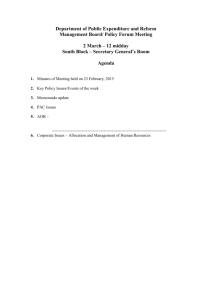

Public Financial Procedures Booklet

advertisement