obtaining, all consents and GOI authorisations required to be in PLN’s name for the Project; • arranging for the operation and maintenance of the special Facilities; and 19 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 • supplying power and energy required by the Company during the testing and commissioning of the Special Facilities, the Units and Power Plant. Terms of purchase Take-or-pay provisions protect the IPP against the failure of PLN to purchase electricity from the IPP. Penalties for non-delivery of power Two forms of penalty are available under the PPA for non-delivery of power: a reduction in the capacity charge or, in more extreme circumstances, termination of the PPA. Force majeure General force majeure is covered by insurance. If force majeure is of a political nature, then PLN is still obligated to ensure the maintenance of the IPP’s income stream. (b) Creditworthiness and track record of all parties PLN, the sole IPP power purchaser, was perceived as having little or no credit worthiness at the time of the significant IPP development in Indonesia in 1994/1996. As the Asian currency crisis illustrated, PLN showed an inability to meet its debt obligations to the IPPs. The support provided by the State to PLN was minimal and consisted of a “letter of support” from the Ministry of Finance noting that it would ensure PLN met its obligations. The form of the letter as support falls far short of a full guarantee. PLN’s track record of meeting debt obligations and showing a consistent level of profitability is poor (ie. PLN has failed to fulfil payment obligations to a number of IPPs and in 1998 PLN reported losses of $US1.1 billion and estimated its total domestic and external debt to be approximately $US9 billion). Few steps appear to have been taken in the past by the Indonesian government to ensure local companies in IPP projects have proven track records. The local companies selected to participate as joint venture partners in Indonesian IPPs generally had contact with the Suharto family and their “proven track record” was on the whole related to political expediency. This said, there is a requirement for local participation in any project in Indonesia (which is usually around 15%). A local requirement does exist, with the basis for it being found in Presidential Decree No. 16/1994 (22 March 1994). However the Decree does not contain any specific percentage(s). Additional to this it is suggested that there is an informal requirement of 25% local content for government turnkey contracts (this information is dated 9/11/94). 20 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 There are no government guarantees of PLN’s obligations under the PPA. Instead, a letter of support (by the Indonesian Government), which is regarded as weak, is utilised. During the Paiton I Power Project, PLN showed no willingness to move away from the letter of support approach for subsequent power projects. (c) Support from international lending agencies The bulk of the IPPs in Indonesia rely upon export credit agencies and multi-lateral lending agencies for financing. This support, on the whole, takes the form of revision of either subsidised financing or, more importantly, political risk guarantees. Political risk guarantees, are, for instance, provide by USEXIM (the United States export credit agency) and ERG (the Swiss export credit agency). Generally, these guarantees are in line with OECD guidelines and provide a level of support for debt on the project (approximately 85%). To date no political risk guarantee has been called upon by any financier. (d) Commercial and political risk insurance The commercial insurance market available in Indonesia is very limited. The bulk of IPPs reinsure offshore in either the US or European markets. However, there are requirements to have a primary insurance policy onshore. Due to this requirement one of the following structures is used to reinsure offshore: (i) reinsurance with cut through arrangements. (ii) identical policies onshore and offshore. The latter requires the insurance provider to have both a domestic and an offshore office and is regarded by financiers as a preferable method. It effectively means that financiers/sponsors have two policies in identical terms that they can claim against. Each policy provides a provision that a claimant may only claim upon one of the two policies. In practice, it is always intended that a claimant would only ever claim off the offshore insurances. (e) Conclusions The major difficulties that are currently experienced with the implementation of this Principle, and are likely to be experienced in the future, are: • the perceived lack of creditworthiness of PLN; • the relative lack of government support for the obligations of PLN; • perceived lack of transparency in the process of renegotiation of the PPAs. 21 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 6.4 Principle 15: Development of domestic capital (a) IPP financing techniques The bulk of the IPPs developed in Indonesia have utilised a combination of multi-lateral and bilateral financing. Generally, because of the inherent political risk in Indonesia (even before the Asian currency crisis), IPPs in Indonesia required a combination of export credit agency subsidised or guaranteed financing and/or multi-lateral agencies financing all political risk support (such as the IFC or CDC). By way of example, the following table sets out the financing sources utilised for some “landmark” IPPs in Indonesia: Project Sources of Debt of Financing Paiton I USEXIM Tanjung Jati B JEXIM, IFC Sengkang ERG The following points are worth noting: • there has been very little domestic debt or capital markets financing used in IPPs in Indonesia. • all financing has been utilised in US dollars. The support granted by export credit agencies has been either in the form of subsidised financing or, more commonly, in the provision of political risk guarantees supporting commercial debt financing. (b) Policies to encourage the development of domestic capital markets The domestic capital markets in Indonesia are reasonably immature. There are little or no domestic capital funds available for equity investment in electricity projects. However, offshore investment funds are used. Domestic markets have not been used for IPP financing in Indonesia. However, in the case of Paiton I, offshore bond market (a 144A capital markets issue) was utilised. Domestic capital is tight in Indonesia and has generally had former President Suharto’s family attached to it. IPPs have generally used (foreign) assisted domestic equity investors. We are not aware of any policies explicitly designed to promote the development of domestic capital markets. (c) Conclusions 22 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Domestic capital markets are reasonably immature. One of the major obstacles facing the promotion of such markets is the development of legal institutions to support them. 23 EWG20/10.3-Att A-Ann 3 Appendix A IPP projects in Indonesia Project Paiton Energy Parties PT Paiton Energy Company. Consortium members: Technology Coal fired Location Probolinggo, East Java Capacity (MW) 1,230 Status PPA entered into in February 1994. • Edison Mission Energy, General Electric (12.5%); • US8.5 cents/kWh for first 6 years; • Mitsui (32.5%) • US8.3 cents/kWh from 7th to 11th year; and • PT Batu Hitam Perkasa (local firm 33.3% owned by Hashim Djojohadikusumo; the brother in law of Titek Prabowo, a daughter of the former president Suharto) (15%) • US5.5 cents from 13th to 30th year. PPA commits Paiton to buying energy at: (Note As at October 1999, PLN sold power to the public at approximately 2.6 cents per kWH). Project cost $2.5 billion. Plant came on line in May 1999 (first IPP to be completed), but is yet to generate electricity for PLN. Paiton claims that PLN has failed to pay the “capacity charge” due under the take or pay clause. In October 1999, PLN filed suit against Paiton, seeking to void the PPA on grounds that the PPA was corrupt and illegitimate. In December 1999, the Indonesian government stepped in and ordered PLN to drop the suit. (The government feared general loss of investor confidence if such a large obligation was 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Project Parties Location Technology Capacity (MW) Status cancelled). Tanjung Jati B Hopewell Holdings (Aust) (80%) and a local firm with links to family of former President Suharto Coal-fired thermal / Jepara, Central Java 1320 Project company’s investment = HK$1.8 billion. Construction halted in September 1998 and force majeure declared by IPP. Interim agreement reached between PLN and shareholders of Tanjung Jati B, in September 1999, to buy the plant for US$1.15 billion through a soft yen loan. [Indication of foreign investors abandoning IPPs] Sengkang Energy Equity Corporation (Perth, Australia) and El Paso Energy International Gas-fired combined cycle South Sulawesi 135 Connected to grid. Tariff of US 6.7 cents per kWh. Interim agreement reached. PT Cikarang Listrindo Cikarang Listrindo Gunung Salak (Unocal) Steam Owned by former President Suharto’s cousin Sudwikatmono Bekasi 204 West Java Geothermal West Java 165 Tariff of US 8.4 cents per Kwh for first 14 years and US 4.9 cents per kWh for following 15 years. Cikang Listrindo PLN suspended power purchases from Cikarang in June 1998. Paiton I 1,230 Paiton II 1,220 Dieng Geotherma l 400 Wayang Connected to grid. [Connected to grid July 1998] Tariff of over US 8 cents per Kwh Geothermal 220 2 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Project Parties Technology Location Capacity (MW) Status Windu Salim Group 100% Indonesian owned Cikampek Region, West Java Karaha Geothermal Java 220 Postponed Sarula Geothermal North Sumatra 300 Postponed Darajat 1, 2 Geothermal West Java 270 Postponed Palembang Timur Combined cycle South Sumatra 130 Postponed Patuha Geothermal West Java 80 Reviewed Asahan 1 Hydro North Sumatra 60 Reviewed Tanjung Jati A Coal Central Java 1320 Reviewed Tanjung Jati C Coal Central Java 1320 Reviewed 3 EWG20/10.3-Att A-Ann 3 Appendix B Risk allocation for IPP projects Risk Remedy Bearer CONSTRUCTION PERIOD Cost Overrun Included in the Fixed Price of Component “A” (capacity charge) of the tariff Developer Delay in Completion Penalties to the EPC Contractor Developer/EPC Contractor Failure of Plant to meet Performance Specifications Tests as result of fault by EPC Contractor Penalties to the TPC Contractor Developer/EPC Contractor Land acquisition Government provides reference land cost for project cost estimation, to be included in the Fixed Price of component “A” Developer Increase Financing Cost Formulated in the Loan Agreement with Lender Developer/Lender Government • changes in law, tax, custom, environmental standard Tariff adjustment based on new regulations Buyer (i.e. PLN) • expropriation, nationalisation, consents withdraw Owner entitled to terminate as government default compensation paid for termination Developer Operating costs overrun Penalties payable by the O&M company Developer Inflation adverse change in cost of finance, exchange or interest rates Formulated in the Invoicing and Payment Procedure Developer/Buyer Foreign exchange non-availability/non-convertibility Formulated in the Invoicing and Payment Procedure Developer/Buyer OPERATION PERIOD 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Risk Remedy Bearer Failure to make available sufficient foreign exchange Formulated in the Invoicing and Payment Procedure Developer/Buyer Fuel Supply Formulated in the fuel supply agreement Developer Failure of purchaser of power (PLN) Formulated in Payment Formula. Buyer payable Capacity Charge with an agreed Capacity Factor Buyer Forced Outage/De-Rate or Temporary Short fall in Capacity, Determination in Heat Rate (owner’s fault) Formulated in Payment Formula Developer Forced outage or Temporary short fail in Capacity (Purchaser’s fault) Formulated in Payment Formula Buyer Increase Fuel Cost (not arising from lighter Heat Rate deterioration than Base Case) Fuel price adjustment formulated in Fuel Price Determination Passed through component of the Tariff Buyer Boiler Explosion Formulated in the insurance policies Developer / Insurance Company Failure of the operator to Perform Obligations Penalties to the O&M Company Developer/O&M Company Environmental Incidents Caused by the Operator Penalties to the O&M Company Developer/O&M Company 2 EWG20/10.3-Att A-Ann 3 Appendix C Overview of Indonesian electricity industry regulatory framework Law / Regulation / Policy / Guideline Details State Policy Guidelines (GBHN) Electricity development as an integrated part of the national development must be conducted in a harmonious and synchronous way with the stages of development. To achieve equitable distribution of the fruits of development, electricity development must be directed for the benefit of all people, particularly the rural population. Electricity development must form a part of the National Energy Policy (KUBE), which comprises: intensification, diversification and conservation of energy utilisation. Law 15/1985 (Electric Energy) Basis and objectives of electricity development. Issues covered: Energy sources for electricity; General national electricity plan; Electricity undertaking; Relationship between the Holder of Electricity Undertaking Authorisation (PIUK) and the Holder of the Electricity Enterprise Permit for Public Use (IUKU); Supply and utilisation of electricity - Electricity supply, organised by Government and carried out by State owned enterprise (PLN). Widest possible opportunity given to cooperatives and other enterprises (private companies) to supply electricity as a complement to the supply by PLN; Management and supervision; and Penal provisions. Government Regulation No 10/1989 (Supply and Use of Electric Power) Deals with business of power supply: ie. proxy, business plan, business license, supply requirements, operation requirements, use of power and power installation and standardisation. Relationship between the Holder of the Proxy for power affairs and the Holder of the License for power business for public Rights and responsibility of the public in the use of electric power Power connection requirements 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Law / Regulation / Policy / Guideline Details interest Selling price of electric power Development/guidance and supervision Presidential Decree No. 37/1992 (Private Power Enterprise for Electricity Supply) Invites private investors to “Build, Own and Operate (BOO)” power generating plants and transmission and/or distribution networks. Permits private participation in transmission and distribution of electricity. IPP’s allowed to sell their supply or lease their activities to PLN and other parties. Investors are permitted to wholly finance projects and operate them independently for 30 years (from date production commences). Selling price of the privately produced power will be stated in Rupiahs must reflect most economical price (based on joint agreement) and must be approved by the Minister of Mines and Energy Priority will be given to the use of primary energy other than oil and domestic supply (in effect all IPP plants must be based on non-oil primary energy resources). Incentives to be provided on import capital goods. Regulation No. 02.P/03/M/PE/1993 jo No.04.P/03/M.PE/1995 Comprehensive policy framework to guide reform and restructuring of the power sector. (Guidelines for Implementing Private Sector and Cooperative to Supply Electric Power for Public Use.) • Private power enterprises supplying electricity for public use will be based on an Electricity Supply Enterprise Permit for Public Benefit (IUKU permit); and • Private power enterprises supplying electricity will be prioritised on Build, Own and Operate (BOO) basis. Issues stipulated: Private power development implemented in 2 ways: (a) Solicited projects - based on a pre-qualification and tender procedure. Investors are invited by the government to participate in the prequalification selection via announcements in both the national and international media. Following Tender procedure then applied to investors who have been prequalified. (b) Unsolicited proposals - private power enterprises or cooperatives may propose power projects to be considered by PLN and the Director General of Electricity. Once approved, a preliminary approval letter is issued and the company can then apply for an investment license. Government Regulation 23/1994 PLN status converted from PERUM (Public) to PERSERO (limited liability). Presidential Decree No. 139/1998 (Power Sector Restructuring) Deals with establishment of a committee to restructure and rehabilitate PLN. The committee has set up 4 working groups, who will: 2 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Law / Regulation / Policy / Guideline Details (i) improve PLN finances; (ii) renegotiate PPA’s (IPP Contracts Rationalisation Group); (iii) renegotiate other long term contracts; and (iv) improve the PLN’s operational efficiency. 3 EWG20/10.3-Att A-Ann 3 Appendix D Permits required by IPPs Type of Permit Details Sitting Permits Business Location Permit (Izin Tempat Usaha) by Regent of respective Regency (Bupati Kepala Daerah TK11) Environmental Permits Approval of the Minister of Mines and Energy on Environment Analysis (Analisa Dampak Lingkungan) including the Environmental Management Plan (Upaya Pengelolaan Lingkungan) and the Environmental Monitoring Plan (Upaya Pemantauan Lingkungan) for the Project conducted by the AMDAL Central Commission of the Ministry of Mines and Energy to be issued to Seller pursuant to Regulation of the Minister of Mines and Energy No. 2 of 1993. Design Construct Permits Work permits for foreign personnel employed by Seller issued by the Chairman of the BKPM, based on approved Manpower Plan (Rencana Penggunaan Tenaga Kerja). and Other (eg. Commissioning O&M) Construction licenses required for the contractors to engage in the construction of the Project issued by Governor of respective Province. Commissioning certificate issued by Director General of Electricity and Energy Development for the Plant following commissioning tests. Electricity Supply Enterprise Permit for Public Benefit (IUKU permit) issued by the Chairman of the BKPM as an operation license following commissioning of Plant. List of permits required by Agency 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Federal Provincial/State Local Investment License under the Foreign Investment Law No. 1 of 1967, in the form of Presidential Approval Notification Letter (the SPPP) or Capital Investment Agreement Letter (the SPPM) on the basis of Domestic Investment Law No. 6 of 1968, as amended from time to time, issued by the Chairman of the BKPM on terms consistent with the material provisions of the PPA and the results of the negotiations between the Sponsors and the GOI. • Approval of the Justice to the notarial deed of establishment of the Project Company. • Issuance by Presidential Decree No. 39/1991 Foreign Loan Team (Tim Koordinasl Pinjaman Komersial Luar Negeri - PKLN) of permit to obtain foreign loans. • Permit from Minister of Finance, Directorate General of Customs and Excise for temporary import of equipment and other materials to be utilised in connection with the construction of the Project. • Registration of Seller with Department of Trade pursuant to Law No. 3 of 1982 (Wajib Daftar Perusahaan) at relevant Department of Trade office at location of Seller’s offices. • Permit from Governor of respective Province to Seller to utilise sea water for purposes of Project. • Building Permit (Izin Mendirikan Bangunan - IMB) issued by Regent of respective Regency. 2 EWG20/10.3-Att A-Ann 3 Appendix E Permits and Approvals Required under Indonesian law in relation to Power Plant Projects I. II. III. Company Formation A. Deed of Establishment (Articles of Association) executed before a notary B. Approval of the Deed of Establishment from the Minister of Justice C. Registration of the approved Deed of Establishment at the Local District Court in the domicile of company D. Publication of the Deed of Establishment in the State Gazette (Berita Negara) by the State Printing Office Investment Procedure A. Letter of Preliminary Approval B. Feasibility Study C. Approval from the President as stated in the Letter of Notification of the President Approval (“SPPP”) issued by the Chairman of BKPM D. Registration at the Regency Office of Department of Trade to obtain a Company Registration Number (TDP) E. Issue of the Commission Certificate by the Director General of Electricity and Power Development for the Plant following the Commissioning Test F. Issue of the licence to a private business company in order that it may undertake the business of electric power supply in the interest of the public (the IUKU) by the Chairman of BKPM G. Business Location License (Ijin Tempat Usaha) H. Permanent/Fixed Business Licence (IUT) I. Issue of Final Operation License by Chairman of the BKPM (Izin Usaha Ketenagalistrikan untuk Kepentingan Umum – IUKU) following the commissioning of the plant Financial A. Registration with the Department of Finance, Directorate General of Taxation, to the centralisation of income tax and value added tax administration in the relevant Jakarta tax office B. Registration with the Department of Finance, Directorate General of Taxation, to obtain Value Added Taxpayer Number C. Consent of the Department of Finance, Directorate General of Taxation, to the centralisation of income tax and value added tax administration in the relevant Jakarta tax office D. Approval from the Department of Finance, Directorate General of Taxation for Book-Keeping in English and in US dollar currency 1 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 IV. V. VI. VII. Construction A. Issue of the Advance Building Permit (presentation delegated by Governor to Regency level) B. Issue of the Building Construction Permit (Izin Mendirikan Bangunan – IMB) by the Regent of Jepara Regency, the Province of Central Java (presentation delegated by Governor to Regency level) C. Permit from the Minister of Communication, Director General of Sea Transportation for construction and operation of a temporary jetty for Project Site during the construction and operation period or, D. Permit from the Director General of Sea Transportation, Governor /Head of the Province of Central Java, to utilise sea water for purpose of the project (cooling water & desalination plant) E. Permit from the Minister of Communication, Directorate General of Sea Communication for discharge of waste water into the sea F. Permit from the Central Java Transportation Office for dredging G. Permit from the Director General of Sea Transportation to carry out reclamation with dredged material Environment A. Approval from the Minister of Mines and Energy of the environment Impact analysis (Analisa Dampak Lingkungan) conducted by the AMDAL Central Committee of the Department of Mines and Energy B. Approval from the Minister of Mines and Energy of the Environment Management Plan (Rencana Kelola Lingkungan or RKL) C. Approval from the Minister of Mines and Energy for the Environment Monitoring Plan (Rencana Pemantauan Lingkungan or RPL) D. Permit from the Minister of Health to possess, store and utilise hazardous waste E. Issue of a Nuisance Act Permit Loan A. Permit from the Team for the Coordination of Offshore Commercial Loans (Tim Koordinasi Pinjaman Komersial Luar Negeri or PKLN) to obtain foreign loan B. Approval from Bank Indonesia of documentation for a foreign loan within the intended investment as set forth in the SPPP Land A. Issue of the Location Licence by the Regent of Jepara Regency, the Province of Central Java B. Execution of Sale and Purchase/land relinquishment documents relating to land acquisition 2 EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 VIII. IX. C. Grant of Hak Guan Bangunan (HGB) title for the Project Site by the Head of the National Land Agency D. Registration of the HGB title A. Issue of Limited Importer Registration Number (APIT) from Chairman of the BKPM for importation of goods for project during operational period B. Approval from the Chairman of BKPM of the Master List of imported capital goods (covers import duty and PPN) and issue of decision on tax facilities for such capital goods* C. Application for exemption from income tax on imports (PPh. 22) D. Application for suspension of Value Added Tax (PPn) and /or Value Added Tax on luxury goods (PPnBN)* E. Order 23 Procedure F. Permit from the Department of Finance, Directorate General of Customs and Excise to establish and operate a customs clearance office and bonded area at the Project Site during the period of construction and operation Tax Employees A. Approval of the Plan on the Employment of Expatriates (‘Manpower Plan’) (RPTKA) from the Chairman of BKPM* B. Issue of Work Permit (IKTA) for individual expatriates by the Chairman of BKPM based on approved RPTKA 3 EWG20/10.3-Att A-Ann 3 Appendix F Interconnection Projects Project Status Sumatra, Indonesia - Peninsula Project aimed for bi-directional electricity flow. MOU has been signed by both parties for the development of a mine power Malaysia (submarine cable) plant in Sumatra, Indonesia. Funding is the constraints for project implementation (private participation as an alternative) Batam, Indonesia Bintan, [Seeking sponsors for financing the study] Indonesia - Singapore - Johore, Malaysia Sarawak, Malaysia West Implementation being prepared with options for private participation Kalimantan, Indonesia (150 MW, 250 kV overhead line) 1 EWG20/10.3-Att A-Ann 3 Appendix G Private Power Development Scheme EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Solicited Solicited Project Project Pre Pre qualification qualification Announcem Announcement ent by byDG DGEED EED Feasibility Feasibility Study Studyby byPLN PLN PrePrequalification qualification Docum Document entfrom from PLN PLN Pre-bid Pre-bidConf. Conf. And AndSite SiteVisit Visit Subm Submission issionof of Proposal Proposal Unsolicited Unsolicited Project Project Subm Submission issionof of Proposal Proposalto to DG DGEED EED PLN PLN Consideration Consideration on onUnsolicited Unsolicited Proposal Proposal M MM ME EDecision Decision for forPre Prequalified qualified Developer Developer DG DGEED EED Received Received Response Responsefrom from PLN PLN Evaluation Evaluation Tender Tender A nnouncement Announcem ent by byPLN PLN Evaluation Evaluation Report Reportto toM MM ME E through throughDG DGEED EED Bid BidDocum Documents ents Issued Issuedby byPLN PLN Subm Submission issionof of Bids Bidsby byPrePrequalified qualified Developers Developers ?? Bid BidEvaluation Evaluation Report Reportto to DG DGEED EEDfor for Validation Validation Bid Bid Evaluation Evaluation DG DGEED EED Received Received R esponse Responsefrom from PLN PLN Inform Informed ed Proposal Proposal not not Accepted Accepted EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Form Formation ationof of Project Project C Com ompany pany Unsolicited Evaluation Evaluation R Report eportto to M Minister inisterof ofM M.E. .E. M MM ME ED Decision ecision D Developer eveloper Feasibility Feasibility Study Study& & D Detailed etailed Proposal Proposal N Negotiation egotiation D Draft raftof ofPow Power er Purchase Purchase A Agreem greement ent D Director irector G General eneral Validation Validation SPPP SPPPor orSPPM SPPM (Investor (Investor A Approval) pproval) M MM ME EA Approval pproval on onTariff Tariff Land Land A Acquisition cquisition& & Env. Env.A Analyst nalyst Licence LicencePerm Permitit by byC Co-ord. o-ord. Investm Investment ent B Board oard C Com omm mission ission& & Test TestC Certificate ertificate O Offshore ffshore C Com omm mercial ercial B orrow Borrowing ing A pproval Approval Start Start C Construction onstruction Financial Financial ?????? ?????? O Offshore ffshore C Com omm mercial ercial B Borrow orrowing ing A Approval pproval EWG20/10.3-Att A-Ann 3 Agenda Item 10.3-Micro Eco Reform-Att A-Ann 3 Appendix H Indonesian Security Documentation The following security will be required to be granted in favour of the lenders: (1) Share Pledges (a) Pledges by current shareholders, with the right for lenders to receive declared and liquidation dividends in the event of default; (b) Pledges of the shares. These are required to allow step-in by the lenders at shareholder’s level as an alternative to enforcing the pledges at 1.1; and (c) Power of attorney over the shares, authorising the lenders to (i) vote in the event of default and (ii) sell shares at a private sale. The shares pledges and powers must be executed in Indonesia in notarial deed form. (2) Security over Receivable It is suggested that a number of fiduciary assignments be entered into: (a) over all PPA receivable, including bank accounts; and (b) all amounts owed to the IPP in respect of insurance claims and proceeds. The Fiduciary Assignments must be executed in Indonesia in notarial deed form. (3) Security in Tangible Movables Tangible movables should be secured as follows: (a) A fiduciary transfer agreement should be used to secure all tangible movables; and (b) Power of Attorney over Sale. Bother the Fiduciary Transfer Agreement and the power of attorney over sale must be executed in Indonesia in notarial deed form. (4) Security in Immovable Property Security over land should be taken at the outset by way of Hypothec. (5) Security over Project Documents under Indonesian law the core project documents cannot be assigned to the lenders by way of security. Accordingly, lenders will require authority pursuant to an irrevocable power of attorney to exercise the rights of the IPP under those project documents. (6) Other Security 1 EWG20/10.3-Att A-Ann 3 The lender will also require an Acknowledgment of Indebtedness from the IPP in notarial deed form. 2 EWG20/10.3-Att A-Ann 3

![Dr. Z's Math251 Handout #13.3 [Arc Length and Curvature] By](http://s3.studylib.net/store/data/008263836_1-3cdb80f6ec4c3c8afbcf7b46fe80eeff-300x300.png)