Electronic Payment & Revenue Reconciliation System

advertisement

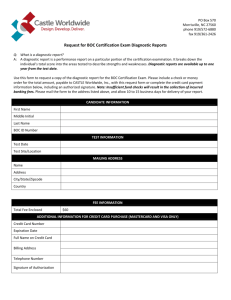

Electronic Payment & Revenue Reconciliation System The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of the Asian Development Bank (ADB) or its Board of Directors, or the governments they represent. ADB does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Outline: 1. 2. 3. 4. 5. 6. Background BOC Electronic mode of payment matrix Import Clearance System Electronic Payment Process Flows Remittance Process Flow Revenue Reconciliation System Background • • • • • • A joint project of Bureau of Customs (BoC) and the Bankers Association of the Philippines (BAP). It was implemented in 1995. Initially, it started with using diskettes (PASS 1) In 1996, it was upgraded to hardware based (smart card technology) encryption/decryption via Philippine Clearing House, Inc. (PCHC) (PASS2) In 1997, the front-end system was enhanced to include additional fields. (PASS3) In 2002, it was upgraded from hardware-based smart card technology to software decryption. By 4th quarter of 2003, it will be upgraded from EDI based (ftp) to browser based technology. Also, it will include mobile broadcasting and payment. (PASS4) BOC Mode of Electronic Payment Daily Transactions (%) Remark E-Payment via PCHC 89% Metro Manila Ports Internet Payment 1% TMW at NAIA Payment using diskettes 4% Provincial Ports AAB In-House Banks 3% Metro Manila Ports Non-Cash Payment 3% Manual Type of Process AAB Participants Nationwide • 35 Authorized Agent Banks • 100 AAB branches nationwide • Landbank and PNB as in-house banks for POM, MICP and NAIA. Authorized Agent Bank Participants (35 AABs) – (100 Branches Nationwide) Na me of Ba nk Allied Bank ANZ Bank Asia United Bank Banco de Oro Commercial Bangkok Bank Bank of America NT & SA Bank of Commerce Bank of the Philippine Islands China Bank Chinatrust Comm'l Bank Citibank Deutsche Bank Development Bank Phils East W est Banking Corportation Equitable-PCI Export and Industry bank Fuji Bank, Limited Hongkong Shanghai ING Bank International Exchange Bank Land Bank Maybank Bank Metrobank PBCom Philippine National bank Philtrust Prudential Bank Rizal Commercial Banking Security Bank Standard Chartered The Bank of Tokyo, Limited Union Bank United Coconut Planters Veterans Bank UOB No. of Bra nche s 5 1 1 6 1 1 1 6 2 1 2 1 1 1 1 1 1 1 1 1 10 1 11 1 13 2 1 9 3 2 1 2 6 1 1 IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI EDI LODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT FROM PAPER TO ELECTRONIC MANIFEST ELECTRONIC MANIFEST IEIRD PAPER MANIFEST Customs PARTNERS •AIR CARRIERS •SHIPPING LINES •ARRASTRE BILL OF LADING & IMPORT DECLARATION SHIPMENT VERIFICATION Manifest 2nd Level IEIRD IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI/ EDI/ EELODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT ACCEPT ELECTRONIC LODGMENT ONLY Single Import Document EDI DTI DTI 95% Entries 83% Revenues P 38.00 Fee EEC-PCCI INTERNET PARTNERS: VAN’s BOC ACOS •PCCI •VAN’s METRICS for 2002 MODE EEC VOLUME REVENUE 91.0% 83.0% DTI/Direct Trade Input EDI/Electronic Data Interchange Internet 0.5% 0.5% 5.0% 9.0% 0.5% 0.5% Super Green Lane (EDI) 3.0% 7.0% Face-to-Face Import Process Flow for Metro Manila Ports Importer Broker Lodgment Channels •EEC •Internet •EDI •DTI Authorized Agent Bank Dock Operators Customs ACOS Import Entry Declaration ASYCUDA •Importer processes import declaration based on self-assessment •Submits to AAB together with copy of Import Entry Declaration •AAB encodes the payment Order using the PASS data Entry screen •Check-writes the Import Entry Declaration •Transmits electronic abstract of payment via PCHC to BOC Validate Manifest Validate Valuation Validate Selectivity •Electronic manifest sent by Airline thru SITA/ARINC •Electronic manifest sent by Shipping Line thru e-mails and to consolidators Airlines Shipping Lines AMPP Payment= Assessment Release Instruction •BoC system transmits •Release Instructions to Operators for the issuance of Gatepass Manifest BL, AWB OLRS Online Cargo Release System •Matches the Payment BOC made at the AAB and the Collection final assessed amount to Division be paid. Once it matches, BOC system generates a release instruction Non Face-to-Face Import Process Flow for Metro Manila Ports Importer Broker Lodgment Channels •EEC •Internet •EDI •DTI Customs ACOS Import Entry Declaration ASYCUDA •Create Import Entry •declaration Transmit Import Entry as CUSDEC/EDI via VAN Customs to the EDI Gateway Create Payment Order based on Final Assessment •Submit to Bank together with copy of Import Entry and Final Assessment Validate Manifest Validate Valuation Validate Selectivity AMPP Payment= Assessment In-Dock Operators Release Instruction •BoC system transmits •Release Instructions to Operators for the issuance of Gatepass OLRS Online Cargo Release System Manifest BL, AWB •Electronic manifest sent by Airline thru SITA/ARINC •Electronic manifest sent by Shipping Line thru e-mails and to consolidators Airlines Shipping Lines Duty Paid Memo •Duty/Tax payment received by Bank banks thru the VAN •Duty-Paid Memo transmitted to Customs on ‘real-time’; with parallel transmission by batch via PCHC, every 3-4 hours (regular banking hours) •No Check-writing, No Additional Payments (2nd- step) IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI EDI LODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT AUTOMATED SELECTIVITY SYSTEM Red Lane Yellow Lane Green Lane Super Green Lane Physical examination Documentary check No Inspection Straight to Importers’ Premises 3% Volume 7% Value IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI EDI LODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI EDI LODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT SECURE ELECTRONIC PAYMENT PARTNERS: •Bankers Assn of Phil •Phil Clearing House •Member Banks Banks Matching of Payables and Payments Encrypted Payment Assessment Division PCH Remittances National Treasury Collection Division Revenue Reconciliation Revenue Accounting Division Electronic Payment Process Flow via PCHC for Metro Manila Ports Authorized Agent Banks BOC Collection Divisions AABs transmit the encrypted electronic abstract of payment of duties and taxes for a particular declaration based POM MICP 1st Copy BOC Port matches the decrypted payment and the payable on the electronic payable generated by the BOC ACOS System. NAIA PCHC BOC Ports pulls the electronic payment from PCHC using BOC-RAD leased line/dial up 2nd Copy (all ports) Electronic Payment Process Flow via In-house Banks for Metro Manila Ports In-House Banks POM MICP In-house Banks transmit the encrypted electronic abstract of payment of duties and taxes via BOC network for a particular declaration based on the electronic payable generated by the BOC ACOS System. BOC Collection Divisions 1st Copy BOC Port matches the decrypted payment and the payable NAIA BOC-RAD 2nd Copy (all ports) Electronic Payment Process Flow via diskette for Provincial Ports Authorized Agent Banks BOC Collection Divisions Provincial Port AAB transmits the encrypted electronic abstract of payment of duties and taxes via diskette hand carried by a designated messenger of the AAB for a particular declaration based on the electronic payable generated by the BOC ACOS System. 1st Copy BOC Port matches the decrypted payment and the payable BOC-RAD 2nd Copy (all ports) Electronic Payment Process Flow With Non-Cash component Authorized Agent Banks BOC Non-Cash Payment System; Tax Credit Tax Exempted Deferred Payment AABs transmit the encrypted electronic abstract of payment of duties and taxes via PCHC BOC Additional Payment System BOC Collection Division BOC system matches the payment made from the In-house bank+the non-cash component- additional payment vs. payable IMPORT CLEARANCE SYSTEM MANIFEST MANIFEST DTI DTI // EDI EDI LODGMENT LODGMENT SELECTIVITY SELECTIVITY RELEASING RELEASING PAYMENT PAYMENT ASSESSMENT ASSESSMENT ON-LINE RELEASE SYSTEM (OLRS) Automates transmission of release instruction to the Arrastre. Automates the receiving of feedback from the Arrastre. PARTNERS: Arrastre Operators Electronic Remittance Process Flow Authorized Agent After 10 days holding period Banks Bureau of Treasury Bangko Sentral ng Pilipinas – Accounting Division Bureau of Customs Revenue Accounting Division Proposed NEW PASS NEW PAYMENT (PASS) SYSTEM Importer / Broker P 30.00 (300 entries/d) P 50.00 (1700 entries/d) Payable File Payment File Authorized Agent Banks Non-EDI Transactions Lodgment OLRS VANS Development Bank of the Phil. Philippine Clearing House, Inc. EDI Transactions BOC Collection Division Payment System BOC ACOS System Released Instruction Value Added Network Bureau of Customs Gateway/Portal Matched File PASS5 System Flowchart Deposit CUSDEC = Customs Declaration PRE-CUSDEC NET PAYABLE IMPORTER/ BROKER PRE-CUSDEC SUFFICIENCY RESPONSE NET PAYABLE 1st Copy ELECTRONIC ABSTRACT of PAYMENT (PAS5 FILE) AAB (SR) VAN / ASP -C US CU DE SD C IF E C UN US C E D DE IFA C CT =SR NE /X TP MV AY AB LE Payment Details Module 3rd PA SS h 4t BSP CO PY F IL E RAD C O PY ONE-TIME ENROLLMENT PROCESS 2nd C O PY PCHC PR E CCC PA REGISTRATION E FIL S CU GENERATE : FINAL ASSSESMENT = CUSRES FINAL PAYMENT ADVANCE PAYMENT NON-CASH PAYMENT SS DE T NE C YA PA E BL GATEWAY ARRASTRE OLRS MATCHED FILE RELEASE MESSAGE GATE PASS ACOS CUSRES DBS File per Port PS NET PAYABLE CUSRES - (NCP + IED Utilization) NON-CASH COMPONENT (NCP) PD Centralized Database CASH DIVISION CONTAINER YARD OPERATORS REALEASE OF GOODS PASS 5 FLOWCHART STEP 1 : ENROLLMENT / REGISTRATION OF AAB Registers at BOC per District Port Registers at BOC Central Office IMPORTER FINAL PAYMENT ADVANCE PAYMENT 1 NON - CASH PAYMENT BOC AAB 1 AAB2 KEY FIELDS Bank Code Bank Branch Acct. Code TIN/Importer BOC GATEWAY KEY FIELDS TIN Tax Credit Reference Code PCHC VAN Portals AAB3 AAB4 1 ONE - TIME ENROLLMENT PROCESS STEP 2 : Payment at AAB for Customs duties and Taxes based on self assessment by importer. Deposits the amount for duties and taxes to BOC acct. with any of the folllowing facility SELF ASSESSMENT AAB processes the payment Over the Counter E-Payment Portal of AAB Note: Reference Code: No encodiing shall take place at the AAB side. Mode of payment of importer is not limited to CASA debit. Scheme of payment is importer's prerrogative as arranged with AAB. TIN Account Code (assigned in the enrollment process) STEP 3 : Pre-lodgement (Replacement for Checkwriting) L O D G E M E N T Internet EDI Entry Number Bank Code Bank Reference Number BOC Gateway Pre - CUSDEC Sufficiency Response V A N Portals Pre - CUSDEC IF Pre-CUSDEC = sufficiency response get CUSDEC File FROM VAN ELSE STOP PROCESS importer goes back to AAB CUSDEC BOC ACOS PCHC Processes sufficiency response KEY FIELD: TIN Account Code Confirmation Flag STEP 4 : Final Assessment (CUSRES) and PASS 4 File Transmit net payable System validates and deducts non-cash component BOC appraises the declaration B O C ACOS BOC Payment System BOC Gateway PASS 4 File PCHC Transmits PASS 4 File PASS 4 File Attaches Electronic Abstract of Payment AAB STEP 5 : Printing of PASS 4 File and release message BOC Payment System Transfer Matched File BOC ACOS Transmits Release Messages ARRASTRE OPERATORS Prints PASS 4 File. Uploads to BOC ACOS System. Generate Matched File. RELEASE of GOODS GATEPASS Front-End & Middleware Application Development (Nationwide) 1. 2. 3. 4. 5. New PASS Data Entry Screen for AABs • Final Payment • Advance Payment Data Capture of Payable (Cusres file) Encryption of Electronic Payment File • Final Payment • Advance Payment BOC Data Capture of Electronic Payment file from PCHC BOC Decryption of Electronic File • Final Payment • Advance Payment AAB (Cash) Payment System Model Advance Payment System Additional Payment System through In-House Banks Final Payment System BOC Cash Payment Collecting Officer’s Duties& Taxes System Other Cash Payment System (overthe counter (<P5,000.00) AAB Final & Advance Payment System Process Flow Authorized Agent Banks AABs transmit the encrypted electronic abstract of payment of duties and taxes for a particular declaration. Final Payment Tin Number Serial Number Port Code Advance Payment Tin Number L/C No. IED No. BOC Cash Payment Server pulls the electronic payment from PCHC using leased line/dial up POM MICP PCHC BOC Collection Divisions 1st Copy BOC Port matches the decrypted paymen and the payable BOC NAIA RAD Provincial Ports 2nd Copy (all ports) Non-Cash Payment System Model Tax Credit System Tentative Release System BOC Non-Cash Payment Collecting Officer’s Non-Duties& Taxes System Tax Exempted System Government Accounts System Indirect Payment Process Flow Importer / Broker BOC Collection Division Billing System Tentative Release System Collecting Officer’s Non-Duties& Taxes System Tax Credit System BOC Non-Cash Payment BOC Collection Division Utilization System Tax Exempted System Government Accounts System Advance Payment System Back-End Payment System Application Development 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Final Payment Advance Payment Utilization Slip Additional Payment Collecting Officer’s Duties & Taxes Other Cash Payment Tax Credit Government Accounts Tax Exempted Tentative Release Collecting Officer’s Non-Duties & Taxes Revenue Reconciliation System Revenue Reconciliation Model Assessment Payment = Remittance = Nationwide Revenue Reconciliation System Performance Measure Model Assessment Payment District Targets Database = Performance Measure System Project Mercury Payment System Business Model Assumptions: 250 Working Days / annum 2000 Cash Payment Trans./Day 800 Non-Cash Payment Trans /Day Type Entries/Day Non-EDI 1700 Fee Amount 50 P21,250,000 EDI 300 30 2,250,000 Tax Credit 200 20 1,000,000 Additional 400 20 2,000,000 Others 200 20 2,000,000 Total P28,500,000