Course outline Code: ACC701 Title: Accounting for Managers

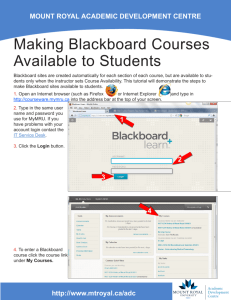

advertisement

Course outline Code: ACC701 Title: Accounting for Managers Faculty of Arts and Business School of Business Teaching Session: Semester 2 Year: 2015 Course Coordinator: Dr Greg Laing Office No: K1.31 Phone No: +61 5459 4675 Email: glaing@usc.edu.au Consultation Times: As advised on Blackboard 1. What is this course about? 1.1 Course description This course aims to provide you with an understanding of how managers can interpret and utilise external and internal reporting information for decision making while considering implications of the international accounting standards, corporate governance, ethics and the environment. Specific topics include: elements of financial statements; techniques for analysing and interpreting financial statements; product costing; cost-volume-profit analysis; annual and capital budgeting; transfer pricing; and performance measurement systems. 1.2 Course content the accounting information system, corporate governance, and reporting initiatives introducing accounting streams the financial reporting framework governance, auditors and their opinions how accountants measure and report information to external users through income statement ,Balance Sheet, and cash flow statements introducing financial ratios and financial statement analysis identifying Cost Concepts and Analysis and Understanding the role of internal management reporting introducing product costing as well as Cost behaviour and Cost Volume Profit (CVP) analysis planning and Controlling for Decision-Making, exchange rate risk management and domestic and international transfer pricing for Responsibility Centres capital investment and management of political and exchange rate risks the budgeting process performance measures and the international balanced scorecard 2. 12 units Unit value Page 2 Course Outline: ACC701 Accounting for Managers 3. How does this course contribute to my learning? Specific Learning Outcomes On successful completion of this course you should be able to: Analyse the impact of diversity of regulation on accounting concepts and methods. Analyse the complexities of corporate governance and its impact on business. Discuss the internal management reporting functions and the impact of business globalisation. Analyse financial reports, specifically the balance sheet, income statement and statement of cash flows. Identify and apply to management decision-making the different types of product and process costs as well as short-term and long-term planning. 4. Assessment Tasks Graduate Qualities You will be assessed on the learning outcome in task/s: Completing these tasks successfully will contribute to you becoming: 1 and 3 Creative and critical thinkers. 1 and 3 Creative and critical thinkers. 2 and 3 Empowered. 1 and 3 Knowledgeable. 2 and 3 Knowledgeable. Am I eligible to enrol in this course? Refer to the Coursework Programs and Awards - Academic Policy for definitions of “pre-requisites, corequisites and anti-requisites” 4.1 Enrolment restrictions Must be enrolled in a Postgraduate program 4.2 Pre-requisites Nil 4.3 Co-requisites Nil 4.4 Anti-requisites MBA705 and MBA717 or EMB755 and EMB767 4.5 N/A Specific assumed prior knowledge and skills Page 3 Course Outline: ACC701 Accounting for Managers 5. How am I going to be assessed? 5.1 Grading scale Standard – High Distinction (HD), Distinction (DN), Credit (CR), Pass (PS), Fail (FL) 5.2 Assessment tasks Task No. Assessment Tasks 1 2 3 Quiz Case study Take home examination Individual or Weighting Group % Individual Individual Individual 25% 25% 50% What is the duration / length? 30 minutes 2500 words N/A When should I submit? Where should I submit it? Week 4 Week 9 Week 13, Monday, 5.00pm AEST Blackboard SafeAssign SafeAssign 100% Assessment Task 1: Quiz Goal: The aim is for you to use critical thinking to identify, analyse and solve problems; to show that you understand and can interpret commerce-related knowledge and information and apply such knowledge. Product: Quiz Format: This is an individual assessment to be completed online through Blackboard. Criteria You will be assessed on your ability to recall and apply the material covered in the course to that date. Generic skill assessed Skill assessment level Information literacy Developing Problem Solving Developing Assessment Task 2: Case study Goal: Product: Format: In this assessment, you will conduct comparative analyses within an internal management reporting system. Case study. You will prepare a report (maximum of 2500 words) which will analyse specific issues in the case. The case study will be available in a PDF file course Blackboard site. Your report will have a maximum of 2500 words. For the report, you should assume the following business relationships and produce a business (formal) report. Criteria You will be assessed on the: quality of the discussion of the internal management reporting functions and the impact of business globalisation clarity of application of management decision-making to the different types of product and process costs as well as short-term and long-term planning quality of presentation Generic skill assessed Skill assessment level Problem solving Developing Communication Developing Page 4 Course Outline: ACC701 Accounting for Managers Assessment Task 3: Take home examination Goal: In this assessment, you will demonstrate your understanding of several specific issues addressed in the course. Product: Task home examination. Format: You will prepare answers to the specific questions asked in the assessment task and will complete the final assessment task by electronic/computer mode. This assessment will be an open book assessment. Instructions with respect to the task will be provided on the course Blackboard site. Criteria You will be assessed on the: clarity of analysis of the impact of diversity of regulation on accounting concepts and methods quality of discussion corporate governance and its impact on business quality of analysis of financial reports quality of discussion of the internal management reporting functions and the impact of business globalisation clarity of application of management decision-making to the different types of product and process costs as well as short-term and long-term planning Generic skill assessed AQF 9 Skill assessment level Problem solving Developing Communication Developing 5.3 Additional assessment requirements SafeAssign In order to minimise incidents of plagiarism and collusion, this course may require that some of its assessment tasks are submitted electronically via SafeAssign. This software allows for text comparisons to be made between your submitted assessment item and all other work that SafeAssign has access to. If required, details of how to submit via SafeAssign will be provided on the Blackboard site of the course. Eligibility for Supplementary Assessment Your eligibility for supplementary assessment in a course is dependent of the following conditions applying: a) The final mark is in the percentage range 47% to 49.4% b) The course is graded using the Standard Grading scale c) You have not failed an assessment task in the course due to academic misconduct 5.4 Submission penalties Late submission of assessment tasks will be penalised at the following maximum rate: 5% (of the assessment task’s identified value) per day for the first two days from the date identified as the due date for the assessment task. 10% (of the assessment task’s identified value) for the third day 20% (of the assessment task’s identified value) for the fourth day and subsequent days up to and including seven days from the date identified as the due date for the assessment task. A result of zero is awarded for an assessment task submitted after seven days from the date identified as the due date for the assessment task. Weekdays and weekends are included in the calculation of days late. To request an extension you must contact your course coordinator to negotiate an outcome. Page 5 Course Outline: ACC701 Accounting for Managers 6. How is the course offered? 6.1 Directed study hours On campus Workshop: 3 hours per week This course is also offered online. 6.2 Teaching semester/session(s) offered Semester 2 6.3 Course activities Teaching Week / Module What key concepts/content will I learn? 1 Module 1: The Accounting Information System, Corporate Governance, and Reporting Initiatives Introduction to accounting The financial reporting framework Governance, auditors and their opinions Module 2: How Accountants Measure and Report Information to External Users Measurement of profit Income Statement 2 3 Module 2: How Accountants Measure and Report Information to External Users (Continued) Balance Sheet Cash flow statements 4 Introduction to financial ratios and financial statement analysis What activities will I engage in to learn the concepts/content? Directed Study Independent Study Activities Activities Workshop with group discussion about selected questions, problems and case studies from the text and ereadings. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. Workshop with group discussion about selected questions, problems, and ABC learning failure case study from the text, ereadings, and YouTube video. Workshop with group discussion about selected questions, problems, and ABC learning failure case study from the text, ereadings, and YouTube video. Workshop with group discussion about selected questions, problems and case studies from the text. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. Page 6 Course Outline: ACC701 Accounting for Managers 5 6 7 8 9 10 Monday, 5th October Labour Day Public Holiday 11 12 Introduction to financial ratios and financial statement analysis continued Workshop with group discussion about selected questions, problems and case studies from the text. Module 3: Cost Concepts and Workshop with Analysis Understanding the role of group discussion internal management reporting about selected questions, problems and case studies from the text. An introduction to product costing Workshop with group discussion about selected questions, problems and case studies from the text. Cost behaviour and Cost Volume Workshop with Profit (CVP) analysis group discussion about selected questions, problems and case studies from the text. Module 4: Planning and Controls for Workshop with Decision-Making group discussion Exchange rate risk management and about selected domestic and international transfer questions, problems pricing for Responsibility Centres and case studies from the e-readings Mid Semester Break Capital investment and management Workshop with of political and exchange rate risks group discussion about selected questions, problems and case studies from the text and ereadings The budgeting process Workshop with group discussion about selected questions, problems and case studies from the text. Performance measures and the Workshop with international balanced scorecard group discussion Revision and Final assessment due about selected questions, problems and case studies A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. A list of chapter readings and problems for discussion and analysis will be provided on Blackboard. Page 7 Course Outline: ACC701 Accounting for Managers from the text and ereadings Please note that the course activities may be subject to variation. 7. What resources do I need to undertake this course? 7.1 Prescribed text(s) Please note that you need to have regular access to the resource(s) listed below: Author Year Title Publisher Hancock, P., Robinson,P., 2014 Contemporary Accounting, CENGAGE, Vic: Australia. Bazley,M. “A Strategic Approach For Users” 9th Edition 7.2 Required and recommended readings Lists of required and recommended readings may be found for this course on its Blackboard site. These materials/readings will assist you in preparing for tutorials and assignments, and will provide further information regarding particular aspects of your course. 7.3 Specific requirements N/A 7.4 Risk management There is minimal health and safety risk in this course. It is your responsibility to familiarise yourself with the Health and Safety policies and procedures applicable within campus areas. 8. How can I obtain help with my studies? In the first instance you should contact your Course Coordinator. Student Life and Learning provides additional assistance to all students through Peer Advisors and Academic Skills Advisors. You can drop in or book an appointment. To book: Tel: +61 7 5430 1226 or Email: StudentLifeandLearning@usc.edu.au 9. Links to relevant University policies and procedures For more information on Academic Learning & Teaching categories including: Assessment: Courses and Coursework Programs Review of Assessment and Final Grades Supplementary Assessment Administration of Central Examinations Deferred Examinations Student Academic Misconduct Students with a Disability http://www.usc.edu.au/university/governance-and-executive/policies-and-procedures#academic-learningand-teaching 10. Faculty specific information Locating Journal Articles If you have been notified that the journal articles in this course are available on e-reserve, use the on-line library catalogue to find them. For journal articles not on e-reserve, click on the "Journals and Newspapers" link on the Library Homepage. Enter the journal title e.g. History Australia, then search for the volume and issue or keyword as needed. Page 8 Course Outline: ACC701 Accounting for Managers Assignment Cover Sheets The Faculty of Arts and Business assignment cover sheet can be found on Blackboard or on the USC Portal at: Faculty of Arts and Business (Students) > Forms. It must be completed in full identifying student name, assignment topic, tutor and tutorial time. This must be attached securely to the front of each assessment item prior to submission. Claims of loss of assignments will not be considered unless supported by a receipt. Help: If you are experiencing problems with your studies or academic work, consult your tutor in the first instance or the Course Coordinator as quickly as possible. Difficulties: If you are experiencing difficulties relating to teaching and assessment you should approach your tutor in the first instance. If not satisfied after that you should approach in order your Course Coordinator, Program Coordinator then Head of School. General enquiries and student support Faculty Student Centre Tel: +61 7 5430 1259 Fax: +61 7 5430 2859 Email: FABinfo@usc.edu.au