Eco 301 Name_______________________________

advertisement

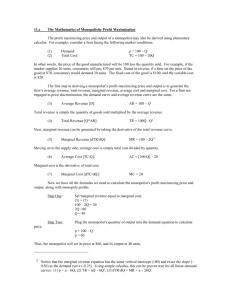

Eco 301 Final Exam Name_______________________________ 9 December 2008 125 points. Please write all answers in ink. Please use pencil and a straight edge to draw graphs. Allocate your time efficiently. 1. Suppose a perfectly discriminating monopolist faces market demand P = 100 — 10Q and has constant marginal cost MC = 20 (with no fixed costs). How much does the monopolist sell? How much profit does the monopolist earn? What is the maximum per-period license fee the government could charge the firm and have the firm still stay in business? A perfectly discriminating monopolist sells the quantity where marginal cost intersects the demand curve P = MC or 100 – 10Q = 20 or 10Q = 80 or Q* = 8. The monopolist’s economic profit is the area under the demand curve down to average cost out to quantity. PS = (1/2)(100 – 20)8 = 320. The government could charge the firm any fixed fee up to 320. 2. The demand by senior citizens for showings at a local movie house has a constant price elasticity equal to —4. The demand curve for all other patrons has a constant price elasticity equal to —2. If the marginal cost per patron is $1 per showing, how much should the theater charge members of each group? MR = P(1 - 1/|η|) = MC, which implies that P = MC/(1 - 1/|η|) Senior citizens: PS* = 1/(1-1/4) = 4/3 Adults: PA* = 1/(1-1/2) = 2. 3. The marginal and average cost curves of taxis in Metropolis are constant at $0.20/mile. The demand curve for taxi trips in Metropolis is given by P = 1 — 0.00001Q, where P is the fare, in dollars per mile, and Q is measured in miles per year. If the industry is perfectly competitive and each cab can provide exactly 10,000 miles/yr of service, how many cabs will there be in equilibrium and what will be the equilibrium fare? The taxi industry supply curve for Metropolis is a horizontal line at P=$0.20/mile. The demand schedule intersects it at Q=80,000 miles/yr, which means 8 taxis. The equilibrium fare will be $0.20/mile. P 1.0 AC=MC 0.20 Q (10,000s) 8 10 4. Each of 1000 identical firms in the competitive peanut butter industry has a short-run marginal cost curve given by SMC = 4 + Q. If the demand curve for this industry is P = 10 – 2Q/1000 what will be the short-run loss in producer and consumer surplus if an outbreak of aflatoxin suddenly makes it impossible to produce any peanut butter? SR supply = ∑ MCi MCi = 4 + Qi Qi = MCi - 4 ∑ Qi = Q = ∑ MCi - 4000 Q = 1000 MC - 4000 MC = P, so Q = 1000 P - 4000, which means that industry supply is given by P = 4 + Q/1000. SR equilibrium Q: 4 + Q/1000 = 10 - 2Q/1000 3Q/1000 = 6, Q = 2000, P = 6. P Consumer surplus 10 Producer surplus S 6 4 D Q 2000 5. Suppose there are two types of users of fireworks: carel careless ess and careful. Careful Care users never get hurt, but careless ones sometimes injure not only them themselves, selves, but also innocent bystanders. The short-run run marginal cost curves of each of the 1000 firms in the fireworks industry are given by MC = 10 + Q, where Q is measured in pounds of cherry bombs per year and MC is measured sured in dollars per pound of cherry bombs. The demand curve for fireworks by careful users is given by P = 30 - 0.001Q (same units as for MC). Legislators Legisla would like to continue to permit careful ul users to enjoy fireworks. But since it is impractical to distinguish between the two types of users, they have decided to outlaw fireworks altogether. How much better off would consumers sumers and producers be if legislators had the means to effect a partial ban? Total surplus is equal to the sum of the two shaded triangles shown below, which is $100,000/yr. 10,000 CS= (30 - 20) 10,000 = 50,000 PS= (20-10) 10,000 = 50,000 Eco 301 Final Exam Name_______________________________ 10 December 2008 125 points. Please write all answers in ink. Please use pencil and a straight edge to draw graphs. Allocate your time efficiently. 1. A monopolist has a demand curve given by P = 100 – Q and a total cost curve given by TC = 16 + Q2. Suppose the monopolist also has access to a foreign market in which he can sell whatever quantity he chooses at a constant price of 60. How much will he sell in the foreign market? What is his quantity and price in the domestic market? MR should be equal in both markets. Since the price is fixed at 60 in the foreign market, MR is also fixed at 60 in that market. This means that MR at home should also be 60. We have MRhome = 100 – 2Q = 60, which solves for Qhome = 20. Also MC should be equal to 60. MC = 2Q = 60 solves for Qtotal = 30. Therefore Qforeign = Qtotal – Qhome = 10. Price in the home market = 100 – 20 = 80. 2. Suppose a monopolist sells in two separate markets, with demand curves given by P1 = 10 – Q1 and P2 = 20 – Q2, respectively. If her total cost curve is given by TC = 5 + 2Q, what quantities should she sell and what prices should she charge in the two markets? MR1 = 10 - 2Q1 (left panel), and MR2 = 20 - 2Q2 (center panel), so the horizontal summation of the MR curves is given by SMR (right panel). The profit-maximizing quantity is 13, 4 of which should be sold in market 1, the remaining 9 in market 2. The profit-maximizing prices are P1* = 6 and P2* = 11. 3a. The marginal and average cost curves of taxis in Metropolis are constant at $0.20/mile. The demand curve for taxi trips in Metropolis is given by P = 1 — 0.00001Q, where P is the fare, in dollars per mile, and Q is measured in miles per year. If the industry is perfectly competitive and each cab can provide exactly 10,000 miles/yr of service, how many cabs will there be in equilibrium and what will be the equilibrium fare? The taxi industry supply curve for Metropolis is a horizontal line at P=$0.20/mile. The demand schedule intersects it at Q=80,000 miles/yr, which means 8 taxis. The equilibrium fare will be $0.20/mile. P 1.0 AC=MC 0.20 Q (10,000s) 8 10 3b. Now suppose that the city council of Metropolis decides to curb congestion in the downtown area by limiting the number of taxis to 6. Applicants participate in a lottery, and the six winners get a medallion, which is a permanent license to operate a taxi in Metropolis. What will the equilibrium fare be now? How much economic profit will each medallion holder earn? If medallions can be traded in the marketplace and the rate of interest is 10 percent/yr, how much will the medallions sell for? (Hint: How much money would you have to deposit in a bank to earn annual interest equal to the profit made by a taxi medallion?) Will the person who buys a medallion at this price earn a positive economic profit? If the total number of taxis is reduced from 8 to 6, the equilibrium fare will rise to $0.40/mile. Ignoring the opportunity cost of the medallion, each medallion owner will earn a profit of $(0.40-0.20)10,000 = $2000/yr. If the annual interest rate is 10%, a person would need $20,000 in order to earn as much interest as a medallion holder earns each year in profit. So medallions will sell in the market for $20,000 each. A person who buys a medallion at this price will earn zero economic profit. P 1.0 0.40 AC=MC 0.20 Q (10,000s) 6 8 10 4. If the short-run marginal and average variable cost curves for a competitive firm are given by MC = 2Q and AVC = Q, how many units of output will the firm produce at a market price of P = 12? At what level of fixed cost will this firm earn zero economic profit? Short-run profit maximization for a perfectly competitive firm occurs at the quantity where price equals marginal cost, P = MC, provided P > min AVC (otherwise, the firm shuts down). Since marginal cost is MC = 2Q, the market price P = 12 equals marginal cost 12 = 2Q at quantity Q = 6. Note that min AVC = 0 here. We can express profits (with fixed costs separated out) as Π = (P – AVC)Q – FC. Since average variable cost is AVC = Q = 6, the firm would earn profits of Π= (12 – 6)6 – FC = 36 – FC. Thus, with fixed cost FC = 36, the firm would earn zero profits. 5. Each of 1000 identical firms in the competitive peanut butter industry has a short-run marginal cost curve given by SMC = 4 + Q. If the demand curve for this industry is P = 10 – 2Q/1000 what will be the short-run loss in producer and consumer surplus if an outbreak of aflatoxin suddenly makes it impossible to produce any peanut butter? Eco 301 Final Exam Name_______________________________ 12 December 2008 125 points. Please write all answers in ink. Please use pencil and a straight edge to draw graphs. Allocate your time efficiently. 1. A firm in a competitive industry has a total cost function of TC = 0.2Q2 – 5Q + 30, whose corresponding marginal cost curve is MC = 0.4Q – 5. If the firm faces a price of 6, what quantity should it sell? What profit does the firm make at this price? Should the firm shut down? TC = 0.2 Q2 - 5Q + 30. MC = dTC/dQ = 0.4 Q - 5. In equilibrium MC = P, which implies 0.4Q - 5 = 6, which solves for Q = 27.5. Profit = revenue – cost = 27.5x6 - [0.2(27.5)2 -5(27.5) + 30] = 121.25. Since the firm earns positive profit, it should stay open. 2. A film director has signed a contract in which the production studio promises to pay her $1,000,000 plus 5 percent of the studio's rental revenues from the film, all of whose costs of production and distribution are fixed. True or false: If both the director and the studio care only about their own financial return from the project, then the director will prefer a lower film rental price than will the studio. Explain. The studio's maximum net income from the project comes when it sets the rental price that corresponds to the quantity for which marginal revenue and marginal cost are equal. The director's net income from the project is maximized when the price is set at the level that maximizes total revenue. The director's best price thus corresponds to the quantity for which marginal revenue equals zero. As long as marginal production costs are zero (which follows from the assumption that all costs are fixed), it follows that the studio will also prefer the price that equates marginal revenue to zero. So false. 3. Suppose there are two types of users of fireworks: careless and careful. Careful users never get hurt, but careless ones sometimes injure not only themselves, but also innocent bystanders. The short-run marginal cost curves of each of the 1000 firms in the fireworks industry are given by MC = 10 + Q, where Q is measured in pounds of cherry bombs per year and MC is measured in dollars per pound of cherry bombs. The demand curve for fireworks by careful users is given by P = 50 - 0.001Q (same units as for MC). Legislators would like to continue to permit careful users to enjoy fireworks. But since it is impractical to distinguish between the two types of users, they have decided to outlaw fireworks altogether. How much better off would consumers and producers be if legislators had the means to enforce a partial ban? MC = 10 + Q Qi = MC – 10 Q + 1000Qi = 1000MC – 10,000 1000MC = Q + 10,000 MC = 0.001Q + 10 P = MC: 50 – 0.001Q = 0.001Q + 10 0.002Q = 40 Q = 20,000 P = 50 – 0.001Q P = 50 – 20 = 30 CS = $200,000 PS = $200,000 4. A monopolist has marginal cost MC = Q and home market demand curve given by P = 30 – Q. The monopolist can also sell to a foreign market at a constant price PF = 12. Find and graph the quantity produced, quantity sold in the home market, quantity sold in the foreign market, and the price charged in the home market. The linear demand curve P = 30 - Q has associated marginal revenue MR = 30 -2Q. The profitmaximizing level of output for a monopolist selling to segmented markets occurs where ΣMR = MC. The horizontal sum of the marginal revenues across markets is the home marginal revenue function MRH up to home output where MRF = MRH, and then the foreign marginal revenue function MRF = 12 for any further units. (Total marginal revenue equals marginal cost at MRF = MC, which solves for Q = 12. Marginal cost for this level of output equals home marginal revenue at 30 – 2QH = 12, so QH = 9 with the remaining units sold abroad: QF = Q – QH = 12 – 9 = 3. In the home market, the monopolist charges PH = 30 – QH = 30 – 9 = 21. 5. If the short-run marginal and average variable cost curves for a competitive firm are given by MC = 2Q and AVC = Q, how many units of output will the firm produce at a market price of P = 12? At what level of fixed cost will this firm earn zero economic profit? Short-run profit maximization for a perfectly competitive firm occurs at the quantity where price equals marginal cost, P = MC, provided P > min AVC (otherwise, the firm shuts down). Since marginal cost is MC = 2Q, the market price P = 12 equals marginal cost 12 = 2Q at quantity Q = 6. Note that min AVC = 0 here. We can express profits (with fixed costs separated out) as Π = (P – AVC)Q – FC. Since average variable cost is AVC = Q = 6, the firm would earn profits of Π= (12 – 6)6 – FC = 36 – FC. Thus, with fixed cost FC = 36, the firm would earn zero profits.