Missouri Central Credit Union

advertisement

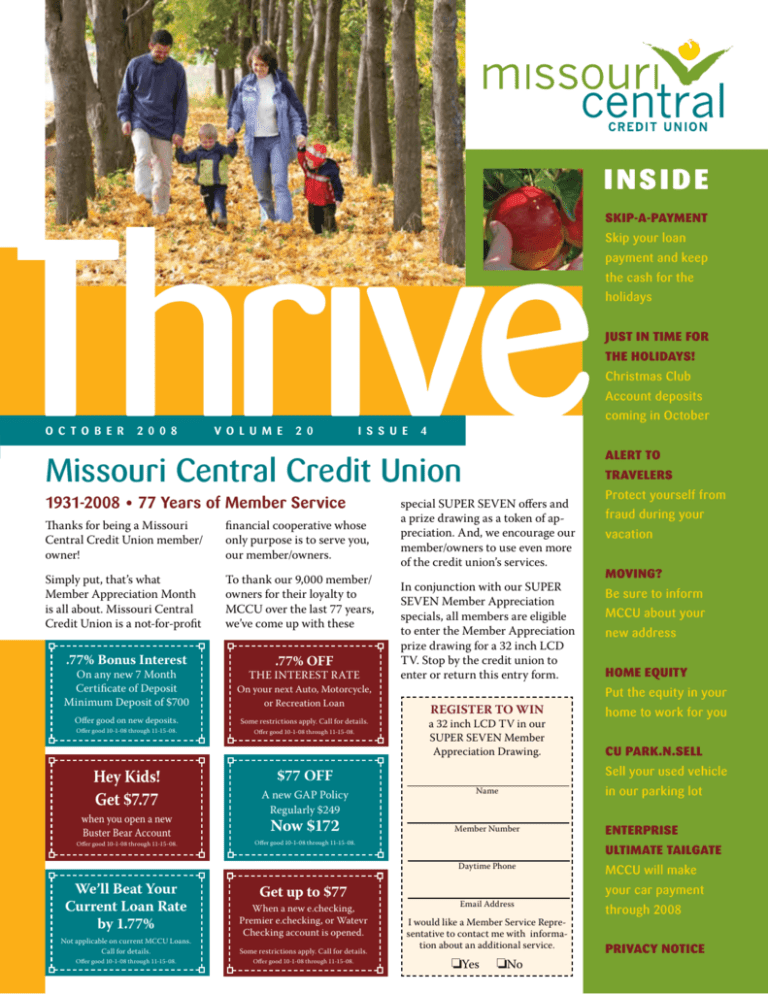

INSIDE SKIP-A-PAYMENT Skip your loan payment and keep the cash for the holidays JUST IN TIME FOR THE HOLIDAYS! Christmas Club Account deposits coming in October O C T O B E R 2 0 0 8 V o l u m e 2 0 I s s u e 4 ALERT TO Missouri Central Credit Union 1931-2008 • 77 Years of Member Service Thanks for being a Missouri Central Credit Union member/ owner! financial cooperative whose only purpose is to serve you, our member/owners. Simply put, that’s what Member Appreciation Month is all about. Missouri Central Credit Union is a not-for-profit To thank our 9,000 member/ owners for their loyalty to MCCU over the last 77 years, we’ve come up with these .77% Bonus Interest .77% OFF On any new 7 Month Certificate of Deposit Minimum Deposit of $700 On your next Auto, Motorcycle, or Recreation Loan Offer good on new deposits. Some restrictions apply. Call for details. Offer good 10-1-08 through 11-15-08. Hey Kids! Get $7.77 when you open a new Buster Bear Account Offer good 10-1-08 through 11-15-08. THE INTEREST RATE Offer good 10-1-08 through 11-15-08. $77 OFF A new GAP Policy Regularly $249 Now $172 TRAVELERS special SUPER SEVEN offers and a prize drawing as a token of appreciation. And, we encourage our member/owners to use even more of the credit union’s services. In conjunction with our SUPER SEVEN Member Appreciation specials, all members are eligible to enter the Member Appreciation prize drawing for a 32 inch LCD TV. Stop by the credit union to enter or return this entry form. REGISTER TO WIN a 32 inch LCD TV in our SUPER SEVEN Member Appreciation Drawing. Name Member Number Offer good 10-1-08 through 11-15-08. Not applicable on current MCCU Loans. Call for details. Offer good 10-1-08 through 11-15-08. Get up to $77 When a new e.checking, Premier e.checking, or Watevr Checking account is opened. Some restrictions apply. Call for details. Offer good 10-1-08 through 11-15-08. fraud during your vacation MOVING? Be sure to inform MCCU about your new address HOME EQUITY Put the equity in your home to work for you CU PARK.N.SELL Sell your used vehicle in our parking lot enterprise ultimate tailgate Daytime Phone We’ll Beat Your Current Loan Rate by 1.77% Protect yourself from MCCU will make your car payment Email Address I would like a Member Service Representative to contact me with information about an additional service. oYes oNo through 2008 PRIVACY NOTICE D E P O S I T Regular and IRA Certificates of Deposits Subject to Change Weekly Rates as of September 24, 2008 Compounded Quarterly Small Saver Certificates - $500 Minimum Interest Rate 6 to 12 Month Terms 12 to 24 Month Terms 24 to 36 Month Terms 36 Month Term 2.526% 2.771% 2.967% 3.162% Annual Percentage Yield 2.55% 2.80% 3.00% 3.20% Big Saver Certificates - $10,000 Minimum Interest Rate 6 to 12 Month Terms 12 to 24 Month Terms 24 to 36 Month Terms 36 Month Term 2.722% 3.016% 3.211% 3.406% Annual Percentage Yield 2.75% 3.05% 3.25% 3.45% Premier Money Market Accounts Subject to Change Monthly - Paid Monthly Rates as of September, 2008 Interest Average Daily Balance Rate $0.00 to $999.99 $1,000.00 to $1,999.99 $2,000.00 to $9,999.99 $10,000.00 to $24,999.99 $25,000.00 to $49,999.99 $50,000.00 & Over 0.00% 1.144% 1.193% 1.588% 1.933% 2.080% Annual Percentage Yield 0.00% 1.15% 1.20% 1.60% 1.95% 2.10% JUST IN TIME FOR THE HOLIDAYS The balance in all Christmas Club Accounts will be deposited into the owner’s primary share account by October 15th. The 2009 Christmas Club Accounts will automatically re-open with the next deposit. This year 470 members saved nearly $500,000 for holiday shopping. Open a Christmas Club Account now for next year with a deduction every pay period and have a stress free holiday season! R A T E S Premier Checking Accounts Subject to Change Quarterly - Paid Monthly Rate as of October, November, December, 2008 Interest Average Daily Balance Rate $.01 & Over 0.499% Annual Percentage Yield 0.50% Primary Share Savings Subject to Change Quarterly - Paid Quarterly Rate as of October, November, December, 2008 Interest Average Daily Balance Rate $25.00 to $99.99 $100.00 to $999.99 $1,000.00 & Over 0.00% 0.748% 0.996% Annual Percentage Yield 0.00% 0.75% 1.00% Christmas Club Accounts Subject to Change Quarterly - Paid Quarterly Rate as of October, November, December, 2008 Interest Average Daily Balance Rate $.01 & Over 0.748% Annual Percentage Yield 0.75% IRA Savings Accounts Subject to Change Monthly - Paid Quarterly Rate as of September, 2008 Interest Average Daily Balance Rate $.01 & Over 1.492% Annual Percentage Yield 1.50% SKIP-A-PAYMENT Put some extra jingle in your pocket this holiday season with MCCU’s Skip-a-Payment program. Eligible members can skip the November, December or January payment on most loans for a fee based on the loan payment amount. To sign up for this program, contact a Member Service Representative at 816-246-0002. Published quarterly by Missouri Central Credit Union BOARD OF DIRECTORS Bob Woody, Chairman Tom Lovell, Vice Chairman Steve Miller, Secretary/Treasurer Doug Hermes, Michael Horton, Nick Nichols, Joanne Thies, Leonard Stonestreet supervisory committee Claudia Walker, Chairperson Leonard Stonestreet, Jacqueline Fairbanks, Bill Simpson, Stan Abrahamson MANAGEMENT TEAM Glenna Osborn, President Tom Loftus, Vice Pres./COO William Trenchard, Vice Pres./CFO Missouri Central Credit Union 825 NE Deerbrook P.O. Box 6617 Lee’s Summit, MO 64064-6617 816-246-0002 Fax 816-246-0043 Web Site: www.mocentral.org E-mail: askmccu@mocentral.org Office Hours Mon-Thurs 9:00 a.m. - 5:00 p.m. Friday 9:00 a.m. - 5:30 p.m. Saturday 9:00 a.m. - 12:30 p.m. Drive Thru Hours Mon-Fri 8:00 a.m. - 6:00 p.m. Saturday 8:00 a.m. - 12:30 p.m. Holidays Missouri Central Credit Union will observe the following holidays and holiday hours: Columbus Day Monday, October 13 Closed Thanksgiving Day Thursday, November 27 Closed Christmas Eve Wednesday, December 24 Drive Thru 8am-12:30pm Lobby 9am-12:30pm Christmas Day Thursday, December 25 Closed New Year’s Eve Wednesday, December 31 Drive Thru 8am-5pm Lobby 9am-5pm New Year’s Day Thursday, January 1 FEDERALLY INSURED Closed You’ve worked hard for your home... now get it working for you! Alert to Travelers Please call us when you have travel plans that include using your Missouri Central Credit Union VISA Credit Card or VISA Debit Card. Due to the increased Home Owner’s Advantage Loans and Home Equity Lines of Credit If you are looking to borrow money, a Home Owner’s Advantage Loan or a Home Equity Line of Credit may be a smart option. Both of these loans are considered second mortgage loans because your home is used to secure the loan. They allow you access to your home’s value, minus outstanding loan balances, to pay for anything from a vacation, to a complete home remodel. Missouri Central has options and terms that make borrowing your home’s equity simple and affordable. Whether a fixed or variable rate fits your style, MCCU’s loans have no closing costs and no annual fees! Home Owner’s Advantage Loans A Home Owner’s Advantage Loan allows you to borrow one time at a fixed rate for a specified term. The set amount you decide to borrow is paid back in fixed monthly payments during the term of the loan. Home Equity Lines of Credit A Home Equity Line of Credit is a revolving loan that can be accessed at any time and as often as you need. Many borrowers set the credit limit as high as possible to provide a cushion for emergencies or expenses they know will be coming in the future. Unlike a Home Owner’s Advantage Loan, the interest rate is variable and moves up or down based on the Prime Interest Rate. The interest rate and the balance on the loan determine the monthly payment. Benefits to both of these loans include: •No Annual Fees •No Closing Costs on loans $10,000 or More •Low Loan Rates •Interest May be Tax Deductible amount of credit and debit card fraud, unusual activity on your credit card may trigger our fraud prevention system to block your card. To keep this from happening, we can place travel dates and destinations in your card record. Call us before you travel so you can travel worry-free. Moving? Let MCCU Know As part of MCCU’s ongoing effort to protect our members from iden- CU PARK.N.SELL • EVERY SATURDAY 9-12 tity theft, we will no longer change your address based on information LOOKING TO BUY OR SELL A CAR, TRUCK, MOTORCYCLE, BOAT OR RV? received from the United Sellers: Choose to sell with increased exposure! Fill out a registration form which gives MCCU basic information about the vehicle, then put a for sale sign on your vehicle and park in our back parking lot off of Windsor Dr. States Post Office. Please Buyers: MCCU is easy to find, right off 291N Hwy. Save gas by shopping for a vehicle at our location instead of driving all over town to find that perfect previously owned vehicle! clude your signature for send your new address to Missouri Central Credit Union. Along with your new address, please inverification purposes. 825 NE Deerbrook • Lee’s Summit, MO 64086 Next to Fairfield Inn Phone: 816.246.0002 loan rate ranges APPROX. TERM AS LOW AS NEW VEHICLE LOANS 0 – 24 months 25 – 36 months 37 – 48 months 49 – 60 months 61 – 72 months 5.50% 5.75% 5.75% 5.75% 6.75% TO 2007-2008 USED VEHICLE LOANS 0 – 24 months 25 – 36 months 37 – 48 months 49 – 60 months 5.50% 5.75% 5.75% 5.75% 10.25% 10.50% 10.50% 10.75% 2004-2006 USED VEHICLE LOANS 0 – 24 months 25 – 36 months 37 – 48 months 49 – 60 months 6.00% 6.25% 6.25% 6.25% October 1st Through October 31, 2008 10.25% 10.50% 10.50% 10.75% 11.50% 10.75% 11.00% 11.00% 11.25% Don’t delay, call to get pre-approved by your Credit Union. Then stop by your local Enterprise Car Sales location to see a great selection of quality used vehicles. 1 0000 Shawnee Mission Parkway Merriam, KS 66204 (913) 789-7111 6417 North Oak Trafficway Gladstone, MO 64118 (816) 468-1588 201 South 7 Highway Blue Springs, MO 64014 (816) 220-5570 Vehicle must be financed using standard financing terms through your Credit Union to qualify for payment offer. Credit Union will make the two payments on the payment due date up to $600 total on member’s behalf after vehicle is financed through your Credit Union. First payment due 45 days from date of purchase then $300 per month for following two months. Offer void when 7-day Repurchase Agreement is activated. Offer valid from October 1st thru October 31st, 2008. No cash advances. Offer not valid for previous Enterprise purchases or with any other offer. Vehicle must be purchased from Enterprise Car Sales. Certain restrictions apply. See a representative for details. 1 The “e” logo, Enterprise, and “Haggle-free buying. Worry-free ownership.” are trademarks of the Enterprise Rent-A-Car Company. All other trademarks are the property of their respective owners. © 2008 Enterprise Rent-A-Car Company. Missouri Central Credit Union Privacy Notice 2002-2003 USED VEHICLE LOANS At Missouri Central Credit Union (MCCU), your privacy is a top priority. This notice describes how we protect the privacy of your personal information. Throughout this notice, the word “information” refers to nonpublic personal information about you. OTHER SECURED LOANS NEW TERM Information That We Collect and Disclose to Others We collect information about you from the following sources: •Applications and other forms you submit to us or our affiliates •Information about your transactions with us or our affiliates •Information about your transactions with others •Information obtained when verifying information you provide on an application or other forms, such as your current or past employers or from other institutions where you conduct financial transactions. • Consumer reporting agencies 0 – 24 months 25 – 36 months 37 – 48 months 0 – 24 months 25 – 36 months 37 – 48 months 49 – 60 months 6.75% 7.00% 7.00% 8.75% 9.75% 10.75% 11.75% 10.75% 11.00% 11.00% 11.50% 12.50% 13.50% 14.50% OTHER SECURED LOANS USED TERM 0 – 24 months 9.75% 12.50% 25 – 36 months 10.75% 13.50% 36 – 48 months 11.75% 14.50% Longer maturities add 1% per year if approved. LINE OF CREDIT & SIGNATURE LOANS 15.00% *22.00% *Effective 11-15-08 for Lines of Credit. *This addendum, effective June 12, 2008, is incorporated into and becomes part of your LOANLINER Credit Agreement. Please keep this attached to your LOANLINER Credit Agreement. The ANNUAL PERCENTAGE RATES for each loan sub-account are show above. The amount and due date of payments will be determined at the time of each advance and disclosed on the Advance Request Voucher. Other charges include: FILING FEES - You will be charged a lien filing fee, based on the amount required by state law, if the credit union takes a security interest in your collateral. LATE CHARGES - You agree to pay a late charge equal to the greater of 5% of the payment due or $15.00, but in no event more than $50.00, for each payment in default 15 days or more. However, the late charge will only be applied once to each payment however long it remains in default. COLLECTION COSTS - You agree to pay all costs of collecting the amount you owe under this agreement, including court costs and reasonable attorney fees. The ANNUAL PERCENTAGE RATE ( APR) you receive on advances is based on the following criteria: credit worthiness, debt ratio, and amount financed (if secured). We may disclose all of the information we collect, as described above. Parties to Whom We Disclose the Information We may disclose information about you to the following type of third parties: •Financial service providers, such as those that provide mortgage services, credit card services, IRA services, ATM or Debit services, and various insurance services •Non-financial companies, such as our data processor, statement mailers, share draft printers and collection companies •Other nonaffiliated third parties as permitted by law We may disclose all the information that we collect, as described above, to companies that perform marketing services on our behalf, our affiliates, or other financial institutions with which we have joint marketing agreements. We may also disclose information about you under other circumstances, as permitted by or required by law. If you decide to terminate your membership with MCCU or become an inactive member, we will not share information we have collected about you, except as may be permitted or required by law. How We Protect Your Information We restrict access to information about you to those employees who need to know that information to provide products or services to you. We maintain physical, electronic, and procedural safeguards that comply with federal regulations to guard your information.