Drug Stores

advertisement

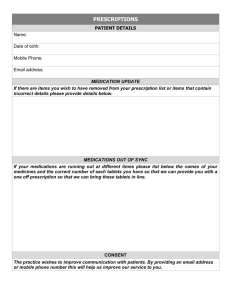

INDUSTRY PROFILE Drug Stores 2.18.2013 NAICS CODES: 44611 SIC CODES: 5912 Industry Overview Companies in this industry sell prescription drugs and other products including over-the-counter medications, health and beauty products, and greeting cards. Major US companies include Walgreens, CVS Caremark, and Rite Aid. The US drug stores industry includes about 42,000 establishments (single-location companies and branches of multi-location companies) with combined annual revenue of about $230 billion. The industry is expected to grow at a moderate rate over the next two years. Key growth drivers include demographics, medical advances, and consumer spending. Competitive Landscape Demand is driven by the aging of the US population and advances in medical treatment. The profitability of individual companies depends on access to medical insurance groups. Large companies have economies of scale in purchasing and in access to large groups of customers. Small companies can compete effectively through convenient location or special merchandising. The industry is concentrated: the 50 largest companies generate about 70 percent of revenue. Chain drug stores account about 50 percent of the retail prescription market, according to Drug Channels. Independent drug stores and mail-order sales each account for about 20 percent; pharmacies at supermarkets account for the remainder. Drug stores that also sell general merchandise compete with grocery stores, discount department stores, and other retailers. Products, Operations & Technology Drug stores sell two main types of products: prescription drugs, and "front-store" products, including over-the-counter (OTC) drugs, health and beauty aids, greeting cards, photo-finishing services, and general merchandise. Prescription drugs draw customers to the store, and stores focus their efforts on the number of new prescriptions they fill. The larger drug store chains typically generate about 70 percent of their sales from prescriptions; front-end items account for 30 percent. The number of front-store items has increased in recent years, as stores have started to offer a wider variety of items to customers. Product Segmentation by Revenue - Census Bureau The operations of drug stores focus on merchandising (which items to stock), advertising, inventory management, billing, and personnel management. Many stores are freestanding, contain about 12,000 square feet, and often include a drive-through window to more easily accommodate customers. Most pharmacies also offer free shipping of prescriptions to customers who want prescriptions mailed to them. Drug store chains generally buy drugs and other products directly from manufacturers or large wholesalers like AmerisourceBergen, Cardinal Health, and McKesson, and distribute them to their stores through a warehouse system. Independent stores usually buy from a local distributor or may participate in buying co-ops that purchase from manufacturers. Imports of pharmaceutical products to the US come primarily from Ireland, the UK, Germany, Switzerland, and France. Computer and other technology is becoming more important in dispensing prescription drugs, driven by demands of large third-party payers and the greater likelihood of errors or drug interactions as the number of drugs increases. Computer systems point out potential drug side effects or drug interactions and aid in billing; pill-counting machines are more accurate than humans; and 24-hour telephone lines and Web sites allow customers to refill prescriptions automatically. Electronic prescriptions eliminate problems with reading doctors' handwriting, allow pharmacies to search databases for drug interactions, and let them bill third-party payers electronically. These improvements allow drug stores to use pharmacists' time more efficiently. Sales & Marketing Major customers of drug stores are the third-party payers that account for a majority of prescription sales. Pharmacies contract with third-party payers like insurance companies, HMOs, or other managed care plans to provide prescription drugs to group members at reduced prices. The margins on this business are lower than on cash sales, but volume can be high, increasing sales of front-store products, so drug stores compete vigorously for this business. Independent drug stores often can't bid for this business because they have fewer locations. Marketing and advertising often focus on services provided, such as drive-through service, in-store clinics, health condition management programs, or online refill services. Convenient location is often the most important factor that draws customers. Advertising is mainly through newspapers, although large chains also use TV. Since drug stores usually get most of their prescription drug sales from repeat customers, they typically emphasize friendly, helpful, and discrete service. Many drug stores also use the Internet to reach customers with online ads and coupons, as well as special offers sent via email. Some chains, such as CVS Caremark, use loyalty cards to offer customers additional store discounts. Finance & Regulation Drug stores typically have high inventories and moderate receivables. Inventory turnover is fairly rapid. Companies may have large investments in computer and communications equipment. Most sales of nonprescription items are in cash. Third-party payers usually pay within 30 days. Drug stores typically see an increase in sales during Christmas and drug sales are affected by the timing and severity of the cold and flu season. Gross margins average about 25 to 30 percent. The industry is capital-intensive: average annual revenue per employee is about $325,000. Pharmacists are regulated by states. To a large extent, prices for prescription drugs are indirectly regulated by large third-party payers that will pay only a certain price for drugs sold to their plan members. Drug stores' nonprescription sales are unregulated except for state consumer-protection laws that apply to all retailers. In some states, pharmacies are required to substitute cheaper generic drugs unless prescriptions specifically demand a particular name-brand drug. Regional Highlights Growth in retail demand depends partly on population increase. The states with the fastest population growth in recent years have included Texas, California, Florida, Georgia, and North Carolina. Human Resources Although pharmacists have advanced degrees and very good salaries, most drug store employees are minimally skilled retail workers with relatively low pay and high turnover. Accordingly, average hourly pay for the industry is slightly lower than the US average. The industry’s annual injury rate is low, close to half the national average. Pharmacists, however, have had to deal with more robberies, as addicts have increasingly targeted drug stores to steal painkillers. Industry Employment Growth Bureau of Labor Statistics Average Hourly Earnings & Annual Wage Increase Bureau of Labor Statistics Industry Forecast US personal consumption expenditures for drug preparations and sundries, which are major indicators for drugstores, are forecast to grow at an annual compounded rate of 4 percent between 2012 and 2016. Data Published: September 2012 Consumer Drug and Sundries Spending Growth Flattens First Research forecasts are based on INFORUM forecasts that are licensed from the Interindustry Economic Research Fund, Inc. (IERF) in College Park, MD. INFORUM's "interindustry-macro" approach to modeling the economy captures the links between industries and the aggregate economy. Forecast FAQs Business Trends Industry Consolidation - Chains eliminate independent drug stores mostly through acquisition by buying the existing independent stores, which often are in small, unfavorable locations, then closing the store and using the patient prescription files (and often hiring the pharmacist). The chains benefit by growing sales and script count. Former patients are targeted through specific initiatives. Online Pharmacies - Large drug store chains, such as Walgreens and Rite Aid, offer convenience by receiving prescription orders over the Internet. Customers don't have to wait at the store while a pharmacist fills their prescriptions. Customers can pick up their orders at the store or have them delivered to their home. Some online pharmacies also allow customers to view and print their prescription history and maintain an online health history. 24-Hour Service - As doctors write more prescriptions and hospitals increasingly trim pharmacy hours, 24-hour drug stores have become a vital link in the health care chain. Sunday, when many smaller drug stores are closed, is typically the busiest day for drug stores that are open. Some 24-hour locations do not keep their pharmacy open until dawn but base their hours on customer demand. Private-Label Products - Drug stores use their own product brands to raise sales of nonprescription products. Drug stores compete with discount stores by selling private-label products, which they can sell at prices comparable to those of discount stores. Common private-label products include beauty supplies and over-thecounter medications. Prescription Savings Cards - Large chains may offer prescription savings cards to customers or segments of customers. CVS Caremark and Walgreens offer their respective savings cards with payment of an enrollment fee. The plans are designed to appeal to those without insurance or with inadequate insurance coverage. Industry Opportunities Drug Spending Growth - Prescription drug sales are expected to continue to increase due to several factors. Increased prescription drug use has been fueled by managed health care companies, which have promoted drug therapy as a cheaper alternative to expensive treatments like surgery. Other factors fueling growth include an aging US baby boomer population and a longer life expectancy. Growth has been slowing in recent years as more prescriptions become over-the-counter and more generics enter the market. Growing OTC Market - The OTC sales in the pharmaceutical market are expected to double by 2023, according to market research. Growth in OTC sales is due partly to patent expirations on prescription drugs. More than 700 OTC drugs are available that were sold only by prescription 30 years ago. Technology to Improve Efficiency - Technology innovations that should improve efficiency at pharmacies include faster claims transmission and adjudication, robotics, central fill, central call centers, electronic prescription transfer, product databases, and other cutting-edge developments. Refills made over the phone and online provide customer convenience, and automated pill-counting machines reduce operating costs and improve reliability. In-store Clinics and Worksite Health Centers - Drug stores are reaching out to customers in new ways. Many now offer in-store health clinics with basic health services such as well checks, minor injury treatment, and immunizations. Walgreens operates worksite health centers, offering a variety of services from or near an employer's campus, as well as store branches inside health clinics. Challenges in gaining access to physicians may send more customers to pharmacies for these services. Expanding Specialty Pharmacy Offerings - Some drug stores are looking to grow through specialty pharmacy services. Specialty pharmacy services include high cost biologic, infusible, injectable, and cancer drugs requiring enhanced care, which can include home visits. Walgreens and CVS Caremark have acquired companies that specialize in this field. Drug Stores Joining with PBMs - Drug stores are joining with existing PBMS or creating their own in order to better compete in the marketplace. CVS acquired prescription benefits management firm Caremark RX in 2007 and changed its name to CVS Caremark. The deal makes CVS Caremark one of the leaders of pharmacy benefits in the US. Walgreens also offers PBM services through its Walgreens Health Initiatives arm. How Does It Affect You? To schedule an industry or benchmark review, email marketing@holdenmoss.com or phone (252) 492 - 3041.