Vehicle Policy - VINCI Construction UK

Vehicle Policy

2

VINCI PLC Vehicle Policy

Contents

1. Company Car Arrangements

1.2 Allocation of Vehicles

1.3 Extras and Accessories

1.4 General Responsibilities of Authorised Drivers

1.5 Servicing and Maintenance

1.6 Insurance

1.7 Authorised Drivers

1.8 Accidents

1.9 Motoring Offences

1.10 Fuel Purchasing

1.11 Private Use/Fuel

1.12 Holiday Travel Abroad

1.13 Business Travel Abroad

1.14 Procedure on Vehicle Return

1.15 Relief Vehicles

1.16 New Employees Temporary Allocations

1.17 Car Allowance

1.18 Long Term Absence

1.19 Mileage Returns

1.20 Replacing Existing Company Vehicles

1.21 Re-grading of Employee’s Car Grade Entitlement

1.22 Trade Down Allowance - Grades A to C

1.23 Trade up contribution - Grades A to C

1.24 Vehicle choice - Grade D to H

9

10

10

10

9

9

8

8

6

7

5

6

4

5

4

4

11

12

12

12

11

11

10

11

VINCI PLC Vehicle Policy

2. Guidelines to HMRC definition of business mileage

2.1 Home to Work Journeys

2.1.1 Permanent Workplace

2.1.2 Temporary Workplace

2.2 Definitions

2.2.1 Limited Duration

2.2.2 Temporary Purpose

2.3 Business Journeys Commenced from Home

2.4 Mileage Returns

3. Overseas Driving Licences

3.1 Duration of Validity of Overseas Licence

3.2 European Community/European Economic Area

3.3 Northern Ireland

3.4 Gibraltar and Designated Countries

3.5 Jersey, Guernsey or Isle of Man

3.6 All Other Countries

3.7 Students from Non-Community Country

4. Appendices

16

17

17

18

18

16

16

16

13

13

13

15

15

13

13

13

13

19

Driver’s General Responsibilities

This refers to drivers of Company vehicles, whether they are company cars, vans and other authorised persons, together with any employee required and authorised to use their own vehicle on Company business, have an absolute responsibility for knowing and complying with the requirements of the law, both generally and specifically, covering their particular vehicle and driving on the public highway.

It is the driver’s responsibility to ensure any vehicle they are driving is in roadworthy condition and is competently driven in a considerate and economic manner. Drivers should ensure they give themselves adequate time for any given journey, giving due consideration to the time of the day the journey takes place and weather conditions at the time. Drivers should ensure that they do not drive whilst tired and should take adequate breaks to reduce fatigue.

3

4

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.1 Company Vehicles

The policy of the Group, at its discretion, is to provide eligible employees with a suitable car for work in accordance with their terms and conditions of employment.

The information contained in this section, which is by no means exhaustive, has been compiled to provide a better understanding of the facilities which are available to those employees who have been allocated a Company car and to enable them to deal effectively with all the more usual situations that they are likely to encounter.

1.2 Allocation of Vehicles a) Wherever possible, employees will be invited to select their choice of car from the appropriate grade within the list of approved makes and models, which is issued periodically.

b) An employee may be allocated a used vehicle. Such a car will not normally be from a grade lower than their usual entitlement. c) In the event that for medical reasons employees require automatic vehicles, documentary evidence from the employee’s GP or Specialist shall be forwarded to the Group Human Resources

Department prior to the ordering of any vehicle.

1.3 Extras and Accessories a) Except as set out in (b) below an employee may not fit any equipment or make any alteration to a

Company car without prior approval from VINCI Fleet Services Limited (VFSL).

b) The following may be fitted at the employee’s own expense without prior approval:

• child safety seats

• towing equipment c) In all cases the fitting must be carried out in a competent manner using quality accessories and the employee may be asked to reimburse the cost of making good if the equipment is subsequently removed.

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.4 General Responsibilities of Authorised Drivers

All employees and other persons authorised to drive a Company car are responsible for knowing and complying with the requirements of the law, both generally and specifically, covering their particular vehicle and relating to driving on the public highway.

Authorised drivers (see below) must possess at all times and provide consent for the group to check driver details for the particular class of vehicle allocated with the DVLA. They must ensure that : a) Their vehicle is fully roadworthy at all times and complies in all respects with the requirements of

Road Traffic Acts or other legislation relating to public safety. Daily attention must be given to tyre condition and pressures, oil and water levels, brakes, lights, steering and windscreen washers/ wipers.

b) It is properly serviced and maintained in accordance with the manufacturer’s specification and that all faults and damage are reported and repaired.

c) It is clean and well maintained and, if possible, garaged when not in use. If it is considered necessary to repair and valet a badly cared for and maintained vehicle, the right is reserved to charge the allocated user. If a charge is to be levied, the employee will be given 7 days notice of any charge.

d) Any protection device is activated and operational when the vehicle is left unattended.

e) Where applicable, drivers’ information packs, breakdown/accident procedural notes etc, are kept within the vehicle at all times.

f) The vehicle is generally available at the allocated user’s place of work.

g) It is a requirement of the Group that all allocated users attend, when requested, a

‘Safe Drivers’ course.

Failure to comply with the above conditions or any other requirements of this policy may lead to disciplinary action and possible withdrawal of the vehicle.

1.5 Servicing and Maintenance a) Allocated users will be provided with a Service and Maintenance charge card and the allocated user should present this at any of the appropriately franchised garages. Together with operational instructions and driver’s information, this card will be forwarded to you when a car is issued.

b) Tyres, batteries, exhausts and replacement glass are covered under national agreements with approved suppliers. The Service and Maintenance charge card should be used when these items are necessary.

c) Emergency breakdown cover is provided initially under manufacturer warranties and drivers are requested to consult the car handbook for details. On expiration of manufacturer cover, an external contractor provides emergency services, details of which are included within the driver information pack.

d) Where a breakdown or emergency occurs in an unsafe or dangerous area, eg. a puncture on the hard shoulder of a motorway, the driver should not endeavour to repair the vehicle, they should call for assistance.

5

6

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.6 Insurance a) All Company vehicles are insured through VINCI Insurance Services Limited in accordance with current Group policy. Copies of all the relevant certificates of motor insurance are lodged at all offices and are available for inspection as and when required.

b) Vehicles may only be used for Company business and for social, domestic and pleasure purposes.

Under no circumstances is any other use authorised.

c) Prior to allocation of a Company vehicle employees must fully complete and return a Group Motor

Insurance Questionnaire and consent form to enable VFSL to check driver details with the DVLA together with a copy of their current driving licence. Upon replacement of a Company vehicle a

Group Motor Insurance Questionnaire must be completed and VFSL must confirm that the driver possesses a valid licence. Only upon approval of the completed questionnaire and confirmation of their valid licence will the employee be permitted to drive. All employees must complete and return a motor insurance questionnaire and a consent form to enable VFSL to check driver details with the

DVLA at least every 3 years.

1.7 Authorised Drivers a) Generally, only Group employees who have been approved in accordance with Section 1.6(c) will be allowed to drive. However, spouses/partners may drive Company cars, as may other members of the employee’s immediate family, provided the latter have attained the age of 25 years and reside at the same address as the employee. All such persons must have the written authority of the Human

Resources Director or Business Unit MD and have been similarly approved under Section 1.6(c).

b) Learner drivers may not drive Company cars.

c) The Group may require an employee/authorised user to produce annually a medical certificate of fitness to drive if considered appropriate.

d) The Group may at its absolute discretion require the immediate return of a Company car if the allocated user is certified by a registered medical practitioner as being unfit to drive or if they are legally debarred from doing so (see Section 1.9(d))

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.8 Accidents a) If the car is involved in a collision resulting in damage to any vehicle, person or property:

i) No admission of guilt should be given at the scene.

ii) Details of all parties involved and their vehicles should be taken.

iii) An attempt should be made to obtain an independent witness.

iv) The car should only be driven if the driver is satisfied that it is safe to do so.

b) In the event of the car being involved in an accident, however trivial, it is the driver’s responsibility to report this by immediately completing and returning an Accident Report form which is obtainable from VISL, Widnes.

c) In the event of major collision, immediate telephone contact must be made with VISL, who will make the necessary arrangements for the vehicle to be removed to an approved repairer.

d) If a replacement car is necessary whilst the damaged vehicle is undergoing repairs a request for such should be made via VFSL. There is no automatic right to a replacement vehicle and the provision and choice of any such alternative is solely at the discretion of the Group and will be provided at a grade of vehicle lower than that to which the employee is normally entitled in the interests of cost saving.

e) VISL will maintain accident records for all drivers and will report to Business Unit Managing

Directors details of allocated users who have been involved in two or more accidents within a period of 12 months. If these are of a serious nature the Group will notify the driver concerned and where appropriate, downgrade their car entitlement. The Group will then issue a replacement vehicle in the new lower grade as soon as availability permits. In exceptional cases the allocated users right to a car may be withdrawn and the Group may charge a personal excess.

f) In the case of drivers with poor records (as detailed in Section 1.8 (e)) who are not allocated a

Company car, permission to drive such vehicles is immediately and automatically withdrawn.

Approval can only be reinstated through compliance with the provisions in Section 1.6(c).

7

8

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.9 Motoring Offences a) All employees and other authorised drivers are responsible for knowing and complying with the requirements of the law and the Highway Code. Drivers should drive within the speed limits. The

Group does not condone the use of equipment that informs the driver of the location of speed enforcement devices as these are deemed not to be in the public interest.

b) Parking and congestion charge fines are the responsibility of the driver and must be paid immediately. In the event that they are initially met by Group companies they will be recovered from the driver inclusive of any administrative costs. Such fines may not be recovered, in any manner, from the Group.

c) All motoring offences carrying penalty points must be reported by the driver to VISL.

d) If an authorised driver is disqualified from driving for any period, the authority to drive a Company car is automatically withdrawn. The driver must immediately notify their employing Company, VFS,

VISL and the Group Human Resources Department. In all cases of employee disqualification, a car may not be retained and used by a third party. Following expiry of a period of disqualification all previously authorised drivers must again complete a Group Motor Insurance Questionnaire and permit the checking of driver details with DVLA as required by Section 1.6(c).

Should, after consideration of the options available, an employee be unable to carry out their duties as a result of disqualification, the Group may have no alternative other than to terminate employment.

1.10 Fuel Purchasing a) A fuel charge card will be made available to allocated users, it should be used for all purchases of fuel and oil at which time the vehicle registration number and recorded mileage must be entered on the sales voucher. The method of payment should be made clear to the fuel retailer prior to filling the vehicle. This facility applies to UK mainland only.

b) The card must be returned to the Group when any of the following circumstances arise.

i) Termination or retirement from employment.

ii) The employee is legally or medically debarred from driving.

iii) The employee is transferred overseas.

iv) Entitlement to the use of a car is withdrawn.

c) If the card is lost or stolen it should be immediately reported to the Police and a crime number obtained. VFSL will then organise a replacement.

Fuel cards will not be provided for temporary allocations (defined as less than one month) or hire vehicles. Employees should ensure valid receipts are kept of fuel purchases and are claimed via the expenses procedure.

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.11 Private Use/Fuel

An authorised driver is normally entitled to use the allocated vehicle for social, domestic and pleasure purposes.

The Company fuel card will be provided and all the costs incurred on the fuel card each month will be recovered from the employee’s salary.

Business mileage will be reimbursed through a monthly expense claim and calculated as the proportion of business to total mileage in each month multiplied by the total fuel card cost in the month. The employee must sign an agreement accepting responsibility for any adverse tax consequences arising on the employee’s failure to meet all private fuel costs. A copy of the agreement is available from the Group HR Department at Watford.

1.12 Holiday Travel Abroad

Company cars may be taken abroad provided an Application to use Company Vehicle Outside Great

Britain form is completed, duly authorised and forwarded to VISL at least 15 days prior to travel.

Full details of the procedure and necessary requirements that must be met are contained with the documentation issued by VISL. The cost of approved recovery insurance and Green Card\Bail Bond will be to the employee’s own account.

1.13 Business Travel Abroad

The procedures are precisely the same as those set out in Section 1.12 except that the cost of recovery insurance and Green Card issue will be met by the driver’s business unit.

9

10

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.14 Procedure on Vehicle Return

Cars that are returned by reason of replacement or employment termination must be delivered in a clean and tidy condition to the nearest collection point agreed mutually with the Group Human

Resources Department.

1.15 Relief Vehicles

All relief vehicles must be sourced through VFSL who may provide these under national agreements with approved suppliers or from the pool of available vehicles. A relief vehicle may not necessarily be of the same grade.

1.16 New Employees Temporary Allocations

New employees joining the Group may be provided with temporary allocations in the form of hire vehicles or pool vehicles. New employees will normally be provided with an equivalent type and size of vehicle to that which their grade of Company car entitles them to drive.

1.17 Car Allowance

Subject to the business unit policies in force, employees may request a car allowance in lieu of their car entitlement. The business unit Managing Director has the responsibility to ensure that the cost of employees transferring from Company car to Car Allowance is no greater than those costs incurred in the operation of a company vehicle (see attached appendices) defined as 15,000 business miles per annum. The payment of a Car Allowance is solely at the Group’s discretion. Further details of this scheme are in the Car Allowance scheme application form detailed in Appendix 4.3.

Continuance of any Car Allowance is dependant upon: a) The employee maintaining a suitable vehicle no more than 5 years old, has covered less than

150,000 miles, has a CO

2

emission figure less than stipulated in appendix 4.5 for the relevant grade and is neither a convertible, sports car (defined as a vehicle capable of carrying less than 4 people) nor a 4X4 off-road capable vehicle.

b) Holding a valid, full driving licence.

c) Arranging insurance cover for the suitable vehicle which extends to business use.

d) Ensuring any vehicle used for business purposes is maintained to the manufacturers specification and conforms to motor vehicle construction and regulations and where applicable holds a current

MOT certificate.

e) Employees are advised that if they are unsure if their vehicle conforms to the above rules they obtain clarification from HR.

The Group requires that employees in receipt of Car Allowance provide evidence of the above. Such evidence includes driving licence, insurance certificate, vehicle registration document (V5), current

MOT certificate and the last service invoice. These documents must be available for inspection when requested. The Group reserve the right to inspect the vehicle detailed in the above evidence at 24 hours notice.

VINCI PLC Vehicle Policy

1. Company Car Arrangements

Employees in receipt of Car Allowance will be issued with a fuel card. This fuel card should be used for the purchase of all fuel for the suitable vehicle. The cost of this fuel will be deducted in full from net salary on a monthly basis. Claims for business mileage must be made on the appropriate form on a monthly basis via the expenses procedure.

1.18 Long Term Absence

In accordance with the Group’s policy relating to benefits during long term absence, the Group reserves the right to withdraw Company vehicles or stop payment of car allowance in cases where absence exceeds 18 continuous weeks.

1.19 Mileage Returns

All employees issued with a Company car or in receipt of Car Allowance must complete a monthly mileage return for the purposes of recording business journeys and mileage.

1.20 Replacing Existing Company Vehicles

Company vehicles will be replaced on regular cycles to ensure that the maintenance of the fleet is kept to within the scope of costs allowed for vehicle upkeep and that employees are provided with reliable vehicles. The Group may at any time and at its absolute discretion vary the cycle of vehicle replacements or extend /reduce the life of any vehicle in order to ensure maximum efficiency from the fleet.

1.21 Re-grading of Employee’s Car Grade Entitlement

From time to time the Group may review the grade of car to which an employee is entitled. It should be noted that upgrades in Company cars should only take effect when the existing vehicle is due for replacement in accordance with 1.20. The Group shall make every effort to place employees in the grade of car to which they are entitled, subject to such opportunities existing within the operation of the fleet. The replacement car may not necessarily be new.

11

VINCI PLC Vehicle Policy

1. Company Car Arrangements

1.22 Trade Down Allowance - Grades A to C

Drivers may choose upon renewal of their Company car to opt to choose a lower grade of car than their normal entitlement and receive a trading down allowance.

Employees may opt for the trading down allowance only when they are offered a Company car for the first time or when their current car is due for renewal.

The allowances are as presented in Appendix 4.6. This is paid monthly through the payroll and is subject to the appropriate tax and National Insurance deductions.

The allowance is not part of salary and does not count for pension or other salary related purposes.

Allowances will be reviewed annually and amended if necessary to reflect changes in the running costs of the vehicle fleet. If an employee is receiving the Allowance and rates are revised, they will automatically be paid the revised rate.

The trading down allowance scheme is provided entirely at the Group’s discretion and may be amended or withdrawn by the Group at any time to reflect future changes in circumstances.

1.23 Trade up contribution - Grades A to C

Drivers may choose upon the renewal of their company car to opt for a higher grade of car than their normal entitlement and to pay the Group an upgrade contribution

Employees may opt to upgrade when they are offered a company car for the first time or when their current car is due for renewal

The contributions are presented in Appendix 4.7. These are paid monthly out of post tax income.

Contributions made will be subject to tax relief

The trade up scheme is provided entirely at the Groups discretion and may be amended or withdrawn at any time

1.24 Vehicle choice - Grade D to H

Employees may opt for a vehicle other than the benchmark cars noted in the approved models list via the Company Intranet. When an alternative vehicle is required VFSL will calculate the cost to the group of the alternative vehicle and compare it to the benchmark. This difference will be treated as either a trade down allowance or an upgrade contribution and will be treated in the same way as in 1.22 and

1.23 above.

VFSL will price up to 4 alternative vehicles subject to the following restrictions: a) the vehicles have a

CO2 figure less than that stipulated in Appendix 4.5 for the relevant grade; b) is neither a convertible nor sports car and is capable of carrying 4 adults and; c) is not a 4x4 off-road capable vehicle. In addition the P11d value of the requested vehicle must not be more than 115% of the cost of the relevant benchmark car and any upgrade contribution is less than £100 per month.

Grade D employees will be restricted to vehicles made by Ford, Vauxhall, Peugeot, Toyota and Volvo.

Correct as at January 2012 although VFSL reserve the right to amend the list of available vehicles

12

VINCI PLC Vehicle Policy

2. Guidelines to HMRC definition of business mileage

This section is to give guidance to staff on the revised rules (applicable from 6 April 1998) on Business mileage based upon the HMRC Publication ‘Employee Travel - A Tax and NIC’s Guide For Employers’. If you are in doubt and wish clarification or a ruling then you should contact Astral House Tax Department or

Group Human Resources Department. This will enable the group to retain a record of rulings provided by

HMRC that can then be applied group wide.

These changes remove the previous HMRC guidelines on business mileage and therefore knowledge of the contents of this section is important as errors in computing business mileage may lead to unforeseen tax demands.

The following rules and examples have been extracted from the HMRC guide previously referred to.

The examples have been selected on the basis that they may apply more directly to situations within the

VINCI Group but should not be considered exhaustive nor will the HMRC accept interpretations, which are obviously manipulative or vague.

2.1 Home to Work Journeys

There are effectively ‘new’ definitions which assist in determining what is business mileage.

2.1.1 Permanent Workplace

This is where an employee regularly attends for the performance of their duties. (This could be one specific place such as Astral House, Watford or it could be an area e.g. Bedfordshire and there may be more than one Permanent Workplace). Mileage between home and a Permanent Workplace is not business mileage.

2.1.2 Temporary Workplace

A Workplace is a Temporary Workplace if an employee goes there only to perform a task of Limited

Duration or for a temporary purpose. In particular a site, providing the duration of the employees assignment to the site is less than 24 months is a Temporary Workplace. Mileage between home and a

Temporary Workplace is business mileage

2.2 Definitions

2.2.1 Limited Duration

Regular attendance for less than 24 months (e.g. a site where work will be carried out over less than 2 years). However, as soon as you are aware your presence at a Temporary Workplace will exceed 2 years it becomes a Permanent Workplace.

2.2.2 Temporary Purpose

An employee may attend a workplace regularly and perform duties there which are not of Limited

Duration without that workplace becoming a Permanent Workplace provided the purpose of each visit is temporary.

13

14

VINCI PLC Vehicle Policy

2. Guidelines to HMRC definition of business mileage

2.2.3 No Permanent Workplace

This is where travel is integral to the performance of the duties (e.g. a service engineer who moves from place to place during the day carrying out repairs at client’s premises).

Examples:

1: Barry is employed as a mobile maintenance engineer. He travels each day to visit anything up to

20 customers or potential clients. He has no Permanent Workplace and performs the duties of his employment at client’s premises. Travel is an integral part of his job. All Barry’s mileage is business mileage.

2: Gilbert is employed as an electrician. Each morning he visits a depot where he is given his job list for the day. He is usually contacted during the day by his office to make changes to that job list. He is, therefore, allocated tasks in many different places. However, Gilbert’s depot is still the place he attends regularly where he is routinely allocated tasks and it is, therefore, his Permanent

Workplace. So, mileage between his home and the depot is private mileage.

3: Colin is a safety officer. He regularly visits a particular site every month to carry out a safety check.

His responsibility for that site has been a duty of his employment for a period exceeding 24 months

(so it is not of limited duration). However, the tasks he performs on each visit, considered alone, is temporary. So his journeys there are business journeys.

4: Nicole is employed as a project manager, and the company operates from sites in Bristol and Bath.

Nicole spends each morning at the site in Bristol and each afternoon at the site in Bath. This has been taking place for over two years. Each site is a permanent workplace. Nicole’s journey between her home and the sites are not business miles. However, travel between the two workplaces is travel in the performance of her duties and is business mileage.

5: As part of her duties Karen has to visit many different sites. She gets tax relief for her travel

(business mileage can be claimed). However, in addition Karen is usually invited to the Christmas

Party held by these sites. She cannot claim these as business mileage as the journeys were not for work purposes.

6: Jim is taken on a fixed term contract of 18 months to work at a particular site. No relief is available for the cost of travel to and from his home to site during the period (this is not business mileage).

VINCI PLC Vehicle Policy

2. Guidelines to HMRC definition of business mileage

2.3 Business Journeys Commenced from Home

Generally all such mileage is business mileage. Examples are listed below to assist in determining the precise mileage that should be recorded.

Examples:

1: Christine has a company car. She normally drives the 40 miles round trip to her office in Watford.

One day she has to make a business journey direct from her home. She travels a total of 200 miles from home to a business client and back again. The number of business miles is the full 200 miles.

2: Lisa drives each day between her home in Southampton and her office in Winchester. One day she has to travel on business to Birmingham and back. She drives directly from home to Birmingham but stops off at her office to pick up some papers. Her stop is incidental to her business journey.

Her business mileage is from her home in Southampton to Birmingham and back.

2.4 Mileage Returns

These are available on the Group intranet:

• they must be completed using the standard forms

• they must be completed using the above criteria,

• they must be completed on a monthly basis.

15

16

VINCI PLC Vehicle Policy

3. Overseas Driving Licences

Driving in the UK as a holder of an overseas driving licence is subject to compliance with British minimum age requirements which are currently 17 for cars and motorcycles, 18 for medium sized vehicles and 21 for large lorries and buses. In addition, there are specific time periods that holders of overseas driving licences are able to drive in the UK before being required to apply for an UK driving licence.

In order to ensure that holders of overseas driving licences are not driving illegally all licences must be checked to ensure that they are valid for duration as detailed below under Duration of Validity of Overseas

Licence.

Prior to expiry the individual is to be notified that they must make application to either exchange their licence for a full UK licence or apply for a provisional licence depending on their current UK status. The forms they will require for this are D1 and D750, which are available from the Post Office.

Where an individual leaves the UK prior to the expiry of the concessionary period and then returns to the UK, the concessionary period will commence from the date of return.

3.1 Duration of Validity of Overseas Licence

It should be noted that international driving permits are only valid for a period of 12 months and are only valid when presented with a current driving licence.

Outlined below are countries of origin and the duration that overseas licence holders are permitted to drive under their current licences:

3.2 European Community/European Economic Area

Visitors from EC or EEA countries holding a valid Community licence can drive any vehicle for as long as the licence remains valid.

Residents from EC or EEA countries whose licence is valid are subject to the following duration:

Ordinary Licence Holders: Up to age 70 or 3 years from becoming resident whichever is the longer

period.

Vocational Licence Holders: Up to age 45 or 5 years from becoming resident whichever is the longer period. Must also register with DVLA.

To continue driving after these periods, an UK driving licence must be obtained.

Students who hold community licences may drive cars and motorcycles in the UK for as long as their licence is valid or until they attain the age of 70.

3.3 Northern Ireland

A holder of a full Northern Ireland driving licence can either exchange this for a full GB licence or can continue using their licence until it expires at which time they may apply for a UK driving licence.

VINCI PLC Vehicle Policy

3. Overseas Driving Licences

3.4 Gibraltar and Designated Countries

Designated countries include: Australia

Barbados

Canada

Japan

Monaco

Singapore

Switzerland

Zimbabwe

Visitors temporarily in the UK who hold a full ordinary licence and are resident outside of the UK can drive vehicles up to 7.5 tonnes with up to 16 passenger seats for up to 12 months from the date they entered the UK. If they are registered to drive large vehicles they can only do so if the vehicle is registered outside of the UK.

Residents can drive small vehicles for 12 months from the date they became resident, provided they hold a full valid licence. A full UK licence should be obtained before this period expires, if not then the holder must stop driving within the UK, but can apply to exchange their driving licence at any time within 5 years of residency.

3.5 Jersey, Guernsey or Isle of Man

Visitors provided they hold a full valid ordinary licence can drive any category of vehicle as shown on their licence for 12 months.

Visitors holding vocational licences issued in Jersey or the Isle of Man can drive British registered or vehicles registered outside of the UK that they have driven into the country for up to 12 months. If the licence was issued in Guernsey they can only drive temporarily imported vehicles.

Residents who hold a full ordinary licence may drive in the UK for up to 12 months from the date they became resident. After that period it must be exchanged for UK equivalent licence, provided it has been valid within the last 10 years.

Residents , who hold a vocational licence issued in Jersey or the Isle of Man, may drive for 12 months and may exchange their licence for the UK equivalent.

A vocational licence issued in Guernsey is not exchangeable.

17

18

VINCI PLC Vehicle Policy

3. Overseas Driving Licences

3.6 All Other Countries

Visitors may drive vehicles up to 7.5 tonnes with up to 16 passenger seats provided their full licence or driving permit remains valid up to 12 months from the date of entry. Larger vehicles may only be driven if registered outside of the UK and which have been driven into the country.

Residents who hold a current ordinary licence can drive any category of vehicle as per their licence for up to 12 months from residency. However they must apply for a provisional UK licence and have passed an UK driving test before the 12-month period elapses. In addition residents who have obtained a provisional UK licence will not be required to display L-plates or be supervised by a qualified driver.

If an UK driving test is not passed within the 12-month period they will not be permitted to drive as a full licence holder and normal provisional conditions will apply.

Residents who hold a vocational licence will not be permitted to drive large vehicles until they have passed the relevant UK driving test and must have completed a category B (motor car) test.

3.7 Students from Non-Community Country

Students who hold a valid ordinary licence or an International Driving Permit may drive in the UK for up to 12 months.

Students from a designated country may exchange their licence for an UK licence at any time up to 5 years from gaining residency.

VINCI PLC Vehicle Policy

4. Appendices

19

20

VINCI PLC Vehicle Policy

4. Appendices

Important Information

Group Head Office / Group Human Resources Department

Astral House

Imperial Way

Watford

WD24 4WW

Tel: 01923 233433

Fax: 01923 256481

VINCI Fleet Services Limited / VINCI Insurance Services Limited

PO Box 117

Ditton Road

Widnes

Cheshire

WA8 0WE

Tel: 0151 422 3800

Fax: 0151 422 3804

HMRC

West Lancs & West Cheshire Area

P.O Box 61

Leigh

WN7 1XZ

Ref: 709 \ WDNWH1

Tel: 01744 621000

VINCI PLC Vehicle Policy

4. Appendices

4.1 Queries

Should you have a query on any of the following sections, please contact the

VSFL Department at Widnes: 1.3, 1.5, 1.10, 1.11, 1.12, 1.16, 1.17

Should you have any queries on any of the following sections, please contact VISL Department at

Widnes: 1.6, 1.7, 1.8, 1.13, 1.14

Should you have any queries on section 1.22 and 1.23, please contact the Payroll Department at

Watford.

Should you have any queries on section 1.20, please contact your relevant Business Unit Accounts

Manager.

For queries in any other respect please contact the Group HR Department, Watford.

4.2 Operating a Mobile Phone or Hand Held Communication Device Whilst Driving

PLEASE ENSURE THAT YOU IMMEDIATELY TAKE STEPS TO COMPLY WITH THE ADVICE.

In brief you are not expected to use hand-held phones, pda or other hand-held communication devices whilst driving and in light of the legislation and recent court cases it is in everyone’s interest to resist the urge to use a phone at all whether with hands free or not.

In addition to the notes overleaf and the current requirement already placed upon you by way of section 3.28 of the current employee handbook you are hereby advised and required to comply with the following:

The only safe way to use a mobile phone in the car is to:

- Switch the phone off while driving and let it take messages or leave the phone switched on and let it go to voicemail

- Find a safe place to stop before picking up the messages and returning calls

- Ask a passenger to deal with the calls - Do not use SMS TEXT whilst driving

The above guidelines and the notes overleaf are designed to ensure that you comply with the law and drive in the safest possible manner.

21

22

VINCI PLC Vehicle Policy

4. Appendices

4.2 Operating a Mobile Phone Whilst Driving (continued)

Further information on operating a mobile phone or ‘hand held communication devices’

Operating a mobile phone whilst driving may reduce concentration and effectiveness, and the distraction of using a phone may contribute to the likelihood of an accident. The Government has therefore introduced legislation.

4.2.1 The Penalties

Driving whilst using a hand-held communication device or mobile phone is a legal offence under the

Road Vehicles (Construction and Use) Regulations 1986.

Offenders will be subject to a £60 fine and 3 penalty points, which can be increased to a maximum fine of £1,000 (£2,500 for drivers of goods vehicles or those manufactured or adapted to carry nine or more passengers) if the matter goes to court.

4.2.2 Hand-free calls

While it is not illegal to use a hands-free mobile phone while driving, hands-free calls are also distracting and drivers should be aware that they still risk prosecution for failing to have proper control of their vehicle.

Under existing law a person may be regarded as ‘driving’ if the engine is running - even if the vehicle is stationary. Hand-held phones should not therefore be used at traffic lights or during short hold-ups.

A hands-free phone is one that is attached to fixed speakers and does not require the operator to hold while in use. However many hand-held phones now come with kits to give them some level of handsfree use. The legislation therefore covers the way in which a mobile phone is being used whilst driving.

A driver is liable for prosecution if he is holding a mobile phone to send or receive any sort of data - be it voice, text, image or Internet access.

If a driver is found to have used a hand-held device in a genuine emergency where it would have been unsafe to stop the car, he may be exempt from penalty. Additionally the use of “press to talk” 2-way radios used by haulage drivers, taxi drivers and emergency services in contact with base stations is also exempt.

4.2.3 Employee responsibility

Yes, employers are liable for prosecution if they require employees to commit an offence (i.e. if they require them to use hand-held phones while driving). Furthermore anyone “causing or permitting” an offence to take place, such as allowing a driver to drive without proper control, is also liable for prosecution. However employers are not liable for prosecution simply by supplying a hand-held mobile phone or by phoning an employee while he or she is driving.

VINCI PLC Vehicle Policy

4. Appendices

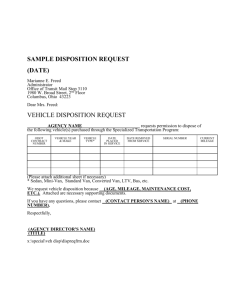

4.3 Option Form - Car Allowance Scheme (Sample)

Please view the latest version available via the Company intranet

Car Allowance Scheme

Company car drivers may choose, with the Company’s agreement, to take a monetary allowance in lieu of a company car. Details and conditions of the Car

Allowance Scheme are as follows:

• You may opt for the Car Allowance only when you are offered a car for the first time or when your current company car is due for renewal. You may at any time opt to return to a company car.

• The allowance is only open to employees whose annual business mileage does not exceed 15,000 miles. The Company reserves the right to withdraw the car allowance in the event that business mileage exceeds 15000 miles per annum. However as a concession employees may opt for an allowance even if they are aware that their business miles will exceed 15,000. In situations where business miles exceed 15,000, an employee may only claim a maximum of 15,000 miles in any one tax year.

• The allowances presently applicable are listed below. The allowance is paid monthly via payroll and is subject to the normal deductions for Tax and National

Insurance.

• The allowance is not part of a salary and does not count for pension or other salary related purposes. Allowance amounts will be reviewed annually and amended if necessary to reflect changes in running costs for the grade of car in question. If you are receiving the allowance and rates are revised, you will automatically be paid the revised amount.

• If you opt for the Car Allowance you must ensure that you have a suitable means of travelling to work and undertaking business journeys in a safe and reliable manner, that you have the necessary insurance cover, your vehicle is maintained to manufacturers standards and complies with the requirements of Road Traffic

Acts.

• Evidence of adequate insurance, servicing and MOT certificates will be required by the 31 January each year.

• Car Allowance recipients will be issued with a Fuel Card, the cost of fuel purchased via the card will be deducted from salary monthly.

• Home to work journeys do not constitute business miles unless your normal place of work is intended to be less than 24 months, then home to work journeys will be classified as business travel and thus enabling you to claim mileage allowance.

• A Mileage Allowance of 17p per mile (ppm) up to 7000 miles and 10ppm from 7001 to 15000 miles.

Therefore, users receive an allowance subject to deductions and a tax and NI free payment of 17ppm. The maximum miles that can be claimed is 15,000 in any one tax year.

• Under the VINCI Scheme, the ppm rate is increased to the maximum allowable under HMRC guidelines to 45ppm for the first 10,000 and 25ppm thereafter thus increasing your take home pay.

NB: HMRC Guidelines maximum of 10,000 miles at 45ppm, all other mileage at 25ppm. The mileage allowance rate may be amended from time to time. The

Car Allowance Scheme is provided at the Company’s discretion and may be amended, varied or withdrawn by the Company to reflect changes in circumstances.

Continuance of any car allowance is dependant upon: a) The employee maintaining a suitable vehicle no more than 5 years old , has covered less than 150,000 miles, has a CO2 emission figure less than stipulated in appendix 4.5 of the Vehicle Policy for the relevant grade and is neither a convertible, sports car nor a 4X4 off-road capable vehicle. b) Holding a valid, full driving licence. c) Arranging insurance cover for the suitable vehicle which extends to business use. d) Ensuring any vehicle used for business purposes is maintained to the manufacturers specification and conforms to motor vehicle construction and regulations and where applicable holds a current MOT certificate.

Example: Grade C Car Allowance user on 40% tax, in the pension scheme and paying NI at 12%, doing 7,000 business miles:

Mileage Paid: 7,000 X 45p

Balance of Allowance under traditional rates: (£4500 + £1190 = £5690)

TOTAL ALLOWANCE

Less tax @ 40%

NI @ 12%

TOTAL PAID

£3,150.00 (free of deductions)

£2,540.00 (subject to tax and NI)

£5,690.00

-£1,016.00

-£304.80

£4,369.20

If you would like to opt for the Car Allowance in lieu of a company car please sign below and return to the Group HR Department to signify your acceptance together with a copy of your current Motor Insurance Certificate which states that you are covered to use your own vehicle for business use, a copy of your full driving licence, current MOT certificate, evidence of last service and the V5 certificate.

Grade A

Grade B

Grade C

Grade D

£3,150 Per annum

£4,100 Per annum

£4,500 Per annum

£5,000 Per annum

Grade E

Grade F

Grade G

Grade H

£5,500 Per annum

£7,000 Per annum

£7,600 Per annum

£8,800 Per annum

Declaration: I would like to take the Car Allowance in place of a company car and accept the above conditions.

Signed

Print Name

Director’s Approval

PLEASE RETURN THIS FORM TO:

Human Resources Department

Date

Date

May 2013

23

24

VINCI PLC Vehicle Policy

4. Appendices

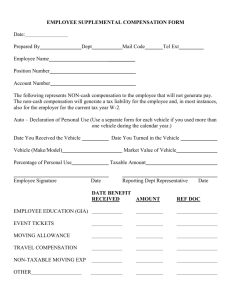

4.4 Motor Insurance Questionnaire (Sample)

Motor Insurance Questionnaire

1. Your Details

Full Name

Home Address

Type of Driving Licence (please enclose a copy of your driving licence and photocard if applicable)

Number of years driving experience Company

Occupation Place of Work

2. Details of Additional Driver

Full Name Age

Home Address

Type of Driving Licence (please enclose a copy of your driving licence and photocard if applicable)

Number of years driving experience Occupation

Age

Relationship to You

3. Questions for You (YOU) and the Additional Driver (AD) (Please circle “YES” or “NO”)

Do you have: (If you Answer “Yes” to any questions please provide details on a separate sheet and attach it to this form)

A Any restriction of movement or control or abnormality or loss, wholly or partially of the limbs?

B Defective hearing or Speech?

C Impaired vision, or loss of either eye?

D Any condition causing predisposition to fits or collapse

E Diabetes

F Any other physical defect or infirmity

Have you: (If you Answer “Yes” to any questions please provide details on a separate sheet and attach it to this form)

A Been convicted of any driving offence and/or had your driving licence suspended during the last 5 years, or is any such

prosecution or police enquiry pending?

B Been involved in any motor accident or suffered loss in connection with any motor vehicle within the last 3 years

YOU

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

AD

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

Yes / No

It is essential that copies of all relevant driving licences are enclosed

Declaration

We confirm that the answers given above are correct and that no material fact has been suppressed or withheld. We undertake to advise VINCI Insurance

Services Limited at Widnes immediately of any material alteration in the above information and of any future convictions for motor offences.

Signature

Signature of Additional Driver

Company Authorisation

Date

Date

Date

August 2009

VINCI PLC Vehicle Policy

4. Appendices

4.5 Car allowances and CO2 restrictions

In line with Vinci’s ongoing commitment to reducing the environmental impact of it’s operations we are reducing the maximum co2 g/km permissible in each car grade for company car orders placed after 1st July 2013 and changes of car for car allowance recipients from 1st August 2013. The revised maximums will be:-

Grade A

Grade B

Grade C

Grade D

Grade E

Grade F

Grade G

Grade H

£3,150.00 per annum

£4,100.00 per annum

£4,500.00 per annum

£5,000.00 per annum

£5,500.00 per annum

£7,000.00 per annum

£7,600.00 per annum

£8,800.00 per annum

A

B

C

D

E

F

G

H

100

120

120

130

130

140

140

160

The new maximums will not apply to car allowance users who have ordered or are already in the process of purchasing a replacement vehicle based on the previous maximum co2 g/km limit.

4.6 Trade down allowance

Down Grades

B to A

C to B

Allowance £/Month

£65.00

£56.00

4.7 Trade up contributions

Grades

A to B

B to C

C to D

Allowance £/Month

£65.00

£56.00

£47.00

25

VINCI PLC Vehicle Policy

Notes

VINCI PLC Vehicle Policy

Notes

VINCI

PLC

Astral House

Imperial Way

Watford

Hertfordshire

WD24 4WW

T: 01923 233433

F: 01923 256481

Part of VINCI, a world leader in concessions and construction.

www.vinci.plc.uk