combined presentation slides, script and Q&A transcript

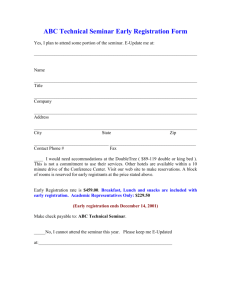

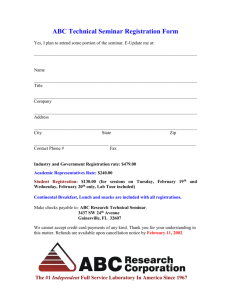

advertisement