Consumer Complaint Survey Report

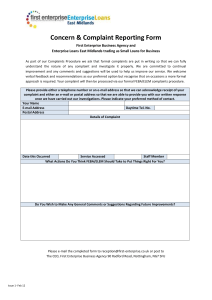

advertisement