Unum disability policy certificate

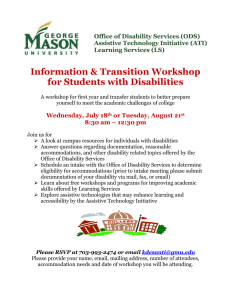

advertisement