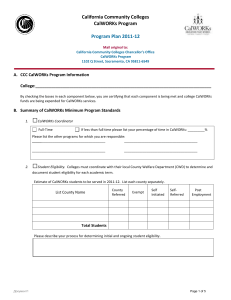

CalWORKs Program Handbook - System Operations

advertisement